Week 7 Practice Quiz c

advertisement

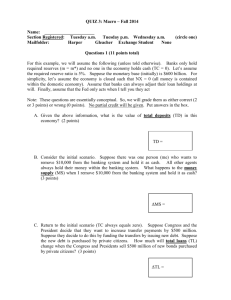

QUIZ 3: Macro – Winter 2013 Name: ______________________ Section Registered: Tuesday a.m. Tuesday p.m. Wednesday a.m. (circle one) Mailfolder: Campus 1st year Campus 2nd year PhD Gleacher Question 1 (Structural Deficits: 3 points each) For each of the following choose the answer that is unambiguously true. Use only the models we have derived in class. All exogenous variables (A, taxes, G, consumer confidence, business confidence, the money supply, etc.) are held fixed unless I tell you otherwise. Also K is assumed to be fixed throughout the problem. All other usual assumptions apply. For ease of exposition, “inc. effect” will mean income effects on labor supply and “sub effect” will mean substitution effects on labor supply. A. An unexpected permanent increase in TFP (A) will: i. ii. iii. iv. Decrease structural deficits if “inc effect” equals the “sub effect”. Decrease structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. B. An unexpected permanent increase in government spending (G) will: i. ii. iii. iv. Increase structural deficits if “inc effect” equals the “sub effect”. Increase structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. C. An unexpected permanent decrease in consumer confidence (assuming no income effects on labor supply) will: i. Increase structural deficits. ii. Decrease structural deficits. iii. Neither (a) nor (b) is true. D. An unexpected permanent decline in labor income taxes (tn) will: i. ii. iii. iv. Increase structural deficits if “inc effect” equals the “sub effect”. Increase structural deficits if “inc effect” is less than “sub effect”. Both (a) and (b) are true. Neither (a) nor (b) are true. Question 2 (Money and Banking Sector) Suppose you are given the following baseline information about the U.S. banking system. Total deposits in the U.S. banking system: The required reserve ratio is 5%: No one in the economy ever holds cash: Banks always hold excess reserves such that they always hold 10% of their deposits as reserves: One year real interest in the economy are 3%: TD m TC = $1 Trillion = 5% = 0 (always) m* r = 10% = 3% A. Given the above information, what is the monetary base in this economy? When answering this question write down the mathematical definition of the monetary base as defined in class. Put your numerical answer in the box. Show your work to receive full credit. (2 points total: question graded either 0 or 2). B. Suppose the U.S. Treasury decided to buy $10 billion of U.S. Treasury securities on the open market. By how much would the money supply (MS) increase? When answering this question write down the mathematical definition of the money supply as defined in class. Put your numerical answer in the box. (3 points total: question graded either 0 or 3). C. Suppose that banks suddenly decide to hold only 7.5% of their deposits as reserves (i.e., m* falls from 10% to 7.5%). By how much would the monetary base change if m* falls from 10% to 7.5%? Put your numerical answer in the box. Provide a brief justification for your answer (math intuition is fine). (3 points total: either 0 or 3).