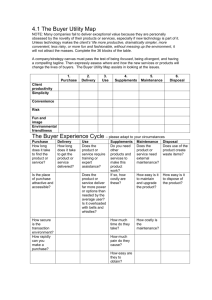

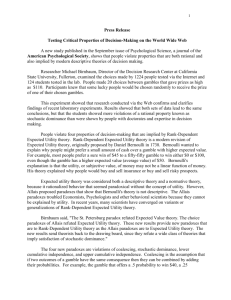

Utility Measurement: Configural-Weight Theory

advertisement