PTE Financial Viability requirements: Graduated information and

advertisement

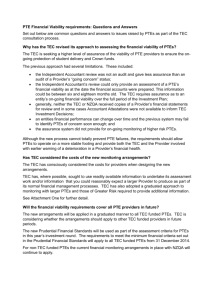

PTE Financial Viability requirements: Graduated information and monitoring arrangements for PTEs TEC has adopted a graduated system of information provision and monitoring as set out below. The TEC will undertake a risk assessment of all TEC funded PTEs in receipt of $2 million or more of TEC funding or any PTE that comes to its attention as warranting a financial review. This assessment will allow the TEC to risk rate PTEs according to a five point scale (A to E) with those PTEs classified as being of greater risk (ie risk category D or E) or of poor financial viability (i.e. risk category C), needing to provide additional information as set out below. TEC will confirm a PTE’s risk rating with each individual provider that is risk assessed. Description/TEC funding Meets Prudenti al Standard s Provide annual accounts to TEC Get accounts audited (and provide audit management letter if requested) Provide prospective information to TEC covering the period of agreed funding i.e. Budget P&L and Balance Sheet. (TEC may also request monthly cash flow forecasts and latest management accounts). Action Plan required if prudential standards not met More frequent monitoring based on PTE’s own internal management accounts (where of acceptable quality). PTE receives greater than $4million in TEC funding and rated Heightened Risk(risk category D) or Technical Insolvency (risk category E) Usually not Yes Yes Yes + requested information. Yes Yes, as specified by the TEC. PTE receives greater than $4million in TEC funding and rated Poor risk (risk category C) Yes Yes Yes Yes + requested information if required. Not generally required Yes - six monthly or as otherwise required. PTE receives greater than $4million in TEC funding and rated Strong (risk category A) or Adequate (risk category B) risk Yes Yes Yes Yes Not required No PTE receives between $2 million and $4million in TEC funding and rated Heightened Risk(D) or Technical Insolvency(E) Usually not Yes Yes Yes + requested information Yes Yes PTE receives between $2 million and $4million in TEC funding and rated Poor(C) risk Yes Yes Independent Accountant attestation based on prospective information. If requested Not generally required If requested PTE receives between $2 million and $4million in TEC funding and rated Strong(A) or Adequate(B) risk Yes Yes Independent Accountant attestation based on prospective information. Not required Not required No PTE receives less than $2 million in TEC funding and rated Heightened Risk(D) or Technical Insolvency(E) Usually not Yes Independent Accountant attestation based on Prospective information Yes + requested information Yes If requested PTE receives less than $2 million in TEC funding and rated Poor(C) risk Yes If requested Independent Accountant attestation. If requested Not generally required If requested PTE receives less than $2 million in TEC funding and rated Strong(A) or Adequate(B) risk or has not been assessed for risk Yes If requested Independent Accountant attestation. Not required Not required No Additional and related information requirements All TEC funded PTEs will be required to meet the Prudential Financial Standards for funding on an ongoing basis from 31 December 2014. All new PTEs seeking TEC funding will be required to demonstrate compliance with the Standards as part of the initial acceptance into a TEC funded scheme/pool. All PTEs with total TEC funding greater than $2 million or any PTE that has been identified as raising material financial viability risks (i.e. risk categories C, D or E) will need to provide a set of financial accounts to the TEC within three months of their financial year end. Those accounts must be prepared in accordance with Generally Accepted Accounting Practice. All PTEs receiving $4 million or more of TEC funding will be required to produce a full set of financial statements including a statement of financial performance/comprehensive income, a statement of financial position and a statement of cash flows for their financial year. All PTEs receiving $4 million or more of TEC funding will be required to undergo an annual external audit of their accounts by an independent qualified auditor. It is envisaged that this requirement will replace the need for an Independent Accountant Attestation. This requirement will be confirmed by the TEC after further consultation with NZQA. All PTEs classified as risk category C, D or E will be more closely monitored and are required to report to the TEC on a more frequent basis. That will be achieved through utilising an entity’s own management accounts and reports wherever possible. In most cases this will involve six-monthly reporting. The TEC will write to PTEs if additional information is required. PTEs may be able to seek a review of their financial assessment if there are circumstances with a particular bearing on their financial viability – for example to take account of a recent capital contribution, abnormal circumstances or a post balance date event. The TEC reserves the right not to fund, discontinue funding, or limit funding, to any PTE assessed as risk categories C, D or E. The TEC reserves the right to seek additional information to that set out in the table above if it requires the information to undertake any of its functions. The reporting and monitoring requirements set out above are in addition to the current NZQA requirements in relation to Accountant Attestations and Student Fee Protection Mechanisms. Refer Student Fee Protection Rules 2013, available from the NZQA web site.