PTE Financial Viability requirements

advertisement

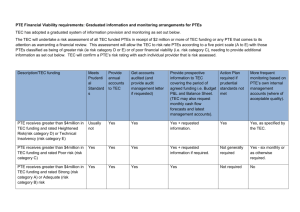

PTE Financial Viability requirements: Questions and Answers Set out below are common questions and answers to issues raised by PTEs as part of the TEC consultation process. Why has the TEC revised its approach to assessing the financial viability of PTEs? The TEC is seeking a higher level of assurance of the viability of PTE providers to ensure the ongoing protection of student delivery and Crown funds. The previous approach had several limitations. These included: the Independent Accountant review was not an audit and gave less assurance than an audit of a Provider’s “going concern” status; the Independent Accountant’s review could only provide an assessment of a PTE’s financial viability as at the date the financial accounts were prepared. This information could be between six and eighteen months old. The TEC requires assurance as to an entity’s on-going financial viability over the full period of the Investment Plan; generally, neither the TEC or NZQA received copies of a Provider’s financial statements for review and in some cases Accountant Attestations were not available to inform TEC Investment Decisions; an entities financial performance can change over time and the previous system may fail to identify PTEs of concern soon enough; and the assurance system did not provide for on-going monitoring of higher risk PTEs. Although the new process cannot totally prevent PTE failures, the requirements should allow PTEs to operate on a more stable footing and provide both the TEC and the Provider involved with earlier warning of a deterioration in a Provider’s financial health. Has TEC considered the costs of the new monitoring arrangements? The TEC has consciously considered the costs for providers when designing the new arrangements. TEC has, where possible, sought to use readily available information to undertake its assessment work and/or information that you could reasonably expect a larger Provider to produce as part of its normal financial management processes. TEC has also adopted a graduated approach to monitoring with larger PTEs and those of Greater Risk required to provide additional information. See Attachment One for further detail. Will the financial viability requirements cover all PTE providers in future? The new arrangements will be applied in a graduated manner to all TEC funded PTEs. TEC is considering whether the arrangements should apply to other TEC funded providers in future periods. The new Prudential Financial Standards will be used as part of the assessment criteria for PTEs in this year’s investment round. The requirements to meet the minimum financial criteria set out in the Prudential Financial Standards will apply to all TEC funded PTEs from 31 December 2014. For non-TEC funded PTEs the current financial monitoring arrangements in place with NZQA will continue to apply. Independent Accountant Attestations and new reporting arrangements NZQA’s requirements for PTEs to provide an Independent Accountant Attestation and conform to the Student Fee Protection scheme will continue to apply. There are some changes which are detailed below: TEC funded PTEs will be required to get their Independent Accountant to fill out a new & separate portion of the current NZQA attestation in relation to TEC funding. This separate part of the attestation will attest to the fact that the Provider has met the minimum Prudential Financial Standards. The attestation will be required for Providers with yearend balance dates after 1 January 2015; For PTEs with less than $2 million in TEC funding (as per their latest TEC annual funding allocation), the previous NZQA Independent Accountant Attestation processes will continue to apply but with a new requirement for Independent Accountants to attest to the compliance of the PTE with the minimum Prudential Financial Standards. This requirement will take effect for PTEs with a year-end balance date after 1 January 2015. For TEC funded PTEs with TEC income of greater than $2 million but less than $4 million (as per their latest TEC annual funding allocation), the Independent Accountant will be asked to attest to the future financial viability of an entity based on budgets and financial forecasts covering the period of the current Investment Plan. PTEs that receive between $2 million and $4 million in TEC funding, and are category 1 or 2 providers according to the NZQA External Evaluation Review assessment system and who, as a consequence, are only required by NZQA to return an Accountant’s Attestation every second year, will be required to prepare a separate financial attestation for TEC purposes in the alternate year. The TEC will provide affected providers with details of the new requirements in due course. For TEC funded PTEs with income of $4 million or greater (as per their latest TEC annual funding allocation) TEC will require these providers to have their financial year end accounts audited by a suitably qualified auditor. (see below for further detail). These providers will also need to provide the TEC with future focused budgets and forecasts covering the period of the current Investment Plan. New Audit Requirements for some providers For Providers in receipt of $4 million or more of TEC funding per annum and those with a higher risk rating (i.e. category D or E) TEC will in future require those providers to have their annual accounts audited. It is envisaged that this requirement replaces the need for a review by an independent accountant, but TEC will confirm this with NZQA and write to affected institutions. The requirement for an audit is part of the legislated accountability requirements for PTEs (refer sections 159YD and 159ZE of the Education Act 1989) but PTEs have up until now been exempted from the requirement. The TEC is of the view that there is no clear policy rationale to exempt larger PTEs from the accountability requirements intended by Parliament and the new requirements bring larger PTEs into line with the requirements for Tertiary Education Institutions. The new audit requirements will provide TEC with greater assurance around future financial viability of the larger providers and some limited protection against the potential for fraud or missuse of funding. The requirement for audit will come into effect for larger PTEs and higher risk PTEs who have an end of year balance date after 1 January 2015. Which agency should financial accounts be provided to? There is no general requirement for PTEs to provide NZQA with a copy of their financial accounts, though we are aware that some Providers and Independent Accountant’s do provide copies. The new arrangements will require all PTEs that receive TEC income of greater than $2 million, and all PTEs that are assessed by TEC to be at risk (i.e. risk categories D & E), to submit a copy of their financial accounts (Statement of Financial Performance and Statement of Financial Position and where available a Statement of Cash flows) annually to the TEC. As TEC and NZQA will be working collaboratively in this area information provided to one of the agencies will be shared with the other agency. What will be the consequences of not meeting the Prudential Financial Standards? It is TEC’s expectation that PTEs will meet the Prudential Financial Standards on an on-going basis. Where a Provider does not meet the minimum Prudential Financial Standards the TEC will have the option to not fund the provider in an Investment Plan/funding round, or agree funding subject to conditions. Providers that do not meet the minimum standards are likely to be required to enter into an Action Plan with the TEC with the aim to ensure that the Provider meets the guidelines within a specified period (i.e. usually within a year). Where a Provider meets the minimum financial standards, and then subsequently fails to do so, the TEC will require the Provider to advise it of such a situation and enter into discussions with the TEC to address the situation as soon as possible. These requirements will be set out in an agreed Action Plan. Failure to meet the minimum requirements may have an impact on future funding. If there are material solvency issues, material amounts owing to the TEC, or doubt around whether a PTE can continue delivering to students, the TEC reserves the right to take what action it considers suitable to protect TEC funding and student interests. Is the financial viability methodology suitable for all types of PTEs and legal entities? Based on experience from the PTE financial reviews undertaken in 2013, and previous work done by TEC, we would consider that the methodology and approach would be suitable for any small and medium sized entity. The assessment approach is intended to be suitable for companies, trusts, incorporated societies, charitable trusts, and any other form of legal entity seeking TEC funding. The TEC engaged Ernst and Young to review the suitability of its new arrangements. We would also clarify that it is not TEC’s intention to require charitable trusts or other not for profit organisations to produce a surplus1. How do the new requirements compare to those in place with Tertiary Education Institutions (TEIs)? TEIs have a specific legal status, accountability regime, and legal compliance requirements set out in legislation. The new financial requirements for PTEs has been consciously aligned to the 1 Charitable trusts and other not for profit organisations will still be required to meet the minimum Prudential Financial Standards to be eligible for TEC funding. financial viability requirements in place for TEIs but they also reflect the different legal status, ownership and size and type of entity that PTEs represent. Is the proposed approach the best means of achieving assurance? In considering the approach that should be adopted the TEC has attempted to balance a number of factors. These include: the need for assurance (by TEC and students) around the continuing financial viability of providers, the need to protect student studies; the need for internationally comparable standards; and the costs of compliance. That is why it has adopted a largely desk based limited scope review process, with a focus on currently available financial information; and the adoption of a graduated approach around reporting and monitoring which recognises the size of institution being dealt with and the risks that are presented. Will “special circumstances” or abnormal events be considered? As part of the methodology for undertaking the financial viability assessments TEC will contact providers that have been identified as being of greater risk to seek additional information and explanation from the provider. The TEC will be interested in why a particular result has occurred and not just what the reported result was. TEC will take into consideration any evidenced based factors that have a bearing on a PTE’s financial performance and risk assessment. How will the information provided to TEC be used? TEC treats all financial information it receives as part of this assessment process as “Commercial, In-Confidence”. The information collected is only used for the purpose it is provided. Only TEC teams undertaking the assessment will have access to the detailed accounts and reports. That said, the TEC does have reciprocal arrangements in place with NZQA’s financial assessment team and information may be shared with NZQA, on a confidential basis. Will financial information provided by Providers remain confidential? TEC is governed by the relevant provisions of the Official Information Act (OIA). TEC recognises that PTEs will be providing commercially sensitive information and will treat it in confidence. There are provisions of the OIA that provide for instances where information of this nature is collected and these recognise the need for the protection of commercial and confidential information. The TEC does not propose to release its risk ratings to the Public. Will the analysis of financial viability be undertaken by suitably qualified accountants? It is intended that the financial assessments will be undertaken by the TEC’s Monitoring and Crown Ownership team which consists of a number of qualified accountants who have experience in dealing with different types of organisations within the tertiary sector. The methodology that is being utilised has been reviewed by Ernst and Young to provide assurance around its suitability. Will Providers be able to seek a review of TEC’s financial assessments? Yes, providers will be able to seek a review of the results of the financial assessments. TEC will be happy to engage with providers to ensure there is an accurate understanding of the PTE’s situation and any actions that a PTE has undertaken to mitigate any adverse risks.