MSFT- SMF Report - University of Connecticut

advertisement

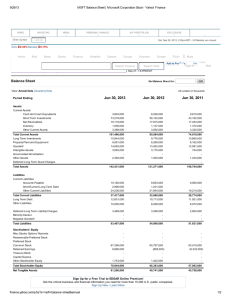

Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal UConn Foundation Student Managed Fund Trade Form Presentation Date: 01/29/03 Covering managers: Eric Burns, Jared Thal Anticipated date for trade: 01/30/02 Stock Name: Microsoft Corporation Ticker: MSFT Decision: Buy Number of shares: approximately 150 shares Approximate cash value: $7500 Limits: Stop Loss: at $42.00 or 15 % of current price Appreciation review price target: $60.00 Vote results for: 11 against: 0 Abstain: Trade executed by: Professor Ghosh Trade manager present: Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal MSFT- Executive Summary After a long endured hiatus, our coveted Microsoft has finally met our buy price. What with the current line up of Microsoft products paired with both the entrance into new platforms and services, our only fear is of further anti-trust squabbles in these new markets. The recent news of a dividend dispersement and stock split has reeked a bit of havoc onto the market price, thus bringing us to this point of a “fair” market price. However, given historical precedence, we are faithful that the reduced price will encourage extended investment and increased liquidity across the market, thereby increasing the overall market cap. Upon reviewing their historical market share, a staunch rejection in the use of debt, managerial steadfastness, and their unprecedented accumulation of cash, Microsoft is the investment to beat. Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal University of Connecticut - Student Managed Fund Stock Analysis Report January 29, 2003 Microsoft Corporation - NYSE (MSFT) Large Cap: Industry: Sector: Valueline: $305 billion Technology Software & Programming Timeliness: 3 Safety: 2 Technical: 2 Stock Scouter Rating: 8 Business Summary: Microsoft Corporation develops, manufactures, licenses and supports a wide range of software products for a multitude of computing devices. The Company's software products include scalable operating systems for servers, personal computers (PCs) and intelligent devices; server applications for client/server environments; information worker productivity applications; business solutions applications, and software development tools. During the year ended June 30, 2002, Microsoft launched Xbox, its next-generation video game system. The Company's online efforts include the MSN network of Internet products and services and alliances with companies involved with broadband access and various forms of digital interactivity. Microsoft licenses consumer software programs, sells hardware devices, provides consulting services and trains and certifies system integrators and developers. Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal Chart: RATIO COMPARISON Valuation Ratios MSFT Industry Sector S&P 500 P/E Ratio (TTM) 27.34 30.79 33.11 22.63 P/E High - Last 5 Yrs. 86.12 85.35 65.88 49.17 P/E Low - Last 5 Yrs. 24.52 21.55 19.47 16.56 Beta 1.75 1.89 1.87 1 Price to Sales (TTM) 8.48 6.83 4.15 2.82 Price to Cash Flow (TTM) 27.35 27.95 26.2 16.29 % Owned Institutions 51.72 43.01 46.48 61.92 MSFT maintains price ratios consistent with the market, thus indicative of reasonable market pricing. Growth Rates(%) Sales (TTM) vs TTM 1 Yr. Ago Sales - 5 Yr. Growth Rate MSFT Industry 14.67 8.77 18.9 21.57 Sector S&P 500 3.42 4.52 17.26 10.84 EPS (MRQ) vs Qtr. 1 Yr. Ago 14.11 15.04 33.54 26.91 EPS (TTM) vs TTM 1 Yr. Ago 58.54 39.18 31.54 21.87 EPS - 5 Yr. Growth Rate 16.54 19.92 9.87 9.49 Capital Spending - 5 Yr. Growth Rate 9.06 -1.23 -15.09 -7.89 As you can see, MSFT has a solid foundation of sales growth. Although Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal more modest growth is predicted of the future in relation to the market, MSFT has established itself as a leading brand and will continue growth steadily. Financial Strength MSFT Industry Sector S&P 500 Quick Ratio (MRQ) 3.55 2.98 2.4 1.14 Current Ratio (MRQ) 3.89 3.27 2.86 1.66 LT Debt to Equity (MRQ) 0 0.06 0.27 0.74 Total Debt to Equity (MRQ) 0 0.07 0.33 0.99 Profitability Ratios (%) MSFT Industry Sector S&P 500 Gross Margin (TTM) 80.52 76.73 51.32 47.38 Gross Margin - 5 Yr. Avg. 84.92 78.21 52.84 47.71 EBITD Margin (TTM) EBITD - 5 Yr. Avg. 43.79 51.14 32.7 35.73 12.56 20.16 19.73 21.86 Operating Margin (TTM) 43.79 30.76 9.62 17.92 Operating Margin - 5 Yr. Avg. 45.8 29.3 14.75 18.2 Here you can see how MSFT has managed to accumulate such massive cash flow over the years. It is apparent that, without any debt, the shareholders receive only further security in their investment. Management Effectiveness (%) MSFT Industry Sector S&P 500 Return On Assets (TTM) 13.87 11.02 3.89 6.2 Return On Assets - 5 Yr. Avg. 19.41 14.54 8.45 7.65 Return On Investment (TTM) 17.01 14.83 6.37 10.05 Return On Investment - 5 Yr. Avg. 24.83 21.93 13.4 12.38 Return On Equity (TTM) 17.84 16.02 8.78 18.4 Return On Equity - 5 Yr. Avg. 26.31 24.5 18.23 21.39 Given the Co-founder’s involvement and current $30 billion stake in the company, management has achieved consistent market leading achievements in regard to efficiency. The SMF’s emphasis on ROE is well supported here, retaining a well regarded stature in our research. Recent News: RealCommentary from TheStreet.com Microsoft's Micro Dividend Tuesday January 21, 2:42 pm E By David Peltier, Special to RealMoney.com Did you hear the good news? Microsoft (NasdaqNM:MSFT - News) has finally decided to pay its shareholders a dividend. The 8-cent payment will be doled out March 7 to investors who are holders of record on Feb. 21. This much-ballyhooed decision has been a long time coming from a company that has amassed an unprecedented amount of cash over the years -- $43.4 billion at the end of the December quarter, to be exact. That equates to about $8 per share, or 15% of the company's market value. Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal U.S. judge quashes some Microsoft consumer suits Monday January 27, 7:23 pm ET WASHINGTON, Jan 27 (Reuters) - A federal judge on Monday granted a motion by Microsoft Corp. (NasdaqNM:MSFT - News) to throw out five of the consumer antitrust lawsuits filed against the company in four states U.S. District Judge J. Frederick Motz struck down lawsuits filed in Connecticut, Kentucky, Maryland and Oklahoma, saying laws in those states do not allow consumers to collect damages from Microsoft unless they purchased software directly from the company. Most consumers purchase Microsoft's Windows operating system and the its other software through retailers or get it pre-installed on the computers they buy. In each of the cases dismissed on Monday, Motz said, state courts have ruled that so-called indirect purchasers cannot collect damages. The cases are part of a slew of class-action lawsuits filed against Microsoft on behalf of consumers in the wake of the government's landmark antitrust case against the company. The judge is overseeing many of the consumer lawsuits, as well as civil cases filed by Sun Microsystems Inc. (NasdaqNM:SUNW - News), AOL Time Warner Inc. (NYSE:AOL - News) unit Netscape Communications, Be Incorporated and Burst.com. In the class-action cases before Motz, the plaintiffs allege Microsoft abused its monopoly power to prevent competition in the market for personal computer operating systems, leveraged its Windows monopoly to obtain monopolies in the markets for word processing and spreadsheet software and used its monopoly positions in these markets to overcharge purchasers of Windows, Word, Excel and Office software. The U.S. Court of Appeals for the District of Columbia, in 2001, reviewed the government suit and agreed that Microsoft had illegally maintained its monopoly in the Windows computer operating system but rejected breaking the company in two to prevent future violations. A settlement of the government suit was endorsed by U.S. District Judge Colleen Kollar-Kotelly in November, although Massachusetts and West Virginia are appealing. Tech Chiefs Enter 2003 with Dim Hopes Sunday January 26, 1:24 pm ET By Lucas van Grinsven DAVOS, Switzerland (Reuters) - Technology executives scrambled to tone down expectations for 2003 this week after hard-learned lessons that their customers cannot predict the future. From Microsoft's (NasdaqNM:MSFT - News) Bill Gates to Michael Dell, the founder of the world's second-largest personal computer maker, few were prepared to predict a recovery in global demand for technology after the Internet bubble burst. "There's no big uptick," Gates told the World Economic Forum. "It's OK, but not good," said Dell, Chief Executive of Dell (NasdaqNM:DELL - News). Many of the chiefs of the world's largest technology companies spent the past days in the Swiss ski resort, host each year to some 2,000 political and business leaders. The corridors have been full of talk of war on Iraq and the sluggish U.S. economy. But technology executives have been taking the pulse of their market, often in back-to-back meetings with customers, ranging from aircraft manufacturing bosses to the heads of global retail chains. MSFT Models: Risk Free Rate: S&P500 (10 year average return): Beta: 1.15 4.095% 7.930% Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal 1. Required Rate of Return k=rf +β(rm-rf): 8.50% Earnings 1994: 0.25 Earnings 2002: 1.87 ge: (1.87/0.25)^(1/9)-1= 25.05% Average ROE: 26.28% (8 year average) Average Retention: 1-(27.2%+31.5%+35.1%+30.4%+27.7%+22.7%+21.2%+19.9%)/8 =73.04% Gr: ROE*retention ratio (b)= 26.28%*.7304= 19.19% Average g: (22.3%+5.88%+3.89)/3 = 10.69% k<g 2. P/E Model Avg P/E ratio 30 Expected EPS (VLIS)= $1.90 5-Year Horizon: 2.85 P/E Ratio: 27.79 Projected high price for the next 5 years: 27.79 * $2.85 = $79.20 Lowest price in the last 3 years: $40.31 Current Price: $47.46 Quartiles Strong buy: $ 40.31 - $50.03 Weak buy: $ 50.03 - $59.76 Hold: $ 59.76 - $69.48 Sell: $ 69.48 - $79.20 Upside potential: $79.20-47.46 = $31.74 Downside potential $47.46-40.31 = $7.15 Upside/Downside potential: 4.44 Strong Buy. 3. Valuepro.net Intrinsic Value Growth Rate Risk Free Rate WACC 65.57 10% 4.095 7.55 Microsoft- MSFT Jan. 31st, 2003 Prepared by Eric Burns & Jared Thal Value line Model MSFT: Long Term Debt + Shareholder Equity: Growth Estimate: Common Shares Outstanding: Average Annual P/E Ratio: Return on Total Capital: The Future Price: 52,180 * 1.11^10 / 5359 *.20 * 30 = (Discount the future price at 15% for n=10) = 52,180 (million) 11.0% 5359 (million). 30 20% $165.90 ($160 - $175) $41.01 ($39 - $44) Based on this buy range we are overpaying for Microsoft. However, Microsoft historically sells at a premium. Recommendation Buy 150 shares at Downside review: Stop loss: Upside review: $ 49.71 = $7456.50 $ 44.00 $ 42.00 (-15%) $ 60.00 (20%) Microsoft- MSFT Jan. 31st, 2003 Top Institutional Holders Prepared by Eric Burns & Jared Thal Shares %Out* Value** Reported FMR Corporation (Fidelity Management & Research Corp) 206,862,779 3.87 $11,664,992,107 30-Sep-02 Barclays Bank Plc 183,097,231 3.42 $10,324,852,856 30-Sep-02 State Street Corporation 137,288,861 2.57 $7,741,718,871 30-Sep-02 AXA Financial, Inc. 105,687,944 1.98 $5,959,743,162 30-Sep-02 Vanguard Group, Inc. (The) 96,151,471 1.8 $5,421,981,449 30-Sep-02 Taunus Corporation 79,836,524 1.49 $4,501,981,588 30-Sep-02 Mellon Bank, N.A. 59,369,780 1.11 $3,347,861,894 30-Sep-02 JP Morgan Chase & Company 51,871,565 0.97 $2,925,037,550 30-Sep-02 Putnam Investment Management, LLC 50,466,272 0.94 $2,845,793,078 30-Sep-02 Citigroup Inc. 45,701,793 0.85 $2,577,124,107 30-Sep-02 Shares %Out* Value** Reported Top Mutual Fund Holders ABN Amro Model Fd 3 131,356,696 2.46 $7,407,204,087 30-Apr-02 Vanguard Index 500 Fund 45,688,436 0.85 $2,576,370,906 30-Jun-02 Fidelity Magellan Fund Inc 39,822,300 0.74 $2,245,579,497 30-Sep-02 College Retirement Equities Fund-Stock Account 30,211,354 0.57 $1,703,618,252 30-Jun-02 Erste-Sparinvest Sparinvest Fund 23,046,000 0.43 $1,299,563,940 30-Nov-01 SPDR Trust Series 1 22,118,378 0.41 $1,247,255,335 30-Sep-02 Fidelity Growth & Income Portfolio 21,590,600 0.4 $1,217,493,934 31-Jul-02 Fidelity Otc Portfolio 21,281,200 0.4 $1,200,046,868 31-Jul-02 Vanguard Institutional Index FundInstitutional Index Fd 19,389,909 0.36 Fidelity Growth Company Fund 17,725,000 0.33 Ownership · Insider and 5%+ Owners: 17% · Over the last 6 months: · one insider buy; 2,000 shares · 45 insider sells; 25.1M shares (2.8% of insider shares) · Institutional: 52% (62% of float) (4,425 institutions) $1,093,396,968 30-Jun-02 $999,512,750 31-May02 Microsoft- MSFT Jan. 31st, 2003 · Net Inst. Buying: 100.2M shares (+3.49%) (prior quarter to latest quarter) Prepared by Eric Burns & Jared Thal