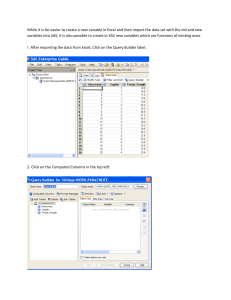

e - Pubpages

advertisement

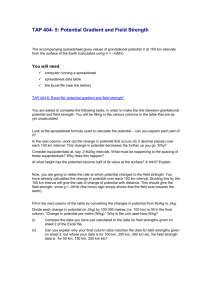

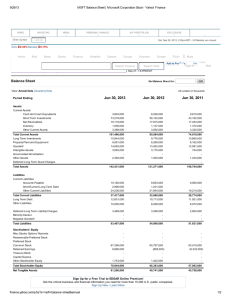

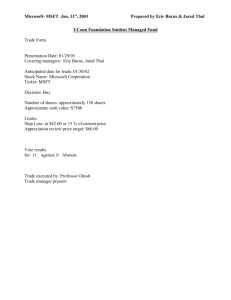

BM Ch. 9, Beta Calculation* – Estimating Return, Total Risk and Beta Risk In this exercise we will use YahooFinance! to retrieve historical "Monthly" market prices for a stock market index (S&P 500) and a company stock (Microsoft). Using Excel, we calculate the rate of return and the risk of both the index and the stock. After doing this exercise, you should be able to extract data for any stock of your liking, find its expected rate of return, its standard deviation, beta and other relevant statistics. To help you with this exercise, I have attached a spreadsheet that shows the desired results from analysis of data for 10 weeks. This sample spreadsheet shows relevant formulas needed to complete this assignment. Prepare and turn in a spreadsheet designed in a similar fashion but with the data requested below. (Note: I have used weekly data, but for this assignment you should use monthly data.) A. Get Data: 1. Go to Yahoo!' at www.yahoo.com and click on Finance under Info. This will take you to 2. 3. 4. 5. 6. 7. 8. YahooFinance! (Direct address for YahooFinance! is http//finance.yahoo.com.) Under Investing go to Today's Markets, click on Indices. Look for Standard and Poor's 500 Index. Record the symbol. Go back to YahooFinance! page. Under Stock Research, Under Research Tools, select Historical Quotes. Download monthly prices for September 1, 1999 to September 1, 2002 for Standard and Poor's 500 (symbol ^SPC) in "Spreadsheet Format". The steps: a. Give the stock symbol, specify the dates and choose "monthly"; then click on "Get Prices". b. Go to the end of the data table and press on "Download in Spreadsheet Format." c. Save the data in "spc.csv" format. Download monthly prices for September 1, 1999 to September 1, 2002 for Microsoft (symbol: MSFT), saving the data in "msft.csv". Open the saved files to verify the data. (Open them in Excel or alternatively, click on them; they will open up in Excel.) Make sure there is the same number of rows in both files. If they do not have the same number of rows, then you may need to extract the required data all over again.) In each file, keep only the data for "Date" and "Close", deleting the other columns. You may want to save the results (files) after deleting the columns. Merge the data by cutting the data in one of the file and pasting it into the other. Before doing so, be sure to replace the word "Close" in each file with its corresponding symbol (MSFT or SPC). Now, you'll have four columns of data, including two sets of "Date[s]" and MSFT and SPC. Check to see if the dates match. Move and rearrange the data so that they appear in following order in the file: "Date" in columns A; "MSFT" in column B; "Date" in column E; and "SPC" in column F. For now leave columns C and D blank. B. Analyze Data: 1. 2. Rate of Risk: What is the rate of return of MSFT and the index over the entire period? Find the monthly percent price change (i.e., rate of return for each month) for MSFT and show the result in column C. Do the same for SPC, showing the result in column G. What is the standard deviation of monthly returns for MSFT and for the index over this period? How risky is MSFT when held in isolation – i.e., based on its STD? Explain in one line. 2. Let SPC represent the market portfolio and calculate the beta (market risk) for MSFT. What’s MSFT’s correlation with the market (SPC)? How risky is MSFT relative to the market (i.e., when held with other assets in a portfolio)? (Note that the market itself has a beta of one.) Explain in one line. Submit your findings in a page similar to the one attached, with your name shown at the top. (Optional: Show detailed regression results by choosing “Regression” in “Data Analysis” under “Tools” in Excel.) DATA AND ANALYSIS FOR July 3-24, 2000 A B C D Microsoft E F G S&P 500 Index Date Price Return Date Price Return 24-Jul-00 70.56 -2.42% 24-Jul-00 1464.29 -1.07% 21-Jul-00 72.31 -3.34% 21-Jul-00 1480.19 -1.03% 20-Jul-00 74.81 2.31% 20-Jul-00 1495.57 0.92% 19-Jul-00 73.13 -6.85% 19-Jul-00 1481.96 -0.79% 18-Jul-00 78.50 0.40% 18-Jul-00 1493.74 -1.11% 17-Jul-00 78.19 -0.95% 17-Jul-00 1510.49 0.03% 14-Jul-00 78.94 -1.25% 14-Jul-00 1509.98 0.95% 13-Jul-00 79.94 -0.47% 13-Jul-00 1495.84 0.20% 12-Jul-00 80.31 1.50% 12-Jul-00 1492.92 0.81% 11-Jul-00 79.13 -0.39% 11-Jul-00 1480.88 0.36% 10-Jul-00 79.44 -3.13% 10-Jul-00 1475.62 -0.22% 07-Jul-00 82.00 1.31% 07-Jul-00 1478.90 1.53% 06-Jul-00 80.94 3.11% 06-Jul-00 1456.67 0.72% 05-Jul-00 78.50 -1.88% 05-Jul-00 1446.23 -1.59% 03-Jul-00 80.00 03-Jul-00 1469.54 Holding period return -11.80% -0.36% 2.61% 0.96% 1.707 1.000 =(B5-B19)/B19 Std Deviation of Return =STDEV(C5:C18) Beta =SLOPE(C5:C18,G5:G18)