Exercises for Chapter 2

advertisement

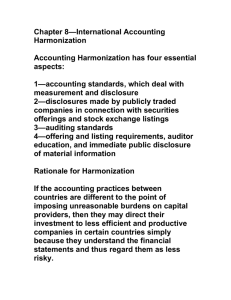

Exercises for Chapter 2 一、Multiple Choice Questions 1. In the United States, the Financial Accounting Standards Board a. establishes accounting principles for business and not for profit entities. b. is the enforcement agency responsible for monitoring that companies comply with accounting and securities regulations. c. receives funding from the U.S. government. d. establishes the tax code that companies must comply with. e. is the representative of the U.S. accounting profession on the IASB. 2. The main body that enforces financial accounting standards in the United States is a. The U.S. Accounting Enforcement Agency (USAEA) b. The Financial Accounting Standards Board (FASB) c. The Securities Exchange Commission (SEC) d. The American Institute of Certified Public Accountants (AICPA) e. All of the above. 3. What is an argument against the effort to harmonize accounting globally? a. Market forces will bring about harmonization if it is truly necessary. b. Investors are rational enough to spend the resources necessary to correctly analyze investment opportunities and focus on real economic results. c. It is unnecessary since most countries already accept U.S. generally accepted accounting principles as the standards to be followed in preparing financial statements. d. Better training of accountants mitigates the need for accounting harmonization. e. The Big Four accounting firms would lose significant revenues if accounting rules were harmonized globally. 4. The key developmental organization for international accounting standards is the a. International Accounting Standards Board. b. International Federation of Accountants. c. International Organization of Securities Commissions. d. International Organization of Accounting Standard Setters. e. Global Agency for Accounting Standards. 5. The Organization for Economic Cooperation and Development is not a. comprised of the governments of nearly all the industrialized world. b. actively participating in writing generally accepted accounting principles for the world. c. established to foster economic growth and development in member countries. d. responsible for issuing a code of conduct for multinational corporations that includes guidelines for voluntary disclosures of financial information. e. any of the above. 6. Which of the following organizations is directly involved with developing, publishing, and advocating the use of financial accounting standards? a. American Institute of Certified Public Accountants b. Organization for Economic Cooperation and Development. c. Nordic Federation of Accountants. d. International Accounting Standards Board. e. International Federation of Accountants. 7. Which of the following organizations is directly involved with developing, publishing, and advocating the use of international auditing standards? a. International Accounting Standards Board. b. Institute of Chartered Accountants of England and Wales. c. United Nations. d. Asean Federation of Accountants. e. International Federation of Accountants. 8. Which of the following organizations is directly involved with harmonizing accounting and auditing standards? a. International Accounting Standards Board. b. Securities and Exchange Commission. c. American Accounting Association. d. International Federation of Accountants. e. Both (a) and (d). 9. Global harmonization of accounting principles does not require: a. Complete uniformity in accounting principles globally. b. That differences in accounting standards between countries be kept at a minimum. c. That difference in accounting rules may exist in different countries as long as they can be reconciled. d. That one supra-national organization enforce global standards in all countries. e. Both (a) and (d). 10. Current proponents of harmonizing accounting standards globally are a. Investors. b. Multinational companies. c. The securities industry and stock exchanges. d. Developing countries. e. All of the above. 11. The International Federation of Accountants (IFAC) is not involved in: a. harmonizing global auditing practices. b. providing ethical guidelines for auditors on issues such as integrity and objectivity. c. establishing public sector standards applicable to all levels of government. d. maintaining auditor independence in today's complex business environment. e. administering a worldwide uniform examination for auditors. 12. The "world class issuer" approach to global accounting harmonization is not very promising because: a. it is opposed by the U.S. Securities and Exchange Commission. b. there are difficulties in establishing and agreeing upon the criteria for inclusion. c. it faces strong opposition by U.S. companies. d. there are practical difficulties in implementation. e. of all of the above. 13. The G4+1 originally consisted of accounting standard-setters from the following countries plus the International Accounting Standards Committee: a. Australia, Canada, New Zealand, and the United Kingdom b. Bangladesh, India, Pakistan, and Sri Lanka c. Indonesia, Japan, Korea, and Malaysia d. Australia, Canada, the United Kingdom and the United States e. None of the above. 14. The different types of articles found in European Union (EU) directives include: a. uniform rules to be implemented in all member countries b. minimum rules that may be strengthened by individual governments c. alternative rules which give member states choices d. All of the above e. Only (a) and (b) 15. The European Union (EU) has adopted a number of directives dealing with accounting matters. Which EU directives are generally regarded as the most significant on accounting issues? a. The First and Second directives b. The Fourth and Seventh directives c. The Second and Fourth directives d. The Third and Seventh directives e. The Fifth and Sixth directives 16. The overall lack of success of the European accounting harmonization effort can be attributed to: a. The scope of the EU directives is technically incomplete with a number of accounting topics not being directly covered. b. The directives were unevenly adopted into individual national legislation. c. The directives were static instruments that were not updated and lacked quality improvement mechanisms. d. Compliance with EU accounting rules did not prove to be sufficient to enter global capital markets. e. All of the above. 17. Which of the following statements best describes accounting harmonization in Europe? a. It has been a tremendous success and is being closely studied by other regional alliances. b. There is considerable evidence of accounting harmonization among EU countries. c. The EU has decided to turn to the IASB to achieve accounting harmonization. d. The ASEAN countries are following the EU model of accounting harmonization. e. Annual reports of companies from France, Germany, and the United Kingdom have become standardized as a result of the European accounting harmonization initiative. 18. The necessary conditions that can make regional accounting harmonization a policy objective among a group of countries include: a. An articulated rationale and a set of values that facilitate regional accounting harmony. b. A high level of economic integration. c. A political infrastructure to pursue harmonization within a broad policy framework. d. The economic and political clout to develop a regional vision without the fear of being marginalized in the global arena. e. All of the above. 19. The reasons why regional accounting harmonization has not been seriously pursued by the member countries of the Association of Southeast Asian Nations (ASEAN) are: a. ASEAN has not been able to articulate a clear rationale for why regional accounting harmonization is a preferred course of action for its member countries. b. ASEAN lacks a political infrastructure to pursue harmonization within a broad policy framework. c. ASEAN countries are mainly developing countries with young accounting traditions and face greater risks of being marginalized in the global arena by developing their distinct regional system. d. ASEAN countries are not sufficiently integrated economically to warrant regional accounting harmonization. e. All of the above. 20. Which of the following countries was not a signatory of the Treaty of Rome of 1957 which led to the formation of the European Economic Community? a. The Netherlands b. France c. Italy d. Luxembourg e. The United Kingdom 二、True/False Questions 1. When accounting standards vary around the world, the inherent reliability of financial statements will also vary. 2. Accounting harmonization is the process by which differences in financial reporting practices among countries are reduced in order to make financial statements more comparable and decision-useful across countries. 3. The primary economic rationale for accounting harmonization is that major differences in accounting practices act as a barrier to capital flowing to the most efficient users. 4. There is a concern that some developing countries might adopt international accounting standards to gain global respectability for their financial reporting without considering whether these standards are suitable for their economies. 5. Most developing countries have the time and the resources to develop their own indigenous accounting standards. 6. The adoption of international accounting standards in countries is a purely technical matter that is not subject to political lobbying. 7. Politically it is easier for countries to adopt external standards promulgated by a supranational organization such as the IASB rather than to adopt the standards of another country. 8. The World Bank and United Nations recently opined that the inconsistent application of auditing standards around the world adversely affects the comparability of financial statements from one country to the next. 9. The International Accounting Standards Board was formed to develop global accounting standards; compliance with IASB standards is mandatory worldwide. 10. Non-U. S. firms that issue securities in the United States must abide by the rules of the SEC. 11. The Organization for Economic Cooperation and Development issues accounting directives which have the full weight of law behind them. 12. In international accounting, harmonization is a movement away from total diversity while standardization is a movement towards uniformity. 13. In international accounting, harmonization and standardization are states while harmony and uniformity are processes. 14. The IASC's early standards were criticized for being too narrow and for allowing too few alternatives. 15. In the 1970s, a United Nations committee produced a list of financial and non-financial disclosures (to be provided by MNCs) which were heartily endorsed by most industrialized countries. 16. The Multijurisdictional Disclosure System negotiated between Canada and the United States represents a very promising model for global accounting harmonization. 17. The New York Stock Exchange strongly opposes the "world class issuer" approach to global accounting harmonization. 18. The G4+1 presently consisted of standard-setters from Australia, Canada, New Zealand, the United Kingdom, the United States and the International Accounting Standards Committee. 19. The basic objective of the European Union (EU) is to bring about a common market which allows for the free mobility of capital, goods and people between member countries. 20. Of the European Union (EU) directives, the Fourth Directive and the Seventh Directive are generally regarded as the most significant on accounting matters. 21. The European accounting harmonization effort has been a resounding success and is being copied in Asia and Africa. 22. The ASEAN countries have followed the regional harmonization paradigm modeled after the European Union (EU) rather than the global harmonization paradigm represented by international accounting standards. 23. The global accounting harmonization paradigm makes more sense for ASEAN countries than the regional harmonization paradigm because ASEAN countries are more dependent economically on their global trading partners than on other ASEAN member countries. 24. Japan, Korea, Singapore, and Thailand have harmonized their accounting as a result of their membership in the Association of Southeast Asian Nations (ASEAN). 25. Global accounting harmonization has not been pursued in ASEAN because the requisite conditions that would make it an important policy objective are not present.