CHAPTER 6

advertisement

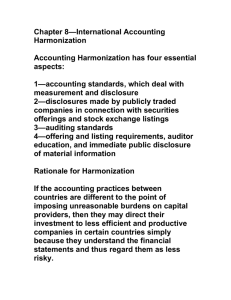

CHAPTER 3 INTERNATIONAL ACCOUNTING Factors Influencing the Development of Accounting Systems: • • • • Level of education Political system Legal system Economic development Influences on the Development of Financial Reporting Agricultural Resource Based Tourist Based Manufacturing 1.Type of economy 2.Legal system Codified Common law 3. Political system Democratic Totalitarian 4.Nature of business ownership Private enterprise Socialist Communist 5.Stability of currency 6.existence of accounting legislation 7.Growth pattern of the economy Growing Stable Declining 7.Education system So what is the solution with such differences • There are major differences in the financial reporting practices of companies around the world. • This Leads to great complications for those preparing, consolidating, auditing and interpreting published financial statement. • Several organizations throughout the world have been involved in attempts TO: HARMONIZE or STANDARDIZE accounting. 4 Harmonisation-BENEFITS AND BARRIERS Improve quality of reporting Increase comparability of reports prepared in different countries Reduce reporting cost for multi-national companies Facilitate comparison of Potential benefits of harmonisation Remove barriers to international capital flows Harmonisation-BENEFITS AND BARRIERS Different purpose of financial reporting nationalism Different legal system Lack of strong accountancy bodies Potential barriers of harmonisation Cultural factors Harmonization versus standardization There are two ways of achieving accounting compatibility: Harmonization: is the process of increasing the compatibility of accounting practices by setting bounds to their degree of variation. - Harmony: is the state where compatibility has been achieved. Harmonization is the minimization of diversity with a view to increasing the comparability of financial information across borders. 7 Harmonization versus standardization • Standardization: appears to imply working toward a more rigid and narrow set of rules. 8 Harmonization versus standardization Regarding Harmonization, there are two terms it’s important to distinguish between them: Harmonization of rules (de jure) Harmonization of practices (de facto) Tay & Parker’s point of view is the Harmonization of rules (de jure) is more useful than the latter. 9 Reasons for harmonization The pressure for international harmonization comes from those who regulate, prepare and use financial statements like: 1. Investors and financial analysts. through understanding the F.S for foreign companies in order to buy their shares. They would be sure that these statements are reliable and comparable. Confidence in the soundness of auditing. Protecting investors. Companies that wish to issue shares widely. 10 Reasons for harmonization 2. MULTINATION ENTERPRISES: In preparing consolidate Financial statements (in all over the world in same basis). Comparing performance with subsidiaries. Evaluating performance. Transferring accounting stuff from country to another. Decision makers. IF ACCOUNTING CAN BE MADE MORE COMPARABLE AND RELIABLE, COST OF CAPITAL SHOULD BE BROUGHT DOWN THROUGH REDUCING THE RISK FOR INVESTORS. 11 Reasons for harmonization 3. INTERNATIONAL ACCOUNTANCY FIRMS: • It’s good for their large clients. 4. TAX AUTHORITIES: • They have big problem by assessing foreign income by differences in the measurement of profit in different countries. - ex. Using LIFO in USA. 5. Governments: • in developing countries might find it easier to understand & control the operations of MNEs if financial reporting were more uniform. 6. LABOR UNIONS. 12 Examples of the need for harmonization: In the inventory valuation, practices in major countries include: • Cost (FIFO, LIFO or weighted average),(e.g. some Japanese companies). • The lower of FIFO and net realizable value (e.g. general IFRS practices in UK ) • The lower of LIFO and current replacement cost (e.g. common US practice). 13