PFIN: Chapter 9

advertisement

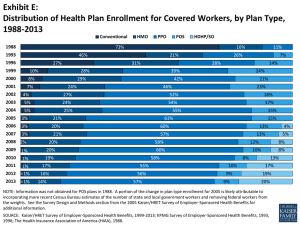

Chapter 9 Concept Checks Use these questions to confirm your understanding of each major section of the chapter. 9-1 Why should health insurance planning be part of your personal financial plan? 9-2 What factors contribute to today’s high costs of health care and health insurance? 9-3 What are the two main sources of health insurance coverage in the United States? 9-4 What is group health insurance? How does it differ from individual health insurance? 9-5 Describe the features of traditional indemnity (fee-for-service) plans and differentiate them from managed care plans. 9-6 Briefly explain how an HMO works. Compare and contrast group HMOs, IPAs, and PPOs. 9-7 Discuss the basics of the Blue Cross/Blue Shield plans. 9-8 Who is eligible for Medicare and Medicaid benefits? What do those benefits encompass? 9-9 What is the objective of workers’ compensation insurance? What types of benefits does it typically provide? 9-10 What four methods can be used to control the risks associated with health care expenses? 9-11 What factors should be considered in evaluating available employer-sponsored health insurance plans? 9-12 What sources of health insurance are available to supplement employer-sponsored health insurance plans? 9-13 What type of plan do you think will best suit your needs? Why? 9-14 What are the key differences between hospitalization insurance and surgical expense insurance? 9-15 What are the features of a major medical plan? How does comprehensive major medical insurance differ from it? 9-16 Describe the following policy provisions commonly found in medical expense plans: (a) deductibles, (b) coinsurance, (c) coordination of benefits, and (d) preexisting conditions. 9-17 What are the key provisions of the Consolidated Omnibus Budget Reconciliation Act (COBRA)? 9-18 What are the key cost containment provisions commonly found in medical expense plans? 9-19 Why should a consumer consider purchasing a long-term care insurance policy? 9-20 What are the differences among long-term care policies regarding (a) type of care, (b) eligibility requirements, and (c) services covered? 9-21 What questions should one ask before buying long-term care insurance? What guidelines can be used to choose the right policy? 9-22 What is disability income insurance? What is the waiting-period provision found in such policies? 9-23 Describe both the liberal and strict definitions used to establish whether an insured is disabled. 9-24 Why is it important to consider benefit duration when shopping for disability income coverage?