Chapter11Overheads

advertisement

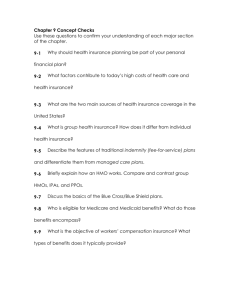

Chapter 11: Health Care Planning Objectives Identify the major sources of health care plans. Describe the major types of coverage provided by health care plans. Objectives Explain the major provisions of health care plans and insurance policies. Describe the purpose and major features of disability income insurance. How Can You Reduce Your Personal Health Care Costs? Stay well - focus on prevention eat a balanced diet and keep your weight under control avoid smoking and don’t drink to excess get enough rest, relaxation, and exercise drive carefully and look for accident and fire hazards in your home Health Insurance and Financial Planning Protection against financial loss due to illness or injury. Part of your overall risk management plan to safeguard your family’s economic security medical expense insurance disability income insurance to protect your most valuable asset - your ability to earn an income Health Care Planning FOUR LOSS TYPES: Direct medical care Recuperative care Rehabilitation Replacement of income Health Care Providers Individual Group Lower rates Employee fringe Coverage for existing health problems Health Insurance and Financial Planning (continued) Group plans comprise more than 85% of all health insurance issued Most group plans are sponsored by employers, with the employer paying most or all of the cost Group plans can be supplemented with individual plans Following divorce, a former spouse can remain covered for three years, but the premiums can be as high as $4,000 a year Health Care Providers Private insurance companies Managed care plans Preferred provider Health maintenance Health Care Providers Government plans Medicare Medicaid Health Care Coverages Hospital Surgical Medical expense Major medical expense Comprehensive health Dental expense and vision care A Good Health Insurance Plan Should.. Provide quality care at a reasonable cost Offer basic coverage for doctor and hospital bills Cover 120 days’ hospital room and board Provide at least $1,000,000 lifetime maximum per person Pay 80% of out-of-hospital expenses after the deductible is met Have no unreasonable exclusions Limit out-of-pocket expenses Types of Health Care Coverages Hospital hospital room, operating room, lab tests, X-rays, medicine Hospital indemnity pays a fixed amount for each day in hospital. Best for people in high risk groups Surgical surgeon's fee Physician office visits, lab tests and X-rays Types of Health Care Coverages (continued) Major medical covers expenses for a long term injury or illness Comprehensive major medical low deductible offered without a separate, basic plan Dread disease focuses on unrealistic fears, and only pays out for very specific conditions. Often sold by people working on commission. Types of Health Care Coverages (continued) Dental group coverage for exams, cleaning, x-rays, fillings, oral surgery Vision care some group plans include exams and glasses Long term care fastest growing coverage, especially for women Health Care Coverages Medicare supplement (Medigap) Long-term care Accident and dread disease Why Do People Buy Long-Term Care Insurance? To avoid losing assets 23.0% To avoid dependence 25.0% Protect standard of living 15.0% Other reasons 25.0% Guarantee services 12.0% 1996, Teacher's Insurance and Annuity Association Making Sense of Health Benefits GENERAL TERMS AND PROVISIONS: Definitions Who is covered Time period Making Sense of Health Benefits PAYMENT LIMITATIONS: Policy Limits Deductibles and copayments Coinsurance Coordination of benefits Making Sense of Health Benefits COVERAGE LIMITATIONS: Based on timing of loss General exclusions Maternity benefits Disability Income Insurance Disability income insurance replaces a portion of the income lost when you cannot work because of illness or injury. The chances of becoming disabled for at least three months are seven times greater than the chances of death! Disability Income Insurance Level of need Important policy provisions Elimination period Benefit period Degree of disability Disability Income Insurance Important policy provisions (continued) Residual clause Social Security rider Cost-of-living adjustments How Long Your Money Will Last Trade-Offs in Choosing a Policy Reimbursement versus indemnity Inside limits versus aggregate limits Deductibles and coinsurance Out-of-pocket limit, or stop-loss Benefits based on reasonable and customary charges How to Choose an HMO Consider the following factors accessibility convenient office hours alternative physicians second opinions type of coverage appeal procedures price