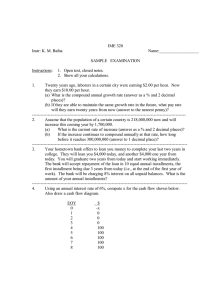

Percent - David Michael Burrow

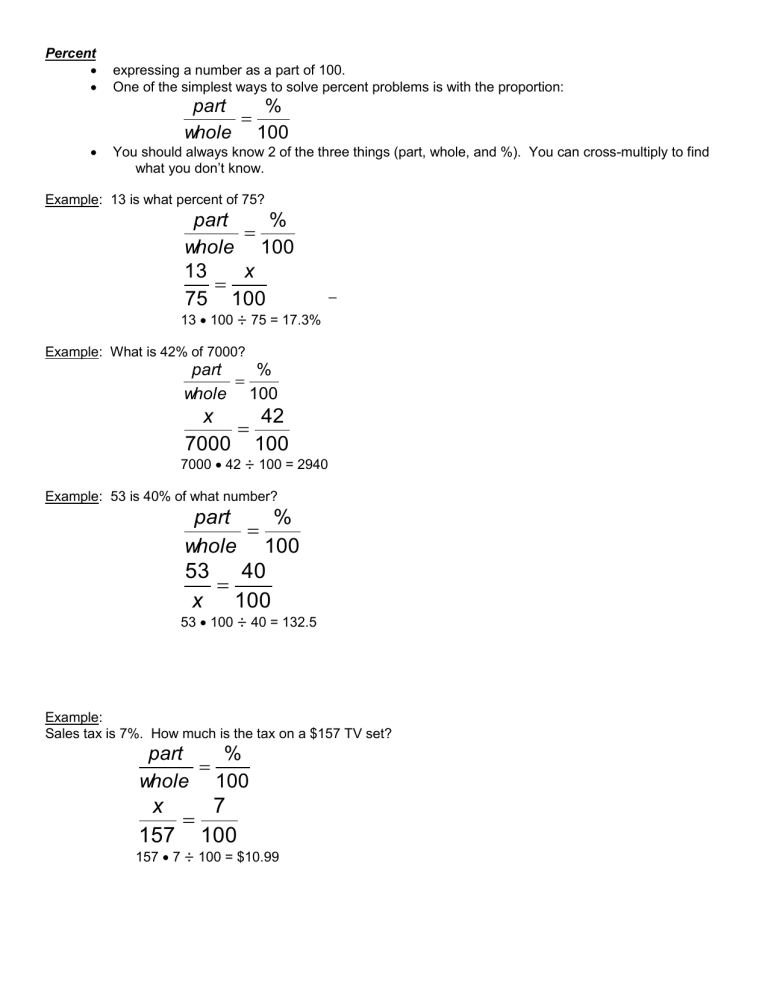

Percent

expressing a number as a part of 100.

One of the simplest ways to solve percent problems is with the proportion:

part

%

whole

100

You should always know 2 of the three things (part, whole, and %). You can cross-multiply to find what you don ’t know.

Example: 13 is what percent of 75?

part whole

%

100

13

x

75 100

Example: What is 42% of 7000?

_

13

100

÷

75 = 17.3%

part whole

%

100 x

42

7000 100

7000

42

÷

100 = 2940

Example: 53 is 40% of what number? part whole

%

100

53

40 x 100

53

100

÷

40 = 132.5

Example:

Sales tax is 7%. How much is the tax on a $157 TV set?

part whole

%

100 x

7

157 100

157

7

÷

100 = $10.99

Example:

Garrigan is having a magazine sales drive. The goal for sales is $10,250. As of Monday they had sold $9,278.

What percent of the goal is this? part

% whole 100

9278

10250

9278

100

÷

%

100

10250

… = about 90.5%.

Example

You need to get 80% to earn a “B” in a course. You earned 377 points, which was just barely enough to get a

“B”. How many total points were available in the course?

part

%

whole

100

377

80 x 100

377

100

÷

80 = 471.25

Example

(rounds to 471 points)

A pair of jeans that originally sold for $79 are on sale for 45% off. a. How much do you save? b. How much do you pay?

part

%

whole

100 x

45

79 100

79

45

÷

100 = 35.55

(So you save $35.55)

79 – 35.55 = 43.45

(So you pay $43.45)

Example

Someone’s bar tab came to $11.75. They told the bartender to keep the change from $15. a. b.

How much money did they tip?

What percent of the bill did they tip?

15 – 11.75 = $3.25 part

% whole 100

3 .

25

11 .

75

x

100

3.25

100

÷

11.75

This was about a 28% tip.

Example

Change the fraction

7

8

to a percent.

part whole

%

100

7

x

8 100

7

100

÷

8 = 87.5%

Example

Last July gas cost $1.74. Now it costs $1.89. What is the percent of increase?

First find how much it increased.

1.89 – 1.74 = .15

For increase or decrease problems, the “whole” is always the original amount. part whole

%

100

.

15

1 .

74

x

100

… about 8.6%

Also remember …

You can change between percents and decimals by moving the decimal point.

Move the decimal 2 places right to change a decimal to a percent

Move the decimal 2 places left to change a percent to a decimal

Example: Change .04275 to a percent.

.04275 4.275%

Change 70% to a decimal

70% .70 or .7

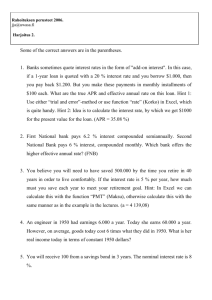

INTEREST TERMS

Principal

Original amount of money you borrow or invest

Interest

Money paid for the right to use someone else’s money over time

Simple Interest

You borrow money and pay it back after a given time period at a set percentage rate.

This is often used in agreements between friends or relatives.

Bonds also often pay simple interest.

Banks, credit cards, and loan companies almost never deal in simple interest.

Idea of simple interest

Years

0

1

2

3

4

5

6

Interest at 4%

$4

$4

$4

$4

$4

$4

Total Value

$100

$104

$108

$112

$116

$120

$124

Notice that you earn exactly the same amount of interest every year. The total value goes up at a steady rate.

Simple Interest Formulas

I

P rt

A

P

1

rt

P … principal rate of interest

(original investment) r t

A

…

…

… time

(always a decimal)

(in years) accumulated amount

(total value after time, including interest

– also called “future value”)

You borrow $700 from your brother-inlaw and agree to pay him back with 6% interest. If you don’t pay him back until 3 years later, how much do you owe him?

A

P ( 1

rt )

A

700 ( 1

.

06

3 )

A

$ 826

You owe him $826.00

Mr. Rich purchased a bond for $7,500. When he dies 24 years later, his estate redeems the bond, which earned 4.25% simple interest.

How much interest does he earn?

I

7500

.

0425

24

$ 7650

What was the total value of the bond?

A

7500

1

.

0425

24

A

$ 15 , 150

Lisa borrowed $300 from her sister. She paid back the loan three months later, including 15% interest. How much did she pay back?

NOTE: The time must be in years … 3 months is ¼ year.

A

300

1

.

15

.

25

b.

I

$ 311 .

25

When little Billy is born, his grandmother buys him a bond at a cost of $3164. When Billy heads off to college

18 years later, he cashes in the bond, which is now worth $5000. What rate of interest did the bond earn?

FIRST How much interest was earned?

5000

3164

1836

I

NOW Find the rate of interest.

I

P rt

1836

3164

r

18

1836

56952 r

.

0322

r

The bond earned about 3.22%.

Many big cities have “Pay-Day Loan” services that advance people money and then have the people sign over their paychecks to cover the loan.

Nick’s regular paycheck is $642.19. He goes to the loan service 5 days before payday. They take out a small service charge and advance him $612.19. Then, 5 days later, he signs over his check. a.

I

642 .

How many dollars in interest did Nick pay?

19

612 .

19

$ 30 .

00

In years, what was the term of the loan? c. d.

5 year

365

What amount was the principal?

P

612 .

19

What was the interest rate?

I

P rt

30

612 .

19

r

5

365

30

8 .

3861543 r

3 .

5773251

… This is 357.7%.

r

Compound Interest

Interest accumulates both on the principal and on interest that is already accumulated.

In the real world, most investments and loans involve compound interest.

Idea of compound interest

Years Interest at 4% Total Value

0

1

2

3

4

5

6

$4.00

$4.16

$4.33

$4.50

$4.68

$4.87

$100

$104.00

$108.16

$112.49

$116.99

$121.67

$126.54

Notice that you earn more interest each year than you did the year before. The total value increases more and more rapidly as you go on.

Compound Interest Formula

A

P

1 r m

P … principal t r

A …

…

… accumulated amount

(sometimes called

“future value”) rate of interest time

(sometimes called

“present value”)

(always a decimal)

(years) m … # of times compounded per year quarterly monthly

semiannually weekly annuall

4

12

2

52

1 daily ???

Traditionally daily compou nding has used the “bankers’ rule” of 360 days/year. However, recently most banks have switched to 365.

Sally inherits $12,345.67 when her grandfather dies. She invests the money in an account that earns 8% interest, compounded monthly. How much will her account be worth 9 years from now?

.

08

12

9

12345 .

67

1

12

You can type this straight in on a calculator if you’re careful with parentheses.

12345.67(1+.08/12)^(12*9)

=$25302.82

Dean invests $300 at 5% interest, compounded daily. How much money will he have in 7 months?

12

7

12

300 1

.

05

12

300(1+.05/12)^(12*7/12)

= $308.86

Find the present value of $4000 invested at 3% interest for 10 years, compounded annually.

A

P

1 r m

We need to find “P”.

4000

4000

P

2976 .

38

P

1

P

.

03

1

1

10

.

343916379

Effective Rate of Return

The rate of simple interest that would need to be paid to earn the same amount in a year that compound interest pays.

Allows you to compare interest with different compounding periods.

Effective Rate Formula r eff

1 r m

m

1

Note that the parentheses are the same as the compound interest formula.

Idea is that you’re figuring out how much compound interest $1 earns in 1 year

An account earns 7% interest, compounded weekly. Find the effective rate of return. r eff

1

.

07

52

52

1

A

B

(1+.07/52)^52-1

=.0724576961

… about 7¼%

Which account is the better deal?

A 8.25%, compounded

B daily

8.4%, compounded semiannually

(1+.0825/365)^365

-1 = .0859885495

(1+.084/2)^2-1

= .085764

A is the better deal.