Yrityksen rahoituksen perusteet

advertisement

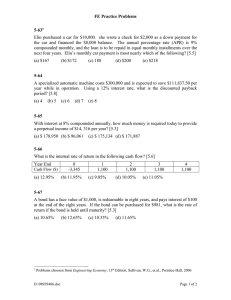

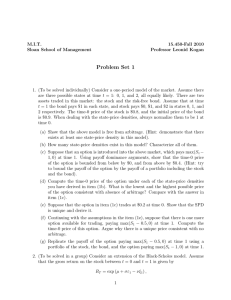

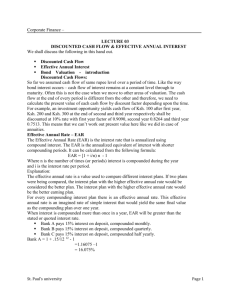

Rahoituksen perusteet 2006. jja@uwasa.fi Yrityksen rahoituksen perusteet Timo Rothovius Harjoitus 2. II 2001 Harjoitus Vaasan yliopisto Some of the correct answers are in the parentheses. 1. Banks sometimes quote interest rates in the form of "add-on interest". In this case, if a 1-year loan is quoted with a 20 % interest rate and you borrow $1.000, then you pay back $1.200. But you make these payments in monthly installments of $100 each. What are the true APR and effective annual rate on this loan. Hint 1: Use either “trial and error”-method or use function “rate” (Korko) in Excel, which is quite handy. Hint 2: Idea is to calculate the interest rate, by which we get $1000 for the present value for the loan. (APR = 35.08 %) 2. First National bank pays 6.2 % interest compounded semiannually. Second National Bank pays 6 % interest, compounded monthly. Which bank offers the higher effective annual rate? (FNB) 3. You believe you will need to have saved 500.000 by the time you retire in 40 years in order to live comfortably. If the interest rate is 5 % per year, how much must you save each year to meet your retirement goal. Hint: In Excel we can calculate this with the function “PMT” (Maksu), otherwise calculate this with the same manner as in the example in the lectures. (a = 4 139,08) 4. An engineer in 1950 had earnings 6.000 a year. Today she earns 60.000 a year. However, on average, goods today cost 6 times what they did in 1950. What is her real income today in terms of constant 1950 dollars? 5. You will receive 100 from a savings bond in 3 years. The nominal interest rate is 8 %. a. What is the present value of the proceeds from the bond? ($79.38) b. If the inflation rate over the next few years is expected to be 3 %, what will the real value of the 100 payoff be in terms of today's dollars? ($91.51) c. What is the real interest rate? (4.854 %) d. Show that the real payoff from the bond (from part b) discounted at the real interest rate (from part c) gives the same present value for the bond as you found in part a. 6. If the interest rate this year is 8 % and the interest rate next year will be 10 %, a) what is the future value of $1 after 2 years? B) What is the present value of a payment of $1 to be received in 2 years? ( a = $1.188 )