solutions to multiple choice questions, exercises and

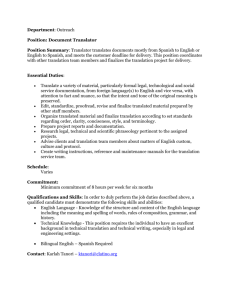

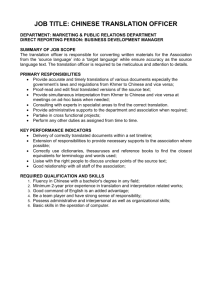

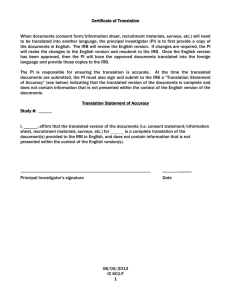

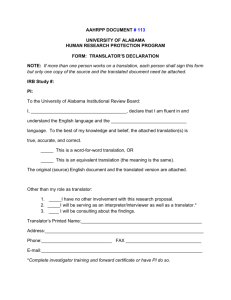

advertisement

CHAPTER 7 SOLUTIONS TO MULTIPLE CHOICE QUESTIONS, EXERCISES AND PROBLEMS MULTIPLE CHOICE QUESTIONS 1.a Remeasurement changes local currency accounts (euros) to the functional currency (krona). Translation changes the functional currency accounts (krona) to the reporting currency (U.S. dollars). 2.d Remeasure the equipment to U.S. dollars using the rates when the equipment was purchased. (€1,000,000 x $1.40) + (€3,000,000 x $1.50) = $5,900,000. 3.a Beginning net assets (200,000 + 600,000) + Net income (4,000,000 – 2,300,000 – 300,000 – 1,200,000) - Dividends Ending net assets Translation loss € 800,000 Rate 1.45 U.S. $ 1,160,000 200,000 (100,000) 1.35 1.32 900,000 1.30 270,000 (132,000) 1,298,000 1,170,000 128,000 4.c Beginning net assets carried at fair value (200,000 – 1,400,000) + Sales - Purchases [2,300,000 + (500,000 – 400,000)] - Out of pocket expenses - Dividends Ending net assets carried at fair value (180,000 – 1,080,000) Remeasurement gain Solutions Manual, Chapter 7 € Rate U.S. $ (1,200,000) 4,000,000 (2,400,000) (1,200,000) (100,000) 1.45 1.35 1.35 1.35 1.32 (1,740,000) 5,400,000 (3,240,000 (1,620,000) (132,000) (1,332,000) (900,000) 1.30 (1,170,000) 162,000 ©Cambridge Business Publishers, 2013 1 5.b Translation multiplies the current ratio numerator and denominator by the same rate. 6.c A steadily weakening dollar means the direct rate is rising. Translated assets are multiplied by an increasing rate. 7.b The direct rate is falling. Entry R debits goodwill at the lower ending rate, and eliminates the remaining investment balance, created at higher rates, leading to a debit to OCI. Entry O credits goodwill at the ending rate and debits impairment loss at the higher average rate, leading to a credit to OCI. 8.c Reported net income Goodwill impairment Equity in net income £ 500,000 (20,000) 480,000 Rate 1.65 1.65 U.S. $ 825,000 (33,000) 792,000 Note: the limited life intangibles were written off prior to 2015. 9.b IFRS: (10,000,000 x 400/100) x £0.01 = £400,000 U.S. GAAP: (10,000,000 x £0.05) = £500,000 10.d For non-inflationary economies, IFRS and U.S. GAAP remeasurement and translation procedures are the same. ©Cambridge Business Publishers, 2013 2 Advanced Accounting, 2nd Edition EXERCISES E7.1 Translation and Remeasurement of Inventory, Cost of Sales, Plant Assets and Depreciation a.(1)20,000 x $0.52 = $10,400 (2)Cost of sales in R is: (100,000 + 75,000 - 20,000) = R155,000 155,000 x $0.475 = $ 73,625 b.(1)20,000 x $0.50 = $10,000 (2) Purchase 100,000 x $0.45 = Purchase 75,000 x $0.50 = Ending inventory (20,000) x $0.50 = Cost of sales c. $ 45,000 37,500 (10,000) $ 72,500 Property, plant and equipment at December 31, 2013, in S$, is as follows: [1,500,000 - (3)(150,000)] = S$ 1,050,000 [900,000 - (2)(90,000)] = 720,000 PP&E, net S$ 1,770,000 (1) 1,770,000 x $0.525 = $929,250 (2)(150,000 + 90,000) x $0.55 = $132,000 d.(1)(1,050,000 x $0.675) + (720,000 x $0.625) = $1,158,750 (2) (150,000 x $0.675) + (90,000 x $0.625) = $157,500 E7.2Translation and Remeasurement Gain or Loss Calculations and Consolidation a. Remeasurement gain or loss Exposed position, 9/10/14 Purchase of equipment Operating expenses Exposed position, 12/31/14 Remeasurement gain (income statement) b. S/ S/ 10,000,000 (2,700,000) (2,900,000) $/S/ 0.30 0.30 0.31 S/ 4,400,000 0.33 S/ S/ 10,000,000 (2,900,000) $/S/ 0.30 0.31 S/ 7,100,000 0.33 $ $3,000,000 (810,000) (899,000) 1,291,000 -1,452,000 $(161,000) Translation gain or loss Exposed position, 9/10/14 Operating expenses Exposed position, 12/31/14 Translation gain (OCI) Solutions Manual, Chapter 7 $ $3,000,000 (899,000) 2,101,000 -2,343,000 $(242,000) ©Cambridge Business Publishers, 2013 3 c. Globe’s entries, remeasurement Equity in net loss of sub Investment in sub $(738,000) = $(2,900,000 x 0.31) – $161,000 738,000 738,000 Globe’s entries, translation Equity in net loss of sub 899,000 Investment in sub OCI $(899,000) = ($2,900,000 x 0.31) d. 657,000 242,000 Remeasurement consolidation Globe Subsidiary Dr (Cr) Dr (Cr) Dr Cr Consol Cash $ 500,000 $ 1,452,000 $ 1,952,000 PP&E 22,000,000 810,000 22,810,000 Investment in sub 2,262,000 (C) 738,000 3,000,000 (E) Liabilities (16,000,000) (16,000,000) Capital (5,000,000) (3,000,000) (E) 3,000,000 (5,000,000) RE, beg (2,000,000) (2,000,000) Revenues (15,000,000) (15,000,000) Equity in NL 738,000 738,000 (C) Expenses 12,500,000 899,000 13,399,000 Remeasurement gain ________ (161,000) ________ ________ (161,000) $ -0- $ -0$3,738,000 $3,738,000 $ -0Translation consolidation Globe Subsidiary Dr (Cr) Dr (Cr) Cash $ 500,000 $ 1,452,000 PP&E 22,000,000 891,000 Investment in sub 2,343,000 Liabilities (16,000,000) Capital (5,000,000) (3,000,000) RE, beg (2,000,000) AOCI (242,000) (242,000) Revenues (15,000,000) Equity in NL 899,000 Expenses 12,500,000 899,000 $ -0- $ -0- ©Cambridge Business Publishers, 2013 4 Dr Cr Consol $ 1,952,000 22,891,000 (C) 899,000 3,242,000 (E) (E) 3,000,000 (E) 242,000 (16,000,000) (5,000,000) (2,000,000) (242,000) (15,000,000) 899,000 (C) ________ ________ 13,399,000 $4,141,000 $4,141,000 $ -0- Advanced Accounting, 2nd Edition E7.3 Translation and Remeasurement of Account Balances a. Cash 4,000,000 x $.75 $3,000,000 Inventory is remeasured at historical rates. There are two layers: (1) quantity acquired in January, 2012; 1,000,000 x $.85 (2) quantity acquired in January, 2014; 2,000,000 x $.78 Total remeasured inventory $ 850,000 1,560,000 $2,410,000 Machinery and equipment are remeasured at historical rates. Remaining equipment purchased in January, 2012; 4,000,000 x $.85 Equipment purchased in January, 2013; 7,000,000 x $.80 Total remeasured machinery and equipment $3,400,000 5,600,000 $9,000,000 Depreciation expense is remeasured at the same historical rate(s) used to remeasure the related machinery and equipment. Depreciation expense on remaining January, 2012 equipment: $.85(4,000,000/10) $ 340,000 Depreciation expense on January, 2013 equipment: $.80(7,000,000/10) 560,000 Total remeasured depreciation expense $ 900,000 b. Cash Inventory Machinery and equipment Depreciation expense E7.4 4,000,000 x $.75 = $3,000,000 3,000,000 x $.75 = $2,250,000 11,000,000 x $.75 = $8,250,000 1,100,000 x $.76 = $ 836,000 Translation and Remeasurement Gain and Loss (in millions) a. Exposed position, 1/1/14 Acquisition of plant assets for debt Purchase of inventory Sales Operating expenses Exposed position, 12/31/14 Remeasurement gain Solutions Manual, Chapter 7 Amount (£) £ 700 (1,000) (3,500) 6,000 (1,200) £ 1,000 $/£ Amount($) 1.90 $ 1,330 1.95 (1,950) 1.97 (6,895) 1.97 11,820 1.97 (2,364) 1,941 2.01 - 2,010 $ (69) ©Cambridge Business Publishers, 2013 5 NOTE: The following items did not affect the remeasurement gain or loss: 1. 2. 3. 4. Collection of receivables has no net effect -- one exposed asset (receivables) is simply replaced by another (cash). Depreciation expense does not affect the exposed position. Refinancing of commercial paper has no net effect -- one liability is simply replaced by another. Cost of goods sold does not affect the exposed position. b. Amount (£) £ 1,200 1,100 Exposed position, 1/1/14 Net income in 2014 (6,000 – 3,300 – 400 -1,200) Exposed position, 12/31/14 Translation gain £ 2,300 E7.5 Translation and Remeasurement Gains and Losses a. Calculation of Remeasurement Gain or Loss January 1, 2014 beginning balance Purchases Book value of land sale Gain on land sale Sales Cash operating expenses December 31, 2014 ending balance 2014 remeasurement gain (income) b. $/£ Amount($) 1.90 $ 2,280 1.97 2,167 4,447 2.01 - 4,623 $ (176) € € (12,000,000) (8,000,000) 700,000 300,000 10,000,000 (1,800,000) $/€ 1.13 1.10 1.15 1.11 1.12 1.12 € (10,800,000) 1.10 € € 9,000,000 $/€ 1.13 $ $10,170,000 2,300,000 1.12 € 11,300,000 1.10 2,576,000 12,746,000 - 12,430,000 $ 316,000 $ $(13,560,000) (8,800,000) 805,000 333,000 11,200,000 (2,016,000) (12,038,000) - (11,880,000) $ (158,000) Analysis of Translation Gain or Loss Exposed position, 1/1/14 Net income (10,000,000 + 300,000 6,000,000 – 1,800,000 - 200,000) Exposed position, 12/31/14 2014 translation loss (OCI) ©Cambridge Business Publishers, 2013 6 Advanced Accounting, 2nd Edition E7.6 Effect of Translation and Remeasurement on Ratios (in thousands) a. Rands return on assets = 1,000/8,000 = 12.5% = return on sales 1,000/5,000 20% x x x asset turnover 5,000/8,000 62.5% $ (remeasurement) 130/2,000 = 6.5% = 130/750 17.3% x x 750/2,000 37.5% $ (translation) 150/1,400 = 10.7% = 150/750 20% x x 750/1,400 53.6% Translation maintains the local currency relationships better than remeasurement. b. The direct exchange rate appears to be falling with the dollar strengthening and the rand weakening. This can be seen by observing that remeasured assets of $2,000,000 (remeasured at historical rates) are higher than translated assets of $1,400,000 (translated at average of beginning and ending current rates). Similarly, remeasured operating income of $130,000 is lower than translated operating income of $150,000, due to depreciation and amortization expenses being remeasured at higher historical rates when the functional currency is the $. The declining exchange rate causes the DuPont analysis performance measures to be distorted by the changing exchange rate. If performance measured in the local currency-rands--is the benchmark, translation does a much better job of preserving the local currency results than remeasurement. Under either method, though, changes in exchange rates over the years weaken our ability to effectively make year-to-year comparisons of $ performance measures. Solutions Manual, Chapter 7 ©Cambridge Business Publishers, 2013 7 E7.7 Remeasured Financial Statements Sales Cost of goods sold Operating expenses Depreciation expense Amortization expense Remeasurement gain Net income Mexico City Subsidiary Statement of Income For the Year Ended December 31, 2013 P $/P P 12,000,000 0.12 (7,000,000) 0.12 (3,000,000) 0.12 (75,000) 0.11 (60,000) 0.10 _________ P 1,865,000 Cash Inventory Office equipment, net Organization costs, net Total assets Mexico City Subsidiary Balance Sheet December 31, 2013 P P 8,700,000 2,000,000 925,000 240,000 P 11,865,000 Capital Retained earnings Total equity P 10,000,000 1,865,000 P 11,865,000 $/P 0.15 0.11 0.11 0.10 $ $ 1,305,000 220,000 101,750 24,000 $ 1,650,750 0.10 see above $ 1,000,000 650,750 $ 1,650,750 Calculation of Remeasurement Gain P $/P Exposed position, 1/2/13 (cash) P 10,000,000 0.10 Sales 12,000,000 0.12 Organization costs (300,000) 0.10 Equipment purchase (1,000,000) 0.11 Merchandise purchase (2,000,000) 0.11 Merchandise purchase (7,000,000) 0.12 Cash operating expenses (3,000,000) 0.12 Exposed position, 12/31/13 Remeasurement gain (income) ©Cambridge Business Publishers, 2013 8 P 8,700,000 $ $ 1,440,000 (840,000) (360,000) (8,250) (6,000) 425,000 $ 650,750 0.15 $ $ 1,000,000 1,440,000 (30,000) (110,000) (220,000) (840,000) (360,000) 880,000 - 1,305,000 $ (425,000) Advanced Accounting, 2nd Edition E7.8 Change in Functional Currency Exposed position, January 1 Net income Dividends Exposed position, December 31 Translation loss Balance, 1/1/14 (gain) (1) Balance, 12/31/14 (gain) C$ C$ 20,000,000 2,500,000 (1,000,000) $/C$ 1.05 1.03 1.02 C$ 21,500,000 1.01 (1) Translated net assets: $1.05 x 20,000,000 = Less remeasured net assets Beginning balance of translation adjustment account 1/1/14 (gain) E7.9 $ $21,000,000 2,575,000 (1,020,000) 22,555,000 - 21,715,000 840,000 (6,000,000) $ (5,160,000) $ 21,000,000 (15,000,000) $ 6,000,000 Translated/Remeasured Financial Statements a. Sales Cost of goods sold Depreciation expense Other expenses Net income Income Statement (Translated) SAR SAR 85,000,000 (40,000,000) (10,000,000) (15,000,000) SAR 20,000,000 Balance Sheet (Translated) SAR Cash SAR 95,000,000 Inventory 25,000,000 Plant assets 90,000,000 Total assets SAR210,000,000 Capital SAR200,000,000 Retained earnings 10,000,000 Accumulated other comprehensive loss __________ Total equity SAR210,000,000 Solutions Manual, Chapter 7 $/SAR .265 .265 .265 .265 $ $ 22,525,000 (10,600,000) (2,650,000) (3,975,000) $ 5,300,000 $/SAR .25 .25 .25 $ $ 23,750,000 6,250,000 22,500,000 $ 52,500,000 $ 60,000,000 2,750,000 (10,250,000) $ 52,500,000 .30 (1) (2) ©Cambridge Business Publishers, 2013 9 (1) Analysis of Retained Earnings (Translated) Net income Dividends Retained earnings, 12/31/13 SAR SAR 20,000,000 (10,000,000) SAR 10,000,000 $/SAR .265 .255 $ $ 5,300,000 (2,550,000) $ 2,750,000 SAR SAR 200,000,000 20,000,000 (10,000,000) $/SAR .300 .265 .255 SAR 210,000,000 .250 $ $60,000,000 5,300,000 (2,550,000) 62,750,000 - 52,500,000 $10,250,000 (2) Analysis of Translation Loss Exposed position, 1/1/13 Net income Dividends Exposed position, 12/31/13 2013 translation loss b. Sales Cost of goods sold Depreciation expense Other expenses Remeasurement loss Net income Cash Inventory Plant assets Total assets Capital Retained earnings Total equity ©Cambridge Business Publishers, 2013 10 Income Statement (Remeasured) SAR SAR 85,000,000 (40,000,000) (10,000,000) (15,000,000) __________ SAR 20,000,000 $/SAR .265 .300 .300 .265 (3) $ $ 22,525,000 (12,000,000) (3,000,000) (3,975,000) (3,275,000) $ 275,000 Balance Sheet (Remeasured) SAR SAR 95,000,000 25,000,000 90,000,000 SAR 210,000,000 $/SAR .25 (4) .30 $ $ 23,750,000 6,975,000 27,000,000 $ 57,725,000 .30 (5) $ 60,000,000 (2,275,000) $ 57,725,000 SAR 200,000,000 10,000,000 SAR 210,000,000 Advanced Accounting, 2nd Edition (3) Analysis of Remeasurement Loss SAR SAR 50,000,000 85,000,000 (15,000,000) (15,000,000) (10,000,000) $/SAR .300 .265 .265 .265 .255 SAR 95,000,000 .250 (4) Remeasurement of 12/31/13 Inventory Balance SAR Inventory purchased 1/1/13 SAR 10,000,000 Inventory purchased evenly in 2013 15,000,000 Inventory balance, 12/31/13 SAR 25,000,000 $/SAR .30 .265 $ $ 3,000,000 3,975,000 $ 6,975,000 $/SAR I/S .255 $ $ 275,000 (2,550,000) $(2,275,000) Exposed position, 1/1/13 Sales Purchases Cash expenses Dividends Exposed position, 12/31/13 2013 remeasurement loss $ $ 15,000,000 22,525,000 (3,975,000) (3,975,000) (2,550,000) 27,025,000 - 23,750,000 $ 3,275,000 (5) Analysis of Retained Earnings (Remeasured) Net income Dividends Retained earnings, 12/31/13 SAR SAR 20,000,000 (10,000,000) SAR 10,000,000 E7.10 Exchange Rate Changes and Return on Assets a. b. Return on Assets (000,000 omitted) $ 2014 12/.5(112 + 95) = .116 2015 10.89/.5(95 + 95) = .115 Note: 10 = 12/1.2; 12.1 = 10.89/.9; 80 = 112/1.4 € 10/.5(80 + 95) = .114 12.1/.5( 95+ 95) = .127 Although the ROA based on euro data increased by 11.4% [= (.127 - .114)/.114], translated data produced an ROA that declined slightly over the period. This distortion created by translation can be attributed to two factors. 1. The declining average exchange rate caused translated operating income to fall by 9.3% [= (10.89 - 12)/12] even though euro income rose by 21%. Thus the numerator of the euro ROA rose while the numerator of the translated ROA fell. 2. Translated average total assets decreased by 8.2% [= (95 -103.5)/103.5], whereas average euro assets increased by 8.6% [= (95 - 87.5)/87.5]. This increased the denominator of the euro ROA relative to the translated ROA. Solutions Manual, Chapter 7 ©Cambridge Business Publishers, 2013 11 The net effect of the changing exchange rate on euro income and average total assets creates a divergence between the euro ROA -- which suggests improved profitability of the asset portfolio -- and the slightly weakening ROA based on translated data. Since the euro is the entity's functional currency, the entity's financial performance is best measured by euro data. Internal management has these euro data and can decide whether to make decisions based on translated data. Financial statement users outside the entity, however, cannot easily determine that translated data provide the wrong performance signal and factor out the translation effects that produce the wrong performance signal. E7.11 Comparison of Translation and Remeasurement a. The direct exchange rate has been steadily increasing. This means that many remeasured expenses are lower than translated expenses, since historical rates are lower than average rates. Since Sears Canada has a positive exposed position for remeasurement, the increase in rate will result in a remeasurement gain on the income statement. For these reasons, remeasured income is higher than translated income. If Sears Canada had a net negative exposed position for remeasurement, a remeasurement loss would be shown on the income statement, possibly offsetting the effect of lower expenses. In this case, no clear statement can be made concerning the relationship between remeasured and translated income. b. Remeasured assets are lower than translated assets since historical rates are lower than the current rate. From above, remeasured income is higher than translated income. These factors combine to show remeasured ROA as greater than translated ROA. c. Remeasured current assets may be slightly lower than translated current assets, as inventories and possibly prepaids would be remeasured at lower historical rates. Current liabilities are likely to be the same under both methods. Therefore the remeasured current ratio is lower than the translated current ratio. Remeasured and translated debt should be the same. Remeasured total assets are lower since the older noncurrent assets are remeasured at lower historical rates. Thus remeasured debt to assets is higher than translated debt to assets. ©Cambridge Business Publishers, 2013 12 Advanced Accounting, 2nd Edition E7.12 Cash Flow Statement Conversion The Luh Company Statement of Cash Flows For the Year Ended December 31, 2014 (in thousands) NT$ $/NT$ $ NT$ 100,000,000 45,000,000 (4,000,000) .0400 .0400 .0400 $ 4,000,000 1,800,000 (160,000) Decrease in other current operating assets Decrease in current operating liabilities Cash provided by operating activities 24,000,000 (32,000,000) 133,000,000 .0400 .0400 960,000 + (1,280,000)+ 5,320,000 Investing Activities Acquisition of plant assets Sale of long-term investments Cash used in investing activities (85,000,000) 50,000,000 (35,000,000) .0423 .0394 (3,595,500) 1,970,000 (1,625,500) (98,000,000) 170,000,000 (65,000,000) 7,000,000 .0394 .0423 .0400 (3,861,200) 7,191,000 (2,600,000) 729,800 (959,300)* 8,820,000 $12,285,000 Operating Activities Net income Depreciation and amortization expense Gain on sale of long-term investments Financing Activities Retirement of long-term debt Issuance of common stock Dividends paid Cash provided by financing activities Effect of exchange rate changes on cash Cash balance, January 1, 2014 Cash balance, December 31, 2014 210,000,000 NT$ 315,000,000 .0420 .0390 + These adjustments to income are for items (1) included in income but not using cash (depreciation, decrease in other current operating assets) or are not operating flows (gain on sale of investments) or are (2) not included in income (decrease in current operating liabilities) but using cash. All such items are translated at the rates used for them in the income statement. Solutions Manual, Chapter 7 ©Cambridge Business Publishers, 2013 13 * Effect of exchange rate changes on cash: Beginning exposed position (cash) Increases in cash: Cash provided by operations: Net income Depreciation and amortization expense Gain on sale of long-term investments Decrease in other current assets Decrease in current operating liabilities Sale of long-term investments Proceeds from stock issuance Decreases in cash: Acquisition of plant assets Retirement of long-term debt Dividends paid Ending exposed position (cash) Translation loss on cash NT$ NT$ 210,000,000 $/NT$ .0420 100,000,000 45,000,000 (4,000,000) 24,000,000 (32,000,000) 133,000,000 50,000,000 170,000,000 220,000,000 .0400 .0400 .0400 .0400 .0400 (85,000,000) (98,000,000) (65,000,000) (248,000,000) .0423 .0394 .0400 NT$ 315,000,000 .0394 .0423 .0390 $ $ 8,820,000 4,000,000 1,800,000 (160,000) 960,000 (1,280,000) 5,320,000 1,970,000 7,191,000 9,161,000 (3,595,500) (3,861,200) (2,600,000) (10,056,700) 13,244,300 - 12,285,000 $ 959,300 E7.13 Consolidation of an International Subsidiary at Date of Acquisition Price paid Book value Undervaluation of inventories Overvaluation of noncurrent assets Goodwill P P 180,000,000 (100,000,000) (15,000,000) 5,000,000 P 70,000,000 $/P 0.10 0.10 0.10 0.10 U.S.$ $ 18,000,000 (10,000,000) (1,500,000) 500,000 $ 7,000,000 Entries to consolidate the balance sheets of parent and subsidiary (amounts are in U.S. dollars): (E) Capital stock 8,000,000 Retained earnings 2,000,000 Investment in subsidiary 10,000,000 (R) Inventories 1,500,000 Goodwill 7,000,000 Noncurrent assets 500,000 Investment in subsidiary 8,000,000 ©Cambridge Business Publishers, 2013 14 Advanced Accounting, 2nd Edition PROBLEMS P7.1 Translating and Remeasuring Selected Accounts (in millions) a. TEurope AG Remeasurement of Selected Accounts into Dollars December 31, 2012 and December 31, 2013 December 31, 2013 CHF $/CHF Accounts receivable (net) CHF 40,000 .67 Inventories, at cost 80,000 .58 Property, plant and equipment 163,000 Schedule 1 Long-term debt 100,000 .67 Common stock 50,000 .50 December 31, 2012 Accounts receivable (net) CHF 35,000 .58 Inventories, at cost 75,000 .50 Property, plant and equipment 150,000 .50 Long-term debt 120,000 .58 Common stock 50,000 .50 $ $ 26,800 46,400 86,090 67,000 25,000 $ 20,300 37,500 75,000 69,600 25,000 Schedule 1 Remeasurement of Property, Plant, and Equipment (Net) into U.S. Dollars at December 31, 2013 CHF $/CHF $ Land purchased on 1/1/12 CHF 24,000 .50 $ 12,000 Plant and equipment purchased on 1/1/12: Original cost 140,000 .50 70,000 Accumulated depreciation (28,000) .50 (14,000) 112,000 56,000 Plant and equipment purchased on 7/4/13: Original cost Accumulated depreciation Total property, plant and equipment Solutions Manual, Chapter 7 30,000 (3,000) 27,000 CHF 163,000 .67 .67 20,100 (2,010) 18,090 $ 86,090 ©Cambridge Business Publishers, 2013 15 b. TEurope AG Translation of Selected Accounts into Dollars December 31, 2013 and December 31, 2012 December 31, 2013 CHF $/CHF Accounts receivable (net) CHF 40,000 .67 Inventories, at cost 80,000 .67 Property, plant and equipment 163,000 .67 Long-term debt 100,000 .67 Common stock 50,000 .50 December 31, 2012 Accounts receivable (net) CHF 35,000 .58 Inventories, at cost 75,000 .58 Property, plant and equipment 150,000 .58 Long-term debt 120,000 .58 Common stock 50,000 .50 P7.2 $ $ 26,800 53,600 109,210 67,000 25,000 $ 20,300 43,500 87,000 69,600 25,000 Existing Subsidiary—Remeasurement a. Valiant Corporation Remeasured Trial Balance at January 1, 2013 Account kr Cash kr 175,000 Accounts receivable, net 400,000 Plant and equipment, net 2,320,000 Accounts payable (535,000) Notes payable (800,000) Capital stock (400,000) Retained earnings, January 1, 2013 (1,160,000) kr 0 ©Cambridge Business Publishers, 2013 16 $/kr .16 .16 .16 .16 .16 .16 .16 $ 28,000 64,000 371,200 (85,600) (128,000) (64,000) (185,600) $ 0 $ Advanced Accounting, 2nd Edition Valiant Corporation Remeasured Trial Balance at December 31, 2013 Account kr $/kr Cash kr 240,000 .19 Accounts receivable, net 360,000 .19 Plant and equipment, net 2,000,000 .16 Accounts payable (200,000) .19 Notes payable (600,000) .19 Capital stock (400,000) .16 Retained earnings, January 1, 2013 (1,160,000) .16 Sales (1,200,000) .17 Depreciation expense 320,000 .16 Other expenses 640,000 .17 see Remeasurement loss _______ sch. kr -0Valiant Corporation Remeasurement Loss for 2013 kr Exposed position, January 1 kr (760,000)1 Sales 1,200,000 Other expenses (640,000) $/kr .16 .17 .17 Exposed position, December 31 .19 kr (200,000)2 Remeasurement loss 1 Net exposure 1/1/13: (760,000) = 175,000 + 400,000 - 535,000 - 800,000 2 Net exposure 12/31/13: (200,000) = 240,000 + 360,000 - 200,000 - 600,000 Solutions Manual, Chapter 7 $ $ 45,600 68,400 320,000 (38,000) (114,000) (64,000) (185,600) (204,000) 51,200 108,800 11,600 $ -0- $ $ (121,600) 204,000 (108,800) (26,400) - (38,000) $ 11,600 ©Cambridge Business Publishers, 2013 17 b. Valiant Corporation Remeasured Income Statement For the Year Ended December 31, 2013 Sales Depreciation expense Other expenses Total Expenses Operating income Remeasurement loss Net Income $204,000 $ 51,200 108,800 $160,000 $ 44,000 11,600 $ 32,400 Valiant Corporation Remeasured Balance Sheet December 31, 2013 Assets Cash Accounts receivable, net Plant and equipment, net Total assets Liabilities and Stockholders’ Equity Accounts payable Notes payable Capital stock Retained earnings ($185,600+ $32,400) Total liabilities and stockholders' equity ©Cambridge Business Publishers, 2013 18 $ 45,600 68,400 320,000 $ 434,000 $ 38,000 114,000 64,000 218,000 $ 434,000 Advanced Accounting, 2nd Edition P7.3 Existing Subsidiary—Translation a. Valiant Corporation Translated Trial Balance at January 1, 2013 Account kr $/kr Cash kr 175,000 .16 Accounts receivable, net 400,000 .16 Plant and equipment, net 2,320,000 .16 Accounts payable (535,000) .16 Notes payable (800,000) .16 Capital stock (400,000) .16 Retained earnings, 1/1/13 (1,160,000) .16 Accumulated other comprehensive income --kr -0- $ $ 28,000 64,000 371,200 (85,600) (128,000) (64,000) (182,400) -$ -0- Valiant Corporation Translated Trial Balance at December 31, 2013 Account kr $/kr Cash kr 240,000 .19 Accounts receivable, net 360,000 .19 Plant and equipment, net 2,000,000 .19 Accounts payable (200,000) .19 Notes payable (600,000) .19 Capital stock (400,000) .16 Retained earnings, 1/1/13 (1,160,000) .16 Sales (1,200,000) .17 Depreciation expense 320,000 .17 Other expenses 640,000 .17 see Accumulated other comprehensive gain -sch. kr 0 Analysis of Translation Adjustment kr Net assets, January 1 (400,000 + 1,160,000) kr 1,560,000 Net income, 2013 (1,200,000 - 320,000 - 640,000) 240,000 Net assets, December 31 Translation gain Cumulative translation adjustment, January 1 Cumulative translation gain, December 31 Solutions Manual, Chapter 7 kr 1,800,000 $ $ 45,600 68,400 380,000 (38,000) (114,000) (64,000) (185,600) (204,000) 54,400 108,800 (51,600) $ 0 $/kr .16 .17 .19 $ $249,600 40,800 290,400 - 342,000 (51,600) -$(51,600) ©Cambridge Business Publishers, 2013 19 b. Valiant Corporation Translated Income Statement For the Year Ended December 31, 2013 Sales Depreciation expense Other expenses Total expenses Net income $204,000 $ 54,400 108,800 $163,200 $ 40,800 Valiant Corporation Translated Balance Sheet December 31, 2013 Assets Cash Accounts receivable, net Plant and equipment, net Total assets Liabilities and stockholders’ equity Accounts payable Notes payable Capital stock Retained earnings ($185,600 + $40,800) Accumulated other comprehensive income Total liabilities and stockholders' equity ©Cambridge Business Publishers, 2013 20 $ 45,600 68,400 380,000 $ 494,000 $ 38,000 114,000 64,000 226,400 51,600 $ 494,000 Advanced Accounting, 2nd Edition P7.4 Translation and Performance Evaluation a. In euros, net income increased about 42% [= (595 - 420)/420], driven by the 20% increase in sales. Expenses increased by 14% but, because they amount to less than sales, there is a much greater impact on the bottom line. Next, we compare 2015 and 2014 in dollars when the functional currency is the euro. Translation comparison 2015 € $/€ $ Sales €2,400 1.35 $3,240 Cost of sales 1,320 1.35 1,782 Gross margin 1,080 1,458 Other operating expenses 230 1.35 310.5 Profit before taxes 850 1,147.5 Income tax expense 255 1.35 344.25 Net income € 595 $803.25 % change in net income 42% 32% (in thousands) 2014 € $/€ €2,000 1.45 1,200 1.45 800 200 1.45 600 180 1.45 € 420 $ $2,900 1,740 1,160 290 870 261 $ 609 Translated net income shows a 32% increase on a 12% increase in sales. This picture is less favorable than that depicted in euros. b. Remeasured net income increases by about 36%, as shown below. Remeasurement comparison (in thousands) 2015 2014 € $/€ $ € $/€ $ Sales €2,400 1.35 $ 3,240 €2,000 1.45 $2,900 Cost of sales 1,320 1.37 1,808.4 1,200 1.48 1,776 Gross margin 1,080 1,431.6 800 1,124 Other operating expenses 230 1.37 315.1 200 1.48 296 Profit before taxes 850 1,116.5 600 828 Income tax expense 255 1.35 344.25 180 1.45 261 Net income € 595 $ 772.25 € 420 $ 567 % change in net income 42% 36% Solutions Manual, Chapter 7 ©Cambridge Business Publishers, 2013 21 c. The basic problem with internal performance evaluation based on either translated or remeasured data is that management is being judged in part on an important factor that it cannot control--the exchange rate. Moreover, because the exchange rate changes each year, "comparative" data tend to become incomparable. At least two approaches could be considered. First, probably the most obvious approach to avoiding exchange rate distortions is to use the euro data, particularly when the euro is the entity's functional currency. High inflation rates or changes in prices of the goods and services bought and sold by the entity weaken the comparability of the comparative euro data. A second approach involves removing the effect of year-to-year exchange rate changes. When the functional currency is the euro, the 2015 euro results can be translated at the 2014 average $/€ rate. Under this approach, 2015 income of €595 translated at the 2014 rate of $1.45/€ amounts to $863, an increase of 42% over 2014's $609. When the functional currency is the U.S. dollar, both the average rate for 2014 as well as the historical rates used in 2014 remeasurement must be retained, as shown below. This approach shows remeasured net 2015 income, using 2014 rates, about 44% higher than reported in 2014. (in thousands) Sales Cost of sales Gross margin Other operating expenses Profit before taxes Income tax expense Net income % change in net income € €2,400 1,320 1,080 230 850 255 € 595 42% 2015 $/€ 1.45 1.48 1.48 1.45 $ € $3,480 €2,000 1,953.6 1,200 1,526.4 800 340.4 200 1,186 600 369.75 180 $ 816.25 € 420 44% 2014 $/€ 1.45 1.48 1.48 1.45 $ $2,900 1,776 1,124 296 828 261 $ 567 For these data, retaining 2014 $/€ exchange rates to translate and remeasure 2015 euro data provides percentage changes in dollar income close to that observed in euros. However, as pointed out in the chapter, applying this approach to remeasurement generally produces similar results only by coincidence. ©Cambridge Business Publishers, 2013 22 Advanced Accounting, 2nd Edition P7.5 Translation and Ratio Analysis (in thousands) a. Income Statement (*) Sales Cost of sales Operating expenses Net Income * $ amounts = € amounts x 1.3 $ 650,000 (416,000) (182,000) $ 52,000 Balance Sheet (*) Cash $ 11,000 Liabilities Merchandise inventory 220,000 Capital stock (200,000 x $1.50) Plant assets 275,000 Retained earnings Accumulated other ______ comprehensive income Total assets $506,000 Stockholders’ Equity * $ amounts of assets and liabilities = € amounts x 1.1 Analysis of Translation Adjustment for 2014 € Exposed position (net assets), January 1, 2014 €200,000 Plus net income in 2014 (500,000 - 460,000) 40,000 Exposed position (net assets),December 31, 2014 Translation loss (OCI) €240,000 $/€ 1.50 1.30 1.10 $242,000 300,000 52,000 (88,000) $506,000 $ $300,000 52,000 352,000 - 264,000 $ 88,000 b. Income Statement Sales Cost of sales (1) Cash operating expenses (90,000 x 1.3) Depreciation expense (50,000 x 1.5) Remeasurement gain (see schedule below) Net income $ 650,000 (446,000) (117,000) (75,000) 62,000 $ 74,000 (1) Purchases Ending inventory Cost of sales Solutions Manual, Chapter 7 € € 520,000 (200,000) € 320,000 $/€ 1.30 1.15 $ $ 676,000 (230,000) $ 446,000 ©Cambridge Business Publishers, 2013 23 Balance Sheet Cash $ 11,000 Liabilities Merchandise inventory (2) 230,000 Capital stock Plant assets (3) 375,000 Retained earnings Total assets $616,000 Stockholders’ equity (2) 200,000 x 1.15; (3) 250,000 x 1.50 Analysis of Remeasurement Gain € Exposed position, January 1, 2014 (100,000 – 200,000) €(100,000) Plus sales 500,000 Less purchases (520,000) Less cash expenses (90,000) $/€ 1.50 1.30 1.30 1.30 €(210,000) Exposed position, December 31, 2014 Remeasurement gain (income) $242,000 300,000 74,000 $616,000 1.10 $ $(150,000) 650,000 (676,000) (117,000) (293,000) - (231,000) $ (62,000) c. $ Net income/sales Net income/total assets, 12/31/14 € .080 (=40/500) translation .080 (=52/650) remeasurement .114 (=74/650) .087 (=40/460) .103 (=52/506) .120 (=74/616) Note to Instructor: The solution to this problem uses net income. Using operating income (excluding the remeasurement gain), the ratios using remeasured data are: Operating income/sales Operating income/total assets (12/650) = (12/616) = .018 .019 The ratios computed using translated data do a better job of preserving the same relationships expressed in euros than do the remeasured ratios. With ratios like return on sales, gross margin percentage and the current ratio, the translated results will be the same as the euro results. This happens because in translation, the numerator and denominator of each ratio are multiplied by the same constant (exchange rate) which then cancels out. Return on assets using translated data will differ somewhat from the euro ratio depending on how much the exchange rate has changed during the year. In this ratio, translated net income reflects the weighted average exchange rate for a year while total assets could be translated at the ending exchange rate or a simple average of beginning and ending rates which may differ from the weighted average. ©Cambridge Business Publishers, 2013 24 Advanced Accounting, 2nd Edition Ratios based on remeasured data equal their euro counterparts only by coincidence. Because some items are translated at historical rates and others at the current rate or the average rate, the numerator and denominator do not reflect a constant which simply cancels out. d. If the euro continues to weaken, the ratios using translated data improve if the activity level is held constant. Return on sales is unaffected by the changing exchange rate but return on assets could increase over the previous year, since assets are translated at the ending (lower) rate while income is translated at the average (higher) rate. While the ratio signals improvement in performance, any new investments in that international country must be considered within the context of its weakening foreign currency. Use of remeasured data, however, shows a decline in the return on assets. Remeasured net income, the numerator, falls as it is largely remeasured at the lower average rate. In contrast, total assets, the denominator, remains high as it is remeasured largely at the higher historical rates. Ratio analysis has been and continues to be a tricky business. It should be viewed as a starting point for further analysis in itself. Management should be aware that certain ratios based on translated data may provide incorrect signals due to the translation process. P7.6 Translation and Remeasurement of Financial Statements (in thousands) a. Cash, receivables Inventories Plant and equipment Accounts and notes payable Common stock Retained earnings (1) (150,000 - 3,000) x .49 = (30,000 - 2,000) x .50 = Solutions Manual, Chapter 7 Balance Sheet as of December 31, 2013 CHF $/CHF CHF 30,000 .55 55,000 .54 175,000 (1) CHF260,000 CHF120,000 .55 30,000 .49 110,000 see below CHF260,000 $ $ 16,500 29,700 86,030 $ 132,230 $ 66,000 14,700 51,530 $ 132,230 $72,030 14,000 $86,030 ©Cambridge Business Publishers, 2013 25 Income Statement and Statement of Retained Earnings Year ended December 31, 2013 CHF $/CHF Sales CHF 500,000 .52 Cost of sales (375,000) (2) Operating expenses: Depreciation (5,000) (3) Other (70,000) .52 Remeasurement loss _______ see below Net income 50,000 Retained earnings, 1/1 80,000 .49 Dividends (20,000) .55 Retained earnings, 12/31 CHF 110,000 (2) Beginning inventory Purchases Ending inventory Cost of sales (3) 3,000 x .49 = 2,000 x .50 = 60,000 x .49 = 370,000 x .52 = (55,000) x .54 = ©Cambridge Business Publishers, 2013 26 (2,470) (36,400) (5,700) 23,330 39,200 (11,000) $ 51,530 $ 29,400 192,400 (29,700) $192,100 $ 1,470 1,000 $ 2,470 Computation of Remeasurement Loss Year ended December 31, 2013 CHF Beginning exposed position (25,000 – 125,000) CHF(100,000) Sales 500,000 Purchases (370,000) Cash operating expenses (70,000) Dividends (20,000) Plant and equipment acquisition (30,000) Ending exposed position (30,000 – 120,000) Remeasurement loss (income) $ $ 260,000 (192,100) CHF (90,000) $/CHF $ .49 .52 .52 .52 .55 .50 $ (49,000) 260,000 (192,400) (36,400) (11,000) (15,000) (43,800) .55 - (49,500) $ 5,700 Advanced Accounting, 2nd Edition b. Balance Sheet as of December 31, 2013 CHF Cash, receivables CHF 30,000 Inventories 55,000 Plant & equipment 175,000 CHF260,000 Accounts & notes payable CHF120,000 Common stock 30,000 Retained earnings 110,000 Accumulated other comprehensive income _____ CHF260,000 $/CHF .55 .55 .55 .55 .49 see below see below $ $ 16,500 30,250 96,250 $143,000 $ 66,000 14,700 54,200 8,100 $143,000 Income Statement and Statement of Retained Earnings Year ended December 31, 2013 CHF $/CHF $ Sales CHF 500,000 .52 $ 260,000 Cost of sales (375,000) .52 (195,000) Operating expenses (75,000) .52 (39,000) Net income 50,000 $ 26,000 Retained earnings, 1/1 80,000 .49 39,200 Dividends (20,000) .55 (11,000) Retained earnings, 12/31 CHF 110,000 $ 54,200 Computation of Translation Adjustment Year ended December 31, 2013 CHF $/CHF Beginning exposed position (30,000 + 80,000) CHF110,000 .49 Net income 50,000 .52 Dividends (20,000) .55 Ending exposed position (30,000 + 110,000) Translation gain (OCI) Solutions Manual, Chapter 7 CHF140,000 .55 $ $ 53,900 26,000 (11,000) 68,900 - 77,000 $ (8,100) ©Cambridge Business Publishers, 2013 27 P7.7 Converting the Cash Flow Statement (in millions) a. Sears Canada Inc. Statement of Cash Flows for the Year Ended January 29, 2011 Operating activities C$ Net income C$ 150 Depreciation expense 105 Increase in other current operating assets (99) Decrease in accounts payable and accruals (347) Decrease in income taxes payable (6) Cash used for operating activities (197) Investing activities Acquisition of plant assets Cash used in investing activities Financing activities Issuance of long-term debt Dividends paid Cash used in financing activities Effect of exchange rate changes on cash Decrease in cash $/C$ .97 .97 .97 .97 .97 $ $ 145.50 101.85 (96.03) (336.59) (5.82) (191.09) (67) (67) .97 (64.99) (64.99) 115 (807) (692) -C$ (956) .97 .97 111.55 (782.79) (671.24) 62.76 $(864.56) (1) Schedule of Translation Effect on Cash C$ Cash balance, January 30, 2010 C$ 1,382 Cash used for operating activities (197) Cash used for investing activities (67) Cash used for financing activities (692) Cash balance, January 29, 2011 Effect of exchange rate changes on cash (gain) ©Cambridge Business Publishers, 2013 28 C$ 426 (1) $/C$ $ .94 $1,299.08 .97 (191.09) .97 (64.99) .97 (671.24) 371.76 1.02 - 434.52 $ (62.76) Advanced Accounting, 2nd Edition b. Sears Canada Inc. Analysis of Cumulative Translation Adjustment for the Year Ended January 29, 2011 C$ $/C$ Balance, January 30, 2010 C$ --2010 translation adjustment: Exposed position, January 30, 2010 1,658 .94 Plus net income 150 .97 Less dividends paid (807) .97 Exposed position, January 29, 2011 2010 translation gain Balance, January 29, 2011 C$1,001 1.02 $ $ (60.00) 1,558.52 145.50 (782.79) 921.23 - 1,021.02 (99.79) $(159.79) c. The choice of remeasurement versus translation does not affect cash flow statement totals. Current period cash flows are always converted at current period exchange rates, repetitive cash transactions at the weighted average rate, large discrete cash transactions at the rates in effect when the transactions occurred. But in the operating section, if the indirect approach is used, remeasured depreciation and inventory adjustments will likely differ from the translated adjustments. P7.8 Analysis of Translation Adjustment Disclosure a. Appearance of the currency translation adjustment as a component of other comprehensive income in stockholders' equity indicates that the functional currency of Asiamart’s Hong Kong subsidiaries is the Hong Kong dollar. Thus the translation adjustments relating to these subsidiaries are carried directly to AOCI in stockholders' equity, bypassing the income statement. b. The following analysis assumes Asiamart’s Hong Kong subsidiaries had positive local currency net assets (assets > liabilities) during this time period. In 2006 and 2007, the translation adjustment is positive (gain), meaning that the dollar on average weakened against the Hong Kong dollar (direct exchange rates increased) and translated net assets also increased. In 2008, the translation adjustment is negative (loss), so the dollar on average strengthened against the Hong Kong dollar. c. The net currency translation adjustment balance at January 1, 2006 is positive (gain), implying that the dollar on average weakened against the Hong Kong dollar (exchange rates increased) for periods prior to 2006. However, the cumulative translation gain at January 1, 2006 is small in relation to the gains reported in 2006 and 2007, indicating that in prior years the exchange rate either did not change as much or may have decreased in prior years. Solutions Manual, Chapter 7 ©Cambridge Business Publishers, 2013 29 d. In order to measure the earnings impact of remeasurement, we must make an assumption about the nature of the Hong Kong subsidiaries’ exposed position under remeasurement. A reasonable assumption is that assets measured at fair value (current money prices) are less than liabilities, creating a negative (liability) exposure to exchange rate changes. Since exchange rates decreased in 2008, there would be a remeasurement gain reported in income on the net liability exposure, since Asiamart’s net liability exposure is remeasured at lower current rates. Depreciation and amortization are remeasured at historical rates. In the years 2006 and 2007, rates increased. The initial balance in the currency translation adjustment as of the beginning of 2006 is also positive, implying that rates have on average increased in the past, and historical rates were lower. Although rates declined in 2008, this is unlikely to completely reverse the net impact on remeasured expenses. Using lower historical rates to remeasure depreciation and amortization produces a positive effect on income. Cost of goods sold is most likely dominated by purchases made in the current year, and therefore the remeasured amount is unlikely to differ significantly from the translated amount. Liquidation of old LIFO layers could create significant differences. In summary, then, historical rates are lower than current or average rates for Asiamart’s Hong Kong subsidiaries. So expenses remeasured at historical rates, such as depreciation and amortization, are lower than expenses measured at average rates. The table below shows the impact of remeasured expenses and the remeasurement gain on net income. Expenses remeasured at historical rates Inclusion of remeasurement gain in income Impact on 2008 net income increase increase Asiamart’s remeasured 2008 net income therefore is likely to be higher than its translated income. Asiamart’s operating income, excluding the remeasurement gain, is also higher. ©Cambridge Business Publishers, 2013 30 Advanced Accounting, 2nd Edition P7.9 Translated/Remeasured Trial Balances a. and b. Account Cash and receivables Inventory Plant assets Accumulated depreciation Accounts payable Long-term debt Equity Sales Cost of goods sold Depreciation expense Other operating expenses Remeasurement loss Other comprehensive income (a) (b) (c) NOTE: (d) £ Balance £ 2,660 2,500 1,800 (560) (2,200) (1,100) (2,100) (4,000) 2,000 160 840 $/£ 2.20 (a) (b) 1.80 2.20 2.20 (c) 2.10 2.12 1.80 2.10 (d) $ Remeasurement $ 5,852 4,575 3,310 (1,008) (4,840) (2,420) (3,520) (8,400) 4,240 288 1,764 159 _____ $ 0 $/£ 2.20 2.20 2.20 2.20 2.20 2.20 (c) 2.10 2.10 2.10 2.10 $ Translation $ 5,852 5,500 3,960 (1,232) (4,840) (2,420) (4,200) (8,400) 4,200 336 1,764 _____ (e) (520) £ 0 $ 0 $4,575 = ($1.80 x 2,200) + ($2.05 x 300) $3,310 = ($1.80 x 1,600) + ($2.15 x 200) The remeasured (translated) balance of equity at January 1, 2013, is given as $3,520 ($4,200). Since no depreciation was taken on the plant assets purchased in 2013, both accumulated depreciation and depreciation expense relate only to the plant assets purchased when the exchange rate was $1.80/£. Calculation of Remeasurement Loss Exposed position, January 1, 2013 Plus sales Less purchase of plant assets Less purchase of LIFO layer Less purchase of goods sold Less other operating expenses Exposed position, December 31, 2013 Remeasurement loss (income) Solutions Manual, Chapter 7 £ £ (1,300) 4,000 (200) (300) (2,000) (840) $/£ 2.00 2.10 2.15 2.05 2.12 2.10 £ 2.20 (640) $ $(2,600) 8,400 (430) (615) (4,240) (1,764) (1,249) - (1,408) $ 159 ©Cambridge Business Publishers, 2013 31 (e) Calculation of Translation Gain Exposed position (net assets), January 1, 2013 Plus net income in 2013 (4,000-2,000-160-840) Exposed position (net assets), December 31, 2013 Translation gain (OCI) £ £2,100 1,000 $/£ 2.00 2.10 £3,100 2.20 $ $4,200 2,100 $6,300 - 6,820 $(520) P7.10 Translating and Remeasuring Financial Statements SA Company Financial Statements Year ended December 31, 2014 (a) Remeasurement Balance Sheet P $/P $ Cash P 310,000 .15 $ 46,500 Inventory (purchased 1/5) 200,000 .10 20,000 Inventory (purchased 6/30) 360,000 .12 43,200 Office equipment, net 180,000 .10 18,000 Total assets 1,050,000 127,700 Contributed capital 1,000,000 .10 100,000 Retained earnings 50,000 27,700 Accumulated other comprehensive income _______ ______ Total Equities P1,050,000 $127,700 Income Statement Sales Cost of goods sold Rent expense Depreciation expense Remeasurement gain Net income ©Cambridge Business Publishers, 2013 32 P P 300,000 (200,000) (30,000) (20,000) -P 50,000 $/P .12 .10 .12 .10 $ $ 36,000 (20,000) (3,600) (2,000) 17,300 $ 27,700 (b) Translation $/P $ .15 $ 46,500 .15 30,000 .15 54,000 .15 27,000 157,500 .10 100,000 6,000 51,500 $157,500 $/P .12 .12 .12 .12 $ $ 36,000 (24,000) (3,600) (2,400) _____ $ 6,000 Advanced Accounting, 2nd Edition Computation of Translation and Remeasurement Gains Remeasurement Translation P $/P $ P $/P $ a a Exposed position, Jan. 1, 2014 P1,000,000 .10 $ 100,000 P1,000,000 .10 $100,000 Plus: Sale of inventory 300,000 .12 36,000 300,000 .12 36,000 Less: Purchase of inventory (1/5) (400,000) .10 (40,000) Purchase of inventory (6/30) (360,000) .12 (43,200) Purchase of office equipment (200,000) .10 (20,000) Payment of rent (30,000) .12 (3,600) (30,000) .12 (3,600) Cost of goods sold (200,000) .12 (24,000) Depreciation expense _____ _____ (20,000) .12 (2,400) 29,200 106,000 Exposed position, Dec. 31, 2014 P 310,000b .15 -46,500 P1,050,000c .15 -157,500 Remeasurement/translation gain $(17,300) $(51,500) Notes a 1,000,000 = cash (1,000,000) = net assets carried at current money prices = net assets. b 310,000 = cash (310,000) = net assets carried at current money prices. c 1,050,000 = cash (310,000) + inventory (200,000 + 360,000) + office equipment, net (180,000) = net assets = 1,000,000 + 50,000 (net income). P7.11 Consolidated Financial Statements with an International Subsidiary Step 1: Translation of Standard=s December 31, 2014 trial balance: £ $/£ Cash and receivables £ 3,000,000 2.30 Inventory 3,000,000 2.30 Property, plant & equipment, net 5,000,000 2.30 Current liabilities (4,000,000) 2.30 Long-term debt (1,000,000) 2.30 Capital stock (2,000,000) 2.00 Retained earnings, January 1 (3,500,000) 2.00 Dividends 1,000,000 2.10 Accumulated other comprehensive income -(1) Sales (10,000,000) 2.15 Cost of goods sold 6,000,000 2.15 Depreciation expense 500,000 2.15 Other operating expenses 2,000,000 2.15 £ -0- Solutions Manual, Chapter 7 $ $ 6,900,000 6,900,000 11,500,000 (9,200,000) (2,300,000) (4,000,000) (7,000,000) 2,100,000 (1,675,000) (21,500,000) 12,900,000 1,075,000 4,300,000 $ -0- ©Cambridge Business Publishers, 2013 33 (1) Calculation of Translation Adjustment for 2014 £ $/£ $ Net assets, January 1, 2014 £ 5,500,000 2.00 $ 11,000,000 Net income 1,500,000 2.15 3,225,000 Dividends (1,000,000) 2.10 (2,100,000) 12,125,000 Net assets, December 31, 2014 £ 6,000,000 2.30 - 13,800,000 Translation gain (OCI) $ (1,675,000) Step 2:Adjust Investment for 2014 Equity in Net Income and Translation Gain Calculation of Revaluations Price paid Book value Excess of cost over book value Inventories revaluation Property, plant and equipment revaluation Goodwill £ £8,000,000 5,500,000 2,500,000 100,000 $/ £ 2.00 2.00 500,000 £1,900,000 2.00 1,000,000 $ 3,800,000 £ £1,500,000 $/ £ 2.15 U.S.$ $3,225,000 (100,000) (25,000) (200,000) £1,175,000 2.15 2.15 2.15 (215,000) (53,750) (430,000) $2,526,250 2.00 U.S.$ $16,000,000 11,000,000 5,000,000 200,000 Calculation of Equity in Net Income for 2014 Standard’s reported net income Revaluation write-offs: Cost of goods sold Depreciation expense [500,000/20] Goodwill impairment Equity in net income Phillips’ entry to update the investment for 2014 equity in net income and its share of Standard=s translation gain: Investment in Standard 4,201,250 Equity in net income of Standard Accumulated other comprehensive income ©Cambridge Business Publishers, 2013 34 2,526,250 1,675,000 Advanced Accounting, 2nd Edition Step 3:Consolidation working paper entries (C) Equity in net income of Standard 2,526,250 Dividends Investment in Standard To reverse equity method entries for 2014. (E) Capital Stock Retained earnings, beg. Accumulated other comprehensive income 2,100,000 426,250 4,000,000 7,000,000 1,675,000 Investment in Standard To eliminate Standard’s stockholders= equity as of 1/1. (R) Inventory (100,000 x $2.30) PP&E, net (500,000 x $2.30) Goodwill (1,900,000 x $2.30) 12,675,000 230,000 1,150,000 4,370,000 Investment in Standard 5,000,000 Other comprehensive income 750,000 To record the beginning-of-year revaluations. $750,000 = ($2.30 - $2.00) x (100,000 + 500,000 + 1,900,000) (O) Cost of goods sold Depreciation expense Goodwill impairment Other comprehensive income 215,000 53,750 430,000 48,750 Inventory Property, plant & equipment Goodwill To write off the revaluations for 2014. $215,000 = 100,000 x $2.15 $53,750 = (500,000/20) x $2.15 $430,000 = 200,000 x $2.15 $230,000 = 100,000 x $2.30 Solutions Manual, Chapter 7 230,000 57,500 460,000 $57,500 = 25,000 x $2.30 $460,000 = 200,000 x $2.30 $48,750=($2.30-$2.15)x(100,000 + 25,000 +200,000) ©Cambridge Business Publishers, 2013 35 The 2014 consolidation working paper appears below. December 31, 2014 Consolidation Working Paper Cash and receivables Inventory Property, plant and equipment, net Investment in Standard Goodwill Current liabilities Long-term debt Capital stock Retained earnings, 1/1 Accumulated other comprehensive income Dividends Sales Equity in net income Cost of goods sold Depreciation expense Other operating expenses Goodwill impairment Consoli-dated Dr (Cr) Phillips Dr (Cr) $2,100,000 4,000,000 Standard Dr (Cr) $6,900,000 6,900,000 12,000,000 18,101,250 11,500,000 (R)1,150,000 (8,000,000) (4,000,000) (10,000,000) (8,000,000) (1,675,000) Dr Cr (R)230,000 57,500 (O) 426,250 (C) 12,675,000 (E) 5,000,000 (R) (R)4,370,000 460,000(O) (9,200,000) (2,300,000) (4,000,000) (E)4,000,000 (7,000,000) (E)7,000,000 (1,675,000) (E)1,675,000 (O) 48,750 2,000,000 2,100,000 (30,000,000) (21,500,000) (2,526,250) (C)2,526,250 20,000,000 12,900,000 (O)215,000 1,000,000 1,075,000 (O)53,750 5,000,000 _______ $ -0- ©Cambridge Business Publishers, 2013 36 230,000 (O) 750,000 (R) 2,100,000(C) 4,300,000 _______ (O)430,000 _______ $ -0- $21,698,750 $21,698,75 0 $ 9,000,000 10,900,000 24,592,500 -3,910,000 (17,200,000) (6,300,000) (10,000,000) (8,000,000) (2,376,250) 2,000,000 (51,500,000) -33,115,000 2,128,750 9,300,000 430,000 $ -0- Advanced Accounting, 2nd Edition Phillips Company and Subsidiary Standard, Ltd. Consolidated Statement of Income and Retained Earnings For the Year Ended December 31, 2014 Sales Cost of goods sold Depreciation expense Other operating expenses Goodwill impairment Total expenses Net income Retained earnings, January 1 Dividends declared and paid Retained earnings, December 31 $51,500,000 $33,115,000 2,128,750 9,300,000 430,000 $44,973,750 $ 6,526,250 8,000,000 (2,000,000) $12,526,250 Phillips Company and Subsidiary Standard, Ltd. Consolidated Balance Sheet December 31, 2014 Assets Cash and receivables Inventory Property, plant & equipment, net Goodwill Total assets Liabilities and stockholders’ equity Current liabilities Long-term debt Capital stock Retained earnings Accumulated other comprehensive income Total liabilities and stockholders’ equity Solutions Manual, Chapter 7 $ 9,000,000 10,900,000 24,592,500 3,910,000 $48,402,500 $17,200,000 6,300,000 10,000,000 12,526,250 2,376,250 $48,402,500 ©Cambridge Business Publishers, 2013 37 P7.12 Hyperinflationary Economy, U.S. GAAP and IFRS a. Because the local currency is highly inflationary, U.S. GAAP requires remeasurement of the subsidiary’s LC accounts into the reporting currency, U.S. dollars, even though the local currency is the subsidiary’s functional currency. Remeasurement of the December 31, 2014 balance sheet is as follows: Account Cash Plant assets, net Liabilities Capital stock Sales revenue Out of pocket operating expenses Depreciation expense Remeasurement loss (income) Balance in LC Dr (Cr) 125,000 35,000 (50,000) (50,000) (200,000) 135,000 5,000 --0- $/LC 0.10 0.65 0.10 0.65 0.15 0.15 0.65 See sch. 1 $ Dr (Cr) 12,500 22,750 (5,000) (32,500) (30,000) 20,250 3,250 8,750 -0- Schedule 1Calculation of Remeasurement Loss Beginning exposed position + Sales - Out of pocket operating expenses Ending exposed position Remeasurement loss (income) LC 10,000 200,000 (135,000) $/LC 0.65 0.15 0.15 75,000 0.10 Remeasured balance sheet December 31, 2014 $ 12,500 Liabilities 22,750 Capital stock ______ Retained earnings $ 35,250 Total Cash Plant assets, net Total $ 6,500 30,000 (20,250) 16,250 - 7,500 8,750 $ 5,000 32,500 (2,250) $ 35,250 Remeasured income statement For the year 2014 Sales revenue Out of pocket operating expenses Depreciation expense Remeasurement loss Net loss ©Cambridge Business Publishers, 2013 38 $ 30,000 (20,250) (3,250) (8,750) $ (2,250) Advanced Accounting, 2nd Edition b. IFRS requires restatement of the LC accounts to the same price level, and then translation to the presentation currency, the U.S. dollar. Price-level adjusted Balance in LC Price-level (LC) $ Account Dr (Cr) adjustment Dr (Cr) $/LC Dr (Cr) Cash 125,000 -125,000 0.10 12,500 Plant assets, net 35,000 600/100 210,000 0.10 21,000 Liabilities (50,000) -(50,000) 0.10 (5,000) Capital stock (50,000) 600/100 (300,000) 0.65 (195,000) Sales revenue (200,000) 600/400 (300,000) 0.15 (45,000) Out of pocket op. expenses 135,000 600/400 202,500 0.15 30,375 Depr. expense 5,000 600/100 30,000 0.15 4,500 Monetary loss (income) -See sch. 2 82,500 0.15 12,375 AOCI (loss) ---- See sch. 3 164,250 -0-0-0-0Schedule 2Calculation of Monetary Loss Beginning monetary position + Sales - Out of pocket operating expenses Ending monetary position Monetary loss (income) LC 10,000 200,000 (135,000) Price-level adjustment 600/100 600/400 600/400 75,000 -- Price-level adjusted (LC) 60,000 300,000 (202,500) 157,500 - 75,000 82,500 Schedule 3Calculation of Translation Loss Beginning exposed position - Net loss (300,000 – 202,500 – 30,000 – 82,500) Ending exposed position Translation loss (OCI) Solutions Manual, Chapter 7 Price-level adjusted (LC) 300,000 $/LC 0.65 $ 195,000 (15,000) 0.15 285,000 0.10 (2,250) 192,750 - 28,500 164,250 ©Cambridge Business Publishers, 2013 39 Cash Plant assets, net Total Translated balance sheet December 31, 2014 $ 12,500 Liabilities 21,000 Capital stock Retained earnings ______ AOCI $ 33,500 Total $ 5,000 195,000 (2,250) (164,250) $ 33,500 Translated income statement For the year 2014 Sales revenue Out of pocket operating expenses Depreciation expense Monetary loss Net loss ©Cambridge Business Publishers, 2013 40 $ 45,000 (30,375) (4,500) (12,375) $ (2,250) Advanced Accounting, 2nd Edition