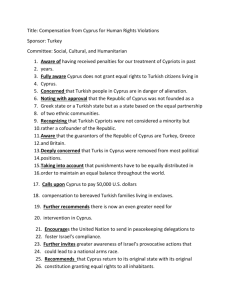

central bank of cyprus

advertisement