courses.psu.edu - Penn State University

advertisement

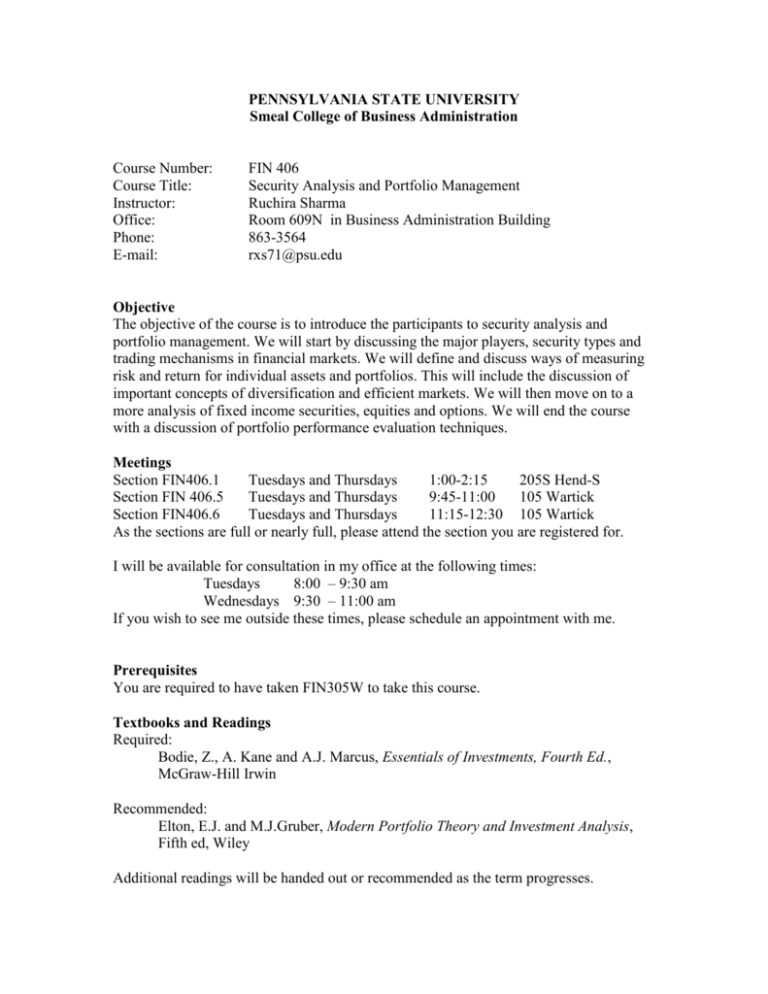

PENNSYLVANIA STATE UNIVERSITY Smeal College of Business Administration Course Number: Course Title: Instructor: Office: Phone: E-mail: FIN 406 Security Analysis and Portfolio Management Ruchira Sharma Room 609N in Business Administration Building 863-3564 rxs71@psu.edu Objective The objective of the course is to introduce the participants to security analysis and portfolio management. We will start by discussing the major players, security types and trading mechanisms in financial markets. We will define and discuss ways of measuring risk and return for individual assets and portfolios. This will include the discussion of important concepts of diversification and efficient markets. We will then move on to a more analysis of fixed income securities, equities and options. We will end the course with a discussion of portfolio performance evaluation techniques. Meetings Section FIN406.1 Tuesdays and Thursdays 1:00-2:15 205S Hend-S Section FIN 406.5 Tuesdays and Thursdays 9:45-11:00 105 Wartick Section FIN406.6 Tuesdays and Thursdays 11:15-12:30 105 Wartick As the sections are full or nearly full, please attend the section you are registered for. I will be available for consultation in my office at the following times: Tuesdays 8:00 – 9:30 am Wednesdays 9:30 – 11:00 am If you wish to see me outside these times, please schedule an appointment with me. Prerequisites You are required to have taken FIN305W to take this course. Textbooks and Readings Required: Bodie, Z., A. Kane and A.J. Marcus, Essentials of Investments, Fourth Ed., McGraw-Hill Irwin Recommended: Elton, E.J. and M.J.Gruber, Modern Portfolio Theory and Investment Analysis, Fifth ed, Wiley Additional readings will be handed out or recommended as the term progresses. Assessment The course grade will be determined by your performance in a project (group work), two quizzes and a final examination. The weights for the various components are: Quiz 1 Quiz 2 Project Final Exam 20% 20% 20% 40% Participation in the quizzes is voluntary. If you do not take one or both quizzes, the weights assigned to them will be allocated to the final exam. [Concepts like risk-aversion and diversification will be useful in your decision-making!]. The quizzes will consist of multiple-choice questions. I will announce the dates and times of the quizzes in the next few days. The project will involve writing a report based on a case that will be given to you. You can work in groups of 4-5 members. The details of the requirements, the case, and due dates will be handed out in due course. I will also assign problems from the book and additional questions as homework. Homework will NOT be collected or graded. I will provide the solutions to the problems and will discuss them in class. I strongly recommend that you spend time doing the problems before they are discussed in class as a way to test your understanding of the material. Tentative Schedule Week 1 Introduction Investment Background and Issues Financial Markets and Instruments Week 2 Investment Process Investment Returns: Historical record Week 3 Measurement of investment returns Risk and Risk Aversion Week 4 The capital allocation line Portfolio returns and risk Diversification Week 5 Portfolio returns and risk (continued) Week 6 The efficient frontier Security market line Week 7 Capital Asset Pricing Model Week 8 The efficient markets hypothesis Week 9 Fixed Income Securities Bond prices and Yields Duration and Convexity Week 10 Managing fixed income investments Week 11 Security Analysis and Equity Valuation Week 12 Financial statement analysis Technical analysis Week 13 Introduction to derivative assets Option valuation Week 14 Portfolio performance evaluation Week 15 International Diversification (time permitting!)