Department - Website of Akash Rattan

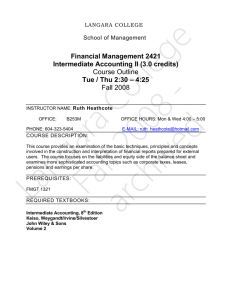

LANGARA SCHOOL OF MANAGEMENT

Course Outline

Course Title:

Department: School of Management

Course Number: FMGT 3121

Advanced Accounting

Semester Year: Fall 2011

Days: Tuesdays (Sept 6 th – Nov 29 th )

Classroom: B253

Section: 001

Hours: 3

Credits: 3

Instructor Contact

Name:

Office :

Akash S. Rattan

B253e

Office Hours: By Appointment

Course Description

Phone: 604-970-3968

Email: arattan@langara.bc.ca

Website: www.akashrattan.com

This rigorous technical based course discusses the IFRS conceptual framework with a focus on business combinations and the accounting issues involved. In depth technical application of advanced financial reporting issues including: consolidation accounting and reporting, financial instruments, foreign currency transactions, hedge accounting, translation and consolidation of financial statements stated in foreign currencies and not-for-profit entities.

Learning Outcomes

Learning Outcome

Be able to prepare Consolidated Financial

Statements when the Parent is using the

Cost and Equity method.

To be able to prepare entity based journal entries on Parent’s books using the Cost and Equity method.

Measurement

Assignments and examinations

Assignments and examinations

Account for foreign exchange transactions and treatment in changes in foreign exchange rates.

Account for foreign exchange transactions when companies have engaged hedging activities.

Prepare consolidated financial statements of a Canadian Parent and a foreign subsidiary.

Become familiar with disclosure requirements under IFRS

Prerequisite(s)

Assignments and examinations

Assignments and examinations

Assignments and examinations

Assignments and examinations

Completion of 54 credits including FMGT 1321 and FMGT 2421 and 6 credits of universitytransferable English or Communications with a minimum “C” grade or permission of the Department Head.

University Transferability

Refer to www.bccat.bc.ca for transferability and whether credits are assigned or unassigned.

Required Textbooks

Modern Advanced Accounting in Canada, Hilton, McGraw-Hill (Sixth Edition, 2010)

Connect: www.mcgrawhillconnect.ca

Recommended Readings

International Financial Reporting Standards, Conceptual Framework

2

Website

I will make available suggested solutions on my website: www.akashrattan.com

. Notes and practice problems can be accessed with your textbook code on www.mcgrawhillconnect.ca

Grade Allocation

Assignments/Participation

Midterm

Final Exam

Assignments

10%

45%

45%

--------

100%

Assignments are announced at the end of class. Not all assignments will be collected for marks. Assignments are designed to assist you in the preparation of the midterm and final examinations. To obtain credit for assignments you must hand them in at the beginning of class (no e-mails or late assignments will be accepted). Further, assignments must meet appropriate professional standards to obtain credit.

Assignments that do not meet the standard will receive a grade of zero.

Expectations

1. Regular class attendance is expected. The pace of the course is fast and the material is challenging. Missing a single class may seriously effect your performance in the course.

2. Students are responsible for all announcements made in class, whether the student is present or not.

3. All exams must be written at the scheduled date, time and location. Only a legitimate reason, such as illness will be accepted as an excuse. Alternate arrangements may be possible if presented with a valid medical certificate or other acceptable formal (written) notice of absence. In that event, the student will have an opportunity to make up an examination at the next available sitting, which would be in the subsequent semester.

3

4. Students must complete all of the specified requirements of the course, or a final grade will not be given.

5. Course schedule is subject to change with notice.

6. Students are responsible for maintaining a classroom atmosphere, which will promote and encourage learning. Frequent classroom disturbances either directly or indirectly as the result of a student’s actions may result in the student’s removal from the course. Taking phone calls on your cell phone or constantly texting will not be tolerated and you will be asked to leave.

7. I make myself very accessible to students via e-mail and telephone. If you cannot attend class it is your responsibility to let me know so you are aware of the content covered in class. If you have questions on homework or need assistance in your studies you may call me on weekends.

Plagiarism and Cheating Policy

Plagiarism and cheating are serious educational offences, which may result in failure of an assignment, failure of a course, and possible suspension from Langara. For more details, please refer to Langara's Code of Conduct in the course calendar or Student

Policies and Procedures on Langara's website at www.langara.bc.ca

.

School of Management

It is the aim of the School Management at Langara College to promote the mastery of core skills such as reading, reading comprehension, writing fluency, verbal articulation, and analytical development. These core skills will be practiced by means of presentations and class participation, and will be evaluated on submitted work. Critical thinking and problem-solving exercises are encouraged at every opportunity. For more information about the School of Management, please contact business@langara.bc.ca.

4

Course Schedule

Week Date

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Sept 6th

Sept 13th

Topics and Deliverables

A Survey of International Accounting Standards

Investments in Equity Securities

Investment in Equity Securities

Business Combinations

Consolidated Financial Statements Date of Acquisition Sept 20th

Sept 27th

Oct 4th

Oct 11th

Oct 18th

Oct 25th

Nov 1st

Consolidated Financial Statements Subsequent to Acquisition

Date

Consolidated Financial Statements Subsequent to Acquisition

Date; Intercompany Inventory and Land Profits

Intercompany Inventory and Land Profits; Intercompany Profits in Depreciable Assets

(Exclude inter-company bond holdings)

Midterm Examination: 2.5 Hours

Inter-company profit eliminations on Depreciable Assets

(Exclude inter-company bond holdings).

Consolidated Financial Statements with Inter-company profit eliminations and future income tax implications

Midterm Examination Debrief; Consolidated Cash Flows;

Change in Ownership

Foreign Currency Transactions Nov 8th

Nov 15th Translation and Consolidation of the Financial Statements of

Foreign Operations

Nov 22nd

Nov 29th

TBD (Scheduled by

Langara)

Translation and Consolidation of the Financial Statements of

Foreign Operations; Accounting for Not-for-Profit Organizations

Class Review

Cumulative Final Examination: 3 Hours

5