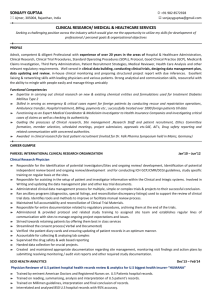

Debt ratios Analysis

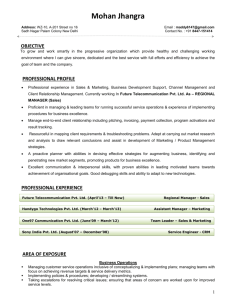

advertisement

Pharma Zone Pvt. Ltd. Internship Report DEDICATED TO My Parents AND All My Teachers Who taught me the first word to speak The first alphabet to write and The first step to take Hailey College of Commerce i Pharma Zone Pvt. Ltd. Internship Report Preface The business world today is considerably different and more complex than it was just some years ago. Today, we experience private-equity firms acquiring hundreds of companies. Both the challenges and opportunities facing organizations of all sizes today are greater than ever. This internship report prepared on one of the company in printing of aluminum foils, gives you a complete over view of that company what is its accounting cycle, what is its opportunities and etc. I have given the ratio analysis of Pharma Zone Pvt. Limited. Ratios are made for 2007, 2008. These ratios are depicted graphically through line chart. Analysis of ratio shows that the ratios of Pharma Zone are satisfactory except average collection period. Hailey College of Commerce ii Pharma Zone Pvt. Ltd. Internship Report Executive summary Pharma Zone, the leading company in the printing of foil, is situated in PCSIR Colony, College Road Lahore. It was a sole proprietorship named as Pharma Link but in 2002 it was converted into private Limited Corporation. Mr. Arshad Mehmood and his wife are the director of Pharma Zone. Pharma Zone has acquired a plot in Shaikhupura to start the work in the year 2010. It has also acquired new machineries to improve its functions. Currently Pharma Zone has 50 gravure (printing) machines. Pharma zone currently manufactures following products: Aluminum Foil Blister Strip Foil Poly Coated Paper Blister Pouches Alu Alu Foil Plain Company keeps its quality at the peak of the business. There are high levels of professionals in all departments of Pharma Zone and it is continuously keeping an eye over their growth. There is a proper channel of communication between the departments of the Pharma Zone. There is a proper organizational chart issued by the organization. Accounting system adopted by Pharma zone is single entry system. Pharma Zone adopted this system because it is an easy approach towards accounting. Ratios of Pharma Zone are good except average collection period which is very poor for Pharma Zone. Ali Mehdi Hailey College of Commerce iii Pharma Zone Pvt. Ltd. Internship Report Acknowledgement I was home when I heard the news from my cousin that you can do your training in his friend’s company, the Pharma Zone Pvt. Limited. After one week I got into my career first opportunity and went to the company with my cousin. Initially there was little bit work to do in the Pharma Zone but Manger Accounts and Finance very kind to me gave me some work of posting and other checking. I want to thanks Mr. Imran Shafi, Manager Accounts and Finance of Pharma Zone for his cooperativeness to me in the prepration of this internship report. Mr. Quasim, the accountant, also assisted me in understanding the management and hierarchy of the organization and the relationship between departments. Mr. Adeel Dawar gave me the Financial Statements of Pharma Zone Pvt. Limited very next day of my internsip to get the ratios and have a work on it. Finally I want to thanks Mr. Arshad Mehmood, the CEO of Pharma Zone who also talked to me on much occasions do discuss any problems faced by me. Ali Mehdi Hailey College of Commerce iv Pharma Zone Pvt. Ltd. Internship Report Table of Contents PREFACE II EXECUTIVE SUMMARY III ACKNOWLEDGEMENT IV HISTORY OF ORGANIZATION 1 ORIGIN: WHY CHANGE TO PRIVATE LIMITED COMPANY? 1 1 ORGANIZATIONAL CHART 2 MANAGEMENT OF ORGANIZATION 3 BOARD OF DIRECTORS: MANAGEMENT: 3 3 FIELD OF ACTIVITIES 6 CUSTOMERS AND SUPPLIERS OF PHARMA ZONE 7 LIST OF QUALITY MAJOR CUSTOMERS: LIST OF MAJOR SUPPLIERS: 7 8 PRODUCT INFORMATION 9 PRODUCT MATRIX PRODUCT RANGE: 9 9 FUTURE PLANS AND PROJECTIONS 10 MISSION & VISION STATEMENT 10 OFFICES AND FACTORY OF PHARMA ZONE 11 Hailey College of Commerce v Pharma Zone Pvt. Ltd. Internship Report MAJOR FUNCTIONS PERFORMED BY ACCOUNTING DEPARTMENT 12 SALES CYCLE 12 STEP I: COLLECTION OF PURCHASE ORDER: STEP II: PREPARATION OF SALES ORDER: STEP III: PREPARATION OF PRINTING JOB CARD: STEP IV: PREPARATION OF DELIVERY CHALLAN: STEP V: PREPARATION OF SALES TAX INVOICE: STEP VI: PREPARATION OF JOURNAL VOUCHERS (JV): STEP VII: POSTING TO LEDGERS: STEP VIII: PREPARATION OF JOURNAL: STEP IX: TAX RETURN FILING: 13 13 14 15 16 17 17 18 18 WHEN A CUSTOMER MAKES PAYMENT 18 WHEN PAYMENT IS MADE TO THE SUPPLIER 18 MY LEARNING 19 CHEQUE ONLINE TRANSFER AND RECEIPT OF CHEQUES: POSTING INTO DEBTORS’ LEDGER: CHECKING THE ENTRIES POSTED INTO LEDGER: CHECKING OF JOURNAL VOUCHERS: MISCELLANEOUS: 19 19 20 20 20 PHARMA ZONE FINANCIAL STATEMENTS: 21 BALANCE SHEET: INCOME STATEMENT: 21 22 RATIO ANALYSIS 23 CATEGORIES OF FINANCIAL RATIOS: LIQUIDITY RATIOS: DEBT RATIO: 23 23 23 24 24 24 24 25 25 25 25 Hailey College of Commerce vi CURRENT RATIO: QUICK (ACID-TEST) RATIO: ACTIVITY RATIOS: INVENTORY TURNOVER: AVERAGE COLLECTION PERIOD: AVERAGE PAYMENT PERIOD: TOTAL ASSET TURNOVER: DEBT RATIOS: Pharma Zone Pvt. Ltd. TIMES INTEREST EARNED RATIO: Internship Report ADVANTAGES OF RATIO ANALYSIS: 25 26 26 26 27 27 27 27 27 28 28 28 RATIOS OF PHARMA ZONE PVT. LIMITED 2007-08 29 RATIOS PHARMA ZONE PVT. LIMITED (2007) 29 RATIOS PHARMA ZONE PVT. LIMITED (2008) 31 IMPORTANT NOTES & ASSUMPTION 33 LIMITATIONS: 33 RATIO ANALYSIS 2007-2008 34 LIQUIDITY RATIOS: 34 LIQUIDITY RATIOS ANALYSIS 35 CURRENT RATIO: QUICK (ACID-TEST) RATIO: ACTIVITY RATIOS: 35 35 36 ACTIVITY RATIOS ANALYSIS 38 INVENTORY TURNOVER: AVERAGE COLLECTION PERIOD: AVERAGE PAYMENT PERIOD: TOTAL ASSET TURNOVER: DEBT RATIOS 38 38 38 38 39 DEBT RATIOS ANALYSIS 40 Hailey College of Commerce vii PROFITABILITY RATIOS: GROSS PROFIT MARGIN: OPERATING PROFIT MARGIN: NET PROFIT MARGIN: EARNING PER SHARE: RETURN ON ASSETS: RETURN ON EQUITY: MARKET RATIOS: PRICE/ EARNINGS (P/E) RATIO: MARKET/BOOK (M/B) RATIO: Pharma Zone Pvt. Ltd. Internship Report DEBT RATIO PROFITABILITY RATIOS 40 41 PROFITABILITY RATIOS ANALYSIS 42 GROSS PROFIT MARGIN: OPERATING PROFIT MARGIN: NET PROFIT MARGIN: RETURN ON ASSETS: RETURN ON EQUITY: 42 42 42 42 42 SUMMARY OF ALL RATIOS 43 RATIO ANALYSIS CONCLUSION 45 HORIZONTAL AND VERTICAL ANALYSIS 46 VERTICAL ANALYSIS: HORIZONTAL ANALYSIS: 46 46 VERTICAL ANALYSIS 46 COMMON-SIZE INCOME STATEMENT: SUPPORTING CALCULATION: 46 47 GRAPHICAL REPRESENTATION OF COMMON-SIZE INCOME STATEMENT 48 COMMON-SIZE BALANCE SHEET: 49 SUPPORTING CALCULATION: 50 HORIZONTAL ANALYSIS 52 HORIZONTAL ANALYSIS OF BALANCE SHEET 52 SUPPORTING CALCULATIONS: 53 HORIZONTAL ANALYSIS OF INCOME STATEMENT 55 SUPPORTING CALCULATION: 55 Hailey College of Commerce viii Pharma Zone Pvt. Ltd. Internship Report RECOMMENDATIONS 57 CONCLUSION 58 INDEX 59 REFERENCES 61 Hailey College of Commerce ix Pharma Zone Pvt. Ltd. Internship Report History of organization Origin: Pharma Zone was established in 2002 with name of Pharma Link for manufacturing of Printed Aluminum Foil, Strip & Poly Coated Paper for Pharmaceutical Industries by: Mr. Arshad Mahmood – Executive director since its inception a position holding bachelor of engineering from UET Lahore who served Material Manager Himont Pharmaceutical (Pvt.) Ltd, and National Sales Manager in Himont Chemicals Lahore for 10 years. Mr. Arshad Mahmood – being a successful purchaser and Marketer has sufficient understanding of quality and commitments which are integral parts of a successful business by any supplier or vendor. This is the reason that in a short span of time Pharma Link has captured a big share of Printing Market for pharmaceutical industries. We have established a private Limited company in the name of Pharma Zone (Pvt.) Limited to further improve the existing business in a corporate and systematic manner. Why Change to Private Limited Company? Pharma Link was the sole proprietorship. Many of the customers of the Pharma Link were the Sales Tax Payer. They wanted to have the transactions secure. So for this reason Pharma Zone was formed. Now with the private limited company customers can be given sales tax invoice and tax can be deducted at source. Hailey College of Commerce 1 Pharma Zone Pvt. Ltd. Internship Report Organizational Chart CEO Assistant CEO/ Director Operations Manager Operations Production Manager Assistant Operations Manger Designer Marketing Manager Marketing Executive Sales Order Maker Hailey College of Commerce Marketing Officer Accounts and Finance Manager Assistant Finance Manger Sales Officer Dispatch Manger Assistant Dispatch Manger Accountant 2 Pharma Zone Pvt. Ltd. Internship Report Management of Organization Following is the experienced management of Pharma Zone Pvt. Ltd.: Board of Directors: In private Limited company minimum directors should be 2. Mr. Arshad Mehmood and his wife are the two directors of Pharma Zone. Management: 1. Arshad Mehmood, CEO: Arshad Mehmood is executive director/Chief executive Officer (CEO) since its inception. He has got position holding bachelor of engineering from UET Lahore who served Material Manager Himont Pharmaceutical (Pvt.) Ltd, and National Sales Manager in Himont Chemicals Lahore for 10 years. 2. Fahad Khalid, Assistant CEO/Director Operations: 3. Sarfraz A. Malik, Manager Operations: Hailey College of Commerce 3 Pharma Zone Pvt. Ltd. Internship Report 4. Faraz Ali, Assistant Operations Manager: 5. Shehzad Ahmed, Designer: 6. Badar Munir, Production Manager: 7. Rana Azhar Jamshed, Marketing Manager: 8. Huma Qureshi, Marketing Executive: Hailey College of Commerce 4 Pharma Zone Pvt. Ltd. Internship Report 9. Waseem Ahmed Jam , Sales Officer: 10. Liaqat Ali, Marketing Officer: 11. Muhammad Imran Shafi, Manager Finance & Accounts: 12. Muhammad Qasim, Accountant: 13. Adeel Dawar, Assistant Finance Manger 14. Muhammad Kashif, Dispatch Manager Hailey College of Commerce 5 Pharma Zone Pvt. Ltd. Internship Report Field of activities Recently, Pharma Zone (Pvt.) Limited is formally leading source of Printed and Plain Aluminum foil for blister, Strip, Poly Coated Paper & Alu Alu Foil. Alu Alu Foil Plain Aluminum Exhibit 1 It Prints Aluminum foil for more than 150 pharmaceutical Companies all over Pakistan and it always use best quality imported material for printing. o It employees over 40 qualified manpower o It prides itself on maintaining internal standards and quality Pharma Zone secures product leadership by: o Product differentiation o Operational Competencies, and o Customer intimacy Hailey College of Commerce 6 Pharma Zone Pvt. Ltd. Internship Report Printed Alu Alu Foil Exhibit 2 Customers and Suppliers of Pharma Zone List of quality Major Customers: Servier Research and Pharmaceuticals (Pvt.) Ltd, Lahore The Schazoo laboratories (Pvt.) Ltd, Lahore Highnoon Laboratories (Pvt.) Ltd, Lahore Wilshire Laboratories (Pvt.) Ltd, Lahore Ferozsons Laboratories (Pvt.) Ltd, Noshera Stand Pharm Pakistan (Pvt.) Ltd, Lahore Pacific Pharmaceuticals (Pvt.) Ltd, Lahore Askari Pharmaceuticals (Pvt.) Ltd, Lahore Hailey College of Commerce 7 Pharma Zone Pvt. Ltd. Siza International (Pvt.) Ltd, Lahore Raazee Therapeutics (Pvt.) Ltd, Lahore Hansel Pharmaceuticals (Pvt.) Ltd, Lahore Dyson Laboratories (Pvt.) Ltd, Lahore Bryon Pharmaceuticals (Pvt.) Ltd, Peshawar Paramount Pharmaceutical (Pvt.) Ltd, Islamabad Polyfine Chem Pharmaceuticals (Pvt.) Ltd, Peshawar Hammaz Pharmaceuticals (Pvt.) Ltd, Multan Batala Pharmaceuticals (Pvt.) Ltd, Gujranwala Qintat Pharmaceuticals (Pvt.) Ltd, Sargodha Fynk Pharmaceuticals (Pvt.) Ltd, Lahore NovaMed Pharmaceuticals (Pvt.) Ltd, Lahore Internship Report List of major suppliers: Local: Chemiaa Enterprises Ltd. (Packages Ltd.) Aluminum Processing Industries, Karachi Abbasi Chemicals (Pvt.) Ltd, Bharay Bha Chemicals Al-Pak Rubber Engineering Descon Corporation (Pvt.) Ltd, Khan Traders Modern Packages Asia Packages Print n Pack Imports: Zibo Hengzbou Aluminum Plastic Packing Material Co Ltd. China Jiangsu Zhongin Medical Packing Co. Ltd. China Hailey College of Commerce 8 Pharma Zone Pvt. Ltd. Internship Report Product Information Product Matrix Aluminum Foil Blister o Use in Blistering of Tablets, Capsules and Injections by Pharmaceuticals Industry Strip Foil o Use in making strips for tablets or capsules by different machine technology Poly Coated Paper o Use in making paper strips and powder sachets by pharmaceuticals and food industry. Blister Pouches o Use to protect blisters from heat, light and moisture Alu Alu Foil Plain o Use in Blister Making in Place of PVC. This is the most protection material used by pharmaceuticals Product Range: According to Pharma Zone Sources the share of the company in the market is as follows: Types of Products Share of Business in Market (%age) Aluminum foil 60 Strip Foil 15 Hailey College of Commerce 9 Pharma Zone Pvt. Ltd. Internship Report Poly Coated Paper 20 Pouches for Blister 5 Alu Alu Plain Foil 80/100 The aluminum foil is the most selling product of Pharma Zone with a market share of 60%. And the Alu Alu Plain foil is the least selling product of Pharma Zone with a market share of 0.8%. Future Plans and Projections Currently, Pharma Zone has 50 gravure printing machines with the printing capacity of 25000 kg/month. Pharma Zone has planned to import one fully computerized gravure machine in this year. Due to addition of new machine its printing capacity will be increased upto 36000 kg/month. Pharma Zone has purchased a plot at Sheikhupura for installation of new unit for business and to relocate the current facility in larger premises to meet future demands. Construction of building has been started and hopes to complete this building and the work will start there by the end of year 2010. The current number of customers of Pharma Zone is over 150 and management is confident to add 50 more companies every year. Mission & Vision Statement Mission & Vision Statement of Pharma Zone is the same and is given as below: To be the leading private company of printing foils in Pakistan Delivering quality printing foils Through innovative technology In a modern and progressive organization High ethical and professional standards, With providing enhance value to all our staff and workers, And contributing to society Hailey College of Commerce 10 Pharma Zone Pvt. Ltd. Internship Report Offices and Factory of Pharma Zone Currently there is one head office and one factory of Pharma Zone, but it is in future plans that one factory should be in Shaikhupura. Currently the address of the office and factory is: Pharma Zone (Pvt.) Ltd. 102-D, PCSIR Staff Colony College Road, Lahore Phone: 0423-5110647 E-mail: thepharmazone@gmail.com Hailey College of Commerce 11 Pharma Zone Pvt. Ltd. Internship Report Major Functions performed by accounting department Pharma Zone currently maintains its books of accounts according to single entry system. The accounting department has number of functions to do in the whole year but here are major functions of accounting department. The following are given three cycles and processes. Each and every document is explained. It is also explained that which document goes into what department? In which department is prepared? How many copies are prepared? First Cycle gives the details of Sales Cycle. Second describes when the customers of the Pharma Zone make payment what documents are prepared. Third one describes how payment is made to the Supplier and other party via different sources e.g. through cheques, or cash. In the boxes these documents are explained little bit. Sales Cycle Here are some steps which tells exactly what’s the sale procedure of Pharma Zone Pvt. Ltd. Sales Cycle consists of following steps: Step I: Collection of Purchase Order Step II: Preparation of Sales Order Step III: Preparation of Printing job card Step IV: Preparation of delivery Challan Step V: Preparation of sales tax invoice Step VI: Preparation of Journal Vouchers (JV) Step VII: Posting to Ledgers Step VIII: Preparation of Journal Step IX: Tax Return Filing Here is the detail of each step. Hailey College of Commerce 12 Pharma Zone Pvt. Ltd. Internship Report Step I: Collection of Purchase Order: Sales cycle of any company starts with the collection of the purchase order from its customer. In the Pharma Zone purchase order is collected by head of the operations department. The original copy of purchase order is received by Pharma Zone. Mostly the head of the operations receives the purchase order. At times the chief executive officer (CEO) receives the purchase order from the company. Purchase Order: Purchase order or PO is the first communication of the customer to purchase a specified amount of goods at specified prices. There are different formats of purchase orders. One of the samples of purchase order is given in Appendix I. Following is the brief description of purchase order: It mentions the company name, address, phone and fax of the customer. It mentions the company name, address, phone and fax of the vendor. It describes the shipping location where the goods are to be ultimately brought. It specifies the item/items which are to be purchased by the customer. Their quantity, preferably in the case of Pharma Industry, their weight, is mentioned. The price of the items is mentioned. The total purchase amount is calculated. If there is any sales tax or other duty such as in Pakistan there is 1% special excise duty is mentioned and the final total is calculated. And finally there is signature of the manager operations of the customer and preferably stamp of the company. Box 1 Step II: Preparation of Sales Order: After receiving the purchase order, Sales order is created in the operations department. Sales order is prepared from purchase order but the prices may change and fluctuate from what the customer has sent in the purchase order. Box 2 gives a brief Hailey College of Commerce 13 Pharma Zone Pvt. Ltd. Internship Report description of Sales order. At the end of this report, the Sample of Sales order of Pharma Zone is also given. Sales Order Following are given brief contents of sales order: It specifies the purchase order number from which it is made. It has its own number which is Sales order number. It tells the job name, order quantity, material, size and other specifications of the order. It includes date of the sales order Required date of the order is mentioned. In the Pharma zone all aluminum foils are sent to the customer wrapping around a cylinder. So in the Pharma Zone Sales order Cylinder information is also given. Blank spaces of different signatures are included. Box 2 There are made three copies of Sales order one is kept in the files for future evidence. One is given to the production department for the manufacturing. And one is sent to the Accounting department. Step III: Preparation of Printing job card: Printing job card is firstly prepared in the manufacturing department and it is moved in different departments. Job card is prepared actually to do that particular job. When job is done it is finished. Box 3 explains Printing Job Card. Hailey College of Commerce 14 Pharma Zone Pvt. Ltd. Internship Report Printing Job Card Printing job card includes the following descriptions. 1. It includes machine name onto which the job is to be done. 2. It specifies the operator name 3. It includes, Sales Order Number, Purchase Order Number, Job card number and Date at which the sales order is received by the production department For the Pharma Zone Pvt. Limited the job card has four sections and it travels into 4 different departments. Production department portion includes o Customer Name o Type of material o Number of Colors, order quantity, etc. Raw Material Store department portion includes o Gross weight issued o Source of Material etc. Quality Control Department portion includes o Quality check during production o Quality check after final production Store Department includes o Weight received o Wastage of material Box 3 Step IV: Preparation of delivery Challan: Job card is moved in different department and when the total foils are printed and the job is done goods are sent to the dispatch department. Along with job card a copy of purchase order and a sample of foil are received by the dispatch department. The dispatch manager prepares the delivery challan (DC) from the following documents. Actually delivery challan is a document issued on the delivery of these goods to the customer. The original copy of DC is sent to the customer with the sales tax invoice. Another copy is Hailey College of Commerce 15 Pharma Zone Pvt. Ltd. Internship Report sent to the accounting department with the purchase order and a specimen of the goods. In box 4 delivery challan specifications are given. Delivery Challan (DC) Delivery Challan includes Purchaser name, address, sales tax registration number, purchase order number invoice number etc. Its delivery challan number It contains the description of the goods, their quantity, size etc. The purchase price is not included in the delivery challan. Box 4 Step V: Preparation of sales tax invoice: When one copy of DC, PO and a specimen of goods is received by the accounting department, it prepares sales tax invoice from these documents. There are made three copies of sales tax invoice in the accounting department. The original copy of sales tax invoice is sent to the customer via courier. One copy is kept in files. One copy is used for the preparation of journal vouchers and attached with it. In box 5 Sales Tax invoice specifications are given. And in the annexed documents to the report Sales tax invoice of Pharma zone is given. Hailey College of Commerce 16 Pharma Zone Pvt. Ltd. Internship Report Sales tax invoice: Sales tax invoice includes: Invoice number Date of invoice created Sales tax registration number National Tax Number Purchase order Number DC Number Purchaser name, address and the sales tax registration number The quantity of goods their prices their total prices Sales tax of the goods Any type of other duties Box 5 Step VI: Preparation of Journal Vouchers (JV): From the Sales tax invoice the vouchers are prepared. Because these sales are credit sales vouchers prepared are journal vouchers. Journal voucher of pharma zone is attached at the end of the internship report. Step VII: Posting to Ledgers: The entries into journal vouchers are posted into debtors’ ledger. Pharma Zone adopts single entry system of book-keeping. In the single entry system Single-entry bookkeeping system also known as Single-entry accounting system is a method of bookkeeping relying on a one sided accounting entry to maintain financial information.1 In this system, for example, in the posting of vouchers in ledger only debtors’ account is debited. Hence it considers only one aspect not the other aspect which is sales. Hailey College of Commerce 17 Pharma Zone Pvt. Ltd. Internship Report Step VIII: Preparation of Journal: From the ledger, Pharma Zone accounts & finance department enters those amounts in computerized Accounting software named “AIMS”. Journal is prepared automatically in the Pharma Zone by this software. Step IX: Tax Return Filing: Every 15 of a month all the sales tax payable in the vouchers are filed to the FBR. When a customer makes payment After sales the customer makes payment by cheques. Cheque comes into accounting department and its Bank receipt voucher (BRV) is prepared. BRV is posted into the ledger of that customer and that account is credited recognizing that his liability has been reduced. From those debtors’ ledgers the input is given into AIMS and journal is obtained. When Payment is made to the supplier When any payment is made to the supplier via cheque, the cheque is issued in the name of the company. It comes into accounting department. Then the Bank Payment voucher (BPV) is prepared. BPV is posted into ledger of that supplier and then ledger is entered into computerized accounting system to get journal and other financial statements. Hailey College of Commerce 18 Pharma Zone Pvt. Ltd. Internship Report My Learning I have a good opportunity to having the internship of 2 months from the Pharma Zone pvt. Limited. All these 2 months were full of events. At start I have little bit work to do but when I got stuck with my job I gained much experience in my these two months. Cheque online transfer and receipt of cheques: At my very first day at the internship I went with marketing Officer, Mr. Liaqat, to deposit some money and transfer online the cheques. Initially I have little bit problem over understanding of the online transfer but Marketing Officer gave me good support to understand this. We went to the Bank al-Habib Peco Road Branch Lahore. There we got slip of cheque online transfer to the payee account. We entered its information such as account number, name of account holder, name of online transferor etc. Then we got the token from the token counter. I still remember the token number I received was 232, I waited for my turn. When my token number was announced I went to the counter number 3, transferred the amount. I waited for at-least 20 minutes for the confirmation of online transfer. So after this we went to HBL Peco Road Branch and did almost the same thing. Posting into debtors’ ledger: I have been given the task by Mr. Qasim the accountant to post the entries from journal vouchers to Debtors’ ledger. He gave a little bit help initially. If there was debit in journal voucher I debited the amount of that customer account in ledger. If there was the credit in the journal vouchers I credited the amount of that customer account in the ledger book. I did some wrong in posting initially. There were mistakes in adding or subtracting initially. But these errors were rectified by the passing of time. I have also posted Bank receipt voucher into the debtors’ ledger. Customer account is credited while posting into the ledger. Hailey College of Commerce 19 Pharma Zone Pvt. Ltd. Internship Report Checking the entries posted into ledger: I also checked the entries posted into ledger by tallying it from the vouchers (e.g. bank receipt voucher). This was easy task I had to check the amount entered, into specific customer account. If these were correct I have to sign on the voucher below which ledger entries are referenced. Checking of journal vouchers: I also checked journal vouchers. Actually journal vouchers are attached to the copy of invoice, Purchase order and Delivery Challan. I had to check from all these documents that all the amounts entered into journal vouchers are correct and there is no mistake. Typical journal voucher entry for the sales was: Debtor’s Account To Sales To Sales Tax Payable To Special Excise Duty Sales, Sales Tax Payable, Special Excise Duty Accounts are tallied from Sales Tax invoice. These 3 accounts are totaled to get that particular debtor’s account. After the checking of journal voucher I signed at the bottom of document. Miscellaneous: If there was no work to do sometimes I was called to do other than routine work. That’s sometimes I was said that “Get the USB net device from the operations department”. Sometimes I have to copy the documents from the photocopy machines given by my superiors. Hailey College of Commerce 20 Pharma Zone Pvt. Ltd. Internship Report Pharma Zone Financial Statements: Here are given two financial statements of Pharma Zone Pvt. Limited. One is balance sheet and other is income statement. Balance Sheet: PHARMA ZONE (PVT.) LIMITED Balance Sheet AS AT JUNE 30, 2008 2008 2007 2,500,000 2,500,000 200,000 200,000 1,627,039 627,244 1,827,039 827,244 6,900,000 6,900,000 2,928,939 2,574,722 504,581 2,120,643 Capital and Liabilities Share Capital and reserves Authorized Share Capital: 25000/-ordinary Shares of 100/- each Issued, Subscribed and Paid up Capital: 2,000/- Ordinary Shares of 100/- each fully paid up in cash Accumulated Profit Share Deposit Money Current Liabilities Director's Loan Creditors Accrued and other Liabilities 77,797 12,238,356 128,298 12,550,907 Property and Assets Hailey College of Commerce 21 Pharma Zone Pvt. Ltd. Internship Report 3,568,529 3,775,000 241,841 241,841 Trade Debts 3,269,571 613,887 Stock in Trade 3,500,535 6,099,229 Advances, deposits, prepayments and other receivables 1,154,642 1,605,861 503,238 215,089 8,427,986 8,534,066 12,238,356 12,550,907 Operating Fixed Assets Deferred Cost Current Assets: Cash and Bank Balances Income Statement: The Pharma Zone Income statement is given below: PHARMA ZONE (PVT.) LIMITED Income Statement FOR THE YEAR ENDED JUNE 30, 2008 2008 Amount (Rupees) 2007 Amount (Rupees) Sales 10442040 7292261 Less: Cost of Sales 8718676 5949751 Gross Profit/ (Loss) 1723364 1342510 Administrative, Selling and General Expenses Financial Charges 723570 683869 5064 Operating Profit 999794 663705 -- 36461 Net Loss before Taxation 999794 627244 Accumulated profit - Transferred to Balance Sheet 1627038 627244 Provision for taxation Hailey College of Commerce 22 Pharma Zone Pvt. Ltd. Internship Report Ratio analysis Categories of Financial Ratios: Financial ratios are divided into five basic categories: 1. Liquidity Ratios 2. Activity Ratios 3. Debt Ratios 4. Profitability Ratios 5. Market Ratios Liquidity Ratios: A firm’s ability to satisfy its short-term obligations as they come due is called liquidity. Liquidity ratios measure the power of the firm to satisfy its short-term obligations. The two basic sources of liquidity are: 1. Current Ratio 2. Quick Ratio Current Ratio: The current ratio is a measure of liquidity calculated by dividing the firm’s current assets by its current liabilities.2 It is calculated by: Current Ratio Current Assets Current Liabilitie s Although the current ratio depends on what type of industry the firm exists, but normally high current ratio is preferred. Hailey College of Commerce 23 Pharma Zone Pvt. Ltd. Internship Report Quick (Acid-Test) Ratio: It is similar to current ratio except that inventory is excluded from current assets. The higher the ratio is preferred. It is calculated by Quick ( Acid Test ) Ratio Current Assets Inventories Current Liabilitie s Activity Ratios: Following are the activity ratios: 1. Inventory Turnover 2. Average Collection Period 3. Average Payment Period 4. Total Asset Turnover Activity ratios measure the speed with which various accounts are converted into sales or cash – inflows or outflows.3 Inventory Turnover: Inventory turnover measures the activity, or liquidity, of a firm’s inventory. 4 Inventory Turnover Cost of Goods Sold Inventory Average Collection Period: The average collection period, or average age of accounts receivable, is useful in evaluating credit and collection policies.5 Average Collection Period Hailey College of Commerce Accounts Re ceivable Average Sales per Day 24 Pharma Zone Pvt. Ltd. Internship Report Average Payment Period: The average payment period, or average age of accounts payable, is the average amount of time needed to pay accounts payable.6 Average Payment Period Accounts Payable Average Purchases per Day Total Asset Turnover: It indicates the efficiency with which the firm uses its assets to generate sales.7 Total Asset Turnover Sales Total Assets Debt Ratios: Following are three debt ratios: 1. Debt Ratio 2. Times Interest Earned Ratio 3. Fixed Payment Coverage Ratio Debt Ratio: It measures the proportion of total assets financed by the firm’s creditors.8 Debt Ratio Total Liabilitie s Total Assets Times Interest Earned Ratio: Hailey College of Commerce 25 Pharma Zone Pvt. Ltd. Internship Report Times interest earned ratio or interest coverage ratio measures the firm’s ability to make contractual interest payments.9 Times Interest earned Ratio Earnings before int erest and Taxes Interest Profitability Ratios: Following are the profitability ratios: 1. Gross Profit Margin 2. Operating Profit Margin 3. Net Profit Margin 4. Earning per Share 5. Return on Assets 6. Return on equity Gross Profit Margin: It measures the percentage of each sales dollar remaining after the firm has paid for its goods.10 Gross Pr ofits M arg in Gross Pr ofits Sales Operating Profit Margin: It measures the percentage of each sales dollar remaining after all costs and expenses other than interest, taxes, and preferred stock dividends are deducted: the “pure profits” earned on each sales dollar.11 Operating Pr ofits M arg in Operating Pr ofits Sales Hailey College of Commerce 26 Pharma Zone Pvt. Ltd. Internship Report Net Profit Margin: It measures the percentage of each sales dollar remaining after all costs and expenses, including interest, taxes and preferred stock dividends, have been deducted.12 Net Pr ofits M arg in Earnings Available to Common Stockholders Sales Earning per Share: The firm’s earnings per share (EPS) is generally of interest to present or prospective stockholders and management.13 Earnings per share Earnings Available to Common Stockholders Number of Shares Return on Assets: It measures the overall effectiveness of management is generating profits with its available assets, also called the return on investment (ROI). Re turn on Assets Earnings Available to Common Stockholders Total Assets Return on equity: It measures the return earned on the common stockholders’ investment in the firm.14 Re turn on Equity Earnings Available to Common Stockholders Common Stock Equity Market Ratios: Following are the two market ratios: Hailey College of Commerce 27 Pharma Zone Pvt. Ltd. Internship Report 1. Price/ earnings (P/E) Ratio: 2. Market/Book (M/B) Ratio: Price/ earnings (P/E) Ratio: It measures the amount that investors are willing to pay for each dollar of a firm’s earnings; the higher the P/E ratio, the greater is investor confidence.15 Pr ice / earnings ( P / E ) ratio Market price per share of common stock Earnings per share Market/Book (M/B) Ratio: It provides an assessment of how investors view the firm’s performance. Firms expected to earn higher returns relative to their risk typically sell at higher M/B multiples.16 Market / book ( M / B) ratio Market price per share ofcommon stock Book value per share of Common Stock Advantages of Ratio Analysis: Helpful in analysis of Financial Statements. Helpful in comparative study. Helpful in locating the weak spots of the business. Helpful in forecasting. Estimate about the trend of the business. Hailey College of Commerce 28 Pharma Zone Pvt. Ltd. Internship Report Ratios of Pharma Zone Pvt. Limited 200708 I have given the ratio analysis for the Pharma Zone for two years. These financial statements are audited by the Arman & Company. Ratios Pharma Zone Pvt. Limited (2007) Liquidity Ratios Ratio Current Ratio Quick (Acid-Test) Ratio Formula Calculation Value = Current Assets Current Liabilities = Rs Rs 8,534,066 4,823,663 = 1.77 = Current Assets - Inventory Current Liabilities = Rs Rs 2,434,767 4,823,663 = 0.50 Activity Ratios Inventory Turnover Average Collection Period Average Payment Period Total Asset Turnover Hailey College of Commerce = Cost of Goods Sold Inventory = Rs Rs 5,949,751 6,099,229 = 0.98 = Accounts Receivable Average Sales Per Day = Rs Rs 613,887 20,256 = 30.31 = Accounts Payable Average Purchases Per Day = Rs Rs 2,120,643 28,515 = 74.37 = Sales Total Assets = Rs 7,292,261 Rs 12,550,907 = 0.58 29 Pharma Zone Pvt. Ltd. Internship Report Debt Ratios Debt Ratio = Total Liabilities Total Assets = Rs Rs 11,723,663 12,550,907 = 0.93 Profitability Ratios Gross Profit Margin Operating Profit Margin Net Profit Margin Return On Assets Return On Equity Hailey College of Commerce = Gross Profits Sales = Rs Rs 1,342,510 7,292,261 = 0.18 = Operating Profits Sales = Rs Rs 663,705 7,292,261 = 0.09 = Net Profits Sales = Rs Rs 627,244 7,292,261 = 0.09 = Net Profits Total Assets = Rs 627,244 Rs 12,550,907 = 0.05 = Net Profits Common Stock Equity = Rs Rs = 0.76 627,244 827,244 30 Pharma Zone Pvt. Ltd. Internship Report Ratios Pharma Zone Pvt. Limited (2008) Liquidity Ratios Ratio Formula Current Ratio Current Assets Current Liabilities Quick (Acid-Test) Ratio = Current Assets Inventory Current Liabilities = Calculation Value = Rs Rs 8,427,986 3,511,317 = 2.40 = Rs Rs 4,927,451 3,511,317 = 1.40 Activity Ratios Inventory Turnover Average Collection Period Average Payment Period Total Asset Turnover = Cost of Goods Sold Inventory = Rs Rs 8,718,676 3,500,535 = 2.49 = Accounts Receivable Average Sales Per Day = Rs Rs 3,269,571 29,006 = 112.72 Rs 504,581 = Accounts Payable Average Purchases Per Day = Rs 12,905 = 39.10 = Sales Total Assets = Rs Rs 10,442,040 12,238,356 = 0.85 = Rs Rs 10,411,317 12,238,356 = 0.85 Debt Ratios Debt Ratio = Hailey College of Commerce Total Liabilities Total Assets 31 Pharma Zone Pvt. Ltd. Internship Report Profitability Ratios Gross Profit Margin Operating Profit Margin Net Profit Margin Return On Assets Return On Equity = Gross Profits Sales = Rs Rs 1,723,364 10,442,040 = 0.17 = Operating Profits Sales = Rs 999,795 Rs 10,442,040 = 0.10 = Net Profits Sales = Rs Rs 1,627,039 10,442,040 = 0.16 = Net Profits Total Assets = Rs Rs 1,627,039 12,238,356 = 0.13 = Net Profits Common Stock Equity = Rs Rs 1,627,039 1,827,039 = 0.89 Hailey College of Commerce 32 Pharma Zone Pvt. Ltd. Internship Report Important Notes & Assumption 1. One year is considered to be comprised of 360 days. 2. Trade debts are accounts receivables. 3. Share deposit money is considered to be long term liability. 4. Creditors/ Accounts payables are excluded from notes to the financial statements. Limitations: 1. Inflation can affect Ratios. 2. Only one ratio is not enough to give the company whole image. 3. Times interest earned ratio is not given because there is no interest. 4. Market ratios are unavailable. Hailey College of Commerce 33 Pharma Zone Pvt. Ltd. Internship Report Ratio analysis 2007-2008 Liquidity Ratios: Ratios Liquidity Ratio Graphical Analysis 3 2.5 2 1.5 1 0.5 0 Current Ratio Quick (Acid-Test) Ratio 2007 2008 Years Hailey College of Commerce 34 Pharma Zone Pvt. Ltd. Internship Report Liquidity Ratios Analysis Current Ratio: Normally the higher the current ratio is preferred. According to some observations if it is above two for a company, it is well enough depending on its nature of the business. Current ratio of Pharma Zone was good in 2007, it increased in 2008. So totally it looks satisfactory for Pharma Zone to have the current ratio around that value. Quick (Acid-Test) Ratio: As we know that quick (Acid-Test) Ratio is actually the current ratio figure without inventory in current assets. The quick ratio of Pharma Zone looks satisfactory in 2008. But in other years it looks poor because it is below 1. Hailey College of Commerce 35 Pharma Zone Pvt. Ltd. Internship Report Activity Ratios: Ratios Activity Ratios Graphical Analysis (ACP & APP) 120 100 80 60 40 20 0 Average Collection Period Average Payment Period 2007 2008 Years Hailey College of Commerce 36 Pharma Zone Pvt. Ltd. Internship Report Activity Ratios Graphical Analysis (Inventory Turnover & Total Asset Turnover) 3 Inventory Turnover Total Asset Turnover 2 Ratios 1 0 2007 2008 Years Hailey College of Commerce 37 Pharma Zone Pvt. Ltd. Internship Report Activity Ratios Analysis Inventory Turnover: Inventory turnover was not good in 2007, but in 2008 it was 2.49 and got better. Average Collection Period: Average collection period is very good in 2007 and it was 30.31 days. It got hammered in 2008 because it was around 112 days. Average Payment Period: Average payment period becomes good from 74.37 days to 39.10 days from 2007 to 2008. Total Asset Turnover: Total asset turnover got better from 2007 to 2008. Although it is getting better from year to year, but it is actually very low for the Pharma Zone. Just it is around 1. Hailey College of Commerce 38 Pharma Zone Pvt. Ltd. Internship Report Debt Ratios Ratio Debt Ratio Graphical Analysis 0.94 0.92 0.9 0.88 0.86 0.84 0.82 0.8 Debt Ratio 2007 2008 Years Hailey College of Commerce 39 Pharma Zone Pvt. Ltd. Internship Report Debt ratios Analysis Debt Ratio The lower the debt ratio is preferred by the new investors. Debt Ratio has been Okay in 2007 and 2008. It is around 0.9 in all the years Other debt ratios cannot be prepared because Pharma Zone have not shown any interest and fixed charges in their financial statements. Hailey College of Commerce 40 Pharma Zone Pvt. Ltd. Internship Report Profitability Ratios Profitability Ratios Graphical Analysis 1 Gross Profit Margin Operating Profit Margin Net Profit Margin Ratios 0.8 0.6 0.4 0.2 0 2007 2008 Years Hailey College of Commerce Return On Assets Return On Equity 41 Pharma Zone Pvt. Ltd. Internship Report Profitability Ratios Analysis All the profitability ratios are good in all the years and are expected to remain good in all the years. But the ratio is a little percentage of Sales. Gross Profit Margin: Gross Profit margin is good in all the years and is expected to be good in all the years. Operating Profit Margin: Operating Profits Margin is around 0.10. It was good and remain almost constant in 2007-08 and is expected to show the same behavior in next overs. Net Profit Margin: Net Profit margin was good in 2008 but is expected to drop a bit from 0.16 to 0.08 from 2007 to 2008. Return On Assets: Return on Assets became good from 0.50 to 0.10 from 2007 to 2008. So assets are not giving proper return. Return On Equity: Return on equity of Pharma Zone is good in the year 2007 and 2008. Hailey College of Commerce 42 Pharma Zone Pvt. Ltd. Internship Report Summary of All Ratios Following is given complete summary of all ratios from 2007-2008 of Pharma Zone Pvt. Limited in a tabular format. Time Series Ratio Analysis Pharma Zone Pvt. Limited (2007-2008) Ratio 2007 Actual 2008 Evaluation 2007-11 Liquidity Ratios Current Ratio Quick (Acid-Test) Ratio 1.77 0.50 2.40 1.40 OK Poor 0.98 30.31 74.37 0.58 2.49 112.72 39.10 0.85 Ok Very Bad Good Poor 0.93 0.85 Ok 0.18 0.09 0.09 0.05 0.76 0.17 0.10 0.16 0.13 0.89 Ok Good Ok Poor Good Activity Ratios Inventory Turnover Average Collection Period Average Payment Period Total Asset Turnover Debt Ratios Debt Ratio Profitability Ratios Gross Profit Margin Operating Profit Margin Net Profit Margin Return On Assets Return On Equity Hailey College of Commerce 43 Pharma Zone Pvt. Ltd. Internship Report Pharma Zone looks good in most of the ratios. But some ratios are not good rather these are poor like the Average collection period is much worse. Its profits are low but this happens in industry in which Pharma Zone lies. Hailey College of Commerce 44 Pharma Zone Pvt. Ltd. Internship Report Ratio Analysis Conclusion Most of the Pharma Zone ratios are good. But Pharma Zone has much to look for the average collection period. Pharma Zone has really to look on it because it is the heart and soul of any business to survive in the marketplace. Hailey College of Commerce 45 Pharma Zone Pvt. Ltd. Internship Report Horizontal and vertical Analysis Vertical Analysis: Vertical Analysis reports each amount on a financial statement as a percentage of another item.17 Horizontal Analysis: Horizontal analysis looks at amounts on the financial statements over the past years.18 Vertical Analysis Common-size Income Statement: An income statement in which each item is expressed as a percentage of sales is called Common-size Income Statement:19 The Common Size income Statement of Pharma Zone is given over the five years. Common-Size Income Statement 2007 2008 100.00% 100.00% Less: Cost of Sales 81.59% 83.50% Gross Profit/ (Loss) 18.41% 16.50% Administrative, Selling and General Expenses Financial Charges 9.38% 0.07% 6.93% Operating Profit 8.96% 9.57% Provision for taxation 0.50% Net Loss before Taxation 8.46% 9.57% Accmulated profit - Transffered to Balance Sheet 8.46% 9.57% Sales Hailey College of Commerce 46 Pharma Zone Pvt. Ltd. Internship Report Supporting Calculation: Here is given the supporting calculation of above common-size Income Statement: Sales Cost of Sales Gross Profit/ (Loss) Administrative, selling and general expenses Financial Charges Operating Profits Provision for taxation Net Loss Before taxation = Sales Sales x = Cost of Sales Sales x = Gross Profits Sales x = Administrative, Selling and general expenses Sales = Financial charges Sales x = Operating Profits Sales x = Provision for taxation Sales x = Net Loss before taxation Sales x Hailey College of Commerce x 100 100 100 = 7292261 7292261 x = 5949751 7292261 x = 1342510 7292261 x = 683869 7292261 = 5064 7292261 x = 663705 7292261 x = 36461 7292261 x = 627244 7292261 x 100 100 100 100 100 x 100 100 100 100.00% = 81.59% = 18.41% = 100 9.38% = 100 100 100 100 0.07% = 9.10% = 0.50% = 8.60% = 47 Pharma Zone Pvt. Ltd. Internship Report Graphical Representation of Common-size Income Statement Comparison b/w GP Margin, OP Margin and NP Margin 20.00% Gross Profit/ (Loss) Operating Profit 15.00% 10.00% Net Loss before Taxation 5.00% 0.00% 2007 2008 Hailey College of Commerce 48 Pharma Zone Pvt. Ltd. Internship Report Common-Size Balance Sheet: Here the base year is taken to be 2007: Common-Size Balance Sheet December 31st, 2008 Capital and Liabilities Share Capital and reserves Authorized Share Capital: 25000/-ordinary Shares of 100/- each 20.43% Issued, Subscribed and Paid up Capital: 2,000/- Ordinary Shares of 100/- each fully paid up in cash 1.63% Accumulated Profit 13.29% Share Deposit Money 56.38% Current Liabilities 28.69% Director's Loan Creditors, accrued and other liabilities 23.93% 4.76% 100.00% Property and Assets Operating Fixed Assets 29.16% Deferred Cost 1.98% Current Assets: 68.87% Trade Debts Stock in Trade Advances, deposits, prepayments and other receivables Cash and Bank Balances 26.72% 28.60% 9.43% 4.11% 100.00% In the Common-size Balance Sheet total assets are taken as 100% of that year and the percentage of each amount is calculated as compared to that percentage of total assets. Hailey College of Commerce 49 Pharma Zone Pvt. Ltd. Internship Report Pharma Zone Cash and Bank Balances position looks bad, it is just 4.11%. Pharma Zone liabilities are much more specially directors’ loan which is about 28% of total assets. Supporting Calculation: Authorized Share Capital: Issued, Subscribed and Paid up Capital: Accumulated Profit Share Deposit Money Current Liabilities Director's Loan Creditors, accrued and other liabilities = = Authorized Share Capital: Total Assets Issued, Subscribed and Paid up Capital: Total Assets = Rs 2,500,000 Rs 12,238,356 = = Rs 200,000 Rs 12,238,356 = = Accumulated Profit Total Assets = Rs 1,627,039 Rs 12,238,356 = = Share Deposit Money Total Assets = Rs 6,900,000 Rs 12,238,356 = = Current Liabilities Total Assets = Rs 504,581 Rs 12,238,356 = = Director's Loan Total Assets = Rs 2,928,939 Rs 12,238,356 = = Rs 582,378 Rs 12,238,356 = = Hailey College of Commerce Creditors, accrued and other liabilities Total Assets 50 20.43% 1.63% 13.29% 56.38% 4.12% 23.93% 4.76% Pharma Zone Pvt. Ltd. Operating Fixed Assets Deferred Cost Current Assets: Trade Debts Stock in Trade Internship Report = Operating Fixed Assets Total Assets = Rs 3,568,529 Rs 12,238,356 = = Deferred Cost Total Assets = Rs 241,841 Rs 12,238,356 = = Current Assets: Total Assets = Rs 8,427,986 Rs 12,238,356 = = Trade Debts Total Assets = Rs 3,269,571 Rs 12,238,356 = = Stock in Trade Total Assets = Rs 3,500,535 Rs 12,238,356 = = Rs 1,154,642 Rs 12,238,356 = = Rs 503,238 Rs 12,238,356 = Advances, deposits, and other receivables = Cash and Bank Balances = Hailey College of Commerce Advances, deposits, and other receivables Total Assets Cash and Bank Balances Total Assets 51 29.16% 1.98% 68.87% 26.72% 28.60% 9.43% 4.11% Pharma Zone Pvt. Ltd. Internship Report Horizontal Analysis In this Horizontal Analysis the base year is considered as 2007. All the amounts of 2008 are divided by 2007 amounts and the percentage is given here Horizontal Analysis of Balance Sheet Horizontal Analysis of Balance sheet Capital and Liabilities Share Capital and reserves Authorized Share Capital: 25000/-ordinary Shares of 100/- each 0.00% Issued, Subscribed and Paid up Capital: 2,000/- Ordinary Shares of 100/- each fully paid up in cash 0.00% Accumulated Profit Share Deposit Money Current Liabilities Director's Loan Creditors, accrued and other liabilities 159.39% 0.00% 13.76% -39.36% 25.90% -2.49% Property and Assets Operating Fixed Assets Deffered Cost Current Assets: Trade Debts Stock in Trade Advances, deposits, prepayments and other receivables Cash and Bank Balances -5.47% 0.00% -1.24% 432.60% -42.61% -28.10% 133.97% -2.49% Hailey College of Commerce 52 Pharma Zone Pvt. Ltd. Internship Report As we can see that accumulated profits are approximately 259% of the year 2007. That’s discussed in the income statement below. Although total assets are decreased in the year 2008 but there is good change in liquidity of the Pharma Zone in the year 2008. As we can see in the ratio analysis Average Collection period is very very large, this is the behavior depicted in the trade debts, just look at the percentage of trade debts, it is 532.60%. Supporting Calculations: Authorized = Share Capital: Issued, Subscribed = and Paid up Capital: Accumulated = Profit Share Deposit Money = Director's Loan = Creditors, accrued and = other liabilities Authorized Share Capital (2008) Authorized Share Capital (2007) Authorized Share Capital (2007) x Issued Capital (2008) - Issued Capital (2007) x 100 = 100 = Issued Capital (2007) Accumulated Profits (2008) Accumulated Profits (2007) Accumulated Profits (2007) 2,500,000 - 2,500,000 = 0.00% 2500000 200,000 - 200,000 = 0.00% 200000 100 = 1,627,039 - 627,244 627244 100 = 6,900,000 - 6,900,000 = 0.00% 6900000 Director's Loan (2008) - Director's Loan (2007) 100 x Director's Loan (2007) = 2,928,939 - 2,574,722 = 13.76% 2574722 Share Deposit Money (2008) - Share Deposit Money (2007) Share Deposit Money (2007) x x Creditors and other liabilities (2008) Creditors and other liabilities (2007) x Creditors and other liabilities (2007) Hailey College of Commerce 100 = 77,797 - 128,298 128298 53 = 159.39% = -39.36% Pharma Zone Pvt. Ltd. Operating = Fixed Assets Operating Fixed Assets (2008) Operating Fixed Assets (2007) Operating Fixed Assets (2007) Deffered Cost = Deffered Cost (2008)- Deffered Cost (2007) Deffered Cost (2007) Internship Report 3,568,529 - 3,775,000 = -5.47% 3775000 100 = 100 = Current Assets (2008) - Current Assets (2007) 100 x Current Assets (2007) = 8,427,986 - 8,534,066 = -1.24% 8534066 = 3,269,571 - 613,887 613887 100 = 3,500,535 - 6,099,229 = -42.61% 6099229 Advances, Advance deposits and receivables (2008) deposits, - Advance deposits and receivables prepayments = (2007) 100 x and other receivables Advance deposits and receivables (2007) = 1,154,642 - 1,605,861 = -28.10% Cash and Bank Balance (2008) - Cash and Bank Balance (2007) 100 x Cash and Bank Balance (2007) = Current Assets: = x x Trade Debts = Trade debts (2008) -Trade debts (2007) 100 x Trade debts (2007) Stock in Trade Cash and Bank Balances = = Stock in Trade(2008) - Stock in Trade(2007) Stock in Trade(2007) x Total Assets = Total Assets (2008) - Total Assets (2007) 100 x Total Assets (2007) Hailey College of Commerce 241,841 - 241,841 241841 = 0.00% = 432.60% 1605861 503,238 - 215,089 215089 = 133.97% = 12,238,356 - 12,550,907 = -2.49% 12550907 54 Pharma Zone Pvt. Ltd. Internship Report Horizontal Analysis of Income Statement Horizontal Analysis of Income Statement For the year ended december 2008 2008 Sales 43.19% Less: Cost of Sales 46.54% Gross Profit/ (Loss) 28.37% Administrative, Selling and General Expenses Financial Charges 5.81% -100.00% Operating Profit 50.64% Provision for taxation -100.00% Net Loss before Taxation 59.39% Accmulated profit - Transffered to Balance Sheet 59.39% As we can see the Income statement looks very healthy as far as the base year 2007 is concerned. Sales are of 143.19% of 2007. This is a very healthy change for the Pharma Zone. It earned the net profit of 15.91% that’s very good for Pharma Zone pvt. Limited. Supporting Calculation: Sales = Sales (2008) - Sales (2007) Sales (2007) Cost of Sales = Cost of Sales (2008) - Cost of Sales (2007) Cost of Sales (2007) Gross Profit/ (Loss) = Gross Profits(2008) - Gross Profits (2007) Sales Hailey College of Commerce x x x 100 = 10442040 - 7292261 = 7292261 43.19% 100 = 8718676 - 5949751 = 5949751 46.54% 100 = 1723364 - 1342510 = 1342510 28.37% 55 Pharma Zone Pvt. Ltd. Internship Report Administrative expenses(2008) Administrative, selling and general = Administrative expenses(2007) 100 = x expenses Administrative expenses(2007) Financial Charges = Operating Profits = Provision for taxation Net Loss Before taxation Accumulated Profits = Financial charges (2008) Financial charges (2007) Financial charges (2007) Operating Profits (2008) Operating Profits (2007) Operating Profits (2007) Provision for taxation (2008) Provision for taxation (2007) Provision for taxation (2007) x x x 100 = 100 = 100 = Net Loss before taxation (2008) = Net Loss before taxation (2007) 100 = x Net Loss before taxation (2007) = Accumulated Profits (2008) Accumulated Profits (2007) Accumulated Profits (2007) Hailey College of Commerce x 100 = 723570 - 683869 = 683869 5.81% 0 5064 5064 = -100.00% 999794 - 663705 = 663705 50.64% 0 - 36461 = 36461 -100.00% 999794 - 627244 = 627244 59.39% 1627038 - 627244 = 627244 159.39% 56 Pharma Zone Pvt. Ltd. Internship Report Recommendations Almost any small business can use advice on how to improve its collection cycle. The first line of defense against late payments is a complete invoice. Bills should be accurate, detailed and easy to understand. If difficult to understand, then client will need to call for additional information. This increases the time of company collection cycle. Include on each invoice: Company's contact information: name, address, tax id number, phone and contact person The date the invoice was prepared The customer's name and address A description of the goods or services sold to the customer The amount due, with sales tax amount broken out Once prepared, send invoices promptly. The longer a company takes to bill a customer the less likely it is to receive payment for the goods and services provided. If the steps are reduced in the cash conversion process Average Collection Period can be reduced. If the Pharma Zone makes the agent to the third party it can reduce its average collection period. For example it may hire the services of the bank or any other professional party. The average accounts receivable collection period is an important indicator for determining when customers business will pay for the goods and services it provides.20 Hailey College of Commerce 57 Pharma Zone Pvt. Ltd. Internship Report Conclusion Pharma Zone, the leading company in the printing of foil, is situated in PCSIR Colony, College Road Lahore. Pharma zone currently manufactures following products: Aluminum Foil Blister Strip Foil Poly Coated Paper Blister Pouches Alu Alu Foil Plain Company keeps its quality at the peak of the business. There are high levels of professionals in all departments of Pharma Zone and it is continuously keeping an eye over their growth. Accounting system adopted by Pharma zone is single entry system. Pharma Zone adopted this system because it is an easy approach towards accounting. There is a proper channel of communication between the departments of the Pharma Zone. There is a proper organizational chart issued by the organization. Ratios of Pharma Zone are good except average collection period which is very poor for Pharma Zone. Overall Pharma Zone is in the good business with low profitability now a day. It is worth mentioned here that in the recent arena where Pakistan is in severe situation such as load shutting, there are different companies which are trying to survive in this situation Pharma Zone has done well and installed well generators of electricity to work effectively in the time of crises. Hailey College of Commerce 58 Pharma Zone Pvt. Ltd. Internship Report Index A Accounts Payable, 31 Accounts Receivable, 31 Activity ratios, 23, 24 AIMS, 18 Alu Alu Foil, iii, 6, 7, 9, 58 Arshad Mahmood, 1 Average Collection Period, 24, 31, 38, 43, 57 Average Payment Period, 24, 25, 31, 38, 43 I Inventory, 24, 31, 38, 43 Inventory Turnover, 24, 31, 38, 43 J Journal, 12, 17, 18 Journal Vouchers, 12, 17 L B Bank Payment voucher, 18 Bank receipt voucher, 18, 19 Liquidity ratios, 23 M C CEO, 3, 13 Common Stock Equity, 32 Cost of Goods Sold, 31 Current Assets, 31 Current Liabilities, 31 Current Ratio, 23, 31, 35, 43 Market Ratios, 23, 27 Market/Book (M/B) Ratio, 28 Mission & Vision Statement, 10 N Net Profit Margin, 26, 27, 32, 42, 43 Net Profits, 32 D Debt Ratio, 25, 31, 40, 43 Debt ratios, 23, 40 delivery Challan, 12 O Operating Profit Margin, 26, 32, 42, 43 Operating Profits, 32, 42 E Earning per Share, 26, 27 F Fixed Payment Coverage Ratio, 25 P Pharma Zone, ii, iii, 1, 3, 6, 7, 9, 10, 11, 12, 13, 14, 15, 17, 18, 19, 29, 31, 35, 38, 40, 43, 44, 45, 57, 58 Price/ earnings (P/E) Ratio, 28 Printing job card, 12, 14, 15 Profitability ratios, 23 Purchase Order, 12, 13, 15 G Gross Profit Margin, 26, 32, 42, 43 Gross Profits, 32 H Horizontal Analysis, 46, 52, 55 Hailey College of Commerce Q Quick Ratio, 23 R Return on Assets, 26, 27, 42 Return on equity, 26, 27 59 Pharma Zone Pvt. Ltd. Internship Report S Sales, 1, 3, 5, 12, 13, 14, 15, 16, 17, 20, 31, 32, 42 Sales Order, 12, 13, 14, 15 sales tax invoice, 1, 12, 15, 16 Sheikhupura, 10 single entry system, iii, 12, 17, 58 Special Excise Duty, 20 T Tax Return, 12, 18 Times Interest Earned Ratio, 25 Total Asset Turnover, 24, 25, 31, 38, 43 V Vertical Analysis, 46 Hailey College of Commerce 60 Pharma Zone Pvt. Ltd. Internship Report References 1 http://en.wikipedia.org/wiki/Single-entry_bookkeeping_system 2 Page 54, Principals of Managerial Finance, 10th edition 3 Page 55, Principals of Managerial Finance, 10th edition 4 Page 55, Principals of Managerial Finance, 10th edition 5 Page 56, Principals of Managerial Finance, 10th edition 6 Page 56, Principals of Managerial Finance, 10th edition 7 Page 57, Principals of Managerial Finance, 10th edition 8 Page 57, Principals of Managerial Finance, 10th edition 9 Page 60, Principals of Managerial Finance, 10th edition 10 Page 62, Principals of Managerial Finance, 10th edition 11 Page 63, Principals of Managerial Finance, 10th edition 12 Page 64, Principals of Managerial Finance, 10th edition 13 Page 65, Principals of Managerial Finance, 10th edition 14 Page 65, Principals of Managerial Finance, 10th edition 15 Page 66, Principals of Managerial Finance, 10th edition 16 Page 66, Principals of Managerial Finance, 10th edition 17 September 7, 2007, article What is the difference between vertical and horizontal analysis? Available on site http://blog.accountingcoach.com/vertical-analysis-horizontal-analysis/ 18 September 7, 2007, article What is the difference between vertical and horizontal analysis? Available on site http://blog.accountingcoach.com/vertical-analysis-horizontal-analysis/ 19 Page 61, Principals of Managerial Finance, 10th edition 20 http://www.content4reprint.com/accounting/bookkeeping/small-business-advice-improve-your-accountsreceivable-collection-cycle-now.htm Hailey College of Commerce 61