c21glandon, The Statement of Cash Flows

advertisement

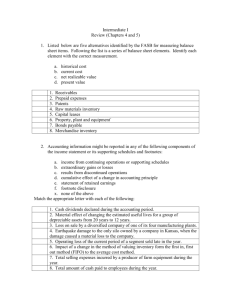

Statement of Cash Flows Sid Glandon, DBA, CPA Associate Professor of Accounting 1 Purpose Reports on cash inflows and outflows for an accounting period Provides information regarding ability of firm to generate cash from operations ability to maintain and expand operating capacity ability to meet financial obligations and pay dividends 2 Types of Cash Flow Activities Cash Flows from Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities 3 Operating Activities Receipts from revenues Payments for expenses 4 Investing Activities Receipts from sale of noncurrent assets Payments for acquisition of noncurrent assets 5 Financing Activities Receipts from issuance of equity and debt securities Payments for dividends redemption of equity securities (treasury stock) redemption of debt securities 6 Noncash Investing/Financing Supplementary schedule to the statement Noncash Investing Activities Acquisition of plant assets by issuing bonds or capital stock Purchase a building through a mortgage loan Noncash Financing Activities Issuance of capital stock in exchange for convertible preferred stock or debt 7 Method of Reporting Cash Flows from Operating Activities Direct Method Indirect Method (reconciliation method) 8 Cash Flows from Operating Activities: Direct Method Cash received from customers Cash paid for inventory, labor, and services 9 Cash Flows from Operating Activities: Indirect Method Net income plus noncash charges to net income plus/minus changes in current assets plus/minus changes in current liabilities plus/minus gains/losses on investing activities plus/minus gains/losses on financing activities 10 Cash Flows From Operating Activities-Indirect Method Net income (from the income statement) Add: Amortization Depreciation Changes in current assets: Increases Decreases Changes in current liabilities: Increases Decreases Gains from investing or financing Losses from investing or financing Net cash flows from operating activities $ + + + + + $ 11 The Three Foolers Reported as Operating Activities Interest paid on debt Interest received on investments Dividends received on investments 12 Using the Worksheet Approach Prepare comparative balance sheets Identify changes in cash for each account Using income statement and T-account analysis Spread changes in cash to appropriate columns Reconcile balances of each type of activity 13 Spencer Company Comparative Balance Sheets December 31, 2001 and 2000 Assets Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Accured expenses (operating expenses) Interest payable Income tax payable Dividends payable Mortgage note payable Bonds payable Common stock, $25 per value Paid-in capital in excess of par Retained earnings Total liabilities and stockholders' equity 2001 2000 $ 57,870 $ 66,200 137,180 117,800 211,500 190,150 5,160 6,120 44,500 93,500 77,250 75,000 412,500 225,000 (91,260) (81,220) 493,700 437,500 (179,700) (149,750) $ 1,168,700 $ 980,300 $ 58,715 11,000 1,875 5,000 15,660 175,000 100,000 450,000 47,250 304,200 $ 1,168,700 $ $ 51,875 10,500 1,875 8,500 12,500 250,000 375,000 41,250 228,800 980,300 14 Spencer Company Income Statement For The Year Ended December 31, 2001 Sales Cost of merchandise sold Gross profit Operating expenses: Depreciation expense Other operating expenses Operating income Other income: Gain on sale of land Gain on sale of investments Other expense: Interest expense Income before income tax Income tax Net income $ 1,520,700 1,110,200 410,500 $ 39,990 227,110 267,100 143,400 20,500 11,000 31,500 $ 25,000 149,900 38,500 111,400 15 T-Account: Investments Description Debit Beginning balance $93,500 Purchase of investment 40,500 Sale of investment Ending balance $44,500 T-Account: Equipment Description Debit Beginning balance $437,500 Purchase of equipment 56,200 Ending balance $493,700 T-Account: Accumulated Depreciation Description Debit Beginning balance Current year depreciation Ending balance Credit $89,500 Credit Credit $149,750 29,950 $179,700 16 T-Account: Land Description Beginning balance Purchase of land Sale of land Ending balance T-Account: Buildings Description Beginning balance Purchase of building Ending balance Debit $75,000 62,500 Credit $60,250 $77,250 Debit $225,000 187,500 $412,500 T-Account: Accumulated Depreciation Description Debit Beginning balance Current year depreciation Ending balance Credit Credit $81,220 10,040 $91,260 17 T-Account: Dividends Payable Description Debit Beginning balance Dividends declared Dividends paid $32,900 Ending balance T-Account: Mortgage Payable Description Debit Beginning balance Issuance of mortgage Ending balance T-Account: Bonds Payable Description Debit Beginning balance Bonds retired at face $150,000 Ending balance Credit $12,500 36,000 $15,600 Credit $0 175,000 $175,000 Credit $250,000 $100,000 18 T-Account: Common Stock Description Debit Beginning balance Sold 3,000 shares, $25 par value Ending balance Credit $375,000 75,000 $450,000 T-Account: Additional Paid-In Capital, Common Stock Description Debit Credit Beginning balance $41,250 Sold 3,000 shares, $2 excess of par 6,000 Ending balance $47,250 T-Account: Retained Earnings Description Debit Beginning balance Net income Dividends declared $36,000 Ending balance Credit $228,800 111,400 $304,200 19 Accounts Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Accounts payable Accrued expenses Interest payable Income tax payable Dividends payable Martgage note payable Bonds payable Common stock, $25 par value Paid-in capital in excess of par Retained earnings December 31, 2001 2000 $57,870 $66,200 137,180 211,500 5,160 44,500 77,250 412,500 (91,260) 493,700 (179,700) (58,715) (11,000) (1,875) (5,000) (15,660) (175,000) (100,000) (450,000) (47,250) (304,200) $0 117,800 190,150 6,120 93,500 75,000 225,000 (81,220) 437,500 (149,750) (51,875) (10,500) (1,875) (8,500) (12,500) 0 (250,000) (375,000) (41,250) (228,800) $0 Changes in Cash Increase Decrease $8,330 $19,380 21,350 $960 49,000 2,250 187,500 10,040 56,200 29,950 6,840 500 3,500 3,160 175,000 150,000 75,000 6,000 75,400 431,850 $431,850 440,180 8,330 $431,850 20 Accounts Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Accounts payable Accrued expenses Interest payable Income tax payable Dividends payable Martgage note payable Bonds payable Common stock, $25 par value Paid-in capital in excess of par Retained earnings Changes in Cash Increase Decrease $8,330 Operating Activities Increase Decrease $19,380 21,350 $19,380 21,350 $960 49,000 2,250 187,500 10,040 Net Cash Flows 10,040 56,200 29,950 6,840 500 29,950 6,840 500 3,500 3,500 3,160 175,000 150,000 75,000 6,000 75,400 431,850 $431,850 Analysis of retained earnings: Net income Gain on sale of investments Gain on sale of land Dividends $960 440,180 8,330 $431,850 111,400 11,000 20,500 159,690 83,960 $75,730 75,730 $75,730 21 Accounts Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Accounts payable Accrued expenses Interest payable Income tax payable Dividends payable Martgage note payable Bonds payable Common stock, $25 par value Paid-in capital in excess of par Retained earnings Changes in Cash Increase Decrease $8,330 $19,380 21,350 $960 49,000 2,250 187,500 $89,500 60,250 $40,500 62,500 187,500 10,040 56,200 56,200 29,950 6,840 500 3,500 3,160 175,000 150,000 75,000 6,000 75,400 431,850 $431,850 Analysis of retained earnings: Net income Gain on sale of investments Gain on sale of land Dividends Investing Activities Increase Decrease 440,180 8,330 $431,850 11,000 20,500 181,250 Net Cash Flows $181,250 346,700 165,450 $181,250 22 Accounts Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Accounts payable Accrued expenses Interest payable Income tax payable Dividends payable Martgage note payable Bonds payable Common stock, $25 par value Paid-in capital in excess of par Retained earnings Changes in Cash Increase Decrease $8,330 Financing Activities Increase Decrease $19,380 21,350 $960 49,000 2,250 187,500 10,040 56,200 29,950 6,840 500 3,500 3,160 175,000 $3,160 175,000 150,000 75,000 6,000 75,400 431,850 $431,850 $150,000 75,000 6,000 440,180 8,330 $431,850 Analysis of retained earnings: Net income Gain on sale of investments Gain on sale of land Dividends Net Cash Flows 259,160 73,160 $186,000 36,000 186,000 $186,000 23 Accounts Cash Trade receivables (net) Inventories Prepaid expenses Investments Land Buildings Accumulated depreciation Equipment Accumulated depreciation Accounts payable Accrued expenses Interest payable Income tax payable Dividends payable Martgage note payable Bonds payable Common stock, $25 par value Paid-in capital in excess of par Retained earnings December 31, 2001 2000 $57,870 $66,200 137,180 211,500 5,160 44,500 77,250 412,500 (91,260) 493,700 (179,700) (58,715) (11,000) (1,875) (5,000) (15,660) (175,000) (100,000) (450,000) (47,250) (304,200) $0 117,800 190,150 6,120 93,500 75,000 225,000 (81,220) 437,500 (149,750) (51,875) (10,500) (1,875) (8,500) (12,500) 0 (250,000) (375,000) (41,250) (228,800) $0 Changes in Cash Increase Decrease $8,330 Operating Activities Increase Decrease $19,380 21,350 $19,380 21,350 $960 49,000 Financing Activities Increase Decrease $960 $89,500 60,250 2,250 187,500 10,040 $40,500 62,500 187,500 10,040 56,200 29,950 6,840 500 56,200 29,950 6,840 500 3,500 3,500 3,160 175,000 $3,160 175,000 150,000 75,000 6,000 75,400 431,850 $431,850 $150,000 75,000 6,000 440,180 8,330 $431,850 Analysis of retained earnings: Net income Gain on sale of investments Gain on sale of land Dividends Net Cash Flows Investing Activities Increase Decrease 111,400 $8,330 159,690 83,960 $75,730 11,000 20,500 11,000 20,500 75,730 181,250 $75,730 $181,250 346,700 165,450 $181,250 259,160 73,160 $186,000 36,000 186,000 $186,000 24 Spencer Company Statement of Cash Flows-Indirect Method For the Year Ended December 31, 2001 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash used by operating activities: Depreciation expense $39,990 Increase in accounts receivable (19,380) Increase in inventories (21,350) Decrease in prepaid expenses 960 Increase in accounts payable 6,840 Increase in accrued expenses 500 Decrease in income tax payable (3,500) Gain on sale of investment (11,000) Gain on sale of land (20,500) Net cash provided by operating activities Cash flows from investing activities: Cash received from sale of investments 100,500 Cash received from sale of land 80,750 Cash payments for purchase of investments (40,500) Cash payments for purchase of equipment (56,200) Cash payments for purchase of land (62,500) Cash payments for purchase of building (187,500) Net cash used in investing activities Cash flows from financing activities: Cash received from issuance of mortage note 175,000 Cash received from issuance of stock 81,000 Cash paid for retirement of bonds payable (150,000) Cash paid for dividends (32,840) Net cash provided by financing activities Net decrease in cash Cash, January 1, 2001 Cash, December 31, 2001 Supplemental Disclosures of Cash Flow Information: Cash paid for the year for: Interest Income taxes $111,400 (27,440) 83,960 (165,450) 73,160 (8,330) 66,200 $57,870 $25,000 42,000 25 Format for Operating Activities Cash Flows From Operating Activities (Using the Indirect Method) Net income (from the income statement) $ Noncash expenses: Amortization Depreciation + + Changes in current assets: Increases Decreases Changes in current liabilities: Increases Decreases + + - Gains from investing or financing Losses from investing or financing Net cash flows from operating activities + $ 26