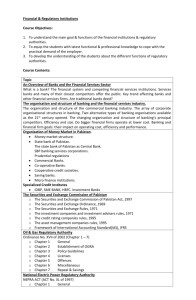

Internship-Report-of-askari-bank

advertisement