Financial Management Yee-Tien Fu

advertisement

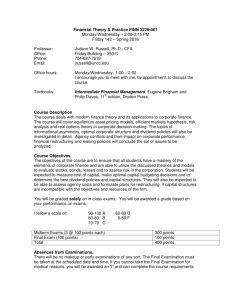

National Cheng-Chi University College of Business Financial Management Autumn 2014 Course Information Course Number: 000347-00-1 (FIN 347) Time: Thurs: 14:10 – 17:00 p.m. Room: Information Science 5th Fl. 140105 Prereq: Principles of Accounting Instructor Information Instructor: Yee-Tien Fu Office: Commerce 12th Fl. #261249 Office Hrs: By Appt. Phone: 2939-3091 Ext 81249 E-mail: iamtedfu@gmail.com I. Introduction This course entails a study of the financial operations of a business firm. The goal of the firm and its financial managers is to maximize shareholder value through a combination of investing, financing, and working capital decisions. Major topics include: (a) the financial environment of the firm, (b) the time value of money, (c) bond and stock valuation, (d) capital budgeting, (e) risk and return, (f) capital structure theory, and (g) working capital management. FIN 347 provides a balanced coverage of the quantitative and qualitative aspects of financial management; hence, it should benefit students in all business disciplines. II. Goals Through a combination of readings, lectures, class discussions, and problem assignments, students should: (a) gain an awareness of the investing and financing alternatives available to the firm, (b) develop a knowledge of cash flow valuation and analysis techniques, (c) achieve an understanding of the role of the financial manager in making decisions that maximize the value of the firm, and (d) appreciate the importance of the risk-return tradeoff, portfolio theory, and efficient capital markets in financial decision making. III. Course Materials Required: 1. Corporate Finance. Berk and Demarzo. Prentice-Hall, 2014. (We intend to cover the full spirits of the whole book within the allotted time in a semester.) 2. A financial calculator 3. Additional readings, as assigned by the instructor Recommended: 1. Subscription (or online access) to current financial publications such as Fortune, Forbes, Business Week, Barron’s, Wall Street Journal, or Financial Times. IV. Examinations There will be 2 midterm examinations and two quizzes. Exam 1 and Quiz 1 will cover Chapters 6, 7, 8, 9. Exam 2 and Quiz 2 will cover Chapters 10, 11, 12, 13. V. Examination Policies 1 Examination Times: Each student is responsible for attending the examinations at the time scheduled in the syllabus. Taking an examination at an alternate time is not possible except under extreme circumstances (as determined by the instructor). If you have a potential conflict with a scheduled exam, please contact me as soon as possible, and no later than two weeks prior to the exam. Written documentation of any conflict must be submitted to me, and include your name and NCCU Student ID Number. Students who miss an examination without prior authorization will receive a grade of zero for the exam. Examination Materials: Each student should bring No. 2 pencils, a financial calculator, and a picture ID to the exam session. All other examination materials (e.g., a test booklet, formula sheet, and scratch paper) will be provided. Test booklets, formula sheets, and used scratch paper must be returned upon completion of the exam. The use of any other materials or technologies during the exam session is strictly prohibited. Personal items should be stored beneath your desk for the duration of the exam. Picture IDs may be checked during the exam session. Any violation of these policies will result in a reduction in your exam grade. Calculators: Many exam questions require the use of a financial calculator. Calculators cannot be shared during the exam, so please ensure that your calculator is fully functional before entering the exam session. All calculators are subject to inspection, and restrictions on certain types are imposed (e.g., programmable calculators must be “de-programmed” during the exam session). Further information regarding calculators is provided in the “Additional Policies” section of this syllabus. Post-Examination Review: Individual examinations will not be returned, however, I will conduct a brief post-examination review during class. Students who wish to review their exams individually are encouraged to do so during my office hours. Specific questions regarding an exam must be addressed in the two-week period following the posting of examination grades. After this time, the examinations will be stored and unavailable for retrieval. Exam grades are final, except in the instance of a recording error. If you feel that your posted exam grade is incorrect, please contact me immediately. Exam Format: Exams may include a combination of question types (e.g., problem, multiple choice, and short answer/essay). The exam questions will reflect a balance of quantitative and qualitative content, consistent with our coverage of the course material. VI. Academic Integrity Academic integrity and honesty are critical to the conduct of this course. Instances of scholastic dishonesty (copying, cheating, using unauthorized materials or technologies, etc.) will be disciplined to the maximum extent allowed by University policy. The responsibilities of both students and faculty with regard to scholastic dishonesty are described in detail in the Policy Statement on Scholastic Dishonesty for the College of Commerce: By teaching this course, I have agreed to observe all of the faculty responsibilities described in that document. By enrolling in this class, you have agreed to observe all of the student responsibilities described in that document. If the application of that Policy Statement to this class and its assignments is unclear in any way, it is your responsibility to ask me for clarification. Policy on Scholastic Dishonesty: Students who violate University rules on scholastic dishonesty are subject to disciplinary penalties, including the possibility of failure in the course and/or dismissal from the University. Since dishonesty harms the individual, all students, and the integrity of the University, policies on scholastic dishonesty will be strictly enforced. Refer to the Student Judicial Services website 2 or the General Information Catalog to access the official University policies and procedures on scholastic dishonesty as well as further elaboration on what constitutes scholastic dishonesty. VII. Grade Computation Exam 1 30% Exam 2 30% Quiz 1 15% Quiz 2 15% Homework Sets 10% Final letter grades will be awarded according to the following criteria: 90-100 = A; 80-89 = B, 70-79 = C, 60-69 = D, below 60 = F You will receive a numeric score for each exam. Letter grades will not be determined until the scores for all exams are averaged, as indicated above. Final course grades may reflect the application of a small curve. If curving is required, the target GPA for the course is approximately 2.8. All letter grades are final except in the instance of a recording error. The requirements and recommendations for succeeding in this course are outlined in this document. Since no make-up or extra-credit work is available, I encourage you to follow these suggestions and utilize office hours to maximize your understanding of the course content before the exam dates. VIII. Additional Policies A. Attendance – You are expected to attend every class meeting. I understand that circumstances may arise that require your absence; however, these should be the exception rather than the rule. Regular attendance and class participation are essential to your understanding of the course content. Some material may be presented only during class meetings; hence, merely reading the text will not ensure sufficient exam preparation. If you must miss a class for any reason, please consult a fellow student to attain the notes and announcements for the class. B. Tardiness/Leaving Early – Please show respect for your classmates and the instructor by arriving on time and remaining for the duration of the class session. If you must arrive late or leave early, please do so quietly and courteously to avoid disrupting the class. Chronic tardiness or leaving early will result in a reduction in your course grade. C. Calculators – A basic financial calculator is required for this course. A relatively inexpensive calculator ($30-$40) with exponent, root, present value, future value, IRR, and NPV functions will suffice for this and other finance courses. Popular models that meet these criteria include the HP 10B and TI BA II Plus. The HP 10bII is my personal favorite, and the only one for which I can provide “technical” support. Before choosing a calculator, please note that more expensive, programmable calculators are unnecessary and must be “de-programmed” during exam sessions. Learning to use your calculator is a necessary, but insufficient ingredient for success in this course. Despite its importance, the calculator is merely a tool that facilitates the problem solving process, so do not over rely on its capabilities. I urge you to become well acquainted with your calculator long before the first exam. 3 D. Homework – I will assign recommended problems for most of the chapters of the text. These problems will not be collected or graded; however, they constitute an essential element in exam preparation. I strongly recommend that you attempt to solve the problems before consulting the solutions manual (posted on Blackboard). As you work these problems, try to understand the concepts and relate them to the material covered during class and in the text. Please consult me during office hours if you encounter difficulties. E. Access to Course Website: TBA. F. Laptop Computer Policy – In the interest of avoiding the distractions of a “wireless world,” students’ use of laptop computers is strictly prohibited. G. Other – All other matters of class management and conduct will be handled in accordance with published University guidelines. Please consult the General Information Catalogue or the Dean of Students’ web site for additional information. IX. Additional Comments The aforementioned policies provide the basic guidelines and code of conduct for the course. They are designed to reduce confusion and establish an equitable framework for the entire class. As a matter of principle, I will enforce these policies fairly and religiously. The “spirit” of the course is just as important as the “rules and regulations.” My goal is to create a cooperative classroom environment in which we learn from each other. To that end, I welcome your constructive comments and suggestions as we progress through the course. Your feedback is an important element of course delivery and development. Barring an emergency, or except as previously arranged, I will be available during my office hours. I encourage you to visit with me regarding any concerns with the course or just to say “hello.” I am also accessible via telephone or E-mail. I will make every effort to return your call or respond to your E-mail within one business day of its receipt. General Study Guidelines The following recommendations are presented as an addendum to the syllabus. Class Preparation: It is important that you read the assigned chapters before we discuss them in class. Class lectures and discussions are much more meaningful if everyone is conversant with the subject matter. I will discuss the major concepts from each chapter and emphasize what is most important, but I will be unable to cover everything during class. As you read the chapters, ask yourself the following questions: What is the purpose of this concept or formula? Why is this concept important? How did the author or instructor demonstrate its application? How does it relate to other concepts/formulae that we have studied? Can I describe this concept or formula in my own words? Can I answer the concept questions in the text? 4 Problem sets - I suggest that you work the recommended problems in conjunction with your reading/review of each chapter. Practice makes perfect, so work as many extra problems as necessary to master the concepts. Initially, try to work each problem without consulting the solution set. Do not wait until the week before the exam to attempt the problems. Be prepared for class - Bring your text, calculator, and pertinent notes to each class session. Much of our class time will be devoted to discussing/reviewing example problems. Consult the tentative course schedule for weekly reading and problem set assignments. Take good class notes - Class notes for each chapter may be posted on Blackboard, but these will be “skeletal” by design. Class lectures and discussions will enhance these notes and integrate them with other essential course material. Ask questions - I encourage you to be an active learner by asking questions and participating during class discussions. Please E-mail me or see me during office hours if you have additional questions regarding the course material. Keep apprised of current financial issues - As time permits, we will discuss how the concepts in our text apply to the “real” world. Devote a little time each day to perusing the Web and/or financial publications for pertinent topical issues. Exam Preparation: The course material and the exams are cumulative by nature. The basic concepts that we cover early in the course provide the foundation for more advanced material that we address later. Try to master the concepts as we cover the material and avoid “cramming” the week before the exam. It is extremely difficult to catch up if you get behind on the readings and problem sets. I will schedule review sessions prior to each examination, however, you should review the course material “early and often” on your own and/or in your study group. 5 FIN 347 – Tentative Course Schedule – Autumn 2014 Wk Day 1 T Date Class Coverage Introduction Chapter Content Overview of Course 2 T T Chapter 1 Chapter 2 Introduction to Corporate Finance Financial Statements and Cash Flow 3 T T Chapters 2 and 3 Chapter 4 Financial Statement Analysis and Planning Discounted Cash Flows (Time value of Money) 4 T T Chapter 4 Wrap-up and Review Discounted Cash Flows (Time value of Money) 5 T T Review Chapter 5 Chapters 1 – 4 Interest Rates and Bond Valuation 6 T T Chapter 6 Chapter 7 Stock Valuation Capital Budgeting and Investment Rules 7 T T Chapters 7 and 8 Chapter 8 Capital Budgeting and Investment Rules Capital Budgeting Decisions 8 T T Wrap-up and Review Exam 1 9 T T Guest Speaker Guest Speaker TBA TBA 10 T T Chapter 9 Chapter 10 Real Options and Risk Analysis Risk and Return 11 T T Chapter 11 Chapter 11 CAPM and Modern Portfolio Theory CAPM and Modern Portfolio Theory 12 T T Chapter 12 Wrap-up and Review Risk, Cost of Capital, and Capital Budgeting 13 T T Exam 2 Chapter 13 Efficient Capital Markets 14 T T Chapter 14 Chapter 15 Capital Structure: Basic Concepts Capital Structure: Advanced Concepts 15 T T Chapters 15 and 16 Chapter 16 Capital Structure and Dividend Policy Dividend Policy 16 T T Chapter 18 Wrap-up and Review Short-term Financial Planning T Final Review and Quiz Comprehensive (emphasis on Ch. 13 - 16, & 18) 6 FIN 347 – Tentative Course Schedule – Autumn 2014 Ref: Dr. Bill Way’s course syllabus of Business Finance at University of Texas Austin. 7