Syllabus

P

R I N C I P L E S O F

M

A N A G E R

University of Nevada at Reno

I A L F

I

Ansari Business Building, Room 101

College of Business Administration

N A N C E

Fin 301 Section 001, MTW 10:10 a.m. – 01:10 p.m.

P

R O F

.

.

A

L I

N

E J A D M A L A Y E R I

, , P

H

.

.

D .

.

, , C F A

Ansari Business Building, Room ???

Office Hours: Monday - Wednesday 1:15 – 2:00 p.m.

Phone: 784 – ???? ext. ???

Email: aliala@unr.edu

C

OURSE

O

BJECTIVE

:

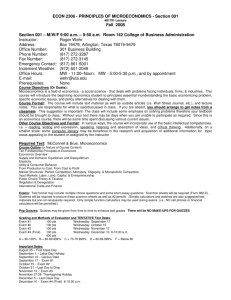

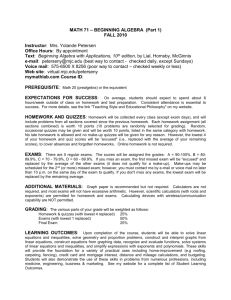

The purpose of this course is to provide students with a comprehensive introduction to the financial management of a business enterprise. The course emphasizes the financing and investment decisions faced by financial managers. Included are such topics as the time value of money, stock and bond pricing, financial statement analysis, capital budgeting, risk and return, and capital structure.

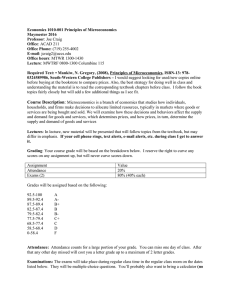

C OURSE M ATERIAL :

The major reference for the course is “ Fundamentals of Corporate Finance, 9 th Ed.”, by Ross,

Westerfield and Jordan . You will need a business calculator or alternatively a laptop and working knowledge of Excel. As far as financial calculators go, I recommend either Hewlett-Packard (HB

10B) or Texas Instruments (TI BA II plus) financial calculators. These calculators are not prohibitively expensive ($40 – $60). I will provide instructions for the calculators and you can find helpful resources in your book as well. Additionally, I will show you how to solve financial problems with

Excel as we progress throughout the semester. You may also find useful information in the course page at: http://spears.okstate.edu/home/nejadma/newfin311.htm

.

G

RADES

:

There will be a total of eight chapter-end quizzes and a final exam. All exams are mandatory. All quizzes are equally weighted (at 10% point each) and they represent 80% of the final grade of the course. The final exam is comprehensive and accounts for 20% of the final grade of the course. Each student must take all of the quizzes and the final exam. If for some reason a student must miss an exam, the student must discuss the matter with the instructor before the date of the exam. Otherwise, the student will receive a “zero” for the missed test. Only university–authorized absences will be accepted. NO MAKE–UP TESTS will be given under any circumstances .

Although there are no homework assignments, selected problems are recommended for each chapter to help students understand the concepts covered in class and in the textbook. These problems are excellent for test preparation. The answers to these problems are provided in the course page under the title of answer key to homework. Note that exams are primarily based on the assigned problems from the book and problems solved in class.

Your final letter grade for this course is determined based on the percentage points as follows:

Final Letter Grade

Percentage

Point Range

A

89.5% to

100.0%

B

79.5% to

89.4%

C

69.5% to

79.4%

D

59.5% to

69.4%

F

Less than

59.5%

P OLICIES & R ULES :

Students are not allowed to have pagers, cellular phones, laser pointers, electronic games, musical devices, or any other device which may distract other students or the instructor. Respect is expected at all times and no cursing or profanity will be tolerated.

If a student requires accommodations based on disability, the student should meet with the instructor during the first week of the semester.

Academic dishonesty is an absolutely unacceptable mode of conduct and will not be tolerated in any form. All persons involved in academic dishonesty will be disciplined in accordance with University regulations and procedures. We strictly adhere to the guidelines set forth by the University Student

Conduct policies.

T

ENTATIVE

C

OURSE

S

CHEDULE

:

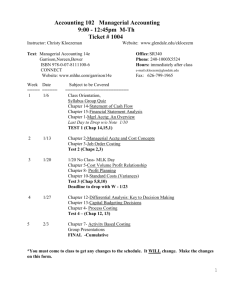

Date Agenda Assignments Quiz

July 11

July 12

Chapter 1: Intro. to Corp. Finance

Chapter 2: Review of Accounting

Chapter 2: (continued)

Chapter 3: Financial Statements

Ch2: P 8 – 13, 18, 22, 24

July 13 Chapter 3: (continued)

July 18 Chapter 5: Time Value of Money

Ch3: P 1 – 10, 21 – 24

July 19

Chapter 5: (continued)

Chapter 6: Discounted CF

Ch5: P 7 – 15, 17, 20

Q1: Ch. 2

Q2: Ch. 3

Q3: Ch. 5

July 20

Chapter 6: (continued) Ch6: P 7 – 13, 21 – 24, 37 – 42,

48, 51 – 58, 66

Q4: Ch. 6

July 25 Chapter 7: Interest Rates & Bonds

Chapter 7: (continued)

July 26

Ch7: P 7 – 18, 23 – 26, 30 – 32 Q5: Ch. 7

Chapter 8: Stocks

Q6: Ch. 8 July 27 Chapter 8: (continued)

Chapter 12: Capital Markets

August 01

Chapter 13: Risk and Return

August 02

Chapter 13: (continued)

Chapter 14: Cost of Capital

August 03 Chapter 14: (continued)

Ch8: P 1 – 7, 11 – 16, 20 – 24

Ch12: P 1 – 10, 14 – 20, 23, 24

Ch13: P 1 – 12, 23 – 26

Ch14: P 1 – 16, 24 – 26

August 08 Chapter 9: NPV & Other Criteria Ch9: P 3 – 8, 13 – 15

August 09 Chapter 10: Investment Decisions Ch10: P 1 – 12, 17 – 23, 34 – 36

R EVIEW S ESSION 10

–

11 A .

M .

August 10

Final Exam: All Chapters

Q7: Ch. 13

Q8: Ch. 14