PFL SAMPLE UNIT - Final Draft 4-20-12

advertisement

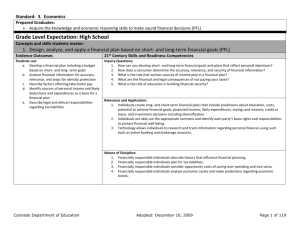

DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT UNIT TOPIC: Making Money: Planning For A Successful Financial Life CONCEPTUAL LENS: Risk and Responsibility Sometimes long-term goals can serve the dual purpose of helping people and making money. Beginning the journey of UNIT making money is a process of establishing financial goals, a budget, and a means of saving. These steps help people prepare OVERVIEW: for the important step of investing money to help reach those long-term goals. Investing money is saving money in a way that earns money. Its purpose is to earn a financial return. Financial planning means being aware of how much money is coming in and how to use it. In this unit we will see how both individuals and the U.S. government make money; how the government tries to ensure that people are protected from abuses; and why financial planning should not only focus on spending and saving, but also on how to help others. SCOS CE.C&G.2.6, CE.C&G.2.7, CE.C&G.3.1, CE.C&G.3.4, CE.C&G.3.6 OBJECTIVES CE.PFL.1.1, CE.PFL.1.2, CE.PFL.1.3, CE.PFL.1.5, CE.PFL.1.6, CE.PFL.2.1, CE.PFL.2.2, CE.PFL.2.3 ADDRESSED CE.E.1.2, CE.E.3.1 UNIT WEBBING HIST CIVICS & GOVERNMENT CE.C&G.2.6, CE.C&G.2.7, CE.C&G.3.1, CE.C&G.3.4, Concepts: Authority, government, individual rights, privilege, rights, rule of law, law, protection, compromise, cooperation, response, consumers Content: Types of laws government can exercise over people, Equal justice under the law, ECONOMICS CE.E.1.2, CE.E.3.1 Concepts: Consumer, producer, investing, market, strategy, wealth, policy, scarcity, resource, economy, growth, money, supply and demand, taxation Content: How government has a role in preserving competition, enforcing contracts, and protecting consumers and producers. How the U.S. government PERSONAL FINANCIAL LITERACY CE.PFL.1.1, CE.PFL.1.2, CE.PFL.1.3, CE.PFL.1.5, CE.PFL.1.6, CE.PFL.2.1, CE.PFL.2.2, CE.PFL.2.3 Concepts: Education, income, career, choice, costs, benefits, finance, responsibility, individuals, budget, taxation, saving, debt, debt management, expense, giving, sharing, planning, money, risk, consumer, producer, investing, government, individual rights, response GE O CUL DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS GENERALIZATI ONS AND GUIDING QUESTIONS Individual rights, Individual responsibility The rights and privileges of citizens Contemporary issues affecting the united states and how government and Citizens respond Government regulation Government protection Freedoms of individuals 1. Governments balance preserving the rights of individuals with protecting the common good. What are the three roles that you will probably play at one time or another in the economic system? (F) makes money. The role of competition in the market The role of prices as coordinators of a market economy. GDP Laissez-faire Circular flow Collecting Taxes Rule of 72 DRAFT Content: Trade-offs “disposable income” and “discretionary income” The responsibility of state and federal governments to enforce laws to protect consumers and producers The influence of government on financial planning Where to find information on various investments. Stocks, bonds and mutual funds Types of investments Rule of 72 Ponzi schemes Examples of basic consumer protections offered to them by state and federal government 1. Informed investors use 1. Financial planning takes research information to time and effort. help make investment What does it mean to decisions. participate in financial planning? (F) What are at least three specific sources you can What are the steps to seek for financial setting up a financial information? (F) plan? (F) What political and Why is it important to economic factors affect think about sharing your personal budget your resources with a DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT and investment cause(s) you believe How do government decisions? (C) in? (C) decisions affect the products and How can a PIRG What is the advantage services available to (Public Interest of linking financial consumers? (C) Research Group) assist goals to values? (C) individuals in making 2. Saving and investing are How do things such investment decisions? strategies that help as the Manguson(F) individuals plan and Moss Warranty Act prepare for future of 1975, the Energy What leading indicators financial goals and Star program and help investors predict financial security. Seals of Approval and react to the protect individual direction the market is What is the rate of rights and the headed? (C) relationship between common good? (F) rate of return and risk? What is the advantage (C) Why do government of you investing in decisions need bonds over stocks? (F) Why is it important to consumer input? (C) allot some money Why are individual from each paycheck or values and goals How does allowance payment to government important to keep in savings? (C) restriction of mind when making competition by investments that move Why is investing in a allowing individual closer to mutual fund usually monopolies in long-term goals? (C) safer than investing all certain industries 2. Government has limited but your money in the protect the common important functions in a stock of a single good? (C) market economy. company? (F) 2. Citizens look to the law What Is the Role of Why do you need to for protection of Government in the budget sharing and individual rights. Economy? (C) saving before spending? (F) Other than the How did the national covered in the government play a key Using the Rule of 72, Consumer’s Bill of role in the economic what is the rate of Rights what crisis of 2009? (F) interest that you need DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS responsibilities do consumers have in our free enterprise system? (F) How do government policies help protect employment and save jobs? (C) What is the role of the Consumer Product Safety Commission? (F) What is the difference between small-claims suits and class-action suits? (F) Do regulated monopolies provide better service at a fairer price than possible competitors? (P) DRAFT to earn in order to How did the U.S. double your money in economy influence 10 years? (F) outcomes in the elections of 1932, 1980, 3. Laws may be enforced by different agencies in order and 2008? (F) to ensure the protection of Why do some the rights of individuals. individuals believe What are some deregulation encourages national organizations more competition, that represent higher productivity and consumers? (C) lower prices for consumers? (C) Why are standards that specify the How are import quotas requirements for a and tariffs important to particular type of U.S. products and product, such as competition? (F) lightbulbs or tires, an 3. Governments need money important form of in order to pay for the government services they provide. regulation? (F) What are some services What are three Acts that local governments (laws) that help provide? (C) protect consumers What are some services when they fill out or that the U.S. enter into a credit government provides to contract? (F) individuals and Why is government citizens? (F) regulation How does the U.S. controversial? (C) government pay for 4. Laws and regulations some of the services exist for the protection of that it provides to the rights of consumers. people living in the How can you protect U.S.? (F) DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS How is a “Fair" Tax System structured? (C) What role does the U.S. government play in making money from consumer investing? (F) Why is consumer investment in bonds, currency, etc. beneficial for both government and individuals? (C) DRAFT yourself from consumer fraud? (F) What are the four basic rights covered in the first Consumer’s Bill of Rights first signed by President John F. Kennedy in 1962? (F) What are the steps that you can take if you are not satisfied with a company’s response to your complaint? (F) DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT UNIT TOPIC: Making Money: Planning For A Successful Financial Life CONCEPTUAL LENS: Risk and Responsibility CIVICS & GOVERNMENT ECONOMICS CE.C&G.2.6, CE.C&G.2.7, CE.C&G.3.1, CE.C&G.3.4 Concepts: Authority, government, individual rights, privilege, rights, rule of law, law, protection, compromise, cooperation, response, Content: Types of laws government can exercise over people, Equal justice under the law, Individual rights, Individual responsibility The rights and privileges of citizens Contemporary issues affecting the united states and how government and Citizens respond Government regulation Government protection Freedoms of individuals MAKING MONEY: PLANNING FOR A SUCCESSFUL FINANCIAL LIFE PERSONAL FINANCIAL LITERACY CE.PFL.1.1, CE.PFL.1.2, CE.PFL.1.3, CE.PFL.1.5, CE.PFL.1.6, CE.PFL.2.1, CE.PFL.2.2, CE.PFL.2.3 Concepts: Education, income, career, choice, costs, benefits, finance, responsibility, individuals, budget, taxation, saving, debt, debt management, expense, giving, sharing, planning, money, risk, consumer, producer, investing, government, individual rights, response Content: HISTORY Trade-offs “disposable income” and “discretionary income” The responsibility of state and federal governments to enforce laws to protect consumers and producers The influence of government on financial planning Where to find information on various investments. Stocks, bonds and mutual funds Types of investments Ponzi schemes Examples of basic consumer protections offered to them by state and federal government CE.E.1.2, CE.E.3.1 Concepts: Consumer, producer, investing, market, strategy, wealth, policy, scarcity, resource, economy, growth, money, supply and demand, taxation Content: How government has a role in preserving competition, enforcing contracts, and protecting consumers and producers. How the U.S. government makes money. The role of competition in the market The role of prices as coordinators of a market economy. GDP Laissez-faire Circular flow Collecting Taxes Rule of 72 CULTURE UNIT OVERVIEW Sometimes long-term goals can serve the dual purpose of helping people and making money. Beginning the journey of making money is a process of establishing financial goals, a budget, and a means of saving. These steps help people prepare for the important step of investing money to help reach those long-term goals. Investing money is saving money in a way that earns money. Its purpose is to earn a financial return. Financial planning means being aware of how much money is coming in and how to use it. In this unit we will see how both individuals and the U.S. government make money; how the government tries to ensure that people are protected from abuses; and why financial planning should not only focus on spending and saving, but also on how to help others. DRAFT CRITICAL CONTENT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT Students should know: 1. Various choices and decisions about education after high school impact life plans and financial goals. 2. The two things that an individual needs to consider when planning for a goal that has a specific amount. 3. The six steps for setting up a financial plan. 4. Ways in which individuals demonstrate responsibility for financial well-being over a lifetime. 5. Ways to be a financially responsible young adult. 6. Examples of the benefits of financial responsibility and the costs of financial irresponsibility. 7. Ways both people and governments make money. 8. Current types of consumer fraud, including online scams. 9. Examples of unfair or deceptive business practices that consumer protection laws forbid. 10. Actions an individual can take to protect personal identity. 11. Ways that thieves can fraudulently obtain personal information. 12. Actions a victim of identity theft should take to restore personal security. 13. The components of a personal budget, including income, planned saving, taxes, and fixed and variable expenses. 14. The difference between assets and liabilities. 15. The factors that affect net worth. 16. The difference between cash inflows (including income) and cash outflows (including expense). 17. That saving is a prerequisite to investing. 18. Compare strategies for investing, including participating in a company retirement plan. 19. The appropriate types of investments to achieve the objectives of liquidity, income, and growth. 20. How economic and business factors affect the market value of a stock. 21. Leading indicators in the U.S. that help investors predict and react to the direction the market is headed. 22. Ways in which federal and state regulators protect investors. 23. Investments differ in their potential rate of return, liquidity, and level of risk. 24. That some government intervention is appropriate in a market economy. 25. That the choices that people make have benefits, costs, and future consequences. 26. A budget identifies expected income and expenses, including saving, and serves as a guide to help people live within their income. 27. Laws and regulations offer specific protections for borrowers. 28. Government agencies, such as the U.S. Securities and Exchange Commission, Federal Deposit Insurance Corporation, and state regulators, oversee the securities and banking industries and combat fraud. DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT 29. Why philanthropy is important and beneficial to the giver as well as the receiver. KEY SKILLS Students should be able to do: 1. Use charts and graphing data to draw conclusions about costs and benefits of investing. 2. Develop graphic data to analyze and draw conclusions about the causes and effects of building financial wealth. 3. Use various types of technology to research and present information on financial planning, investing, government regulation and consumer protection; orally, virtually and on paper. 4. Formulate financial and economic questions by deconstructing a variety of sources, such as personal financial decision making scenarios and financial reports, economic forecasts, letters, legal documents and court decisions, etc. 5. Construct reasoned arguments and draw conclusions using consumer protection laws matched to descriptions of the issues that they address and the safeguards that they provide. 6. Research online and printed sources of up-to-date information about consumer rights. 7. Use online graphic organizers to organize and present information on how government agencies, such as the U.S. Securities and Exchange Commission, Federal Deposit Insurance Corporation, and state regulators oversee the securities and banking industries and combat fraud. 8. Write formal letters of complaint that state economic, regulatory, or financial problems, ask for specific action and include copies of supporting documents. 9. Research online and printed sources of up-to-date information about consumer rights. 10. Use financial or online calculators to determine the cost of achieving a long-term goal. PERFORMANCE WHAT?: Investigate why making money involves good planning as well as various means to ensure protection from financial abuse. TASK (S) governments need money in order to pay for the services they provide: education, fire protection, national defense, and so on. Governments obtain money by taxation— by imposing WHY?: In order to understand that financial planning takes time and effort. HOW?: You are a member of a design team responsible for creating a game to teach middle and high school students about the importance of good financial planning in managing money in order to have successful finances. Identify the purpose of the game. Develop a set of at least 30 “Financial Planning and Money Making Questions” with answers on a flip side of wherever you have your questions. Design the game so that players mover along a path from Start to Finish b correctly answering the questions that you have written for the game. Place six “Penalty” and six “Bonus” points along the game path, and develop six “Penalty” and six “Bonus” cards also. DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS various taxes on individuals and corporations. DRAFT Design six “Penalty” and six “Bonus” spots along various places on the game path. Decide how the players will move through the game for each correct answer (dice, spinner, or based on the number of moves that may be written on one of the game cards). If your game is designed as a physical gameboard decide find or make chips and/or tokens to use as game pieces. If your game is designed to be played on the computer then decide on the images that will be used to represent chips and/or tokens. Make sure to play the game and test it out with your team members. Performance Task Criteria Content: The written questions as well as the verbal or typed (if played on the computer) responses to the questions reflect thorough and accurate research on specific case studies or situational events, perspectives and interpretation of financial planning actions by individuals and the U.S. government. The concept of risk comes out as an important consideration for a person participating in investing money. The concept of responsibility comes out as an important factor in financial success. Essential vocabulary terms related to financial planning are present throughout the entire game in both the “game’s path” as well as the “game’s Penalty and Bonus cards”. Process All questions are logical and are phrased with the intent of generating information based on good financial planning on the part of an individual or a government. Note: You may use a rubric to evaluate the requirements in developing and producing the game. Use Rubistar or other rubric to evaluate the game and its develop process. Possible Points or % (Final Numbers = 100) Content Elements for Performance Self-‐Assessment (Final Numbers = 100) Teacher Assessment (Final Numbers = 100) DRAFT SCORING GUIDE A=93-100, B=92-85, C=84-77, D=76-70, F=69 & below SAMPLE UNIT FOR CIVIC & ECONOMICS Content: The written questions as well as the verbal or typed (if played on the computer) responses to the questions reflect thorough and accurate research on specific case studies or situational events, perspectives and interpretation of financial planning actions by individuals and the U.S. government. The concept of risk comes out as an important consideration for a person participating in investing money. DRAFT 30 10 10 The concept of responsibility comes out as an important factor in financial success. Essential vocabulary terms related to financial planning are present throughout the entire game in both the “game’s path” as well as the “game’s Penalty and Bonus cards”. 20 All questions are logical and are phrased with the intent of generating information based on good financial planning on the part of an individual or a government. 20 10 LEARNING EXPERIENCES The responses of the players were accurate and showed the depth of knowledge that each person had about the concepts, understandings, facts and topics involved in good financial planning. Suggested Learning Experiences Generalizations Know (The numbers Refer back to the Critical Key Skills (The numbers Refer back DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT Content section of unit.) Use real-world documents (the types of documents that financially responsible individual, individuals in financial fields or government agencies use) found through teacher-provided Web sites to help you determine income and expenses in two hypothetical situations: An individual planning for his/her future A U.S. government agency planning for its upcoming fiscal year Summarize your predictions or plans using the data found in a well-constructed paragraph. Choose a company or government agency and research that agency’s prospectus that provides information about its objectives, investment strategies, risks, past performances, fees and expenses, management, and distribution policy (how to fund its investors). Use one of the lenses to reflect on financial planning of a fictious person or an actual institution/agency. You can reflect in one of the following ways: Visual display on poster or computer Story (written or oral) to The Key Skills Section of this unit.) 3,6 -Financial planning takes time and effort. -Saving and investing are strategies that help government and individuals plan and prepare for future financial goals and financial security. 1,2,3,4,5,6,7, 13,14,1516,17, 18,19,26 -Informed investors use research information to help make investment decisions. Financial planning takes time and effort. 7,14,15,16,18, 3,4,6 19,20,21,22,23, 24 -Saving and investing are strategies that help government and individuals plan and prepare for future financial goals and financial security. 1,2,3,4,5, 6,13, 25,26 3,9 DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT Work with a classmate to create an imaginary portfolio of stocks. Select companies that you think could provide a good return and invest an imaginary $50, 000. (Track your portfolio for the remainder of the course.) -Informed investors use research information to help make investment decisions 17,18,19,20, 21,23 1,2,3,9 Visit the SallieMae Web site and find out about Stafford loans. What are the qualifications for student loans? How much money can be borrowed? How much interest is charge? What are the repayment terms? -Saving and investing are strategies that help government and individuals plan and prepare for future financial goals and financial security. 1, 5, 23, 25 3,9 Make a chart of organizations in your community and on a federal level that provide help with consumer problems. Describe the kind of help offered. Find some you know or research to find a story online of someone who has been a victim of fraud. Write a report about what happened. -Governments balance preserving the rights of individuals with protecting the common good. 10,22, 27,28 3,5 Check news sources for information about consumer fraud, such as online or telephone scams. Prepare a fact sheet to alert people to these scams and help them avoid being conned. -Citizens look to the law for protection of individual rights. 10,22, 27,28 3,6 DRAFT SAMPLE UNIT FOR CIVIC & ECONOMICS DRAFT Financial planning takes time and effort. TEACHER RESOURCES AND NOTES Talk to a parent or willing adult about a recent big-ticket purchase they made. Ask questions about how they planned, budgeted, and determined what to buy. Ask the person to reflect on the purchase. Would the person make the same purchase again? Why or why not? You may do the same interview with your subject being the owner of a small business that is successful. -Saving and investing are strategies that help government and individuals plan and prepare for future financial goals and financial security. Select one of the choices below and create a graphic organizer comparing ways that each makes money. Federal government compared with a Fortune 500 company State government compared with an individual Local government compared with a small business -Government has limited 1,2,3,4,5,6,7, but important functions 13,14,1516,17, in a market economy. 18,19,26 -Governments need money in order to pay for the services they provide. Resources: Approved print or web-based resources for the course Supplemental textbooks and resource materials Internet Magazines and other periodicals Teacher Designed or approved Webquest 1,2,3,4,5,6,7, 13,14,1516,17, 18,19,26 5,6 1,2,3,7