Car Purchasing and Repossession

advertisement

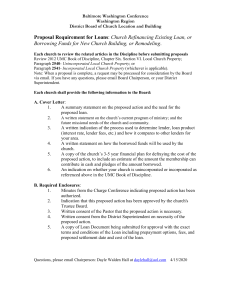

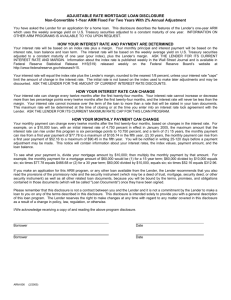

CAR PURCHASING AND REPOSSESSION This handbook was developed by Legal Aid of Nebraska, a private, non-profit law firm that provides legal services to low-income Nebraskans. If you would like more information about Legal Aid of Nebraska, or if you would like to make a donation, please visit our website at www.legalaidofnebraska.com If you would like to apply for services please call: AccessLine® at 1-877-250-2016 For Spanish - Press #2 Monday - Thursday 9 a.m. - 4 p.m. Friday 9 a.m. - 12 p.m. Elder AccessLine® (for people over age 60) at 1-800-527-7249 Monday – Thursday 9 a.m. to 12 p.m. & 1 p.m. to 3 p.m. Fridays 9 a.m. to 12 p.m. Native American AccessLine® at 1-800-729-9908 Monday –Friday 9 a.m. – 12 p.m. Rural Response Hotline 1-800-464-0258 Important Disclaimer Use of this informational handbook is not intended to and does not create an attorney-client relationship between you and Legal Aid of Nebraska’s attorneys. The information provided to you through this handbook is intended for educational purposes only. Nothing in this handbook should be considered legal advice or as a substitute for legal advice. Please understand that the information contained in this handbook is based upon generally applicable Nebraska law. Some laws and procedures may vary depending on the specifics of your case. If you want legal advice about your specific issue you must consult an attorney. Considering a Car Purchase Here are some links to car buying guides: Tips on Buying a Used Car, Federal Trade Commission http://www.ftc.gov/bcp/edu/pubs/articles/naps21.pdf Keys to Getting a Vehicle, Hummingbird Credit Counseling and Education Inc. http://www.hummingbirdcreditcounseling.org/learning/carbuying/index.php?id=3 Q&A About Financing a Car, Consumer Action http://www.consumer-action.org/english/articles/qa_about_financing_a_car_leaders_guide/ Car Purchasing and Repossession - 1 Other Helpful Links: www.carfax.com www.consumerreports.org www.kbb.com www.edmunds.com www.bbb.org https://www-odi.nhtsa.dot.gov/ivoq/ Consumer Rights in Car Purchasing Warranties When you buy a car, you may get a warranty that protects you if you have problems after the sale. An express warranty is a promise made in the written or oral terms of a sales agreement. It is much better to get an express written warranty. You should get all warranties in writing prior to purchasing a car. An implied warranty is one that is created by law. An implied warranty does not have to be in the sales agreement. Every car buyer gets a warranty of title unless there is an express written agreement otherwise. A warranty of title does not have to be in writing. A warranty of title means that the dealer is promising that the car buyer will get a good title that it is free and clear from liens. A car buyer does not get a warranty of title if they know there are liens or problems with title and buy the car anyway. When you buy a car “as is” you still get a warranty of title. A car buyer might also get an implied warranty of merchantability. An implied warranty of merchantability is a guarantee that the car is usable as a car. If you buy a used car “as is” that means there is no implied warranty of merchantability that would require the dealer to make repairs, even if a major breakdown occurs on the trip home from the dealership. On the other hand, used car dealers have a duty to inspect cars sold “as is” for safety defects. If the dealer finds a safety defect, it must fix it or warn the purchaser about the defect. Lemon Laws for New Car Purchases Lemon laws were developed to protect new car buyers who have purchased cars that are defective. Nebraska lemon laws protect new car buyers who have an express written warranty from a manufacturer or the manufacturer’s authorized dealer. Nebraska law requires a car buyer to first report any defects to the manufacturer before the express warranty expires or within one year from the date of purchase, whichever is earlier. Written notice should be sent to the manufacturer by certified mail. The manufacturer must then make the necessary repairs that are required under the express warranty. If you think that an automobile seller is not following the law, you should contact your attorney or call Legal Aid of Nebraska. You can also file a written complaint with the Nebraska Motor Vehicle Industry Licensing Board. You can contact them at (402) 471-2148 and at http://mvdealerbd.ne.gov/ . Finally, you Car Purchasing and Repossession - 2 may request mediation of a dispute with a seller by contacting the Nebraska Attorney General. You can reach the Nebraska Attorney General’s Consumer Protection Division at (800) 727-6432 or at http://www.ago.state.ne.us/consumer/. Consumer Rights in Automobile Repossession If you get behind on your car payments, your lender will most likely try to repossess your car. Nebraska law says your lender must first mail or drop-off a notice to the last address it has for you. This notice must be in writing and have the following information: 1. 2. 3. 4. 5. 6. The name, address, and telephone number of where you should make your payment; A brief description of why you owe the money (i.e., automobile loan); Your right to catch up on late payments; The amount you must pay to bring the loan current; The date by which this payment must be made; Any other action necessary to take loan out of default status (i.e., obtaining full coverage insurance). After you get the notice, you have twenty days to make your late payments to avoid repossession of your car. Nebraska law only requires a creditor to give this notice to you one time. This means that if you miss another payment after you get the notice, your car can be repossessed without any warning. Your loan agreement may have other requirements that the lender must meet before repossessing your car. You should always save your car loan agreement with your other financial records. Your lender cannot break into your home or garage to repossess your property. Police cannot help a lender repossess a car unless they are following a court order. The lender may not do anything that is a “breach of the peace” when trying to repossess your property. Sometimes it may be best to voluntarily surrender your vehicle. You should seek advice from an attorney when deciding what is best for you. Before your repossessed car can be sold by the lender, you and any co-signor on the loan must get notice. This notice must include: 1. 2. 3. 4. 5. 6. 7. 8. The name and address of the lender; The name of the borrower and a description of the car; How the lender plans to sell the car (e.g., sale at auction); That you have a right to an accounting of what is owed on the debt and how much that accounting would cost you; The time and place of a public sale or, for a private sale, the date after which the car will be sold; A description of any liability you may have for a deficiency; A telephone number to call to get the amount that must be paid to get back the car; A telephone number to call to get more information on the sale of the car. If you have personal property in your car when it is repossessed, you can contact the lender to request the return of this property. If the lender refuses, you should contact a lawyer for assistance. Car Purchasing and Repossession - 3 The lender must sell or otherwise dispose of the repossessed car in a commercially reasonable manner. If a car is sold for more than the amount owed to the lender that means there is a surplus. If the car is sold for less than the amount owed to the lender that means there is a deficiency. The lender must notify you of any surplus and pay it to you. The lender must also notify you of any deficiency if the lender makes any attempt to collect the deficiency from you. This notice must be in writing and state the following: 1. 2. 3. 4. 5. The total amount owed on the loan at the time of sale; The amount of proceeds of any sale or disposition; Any costs incurred to repossess and process the vehicle including attorney’s fees; Any credits or rebates that reduce the amount of the loan; and The amount of any surplus or deficiency owed after sale or disposition of the car. If you owe the lender for a deficiency, the lender (or a collection agency) can sue you and get a judgment. If you filed bankruptcy after you obtained the car loan and you did not sign a reaffirmation agreement for the loan, your lender cannot try to collect the deficiency. For more information on your rights in collection, see our Collections Handbook. If you think that a creditor has violated the consumer rights described in this handbook, you should contact an attorney. Car Purchasing and Repossession - 4