FINANCE 125

advertisement

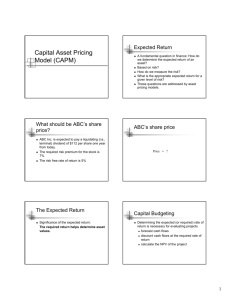

FINANCE 384: Corporate Valuation, Investment Decisions and Risk Management STUDENT LECTURE NOTE 1 Sp14CR I. Systematic Risk, Beta and the Capital Asset Pricing Model A. Systematic and Unsystematic Risk 1. Types of Information and Its Relevancy (Consider the headlines of some stories from the WSJ Online edition of November 2, 2013) “GOP Gives Health Law Stumbling Room” “What's Next for Gold? The Precious Metal has Lost its Luster as Stocks Have Regained Center Stage” “Amazon Mines Its Data Trove to Bet on TV's Next Hit” “Pakistani Taliban Picks New Leader to Succeed Hakimullah Mehsud, Killed Friday in U.S. Drone Strike, Roiling Washington’s Relations with Islamabad” “Currency Probe Widens as Major Banks Suspend Traders Over Investigation of Chatroom Transcripts” Which headlines are most likely to affect ___ firms in the U.S. market? Which are ________ to just one firm or perhaps a certain industry? 2. Total (Stand-Alone) Risk = Systematic Risk + Unsystematic Risk. 1 3. Systematic Risk: Risk from factors that affect ___ marketable assets because they are traded in financial markets. Also called market risk, common risk or undiversifiable risk. 4. Unsystematic Risk: Risk that affects only an individual firm. It is typically due to the firm’s __________ (business risk) or how it is ________ capital structure/financial risk). To a certain extent it will also be affected by industry risk and possibly international risk. It is also called nonmarket risk, specific risk or diversifiable risk. Can Total Risk be eliminated? Of course not, the only risk that can be eliminated is __________ (unsystematic) risk (through diversification). B. The Principle of Diversification 1. Spreading your investment portfolio over many different investments, different types of assets, and/or across different markets is the practice of investment diversification. 2. How it works: As more and more assets are added to a portfolio, the ____________ risk of each individual asset becomes a smaller (and smaller) component of the portfolio’s overall risk. 3. In fact, the individual risks of some assets will actually tend to offset those of other assets as the number of securities grows. (cf. The currency risk of an importer may be offset by adding an exporter’s stock to the portfolio. The elastic demand curve of an automaker could be offset by the inelastic demand for an electricity producer.) 2 4. Although the non-market (diversifiable) risk may be reduced through diversification, the ______ risk of each asset will still be a relevant consideration. Thus, the market risk is UNDIVERSIFIABLE. While DIVERSIFIABLE RISK is reduced towards zero through the addition of additional assets. p(%) Diversifiable Risk Stand-Alone Risk (p) Market Risk 10 20 30 40 # Stocks in Portfolio 2,000+ 5. Given this line of reasoning, in determining portfolio risk, the only relevant risk to be considered when adding a particular asset to a portfolio, is how much ______ (undiversifiable) risk it adds? 6. This (the previous question) leads to the next major issue. How much extra ______ do we require from adding a certain asset, (or equivalently how large is the risk premium for this asset) due to the amount of market risk it would add to a well-diversified portfolio? 3 7. The Capital Asset Pricing Model was developed to answer that question. C. The Capital Asset Pricing Model 1. Model: Determines the ________ return on an asset in relation to the systematic risk which that asset contributes to the risk of the total portfolio of marketable securities. 2. This individual asset’s contribution to portfolio market risk is the ________ risk in the model because investors are assumed to have diversified all non-market risk away through portfolio diversification. 3. Under the Efficient Market Hypothesis, since markets are (assumed to be) efficient this Required rate of return (CAPM-ROR) is also the average investor’s Expected Return. D. Intuitive Formulation of the CAPM 1. Required Return on any security (CAPM ROR) is found as follows: CAPM ROR = Rf + Risk Premium; (1.1) where: Risk Premium = (Beta * Market Risk Premium.) 2. Risk-free Rate is simply the minimum return required on a risk-free (default-free) security, i.e. T-Bill rate. 3. Market Risk Premium = Rm – Rf; the added required return which the Market Portfolio must earn because it is riskier than the riskless asset 4 (i.e., any non-riskless asset it has added default risk). 4. It turns out that the risk of an individual security may be reflected by multiplying the Market Risk Premium by the "Beta Coefficient". E. Beta (Term "Beta Coefficient" comes from fact it is the regression coefficient for the independent variable, i.e. beta.) 1. An index of ___________ between the return on an asset i and the return on the "Market Portfolio". a. Specifically it measures the expected change in the return on asset i for a 1% change in the market's return. b. As a practical matter, beta is calculated using past price data—by regressing the percentage change in asset i's prices (y-variable) on the percentage change in the representative market index (x-variable). Illustrated in later example. c. It turns out that βeta is equal to: Cov(R i , R m ) %Chg(Stock i) βi,m = = %Chg(Market) . Var(R ) m (1.2) Please understand very clearly, Cov(Ri,Rm) refers to a particular number, and means specifically, the __________ between the return on asset i and the market (m). It is not two numbers multiplied together, or any other such misconception. 2. Different Ranges for Beta 5 a. Beta(Rf)=__. Cov(R f , R m ) (R f , R m ) * (R f ) * (R m ) βRf,m = = = __. Var(R ) Var(R ) m m By definition, the variance of a risk-free asset is zero. From statistics, the covariance between asset Rf and the market return, Rm, equals the numerator in the formula above. Since σ(Rf) = 0, Cov(Rf,Rm) also = 0. b. Beta(Rm)=__. Again by definition: Cov(R m , R m ) Var(R m ) βm,m = = Var(R ) = __. Var(R ) m m Recall from statistics that the covariance of anything with itself is its variance, this clearly shows that βm,m equals 1. c. Betaim > 1. __________ stocks: the expected change in asset i is greater than the change in the market. Ex.=Growth, Hi-Tech, Emerging Industry, etc. d. 0 < Betajm < 1. _________ stocks: the expected change in asset j is less than change in the market. Examples: Utility stocks, stock of firms with inelastic demand curves. 6 e. Betakm < 0. Counter-cyclical stocks, eg. stocks of gold mining firms and short-stock positions (negative of their long position beta). Figure 1.1: Sample Betas (as of November 2, 2013) Source Yahoo.finance ABT 0.58 ARNA* -0.32 IBM 0.65 PIR** 1.35 VC*** 2.02 *Arena Pharmaceuticals; **Pier 1 Imports; ***Visteon Corporation In Conclusion: If Betaim > 1, Asset i is required to earn a ______ return than the market. If Betajm < 1, Asset j is required to earn a ______ return than the market. If Betakm < 0, Asset k is required to earn ______ than the risk-free rate. F. Expectational Version of the CAPM E(Ri) = Rf + [βi * (E(Rm) – Rf)]. (1.3) G. Operational Version of the CAPM Because expected returns are unobservable, past returns are typically employed in the model. To make this (admittedly technical) distinction, the CAPM is restated to focus on the CAPM Required Rate of Return (ki) as in equation (1.4) below, where the risk-free rate (kRf) and required market return (km) are similarly restated. ki = kRf + βi * (km – kRf). 7 (1.4) Note: Need to make CLEAR distinction between the Market Risk Premium (MRP) and km. MRP is the required return on the market above the riskfree rate. Market Risk Premium = [km – kRf]. Ex. 1.1 Amy DiGangi (F382 Fa’12) is estimating the CAPM Required Returns for the five stocks given below, as of November 6, 2013. She has chosen these stocks using yahoo.finance and their stock screener. The criteria she used to choose these stocks is that Market Cap must be at least $1B, Dividend Yield must be at least 3.0% and the P/E ratio must be between 15 and 20. Information on the stocks follows: Ticker AHGP ATO GIS HMC WSTC Company Mkt Cap Alliance Holdings GP $3.60B Atmos Energy Corp. $4.04B General Mills Inc. $31.92B Honda Motor Company $72.27B West Corporation $1.85B P/E 15.77 16.79 18.85 15.89 16.05 DivYld 5.40% 3.10% 3.00% 5.00% 4.10% Beta 1.48 0.55 0.22 1.17 -0.27 Mkt Price $57.55 $44.80 $50.40 $39.11 $22.13 Amy has also determined that the current five-year Treasury rate (kRf) equals 1.288%. Further, she will use the HPR calculated from the dividend-adjusted S&P 500 Index (Nov ’08 = 896.24 to Nov ’13 = 1770.49) to represent the Required Return on the Market (km) assuming the time interval for the annualisation is five years. Given this information answer the following questions. a) Calculate the Annualized HPR that Amy will use to represent the return on the market. 8 b) What is the Market Risk Premium in this example? c) Which of these stocks are considered aggressive (and will have a required return that is greater than the required return on the market, km)? d) What stocks are considered to be defensive stocks (i.e., have a CAPM return less than km)? e) Do any of these stocks appear to be counter-cyclical (and will have a CAPM-required return less than the risk-free rate)? f) Determine the CAPM required returns for each stock. $1770.49 A1.1a) HPRS&P500 = km = $896.24 1 5 1 = _______%. A1.1b) MRP = km – kRf = 0.14587 – 0.01288 = ______%. A1.1c) Assets with betas greater than 1.0 are considered aggressive stocks and will have CAPM required returns _______ than km, here these would be AHGP and HMC. A1.1d) Assets with betas less than 1.0 are termed defensive stocks and will have CAPM RORs _____ than km. ATO and GIS (and also WSTC) fit into this category. A1.1e) Stocks with negative betas are counter-cyclical assets and they will have CAPM required returns that are _____ than the risk-free rate, here that would be WSTC. 9 A1.1f) Individual Stock CAPM Required Returns: kAHGP = 0.01288+[1.48*(0.14587–0.01288)] = ______%. kATO = 0.01288+[0.55*(0.14587–0.01288)] = ______%. kGIS = 0.01288+[0.22*(0.14587–0.01288)] = ______%. kHMC = 0.01288+[1.17*(0.14587–0.01288)] = ______%. kWSTC = 0.01288+[-0.27*(0.14587–0.01288)] = ______%. Ex. 1.2 Assume that for every 1% increase in Apple Computer's (AAPL) common stock price we expect the market index to rise by 1.6393%. If the Market Risk Premium is 12.80%, and the Risk-free rate = 2.50%, answer the following questions: a) What is the required return on the market? b) What is AAPL's beta equal to? c) Again, w/o calculation, should we expect the CAPM ROR for Apple to be greater or less than the required return on the market? d) What is the required return on AAPL's stock? A1.2a) Since MRP=km-kRf, then km = MRP + kRf. Here: km = 0.1280 + .0250 = 0.1530 = ______%. %Chg(Stock AAPL) 1.00 A1.2b) βAAPL = = %Chg(Market) 1.6393 10 = _______. A1.2c) Since βAAPL < 1.0, CAPM RORAAPL < km. A1.2d) kAAPL = .0250 + (0.610 * 0.128) = ______%. II. Estimation of Stock and Portfolio Betas A. Beta (from the Capital Asset Pricing Model) measures the stock’s volatility relative to the market (systematic risk). B. How are betas calculated? 1. Numerical Formula for beta given above in (1.2). 2. Regression Approach: Run a regression with returns on the stock (Yvariable) regressed on the market portfolio (Xvariable). Remember, always regress Y (the stock = dependent variable) on X (the market = independent variable)! The slope of the regression line (the characteristic line) is the stock’s ______ coefficient, or β. Analysts typically use at least 36 monthly returns or one year of weekly returns. 3. The form of this regression is as follows: %Chg Stocki = αimt + (βimt* %ChgMarket) + εt, (1.5) where: %ChgStocki = (Monthly) % change in stock i's price, %ChgMarket = (Monthly) % change in market's price, 11 αim = Unexpected Excess Return on stock i, and βim = Index of Comovement between stock i rate of return and market's rate of return. C. How does the LINEST Excel function work and how are the Regression Output Results interpreted? 1. LINEST calculates the statistics for a linear regression line by using the "least squares" method to calculate a straight line that best fits your data, and returns an array that describes the line. Because this function returns an array of values, it must be entered as an array formula. The syntax for calculating the least squares regression statistics function (LINEST) is: LINEST(known_y’s,known_x’s,const,stats). To generate all of the available statistics, which include the slope (m), the intercept (b), coefficient of determination (R2), the F-test statistic (F) as well as the standard errors for the slope coefficient (sem), the intercept (seb), the y-estimate (sey), the “stats” logical value should be set to ______. This function will produce results (in this univariate (one x-variable) example) in the form of a 5 x 2 matrix (5 rows with 2 columns). So the target range (highlight it with the cursor), Press F2, Enter the function, then hold down CTRL + SHIFT, then hit ENTER. 2. The F-test is used to determine if the observed relationship between the dependent and independent variables is likely to be spurious (by 12 chance). High observed F values provide evidence to reject the null hypothesis of no systematic relationship. For values of the F-test that are higher than the critical value the null hypothesis would be rejected. 3. The coefficient of determination (R2) is used to describe the regression model’s “goodness of fit” and ranges from 0 (no fit) to 1.0 (perfect fit). 4. To assess whether the parameter estimates are significantly different from their hypothesized values (i.e., H0: Slope = 1 and H0: Intercept = 0) the t-test statistics may be calculated. The form of this test (for Slope) is given in (1.6) below. Estimated Slope Coefficient m t-test = . (1.6) Standard Error of Slope Est. se m If the observed t-stat < critical t-value, the null hypothesis cannot be rejected. If testing the slope, this means the slope is not significantly different from 1.0. If testing the intercept, this finding would suggest the intercept is not significantly different from 0. Ex. 1.3 Use the following historical stock returns to calculate the beta for KWE in F384_LN01_SS_Sp14CR employing the three approaches described below. Year 1 Market 25.7 KWE 40.0 Year 6 13 Market 13.7 KWE 30.0 2 3 4 5 8.0 -11.0 15.0 32.5 -15.0 -15.0 35.0 10.0 7 8 9 10 40.0 10.0 -10.8 -13.1 42.0 -10.0 -25.0 25.0 a) Employ the numerical approach in (1.2) using the covariance (COVAR) and variance (VARP) functions. b) Use the SLOPE function to find beta. c) Use the Excel Regression Data Analysis Tool, i.e., [Tools] [Data Analysis] [Regression] (assuming this has been installed on your computer). A1.3. Spreadsheet Solutions FIGURE 3 SUMMARY OUTPUT Regression Statistics Multiple R 0.5955 R Square 0.3546 Adjusted R Sq 0.2739 Stand Error 0.2204 Observations 10 A1.3a) A1.3b) Covariance Function Variance Function Calculated Beta BETA Function 0.025695 0.030927 0.830833 0.830833 ANOVA df Regression Residual Total A1.3c) Intercept X Variable 1 1 8 9 SS 0.21348 0.38853 0.60201 Coefficients 0.0256 0.8308 Standard Error 0.08220 0.39628 MS 0.213483 0.048566 F 4.395725 Significan. F 0.069303 t Stat 0.311540 2.096598 P-value 0.76335 0.06930 Lower 95% -0.16394 -0.08298 Upper 95% 0.21516 1.74465 Obtaining Stock Beta with Regression: Depiction of the Least-Squares Characteristic Regression Line is shown below. 14 D. How are beta and regression results interpreted? 1. From the slope of KWE’s characteristic line, the beta of KWE turns out to be _____. Thus, 40% kKWE 20% kM 0% -40% -20% 0% 20% 40% -20% -40% kKWE = 0.83kM + 0.03 R2 = 0.36 2. R2 (coefficient of determination) measures the percent of a stock’s variance that is explained by the market. Here, _______ of the variation in KWE is due to changes in the market index. 3. The 95% confidence interval shows the range in which you should be sure that the true value of beta lies. From the KWE beta regression the 95% confidence interval is -0.08298 to 1.74465. This range is quite wide as the regression is based on only 10 observations. 15 Ex. 1.4 Brittani Wester (F382, Fa’07) has been provided with F384_LN01_SS_Sp14CR that contains (beginning-ofthe-month) monthly prices for Southwest Airlines (LUV), the S&P 500 Index (^GSPC) and for the period of January 1997 to October 2013. She will use the LINEST Excel function in conducting the following analysis. a) Estimate the beta and all of the other available statistics by regressing the monthly return for LUV versus the S&P index, using the Market Model, for: The entire overall period, i.e., Jan ’97 to Oct ’13, The five-year period from Nov ’08 to Oct ’13, The five-year period from Nov ’03 to Oct ’08, and The five-year period from Nov ’98 to Oct ’03. b) Does the observed relationship between the dependent and independent variables seem to occur by chance? (Critical F-test value = 1.88.) Does the regression model appear to be helpful in predicting the y-value? c) Calculate the t-test statistics and use them to determine if the slope coefficient is significantly different from one and if the intercept coefficient is significantly different from zero? (Critical t-test value = 2.012.) Type “YES” in the cell below the tstat if the null can be rejected. Otherwise, type “NO” below the observed t-stat if it is not significant and the null hypothesis cannot be rejected. Alternatively, use the IF (/Then) Function to generate the same answers. 16 d) Using the Market Model results, how stable does the beta estimate appear over the three sub-periods? A1.4a) As an example, in the spreadsheet, the first set of calculations (LUV vs. SPX, Whole Period – Market Model), will have the range W226:X230 as the destination. So select this range (highlight it with the cursor), Press F2, Enter the formula (in W226), Then holding down CTRL & SHIFT together, press ENTER. The results of running the market model for the overall period and the three sub-periods are shown in Figure 3 below. Summary Statistics Nov 08 to Oct 13 SPX Nov98-Oct13 m sem R2 F SSreg tm Reject H0? Nov03-Oct08 m sem R2 F SSreg tm Reject H0? LUV 12.32% 16.24% 1.32 1.00000 60 Arith Annlzd Avg Arith Annlzd SD Coef Variation Corr Coef Count 10.26% 33.47% 3.26 0.65154 60 Whole Period - Market Model 1.15072 -0.00155 b 0.13830 0.00640 seb sey df SSresid tb Reject H0? 0.25809 69.226 0.56412 8.32020 Nov08-Oct13 M sem 0.09027 199 1.62165 -0.24193 R2 F SSreg tm Reject H0? LUV vs. SPX 5-Year Period - Market Model 0.40988 -0.00559 b 0.24571 0.00891 seb sey df SSresid tb Reject H0? 0.04578 2.78282 0.01324 1.66818 Nov98-Oct03 M sem 0.06898 58 0.27598 -0.62706 R2 F SSreg tm Reject H0? 17 5-Year Period - Market Model 1.34258 -0.00523 b 0.20526 0.00977 seb sey df SSresid tb Reject H0? 0.42450 42.782 0.23374 6.54078 0.07392 58 0.31689 -0.53532 LUV vs. SPX 5-Year Period - Market Model 1.14732 0.00638 b 0.28457 0.01415 seb sey df SSresid tb Reject H0? 0.21891 16.25537 0.19532 4.03180 0.10961 58 0.6968947 0.45050 A1.4b) Since most of the F-values are quite high, and range from 2.7828 to 69.226 (in comparison to the critical value of 1.88 @ alpha=5%, with 40 degrees of freedom), the null hypothesis of no systematic relation would be ________. The coefficient of determination (R2) is used to describe the regression model’s “goodness of fit”. The fact that the R2s range from 0.04578 to 0.42450 indicate that the regression model has fairly poor power for predicting the y-value (although the best R2 is in the most recent subperiod). A1.4c) An example of the t-test testing whether the slope is significantly different from zero is provided below for the Market model, in the five-year period of Nov ’08 to Oct ’13. 1.34258 Observed t-stat = = _______. 0.20526 From t-test table (Source: M. DeGroot, Probability and Statistics, (1975), AddisonWesley Publishers), the critical value @ alpha = 5%, n=40, is 2.021. Since the observed t-stat > critical t-value, the null hypothesis ____ be rejected, in this case. [The student needs to make the remaining deter- 18 minations as part of F384_LN01_SS_Sp14CR using the critical value supplied above]. A1.4f) Although three beta estimates are insufficient to conduct any formal statistical tests, some general comments about beta stability are possible. In the earliest sub-period, βNov98-Oct03 = 1.1473. In the middle sub-period, βNov03-Oct08 = 0.4099. In the most recent sub-period, βNov08-Oct13 = 1.3426. Betas above one suggest greater volatility than the market (1998-2003 and 2008-2013). Whereas the middle period (2003-2008) beta suggests less volatility than the market. Altogether these results suggest that this firm’s beta has not been _______. Thus, the period chosen to estimate beta is an important consideration. E. Expected Return, Market Risk and Required Return 1. Use the SML to calculate each alternative’s required return. 2. The Security Market Line (SML) is part of the Capital Asset Pricing Model (CAPM). 3. The Expected (Probability-Weighted) Return (EPWR) (as in F382 LN #3: Equation (3.2)) and the SML Required Return can be compared to determine whether or not assets are fairly priced. If EPWR > Required Return Asset Underpriced. If EPWR = Required Return Asset Fairly Priced. If EPWR < Required Return Asset Overpriced. Ex. 1.5 19 Refer back to the five assets in F382 Fa13CR Ex. 3.2. Use the F384_LN01_SS_Sp14CR to calculate the betas (numerically) and the SML required returns. Determine if the assets are fairly priced. Note: The COVAR function will NOT work since the probabilities are NOT equi-likely. Graphical Depiction of the SML And How the Five Securities Plot CAPM Required vs. Expected Returns 18% 16% 14% 12% Return 10% Sec Mkt Line (SML) 8% Expected Returns 6% 4% 2% Beta 0% -1.00 -0.50 0.00 0.50 20 1.00 1.50 A1.5. The equation approach must be used since the probabilities are not equal. To correctly calculate the covariance, you need to multiply the asset’s de-meaned return times the market’s de-meaned return in each state, times the probability and then sum these. This calculation is shown below for the covariance between Hi-Tech (HT) and the Market (m). HT,m = [(-0.22 - 0.174)*(-0.13 - 0.15)* 0.10] + [(-0.02 - 0.174)*(0.01 - 0.15)*0.20] + [(0.20 - 0.174)*(0.15 - 0.15)*0.40] + [(0.35 - 0.174)*(0.29 - 0.15)*0.20] + [(0.50 - 0.174)*(0.43 - 0.15)*0.10] = ________. σ HT, m 0.03052 βHT,m = 2 = = _______. 0 . 02352 σ m The SML required return on HT (for example) is: kHT = .08 + (1.2976)*(.15 - .08) = ______%. Security Hi-Tech Market USR T-bills Collections Expected Return 17.4% 15.0% 13.8% 8.0% 1.74% Market Risk, β 1.2976 1.0000 0.8929 0.0000 -0.8655 Required Return 17.08% 15.00% 14.25% 8.00% 1.94% Conclude Underpriced Fairly Priced Overpriced Fairly Priced Overpriced Additional results are shown at the end of this lecture note. F. Calculating Portfolio Betas 21 1. Portfolio beta may be calculated just like the expected return on a portfolio. The approach used is to weight each asset’s individual beta, by the market value (MV) proportion of the portfolio for which it accounts. N βp = (wi * βi) = (β1*w1) + (β2 * w2) +...+ (βN * wN). (1.7) i 1 2. The CAPM may then be used to find the required/expected return on a portfolio of assets, where the portfolio’s beta is employed and everything else is the same. Ex. 1.6 Tiffany Mizell (F382, Sp’08) has decided to make the following investments to form a starting portfolio on the basis of information obtained from finance.yahoo.com as of Monday, 10 November 2013. a) Calculate the market-value portfolio weights and b) the portfolio beta. c) If the relevant risk-free rate equals 2.35% and the market’s required return equals 13.67%, determine the CAPM required return for this portfolio. Stock Abbott Lab IBM Visteon Corp Mkt. Price $ 38.12 $ 179.99 $ 75.16 #Shares 96 49 100 Beta 0.66 0.65 2.02 A1.6a) She needs to calculate the MV of each stock investment first. Second, add together all market values to find MV of her portfolio. Third, divide 22 each stock’s MV by the MV of the portfolio. Stock ABT IBM VC Mkt Price #Shares MP*#Sh $38.12 96 $3,659.52 $179.99 49 $8,819.51 $75.16 100 $7,516.00 $19,995.03 Sum Weight 0.1830 0.4411 0.3759 1.0000 A1.6b) βp = (0.1830*0.66) + (0.4411*0.65) + (0.3759*2.02) = __________. A1.6c) E(Rp) = 0.0235 + [1.1668 * (0.1367 – 0.0235)] = _______%. 6 7 8 9 10 11 12 13 14 15 16 17 B C D E F G H Calculating Beta and CAPM Required Returns for Individual Assets Ex. 1.5 Economy Recession Below Avg. Average Above Avg. Boom Sum Prob 0.10 0.20 0.40 0.20 0.10 1.00 Hi-Tech -22.0% -2.0% 20.0% 35.0% 50.0% Colls 28.0% 14.7% 0.0% -10.0% -20.0% USR 10.0% -10.0% 7.0% 45.0% 30.0% kRf (R) (Exp Return) 18 19 20 21 2(R) (R) (Variance) (Std Devn) 22 i,m 23 24 T-Bill 8.0% 8.0% 8.0% 8.0% 8.0% Mkt Port -13.0% 1.0% 15.0% 29.0% 43.0% km 8.00% 17.40% 1.74% 13.80% 15.00% 0.00000 0.00% 0.04014 20.03% 0.01786 13.36% 0.03542 18.82% 0.02352 15.34% 0 0.03052 -0.02036 0.021 0.02352 0 8.00% 1.2976 17.08% -0.8655 1.94% 0.8929 14.25% 1.0000 15.00% (Covariance) i,m (Beta) SML Req'd. Return I 23