Раздел 5 Деньги и Банковская система

advertisement

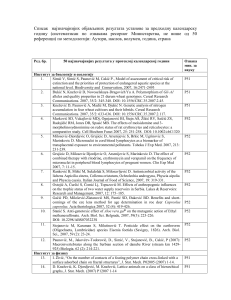

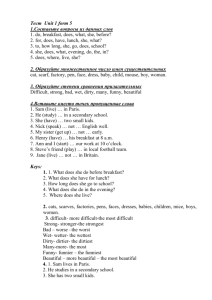

МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE Раздел 5. Деньги и банковская система Тема 16. Деньги 1. Развитие навыков чтения и перевода. 2. Изучение профессиональной лексики и терминологии по теме «Деньги». 3. Ознакомление с основными функциями денег. 4. Обзор основных видов денежных расчетов и инвестиций. 5. Изучение наречий. Оглавление Раздел 5. Деньги и Банковская система ..................................................... 1 Тема 16. Деньги............................................................................................ 1 16.1 Функции денег ................................................................................... 1 16.2 Виды и методы безналичных расчётов ........................................... 3 16.3 Инвестиции ........................................................................................ 6 16.4 Наречия ............................................................................................. 7 Выводы .................................................................................................... 11 Библиография ......................................................................................... 11 16.1 Функции денег Text 1. Read and translate the text. Give Russian equivalents to the underlined words and phrases. Money and its functions The main feature of money is its acceptance as the means of payment or medium of exchange. Nevertheless, money has other functions. It is a standard of value, a unit of account, a store of value and a standard of deferred payment. Money is a commodity commonly accepted as a medium of economic exchange. The idea of money as a universal equivalent is familiar to us since our childhood. Money circulates from person to person and country to country, thus facilitating trade, and it is the principal measure of wealth. Money has four functions: 1. to serve as a medium of exchange, a commodity universally accepted in exchange for goods and services and for the discharge of debts or for the discharge of contracts; 2. to act as a unit of account, the unit that makes the operation of the price system possible and provides the basis for keeping accounts and calculating cost, profit, and loss; МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE 3. to serve as a standard of deferred payments, the unit in which loans are made and future transactions are fixed; 4. to provide a store of wealth, a convenient form in which to hold any income not immediately required for use. Different Kinds of Money Golden coins are the examples of commodity money, because their gold content is a commodity. Token money is a means of payment whose value or purchasing power as money greatly exceeds its cost of production or value in uses other than as money. The essential condition for the survival of token money is the restriction of the right to supply it. Private production is illegal. Society enforces the use of token money by making it legal tender. The law says it must be accepted as a means of payment. In modem economies, token money is supplemented by IOU money. An IOU money is a medium of exchange based on the debt of a private firm or individual. A bank deposit is IOU money because it is a debt of the bank. When you have a bank deposit the bank owes you money. You can write a cheque to yourself or a third party and the bank is obliged to pay whenever the cheque is presented. Bank deposits are a medium of exchange because they are generally accepted as payment. Key Vocabulary commodity medium of exchange facilitate discharge of debt discharge of contract unit of account price system keep an account cost profit deferred payment defer payment loan future transactions/futures товар средство обмена содействовать погашение долга исполнение договора расчетная единица ценовая система вести счет стоимость прибыль отсроченный платеж откладывать платеж ссуда сделки на срок (купля продажа товаров по фиксируемой в момент заключения сделки цене с исполнением операций через определенный промежуток времени); store of wealth profit loss discharge of debts discharge of contract хранение материальных ценностей. прибыль убыток погашение долгов прекращение обязательств по договору МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE means of payment standard of value store of value standard of deferred payment subsequently barter economy to swap (to exchange, to barter) double coincidence of wants monetary unit to remind of to be worthless an interest-bearing bank account to pay interest hard currency soft currency invariably commodity money token money legal tender IOU money (I Owe You - я вам должен) to melt down tiny costs to supplement bank deposit purchasing power debt survival manufacturing costs средство платежа мера стоимости средство сбережения (сохранения стоимости) средство погашения долга впоследствии бартерная экономика обменивать, менять двойное совпадение потребностей денежная единица напоминать обесцениваться счёт в банке с выплатой процентов приносить процентный доход твердая (конвертируемая) валюта неконвертируемая валюта неизменно, постоянно деньги - товар символические деньги (дензнаки, жетоны, и т.п.) законное платежное средство деньги - долговое обязательство расплавить мизерные затраты дополнять вклад в банке покупательная способность долг выживание, продолжительность существования производственные издержки 16.2 Виды и методы безналичных расчётов Text 2. Read and translate the text. Terms of payment It is important to choose the terms of payment. Before determining the terms of payment, the seller must find out about the financial standing of the buyer by making status inquiries through banks or specialized agencies. The terms of payment should include the following: method of payment time of payment currency, price (and security) bank charges. МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE Methods of payment Risks, speed and costs incurred are the three main factors to be соnsidered in choosing the best method of payment. Open account terms are used when the business relationship is longestablished. Payment is made on the due date of the invoice monthly, quarterly or twice a year against a statement of account. The remittance is usually sent by payment order (bank remittance) or by cheque. The shipping documents are sent directly to the customer. When documentary collections (CAD) are used, the exporter submits the documents to his bank for collection. This reduces the risk of nonpayment, because the importer gets the documents only against payment or acceptance of a draft. If payment is made in cash, the term is D/P, which means that the documents are surrendered against payment. If credit is given, the seller draws a draft (a bill of exchange) on the buyer, who accepts it and receives the shipping documents against this acceptance (D/A). The Documentary Credit (D/C) or the Letter of Credit (L/C) gives protection to both seller and buyer. By agreeing to open a credit, the importer's bank guarantees to pay the exporter if the importer fails to pay. This method is, therefore, ideal in cases where the business parties do not know each other very well or the unstable financial or political situation requires more security. Documentary credits are normally irrevocable which means that they cannot be changed or cancelled without the agreement of all parties. In documentary credits, as in CAD, the banks operate solely on the basis of documents, and it is their responsibility to check them. If the terms and conditions of a D/C are fulfilled, the exporter receives the payment as set forth in the terms of the D/C. The D/C is the most expensive method of payment, and, unless otherwise agreed upon, the bank charges are borne by the buyer. Time of payment The due date, or date of maturity, must be mentioned in the terms of payment. Payment in advance is rare, but it might be used if the buyer is unknown to the seller, or in the case of a large single transaction, where part of the total amount is paid before delivery. Currency and price In the terms of payment, you must state the price and determine the currency in which it is to be paid, eg in sterling, in US dollars. If a Banker's Guarantee is needed, this should be noted in the terms. МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE Bank charges Banks play a vital part in financing foreign trade. Their services are paid for by their commissions and charges, and the terms of payment should indicate who is responsible for them. Direct payments A payment order in foreign trade is much the same as a banker's transfer in the home trade. In it the buyer orders his bank to remit an amount of money to the seller. In practice this means that the foreign (buyer's) bank credits the account of the seller's bank. If the transfer is made by cable, it is known as a telegraphic transfer (TT), and if it is mailed, a mail transfer (MT). A cheque is a suitable method of payment no matter whether payment is made in advance, on delivery or after delivery. It is advisable to use Bank Cheque, as private (personal) cheques may not be honoured abroad. There are such means of payment as Banker’s Drafts, International Money Oders (IMOs) and Giro Transfers. A draft is an unconditional written order by which one party directs a second party to pay to the order of a third party or to the bearer a certain sum of money on demand or at a definite time A draft is also known as a bill of exchange. Key Vocabulary to practise practice to transfer money transfer bank transfer to make a transfer letter of credit (сокр. L/C) to collect collection for collection on a collection basis draft to pay by drafts a sight draft a 30 days' sight draft mixed within for You are to ship goods within 30 days. You are to ship goods for 30 days. shipping documents практиковать, применять практика, применение переводить денежный перевод банковский перевод произвести перевод аккредитив инкассировать, взимать инкассо на инкассо на основе инкассо тратта оплачивать траттами тратта, срочная по предъявлении тратта, срочная через 30 дней после предъявления смешанный в течение (в пределах) в течение (всего срока) Вы должны отгрузить товар в течение 30 дней. Вы должны отгружать товар в течение 30 дней. отгрузочные документы МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE commercial paper unconditional promise substitute to deliver amount to comply (with) depositor debtor demand instrument in accordance with 1).векселя, документы краткосрочного коммерческого кредита 2).оборотные кредитно-денежные документы не ограниченный условиями, безоговорочный, безусловный 1) обещание 2) обязательство замена, заменитель представлять сумма 1) исполнять 2) подчиняться вкладчик, депозитор, депонент должник, дебитор требование 1) документ 2) средство согласуясь с (чем – либо) 16.3 Инвестиции Text 3. Read and translate the text. DIFFERENT TYPES OF INVESTMENT Investors may be organizations or individuals. Organizations as institutional investors buy securities with their funds or funds held in trust for others. Major institutional investors are insurance companies, pension funds and universities. Insurance companies make their investments generate profits and funds for paying future insurance claims. A pension fund wants to make money on its investments so that it can pay off pensioners.The other types of investors are individuals who trade securities for their own accounts. The majority of personal investors have rather small stock portfolios usually valued at less than $50,000. They often use these funds for major purchases such as a home, retirement income, or as a source of cash in case of emergency. Investors are interested in long term growth in the value of their investment. They tend to prefer the so called blue chip stocks of large, high quality companies such as IBM, General Motors, American Express. The dividend for blue chip stocks is rather low because these firms reinvest much of their profits in research in order to remain competitive. Some investors are interested in a stock's yield which is the percentage return from stock dividends. The highest regular yields are provided by utility stocks because they have minimal risk. Common stock is less safe than preferred stock because preferred stockholders receive dividends before they are paid to the common stockholders. The safest type of securities are government bonds because they are backed by the government. The stocks of the biggest and best known corporations in Russia are bought and sold in the Moscow Stock Exchange. The stocks of the biggest МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE corporations in America are bought and sold on the New York Stock Exchange. Securities issued by the British Government are called gilts or giltedged securities. This can also mean any high quality security without financial risk. Most people, if they have anything at all after paying their bills, will think first of putting that extra money into a savings bank or into life insurance. If you put your money in a savings bank it's almost impossible to lose money. But you have to realize that a savings account provides no protection against the unseen risk of inflation. You can invest in real estate. As a rule real estate prices are likely to rise if the prices of other things do. So there you can find protection against that unseen risk. But all the taxes you pay while you own your property can eat up your potential profit. Here the evident risks are very great. Key Vocabulary savings bank unseen risk real estate stocks and bonds return insurance stock exchange provided (syn. providing) a capital gain capital outlay gilt - edged securities (gilts) ordinary shares/stock fixed rate of interest pay a dividend capital loss yield dividend yield overall return blue chip to admit particular portfolio to seek yield held in trust сберегательный банк невидимый риск недвижимость акции и облигации прибыль, доход страхование фондовая биржа при условии доход от прироста капитала капиталовложения первоклассные (особо надежные) ценные бумаги (дословно с золотым обрезом) обыкновенные акции фиксированная процентная ставка приносить дивиденд капитальный убыток доход по ценным бумагам (особенно облигациям) доход на акцию общий, суммарный доход первоклассная ценная бумага разрешать, допускать определенный, специфический портфель, пакет акций искать, желать доход в виде процентов на капитал вверенный попечению 16.4 Наречия Наречие (Adverb) - часть речи, которая указывает на качество действия и отвечает на вопросы: how?, when?, where?, why?, in what МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE manner?, to what degree?. Наречие дает нам дополнительные сведения о ГЛАГОЛЕ. Наречие говорит, как кто-то сделал что-то или каким образом что-то случилось: Your English is very good. Ваш английский очень хороший. You speak English very well. Вы говорите по-английски очень хорошо. Good - является прилагательным, well – наречием. Ann is a good pianist. Анна хорошая пианистка. She plays the piano well. Она хорошо играет на пианино. Your English is very good. Ваш английский очень хороший. You speak English very well. Вы очень хорошо говорите поанглийски. Мы часто употребляем well с причастием (dressed/known и т.д.): well-dressed (но не `good dressed') Хорошо одет well-known Хорошо известный well-educated Хорошо образованный Большинство наречий образуется путем прибавления суффикса -lу к соответствующему ему прилагательному: quick быстрый quickly быстро serious серьёзный seriously серьёзно intensive интенсивный intensively интенсивно sudden внезапный suddenly внезапно near близлежащий nearly близко high высокий highly высоко Примечание 1. Не все слова, оканчивающиеся на -ly, являются наречиями. Они могут быть прилагательными. Например: lovely lonely friendly silly daily weekly monthly yearly чудесный одинокий дружелюбный глупый ежедневный еженедельный ежемесячный ежегодный Примечание 2. Обратите внимание на разницу в значении следующих слов: hard (много, тяжело, упорно) - hardly (еле-еле, едва-едва). Не works hard. Он много работает. Не can hardly walk. He is too old. Он едва ходит. Он очень старый. Мы также употребляем hardly с any/anyone/anything/anywhere: Hardly anybody came to the meeting (very few people came to the meeting.) Отметьте, что можно сказать: She ate hardly anything. или She Она почти ничего не ела. МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE hardly ate anything. Hardly ever -почти никогда: I'm nearly always at home in the По вечерам я всё время дома. Я evenings. I hardly ever go out. почти никогда не выхожу. Иногда мы употребляем наречие перед прилагательным и другим наречием: 1. extremely interesting (наречие+ прилагательное); 2. awfully sorry (наречие+ прилагательное); 3. incredibly quickly (наречие+ наречие). Your story is extremely interesting. Ваш рассказ очень (чрезвычайно) интересный. I am late again, I am awfully sorry . Я снова опоздал. Я очень (ужасно) виноват. He came incredibly quickly. Он пришёл невероятно быстро. Наречия fast, hard, early, late, long, far, little, much, straight по форме совпадают с соответствующими прилагательными. Сравните: We took an early train. Мы отправились ранним поездом. We arrived at the station early. Мы приехали на станцию рано. We had a late dinner. У нас был поздний ужин. Why do you always come home so Почему ты всегда так поздно late? приходишь домой? Все наречия делятся на наречия обозначающие место (here, there, at home, outside), время (now, then, today, long ago), образ действия (by chance, by mistake, quickly, suddenly), частотность (sometimes, usually, often, never, once, always), степень (quite, rather, extremely, fairly, a bit). Наречия места и направления here здесь, тут there там inside внутри outside снаружи down внизу back сзади, назад away вдали, вон, прочь downward вниз upward вверх now before ever never always Наречия времени сейчас, теперь до, перед, прежде когда - либо никогда всегда МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE often usually seldom still already just yet sometimes today recently lately commonly always часто обычно редко все уже только еще, уже иногда сегодня недавно в последнее время обычно всегда Наречия образа действия slowly медленно quickly быстро easily легко calmly спокойно brightly ярко hardly с трудом, едва Наречия меры и степени much много, сильно little немного, мало enough достаточно too слишком almost уже, почти very очень В соответствии с выражаемыми значениями наречия могут выполнять в предложении функцию обстоятельства места, времени, образа действия, степени. It's windy outside and it's warm Снаружи ветрено, а внутри тепло. inside. Everything started badly but finished Всё плохо началось, но хорошо well. закончилось. I meet him from time to time. Я встречаю его время от времени. It's a bit warmer today, isn't it? Не правда ли сегодня немного теплее Degrees of Comparison of Adverbs/Степени сравнения наречий Наречия имеют положительную (the Positive Degree), сравнительную (the Comparative Degree) и превосходную (the Superlative МЕЖДУНАРОДНЫЙ БАНКОВСКИЙ ИНСТИТУТ INTERNATIONAL BANKING INSTITUTE Degree) степени сравнения. Наречия, оканчивающиеся на - ly, образуют степени сравнения путём прибавления слов more (less) или most (least) к положительной степени слова. carefully - more carefully - most carefully; gratefully - more gratefully - most gratefully; efficiently - less efficiently - least efficiently. Наречия типа late, hard, fast, near, soon образуют степени сравнения как соответствующие им прилагательные: soon - sooner – soonest; near - nearer – nearest. Примечание. Следующие наречия имеют неправильные формы степеней сравнения: far - farther - farthest far - further - furthest badly - worse - worst little - less - least much - more - most well - better - best Выводы В результате изучения данной темы студенты изучат профессиональную лексику по теме «Деньги» и приобретут знания об основных функциях денег, видах денежных расчетов и инвестиций. Кроме того, студенты ознакомятся с наречиями, их образованием и использованием. 1. 2. 3. 4. Библиография English Dictionary, Macmillan, 2005. David Begg, Stanely Fischer, Economics, UK Limited. 1984. Stephen Danks, A First Course in Business Studies, 1991. И.П. Агабекян, English for Managers, Феникс, 2005.