effective working capital (liquidity)

advertisement

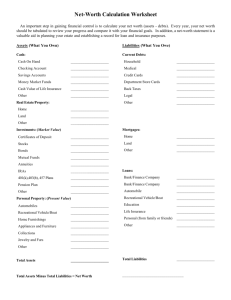

EFFECTIVE WORKING CAPITAL (LIQUIDITY) By Jessica, Jack and Tawney What is effective working capital? • Working capital refers to the money available to a business for day-to-day operations. WC = Current assets – Current liabilities • Effective working capital is linked to the term liquidity. Liquidity is the ability of the business to pay its short-term debts. 1. THE WORKING CAPITAL RATIO This formula is used as a means of calculating the current working capital ratio in any situation, it is called Current Ratio. Liquidity is measured by the \ Current Ratio. The formula for this measurement is given as; Current ratio = total current assets/current liabilities = (times) Calculating the current ratio is not difficult For example; Total current assets $40 000/ Total current liabilities $20 000 = 2.0 times (Written as a ratio 2:1) This ratio does not measure the business’ ability to pay their debts as they fall due. 2. CONTROL OF CURRENT ASSETS Current assets are inclusive of; cash, short-term deposits, customers’ accounts, stock (including work in progress, raw materials and finished goods), that will be converted into cash during the normal course of business, within a year. (extracted from Business Studies HSC 2nd edition “Getting Better Results”, Don Sykes and Kim Crawford ) Cash: • Controlled by cash budgets (a planning and controlling tool) • Cash budget sets out anticipated sources and uses of cash on a monthly basis. • Enables managers to time the payment of significant ongoing expenses to ensure they are paid when their cash surpluses Cash outflows are easier to predict than cash inflows. Receivables: These are customer debts. When a business supplies a customer with a product on credit, there is generally a time limit of 7-30 days for the payment to be made. As people are generally reluctant to pay bills on time, there are a number of management strategies that can be used to monitor customer repayments. These strategies ensure that all customer debt is payed on time. These include: - Credit policy A credit policy is a set of guidelines to staff on how to monitor and collect customer debts. • most cost-effective way of managing customer debts. • A credit limit is set. Credit limits are the maximum value of credit the business is prepared to give to its customers. • Accompanying credit limits is the credit period which refers to how long the customer has to pay the business back. • Collection policy is implemented in case of customer reluctance to pay debts on time. It advises staff what to do if customers fail to pay on time. • Customers who are notably overdue may need the threat of debt collectors. - Factoring Used due to cash flow problems. • Cash flow problems come about when a large proportion of the working capital is locked up in customer debts. • Factoring is the sale of customer debts (invoices) to a financier or financial institution. • Factoring is an expensive option which increases costs and lowers profitability. • An effective credit policy is a more efficient option. In some situations factoring is the better option, particularly during rapid growth. - Invoice discounting Means that the total payment by the customer is reduced by say 3% If the bill is paid in, for example, 7 days instead of 30. • This approach sources danger as costs are increased by x%. This reduces the business’ competitive position. • It should only be used when the business is growing rapidly. • It is an important cash flow strategy to improve cash inflow when a business is experiencing a period of cash deficit. • usually a lower cost strategy than using an overdraft to cover cash deficits. Inventory Control: Refers to stored resources such as raw materials • Is often one of the largest assets for many businesses. • Businesses need inventory in order to respond quickly to customer orders. • If there is no efficient inventory in a business, customers may take their orders to other competitors One of the best ways to manage inventory is through an inventory policy - Inventory policy Manages inventory It sets out such things as where the inventory is Stored what items are stored and how many of each. Policies are usually computerised, which makes new orders easy to check against inventories in stock. A good policy will comment on the condition or quality of the items in inventory. - “Just-in-time” (JIT) Each inventory system is supplied just-in-time to be used. • The advantage of this system is that there is no storage costs and no obsolete or damaged stock Coca-Cola used this system at their Northmead factory. 3. CONTROL OF CURRENT LIABILITIES Current liabilities = Bills that have to be paid in the short term • Most current liabilities are debts owed to the business’s suppliers and these will need to be paid as they fall due. It is important that the business keeps on top of short-term debts as they can subsequently build up and put the business under financial stress, perhaps consequently ending in business failure. The control of current liabilities is also linked with ethical consideration….. “how can the business expect debts to be paid on time, if in turn, fails to pay on time?” Control of loans A loan is a cost which is often used as a substitute for Controlling receivables. • • • Overdrafts are used by managers to pay wages that should be paid with overdue customer debts. Interest is charged on loans therefore, adds to expenses and reduces profitability Loans should be controlled through capital budgeting Capital budgeting = concerned with the finance needed for particular projects. Control of overdrafts • Normal operations of a business usually results in surpluses and deficits of cash • Overdrafts are convenient for dealing with cash deficits • Budgeting cash is a sufficient method of controlling overdrafts • Cash budgets should be compiled from the cash flow statement • Overdrafts should NOT be used to cover problems such as failure to control customer debts 4. STRATEGIES FOR MANAGING WORKING CAPITAL Leasing • A popular way of financing assets • Payments for the asset can be matched to the earnings of the asset (advantage) • Allows the business to control and use an asset owned by someone else in return for regular payments • Almost any asset can be leased • No upfront fees are paid therefore working capital is looked after Factoring Refers to the sales of customer debts to a financier • Is not good for managing working capital due to costs factoring adds to he business • Can be an important strategy in circumstances, e.g. rapidly growing business, due to the great deal of pressure to pay suppliers and factoring provides quick cash Sale and lease-back • Became popular in the 1990’s • It was common for large businesses to sell the land and buildings they used for their operations to a financier • They agreed to lease the property back for a certain number of years in return for regular payments This strategy improves or increases working capital, rather than conserving it. Money received can be used for additional projects within the expertise of the business