mostly

advertisement

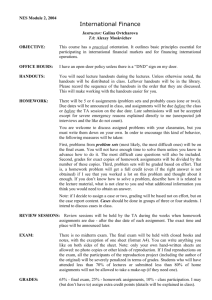

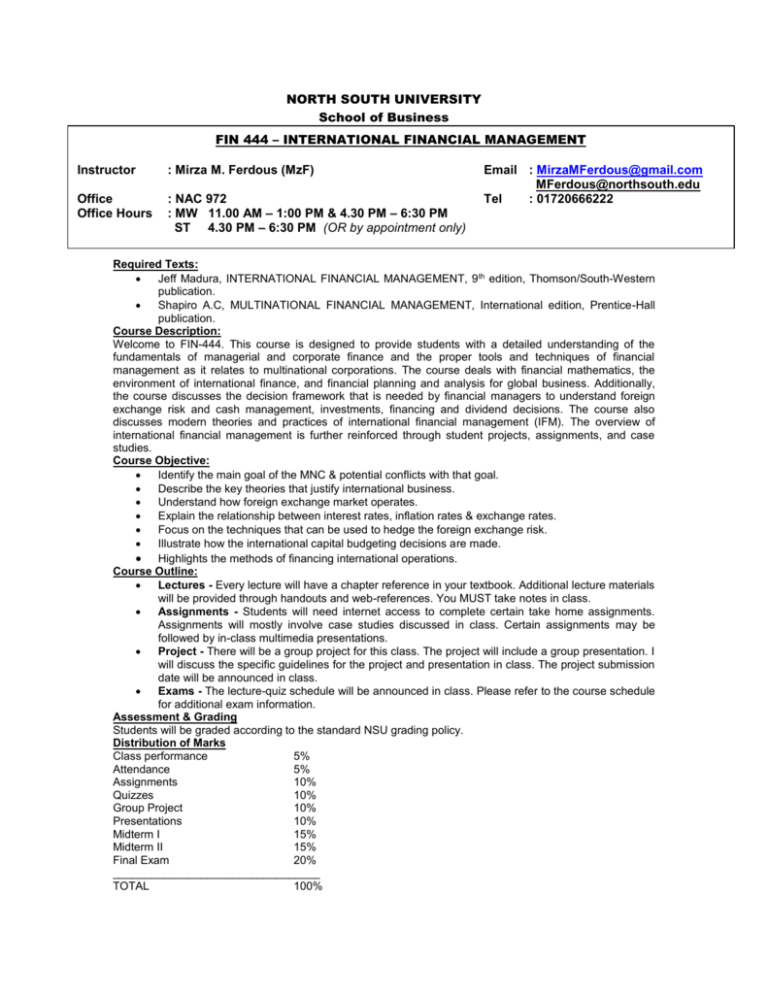

NORTH SOUTH UNIVERSITY School of Business FIN 444 – INTERNATIONAL FINANCIAL MANAGEMENT Instructor : Mirza M. Ferdous (MzF) Office Office Hours : NAC 972 : MW 11.00 AM – 1:00 PM & 4.30 PM – 6:30 PM ST 4.30 PM – 6:30 PM (OR by appointment only) Email : MirzaMFerdous@gmail.com MFerdous@northsouth.edu Tel : 01720666222 Required Texts: Jeff Madura, INTERNATIONAL FINANCIAL MANAGEMENT, 9th edition, Thomson/South-Western publication. Shapiro A.C, MULTINATIONAL FINANCIAL MANAGEMENT, International edition, Prentice-Hall publication. Course Description: Welcome to FIN-444. This course is designed to provide students with a detailed understanding of the fundamentals of managerial and corporate finance and the proper tools and techniques of financial management as it relates to multinational corporations. The course deals with financial mathematics, the environment of international finance, and financial planning and analysis for global business. Additionally, the course discusses the decision framework that is needed by financial managers to understand foreign exchange risk and cash management, investments, financing and dividend decisions. The course also discusses modern theories and practices of international financial management (IFM). The overview of international financial management is further reinforced through student projects, assignments, and case studies. Course Objective: Identify the main goal of the MNC & potential conflicts with that goal. Describe the key theories that justify international business. Understand how foreign exchange market operates. Explain the relationship between interest rates, inflation rates & exchange rates. Focus on the techniques that can be used to hedge the foreign exchange risk. Illustrate how the international capital budgeting decisions are made. Highlights the methods of financing international operations. Course Outline: Lectures - Every lecture will have a chapter reference in your textbook. Additional lecture materials will be provided through handouts and web-references. You MUST take notes in class. Assignments - Students will need internet access to complete certain take home assignments. Assignments will mostly involve case studies discussed in class. Certain assignments may be followed by in-class multimedia presentations. Project - There will be a group project for this class. The project will include a group presentation. I will discuss the specific guidelines for the project and presentation in class. The project submission date will be announced in class. Exams - The lecture-quiz schedule will be announced in class. Please refer to the course schedule for additional exam information. Assessment & Grading Students will be graded according to the standard NSU grading policy. Distribution of Marks Class performance 5% Attendance 5% Assignments 10% Quizzes 10% Group Project 10% Presentations 10% Midterm I 15% Midterm II 15% Final Exam 20% _________________________________ TOTAL 100% Rules & Regulations Attendance is mandatory for this class. Attendance counts towards your grade Come to class on time – I will deduct participation points for students coming late to class. Put your mobile phones on vibrate during classes Class performance points will also be based on class participation- I encourage cooperative learning, so please share your ideas and ask/answer questions. All students are required to bring a scientific calculator to class. There will be no make-up quizzes If you miss a mid-term exam, your make-up will be decided comprehensively with the next exam. Any form of cheating, plagiarism, and disruptive behavior will result in an F. Lecture Outline You will be provided handouts for certain lectures, however, there will be course material discussed in class that will not be in the handouts. Please take notes in class. All lectures will have chapter references in your textbook. This is the tentative chapter and subject coverage for each exam. This outline is subject to change depending on class performance. Dates for exams will be announced in class. Chapter Topics One (1) MULTINATIONAL FINANCIAL MANAGEMENT- AN OVERVIEW: Goal of the MNC, Constraints with the MNC’s goal, Theories of international trade, Modes of international business, International opportunities, Valuation model for MNC. Two (2) INTERNATIONAL FLOW OF FUNDS: Balance of Payments, Components of Current Accounts & Capital Accounts, Measurements of Current Accounts & Capital Accounts, factors affecting international trade flows, Balance of Trade deficit, Factors affecting International portfolio Investment, Agencies that facilitate international flows. Three (3) INTERNATIONAL FINANCIAL MARKETS: Motives for investing in foreign markets, motives for providing credit in foreign market, Motives for borrowing in foreign markets, Foreign Exchange Market, Foreign exchange transactions, Attributes of banks that provide foreign exchange (p: 70), Eurocurrency market, Eurocredit market, Eurobond market Four (4) EXCHANGE RATE DETERMINATION: Exchange rate equilibrium, Factors that influence exchange rates. Mid Term Examination: 01 Five (5) CURRENCY DERIVATIVES: Forward market, Currency Futures market, Comparison of the Forward & Futures markets, Currency Options market, Currency call options, Currency Put options, Contingency graphs for currency options. Six (6) GOVERNMENT INFLUENCE ON EXCHANGE RATE: Exchange Rate System; Fixed, floating, Managed & Pegged exchange rate system; Currency Boards; Exposure of a pegged currency rate in exchange rate movements; Dollarization; Single European Currency, Government Interventions; Intervention as policy tools. Seven (7) INTERNATIONAL ARBITRAGE & INTEREST RATE PARITY: International Arbitrage & different types of Arbitrage, Interest Rate parity (IRP), Determining the forward premium, Graphic analysis of IRP. Eight (9) FORECASTING EXCHANGE RATES: Why firms forecast exchange rates, Forecasting techniques, Evaluation of forecast performance, Exchange rate Volatility, Methods of forecasting exchange rate volatility. Nine (10) MEASURING EXPOSURE TO EXCHANGE RATE FLUCTUATIONS: Exchange rate risk; Types of Exposure. Mid Term Examination: 02 Ten (13) DIRECT FOREIGN INVESTMENT: Motives for foreign direct investment, Benefits of International Diversification, How government views of DFI. Eleven (14) MULTINATIONAL CAPITAL BIDGETING: Subsidiary VS Parent company, Input for multinational capital budgeting, Multinational capital budgeting example, Analysis (Ex: 14-2), Factors to consider in MNC capital budgeting, Adjusting project assessment for risk. Twelve (15) MULTINATIONAL RESTRUCTURING: Background; Factors that affect the expected cash flows; Valuation process; Restructuring decisions of real options. Thirteen (16) COUNTRY RISK ANALYSIS: Country risk analysis; Political Risk factors; Financial Risk factors; Types of country risk assessment; Techniques of assessing country risk; Developing a country risk rating; Actual country risk rating across the country; Incorporating country risk in capital budgeting; Application of country risk analysis; Reducing exposure to host government takeovers. Fourteen (19) FINANCING INTERNATIONAL TRADE: Payment methods; Trade finance methods; Agencies that motivate international trade. Final Examination