NES Module 2, 2004

advertisement

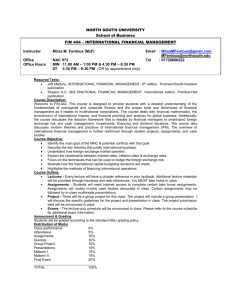

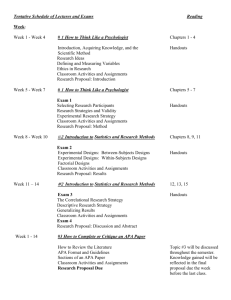

NES Module 2, 2004 International Finance Instructor: Galina Ovtcharova TA: Alexey Moskvichev OBJECTIVE: This course has a practical orientation. It outlines basic principles essential for participating in international financial markets and for financing international operations. OFFICE HOURS: I have an open-door policy unless there is a “DND” sign on my door. HANDOUTS: You will need lecture handouts during the lectures. Unless otherwise noted, the handouts will be distributed in class. Leftover handouts will be in the library. Please record the sequence of the handouts in the order that they are discussed. This will make working with the handouts easier for you. HOMEWORK: There will be 5 or 6 assignments (problem sets and probably cases (one or two)). Due dates will be announced in class, and assignments will be due before the class or before the TA session on the due date. Late submissions will not be accepted except for severe emergency reasons explained directly to me (unexpected job interviews and the like do not count). You are welcome to discuss assigned problems with your classmates, but you must write them down on your own. In order to encourage this kind of behavior, the following measures will be taken: First, problems from problem sets (most likely, the most difficult ones) will be on the final exam. You will not have enough time to solve them unless you know in advance how to do it. The most difficult case questions will also be included. Second, grades for exact copies of homework assignments will be divided by the number of these copies. Third, problem sets will be graded based on effort. That is, a homework problem will get a full credit (even if the right answer is not obtained) if I see that you worked a lot on this problem and thought about it enough. If you don’t know how to solve a problem, describe how it is related to the lecture material, what is not clear to you and what additional information you think you would need to obtain an answer. Note: if I decide to assign a case or two, grading will be based not on effort, but on the case report content. Cases should be done in groups of three or four students. I intend to discuss cases in class. REVIEW SESSIONS: Review sessions will be held by the TA during the weeks when homework assignments are due - after the due date of each assignment. The exact time and place will be announced later. EXAM: There is no midterm exam. The final exam will be held with closed books and notes, with the exception of one sheet (format A4). You can write anything you like on both sides of the sheet. Note: only your own hand-written sheets are allowed: no photo copies or other kinds of reproduction. If I find reproductions on the exam, all the participants of the reproduction project (including the author of the original) will be severely penalized in terms of grades. Students who will have attended less than 70% of lectures or submitted less than 80% of home assignments will not be allowed to take a make-up (if they need one). GRADES: 65% - final exam, 25% - homework assignments, 10% - class participation. I may (but don’t have to) assign extra credit points (details will be explained in class). COURSE OUTLINE (Tentative and subject to change) Introduction Additional opportunities and additional risks faced by a multinational corporation Integration of world markets International monetary system Exchange rate systems International Financial Environment International financial markets – overview The foreign exchange market and currency risk management International Parity Conditions Exchange rate determination Forecasting exchange rates Foreign Exchange Derivatives Currency forwards and futures Currency options Put-call parity; reproducing securities Currency swaps Global Financing. Offshore financial markets: Euro-Banking products; Euro-securities International bond and stock markets Corporate FX Risk Management: The relevance of currency hedging Types of currency exposure: economic (contractual and operating) and accounting exposure Valuation and the Structure of Multinational Operations Cross-border capital budgeting Multinational capital structure and cost of capital International Portfolio Investment and Asset Pricing READINGS: Books: (The abbreviation before the book title will be used during the lectures as a reference to a particular book.) SU: International Financial Markets and the Firm by P. Sercu and R. Uppal (Southwestern Publishing 1995). This is a comprehensive graduate-level book. Too bad that there are no newer editions. Bt: Multinational Finance by Kirt Charles Butler, 3rd edition (Southwestern Publishing 2003). This is a more practical book, containing a lot of factual information and practical recommendations for international investments and risks management. In addition, it contains the most important academic references (including relatively recent ones) after each chapter. A word of caution: the book is evolving and contains quite a few typos. I will let you know which ones I have noticed. Selected papers: Required papers will be distributed in class. Recommended papers will be available in the library.