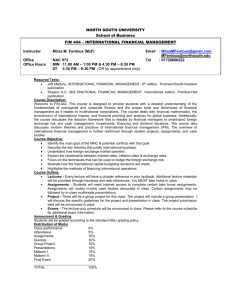

PowerPoint Presentation - McGraw Hill Higher Education

Chapter 13:

Strategic

Accounting

Issues in

Multinational

Corporations

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Learning Objectives

Explain the role played by accounting in formulating multinational business strategy.

Demonstrate an understanding of multinational capital budgeting.

Describe the factors that influence strategy implementation within a multinational corporation.

13-2

Learning Objectives

Discuss the role of accounting in implementing multinational business strategy.

Identify issues involved in the design and implementation of an effective performance evaluation system within a multinational corporation.

Explain the impact of cultural diversity on strategic accounting issues within a multinational corporation.

13-3

Strategy

Large scale plans

Reflect future direction

Categories

Strategy formulation

Determining organizational goals

Strategies to achieve goals

Strategy implementation

Managerial efforts

Attain organizational goals

Performance evaluation

Extent of goals achieved

Accounting

Significant role

Strategy formulation

Implementation

13-4

EXHIBIT 13.1 Strategy formulation

13-5

Strategy Formulation

Analysis of information

Internal factors

Culture, skills and know-how

External Factors

Customer, market, and competitor

Regulatory, social, and political factors

Financial expressions

Firm strategy

Preparation of budgets

Capital budgeting

Important part of strategy formulation

13-6

Budgeting

Primary contribution of accounting

Assists in strategy formulation

Information to managers

Short-term responsibilities

Long-term planning responsibilities

Provides future expectations

Future results can be judged

13-7

Capital Budgeting

Key activity in selecting capital investments

Capital investments

Involve large amount of resources

Cost and benefit over large periods of time

Three steps

Project identification and definition,

Evaluation and selection

Monitoring and review

13-8

Capital budgeting techniques

Four techniques

Payback period

Return on investment

Net present value

Internal rate of return

13-9

Payback period

Length of time

Recoupment of initial investment

Knowledge required

Initial investment amount

Annual after-tax cash flows

Project accepted

Payback period within predetermined length

Primary weaknesses

Ignores time value of money

Ignores total profitability of project

13-10

Return on investment

Average annual return

On initial investment

Equals

Average annual net income divided by

Initial investment

Project accepted if

Return on investment over predetermined rate

Primary weaknesses

Ignores time value of money

Ignores possible cash outlays subsequent to initial investment

13-11

Net present value

Present value of net future cash flows less

The initial investment

Requires

Estimate of minimum rate of return

Used as discount rate

Project accepted if

Net present value is equal to or greater than zero

Primary weaknesses

Not used for comparing projects

Of different sizes

Biased toward large investments

13-12

Internal rate of return

Discount rate

Causes net present value of future cash flows to equal

Initial investment

Results in zero net present value

Project accepted if

IRR more than desired rate of return

Primary weaknesses

Requires unrealistic reinvestment assumptions

Difficult manual calculation

13-13

Multinational Capital Budgeting

Requires

Initial investment required

Estimated future cash flows

Discount rate for present values

Complicated factors

Risk associated with future cash flows

Political risk

Economic risk

Financial risk

Taxes, import duties

Dividend restrictions

Cash flow limitations imposed by governments

13-14

Political Risk

Political events impact cash flows

Extreme form

Nationalization

Expropriation of assets

Changes in foreign exchange controls

Repatriation restrictions

Tax rules

Labor laws

Varies significantly from one country to another

13-15

Economic Risk

Impact on cash flows

Host country economy changes

Inflation

Most significant risk

Affects local population’s purchasing power

Impacts business’s overall cost structure

Costs associated with

Manager time

Effort to respond to inflation

13-16

Financial Risk

Impact on cash flows

Changes in currency values

Interest rates

Other financial factors

Foreign exchange risk

Important component of financial risk

Foreign exchange risk affects

Evaluation of project based on

Host country cash flows

Parent country cash flows

13-17

Evaluation of foreign project

Factors considered

Project perspective

Taxes

Rate of inflation

Political risk

Parent company perspective

Form of cash remittance to parent company

Expected changes in exchange rate

Over project life

Political risk

13-18

EXHIBIT 13.4

Framework for Strategy Implementation

13-19

Management control

Planning

Effectively implements strategy

Coordinating organization activities

Communicating with organizational members

Information Evaluating

Action decision

Influencing organizational members

Change their behavior

Consistent with organization’s strategy

Important issue

Delegation of decision-making authority

13-20

Management control

Factors influencing effective control system

Organizational structure

Strategic role assigned to subsidiaries

Forms of organizational structures

Ethnocentric

Assumes universal cultural background of firm

Polycentric

Host country culture is important and adopted

Geocentric

Synergy of ideas of different countries

13-21

Operational Budgeting

Expresses long-term strategy within shorter time frames

Provides mechanisms to

Translate organizational goals in financial terms

Assign responsibilities

Assign scarce resources

Monitor actual performance

Targets to achieve

13-22

Exhibit 13.6—Influences Affecting the Operating

Environment of Subsidiaries in Foreign Countries

13-23

Performance Evaluation

Major aspects for evaluating foreign operations

Performance evaluating measures

Classification of foreign operations

Cost

Profit

Investment center

Issues

Evaluation of the foreign operation

Evaluation of manager of operation

The profit measurement method

13-24

Performance evaluation measures

Financial criteria

Measures based directly on financial statement data

Net profit

Return on investment

Comparison of budgeted to actual profit

Nonfinancial criteria

Measures not based directly on financial statements

Market share

Relationship with host country government

Labor turnover

13-25

Performance evaluation

Balanced scorecard

Balanced consideration to

Financial

Nonfinancial measures

Four perspectives

Financial perspective

Customer perspectives

Internal business process perspective

Innovation and learning perspectives

13-26

EXHIBIT 13.12—Basic Model of a Balanced

Scorecard Performance System

13-27

Responsibility centers

Foreign affiliate held accountable as

Cost centers

Produce output using available resources

Profit centers

Responsible for costs and revenues

Investment centers

Responsibilities of profit center plus

Responsibility for investment decisions

Return on investment (ROI)

Most common performance measure

13-28

Separating managerial and unit performance

Separating performance evaluation

Managerial performance

Unit performance

Uncontrollable items

Local manager has no control

No permission to manage

Controlled by the parent

The host government

Controlled by others

Responsibility accounting

Managers not accountable

For uncontrollable items

13-29

Uncontrollable items

Controlled by the parent company

Sales and cost

Determined by transfer pricing

Allocation of corporate expenses

Interest expense

Controlled by the host government

Foreign exchange spending restrictions

Price controls

Local content laws

Controlled by others

Labor strikes

Foreign exchange loss

Power outrages

War, riots, and terrorism

13-30

Choice of currency in measuring profit

Profit measured in

Local currency

Subsidiary not paying parent currency dividends

Parent currency

Subsidiary paying parent currency dividends

Choice of a translation method

Whether translation adjustment included in profit

13-31

Foreign Currency Translation

Translation for internal purposes

Financial accounting standards not followed

Factor influencing translation adjustment in the profit

Adjustment reflects the impact of change in rates on parent currency cash flows

Local manager has authority to hedge translation exposure

13-32

Choice of currency in operational budgeting

Operational budgets

Include budget-to-actual comparisons

If actual compared to budget

In local currency

Functions of overall budget variance

Sales volume variance

Local currency price variances

In parent currency

Functions of overall budget variance

Change in exchange rates

Sales volume variance

Local currency price variances

Exchange rates

Actual at time of budget

Projected at time of budget

Actual at end of budget period

13-33

EXHIBIT 13.17—Combinations for translation of budget and actual results

13-34

Implementing performance evaluation

Success of system depends on

Integration of system and business strategy

Feedback and review

Comprehensive measures

Ownership and support throughout organization

Fair and achievable measures

Simple, clear, and understandable system

13-35

Culture and management control

Objectives

Influence human behavior

People in different cultures

React differently to control systems

Japan more collectivist society than the United States

Culture affects

Management style

Capital budgeting decisions

Short vs. long payback

13-36

End of Chapter 13

13-37