UK supermarket location assessment

advertisement

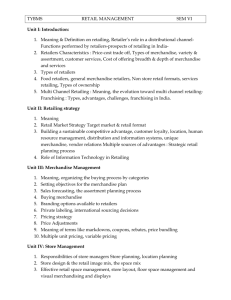

UK supermarket location assessment The Authors Richard M. Clarkson, Research Student, Business Policy at the School of Business, University of Huddersfield, Huddersfield, UK. Colin M. Clarke-Hill, Research Student Principal Lecturer in Business Policy at the School of Business, University of Huddersfield, Huddersfield, UK. Terry Robinson, Reader and Principal Lecturer at Teeside Business School, University of Teesside, Middlesbrough, UK. Abstract States that the choice of a store’s location is considered to be the single most important decision a retail organization has to make, and that location is seen as a critical factor of success. Reviews the literature on store location models and how grocery retailers in the UK assess store location sites in terms of site potential and the location models that they apply to these potential sites. Also develops and highlights issues of the use of existing store location models to geographical areas of Eastern and Central Europe. Article Type: Research paper Keyword(s): Central Europe; Eastern Europe; Grocery industry; Location; Retail trade; Stores; United Kingdom. Journal: International Journal of Retail & Distribution Management Volume: 24 Number: 6 Year: 1996 pp: 22-33 Copyright © MCB UP Ltd ISSN: 0959-0552 Introduction The study of the ways in which retailers make their location decisions can be traced back as far as the works of Haig[1, 2] and the competitive bidding for specific sites based on anticipated future returns; Hotelling’s[3] explanation of the clustering of similar stores; Reilly[4] with the famous Law of Retail Gravitation combining the effects on patronage of both distance and centre attractiveness; and Christaller’s[5] focus on the “real price” of a good which includes a notional transportation “cost”. The attempt to set a theoretical framework for retail location in the UK context has been largely confined to the reviews of Brown[6, 7, 8]; the regression modelling work of Simkin[9, 10] with his Store Location Assessment Model (SLAM); and the recent work of Clarke et al.[11] concerning an integrated framework for location positioning and strategies. During the 1980s and early 1990s the major thrust of the growth of UK supermarket multiples has been by what is often described as “organic” methods namely the opening of more and more stores to a standard format in new townships. This is illustrated by the gradual move northward by J. Sainsbury and southward by Asda. The very nature of this form of growth suggests the importance of those decisions that evaluate the trading potential of stores in specific towns. This article attempts to explore whether or not any of the theoretical models of store location are used in practice by UK grocery multiples or whether any “new” models or techniques have emerged. The broad aim of this article is to ascertain the type, nature and extent to which location models are used by UK grocery retailers in their location decisions. More specifically, the objectives of the work are to: review the literature on retail location models; ascertain whether or not major UK grocery retailers use any models for their location decisions; examine the models that are used individually or in combination; identify issues that need to be addressed in the future use of such models in a “post saturation” grocery retailing environment in the UK; explore the applicability of location models to decision making in the emerging retail environments of mainland Europe including the newly democratised states of eastern and central Europe. Retail location theory Retail location theory can be said to rest on four broad theoretical approaches, namely: central place theory; spatial interaction theory; land value theory; the principle of minimum differentiation. Central place theory Central place theory was first formulated by Christaller[5] and subsequently developed by Losch[12], and is described by Craig et al.[13] as “the best developed normative theory of retail location”. Stevens[14] believes it to be “the most innovative and successful attempt to construct a fully realised theory of spatial structure”, while Marshall[15] considers it “too implausible to serve as a basis for empirical work”. Central place theory seeks to explain an apparent order among the pattern of settlements, or central places that dispensed goods and services to a surrounding area. Christaller’s original theory of central place rests on two fundamental concepts; the range and the threshold of a good (or service). Christaller’s theory attempts to explain retail patterns by the notion of a hierarchy of centres proposing that the process of centralization would lead to a clearly recognizable stepped hierarchy of centres. Losch’s work strengthens many of Christaller’s suggestions, yet differs in the consideration of hierarchies. He proposed that there would be so many extrinsic influences in the real world that size groups would become indistinct and merge into a continuum. Several authors have provided empirical evidence to support Losch’s view. Berry and Garrison’s[16] “theory of tertiary activity” made a significant modification to the central place model drawing an analogy between a hierarchy of settlements. Berry[17] was criticized for this approach, to which he responded by expanding it and formalizing the widely accepted typology of centres, ribbons and specialized areas. Central place theory over the past 60 years has been extremely influential in providing a framework for the analysis of both spatial and non-spatial retailing patterns, although it is subject to certain limitations discussed by Carter[18] and by Brown[8]. The major criticisms start with Kivell and Shaws’s[19] observation that any model which attempts to reduce a complex reality into a simplified and manageable form suffers from a high degree of abstraction in terms of the assumptions of identical consumers, an even distribution of population and the concept of single purpose (product) shopping trips to the nearest centre that supplies the merchandise. Central place theory assumes consumers to be identical, adopting the economist’s “optimizing man”. This is not seen to be a very realistic concept as shown by Golledge et al.[20] in that consumers do not always follow the exact precepts of central place theory. Curry[21] argued that his “summation man”, a kind of group average of individual choices, which, at the general level, have a considerable random element, is more realistic. The inclusion of a random or stochastic element has been clearly recognized[22], and substantial attempts have been made to interpret central place theory within a probabilistic framework. It is generally accepted that the central place theory’s failure to accommodate change successfully is its single most significant shortcoming, Brown[8] argues that: Central place theory is predicated upon static, equilibrium-seeking assumptions which have become increasingly divorced from today’s highly dynamic retailing environment. The concept of single purpose shopping trips is arguably the most talked about assumption made by central place theory. Authors have criticized the lack of sophistication of a single product approach, arguing for a multi-product perspective. Thompson[23] believed that even where the focus is moved from products/purpose to stores there is an implicit assumption that the only factor differentiating one store from another of the same type is location, thus ignoring such factors as price, quality and image. In response to this, formal attempts have been made in recent years to develop mathematical modelling in central place theory which incorporates multipurpose shopping. A review of intra-urban shopping patterns in British towns by Warnes and Daniels[24] suggests that: To a very large extent, the residents of British towns do use the nearest shopping centre offering a given type, quality and combination of goods and services. There are certain factors which can over-ride movement minimization, but this assumption is unusually valid: there are few spatial generalizations concerning human behaviour that are empirically so well supported. Even though this review is now almost 20 years old, the commercial structures of many western cities are still built around centres based upon national and regional “hierarchies”. To summarize, central place theory provides a partial explanation for shopping behaviour in the intra-urban environment with the refinements necessary to rectify this situation being likely to prove extremely difficult to develop and even more so in providing valid empirical evidence. Consequently, it is suggested that the value of central place theory in the study of consumer spatial behaviour in cities is most relevant to an understanding of the fundamentals of the spatial structure of shopping opportunities, and serves as a useful pedagogic introduction to study consumer behaviour[8]. Spatial interaction theory Spatial interaction theory is based on the hypothesis that consumers trade off the attractiveness of alternative shopping areas against the deterrent effect of distance. This offers an alternative normative model to explain behavioural interaction. In doing so it discards the assumption made by central place theory that behaviour is explained by consumers using the nearest offering of a good or service. The origins of spatial interaction theory are fairly ambiguous, however, retailingrelated applications date from the pioneering studies of William J. Reilly[4]. Reilly based his “Law of Retail Gravitation”, on an analogy with Newtonian physics linked with empirical observations of shopping behaviour placed in an inter-urban structural context[8]. Although some empirical studies showed that Reilly’s model performed reasonably well in practical situations, others found its performance inconsistent. The basic problem with the original gravity model is that its variables; population and road distance, and the parameters on these variables, unity and the inverse square, do not always perform well in practice[22, 26]. The first recognized refinements and modifications to Reilly’s Law came from Converse[25] in identifying an “inertia factor” that reflected the reluctance of a consumer to move any distance in making a purchase. Others have refined and modified the variables and parameters in Reilly’s Law. Arguably the single most significant post-war contribution to spatial interaction theory came from Huff[22, 26]. He believed that consumers patronize competing shopping areas as the basis of their overall “utility.” The Lakshmanan and Hansen’s[27] refined version of Huff’s[22, 26] model has been used subsequently in many planning studies. Their model, devised for metropolitan regions, states that a shopping centre located in a given zone will attract consumer expenditure from another zone in direct proportion to the size of the centre measured in floor space, and in inverse proportion to the distance to the consumer expressed in travel time, and to competing facilities. In this way it allows for overlapping trade areas. The simplicity of the gravity model has given rise to considerable operational problems. Apart from the absence of a satisfactory test to measure their closeness of fit[8, 19], the operational difficulties mostly revolve around the subjective indexing of variables and calibration of the model. Arguably the most difficult variables to define are measures of attraction and distance. The variables used depend on personal opinion, data availability and time or cost constraints; with numbers of shops, retail employment, sales turnover, retail floor space and types of stores having all been used as measure of attraction; while geographic distance, road distance, travel times and travel costs have all been used as measures of distance[8, 19]. Calibration is regarded as problematic. It is normally carried out by feeding in known data and/or by the undertaking of trial runs. Openshaw[28] identifies a pressing need for model calibration based on observed trip data, a need partly fulfilled by ParrLewis and Bridges[29] in their two-stage shopping model. Apart from the operational problems discussed above, spatial interaction modelling is essentially an equilibrium seeking model which fails to predict the dynamics of the changing retail environment. Furthermore, Jensen-Butler[30] criticizes spatial interaction modelling for having a very weak theoretical base, suggesting the assumption that the slope of the distance decay function is negative represents only an empirical observation which has no theoretical base. In recent years, gravity modellers have made several attempts to optimize the calibration procedure and numerous investigations into alternatives and improvements to ordinary least squares for estimating goodness of fit. Further to this, attempts have been made to incorporate “trip changing”, multi-purpose shopping behaviour and the development of a dynamic perspective into the gravity model. Although many of these investigations have led to little success, retail gravity modelling has been rejuvenated with the prospect of having real commercial applications. This follows on from Jenson-Butler’s[30] view that gravity modelling would have value as a shortterm allocative model because of its potential for further refinement and calibration in the context of goods. Land value theory Land value theory, also known as bid rent theory and urban rent theory, first achieved recognition in a retailing context from the early work of Haig[1, 2]. He argued that competition for an inelastic supply of land ensures that, in the long run, all urban sites are occupied by the activity capable of paying the highest rentals, and land is thereby put to its “highest and best” use. Land value theory proposes that the location of different activities (retailing formats) will depend on competitive bidding for specific sites. Haig’s work formed the basis of Alonso’s seminal land use model. Alonso[31] constructed bid rent curves for each land use function, their slope reflecting the sensitivity of that activity to changes in accessibility. In a desire to attract custom from the entire urban area and, as a result, requiring the most central sites, businesses are prepared to bid the highest rentals, but the amount they are willing to pay falls off rapidly with distance. However, Alonso’s analysis is concerned with business, residential and agricultural land uses and is often considered too broad to show a true reflection of retail location. Within the context of retailing, these principles have been taken up notably by Firey and Garner. Assuming equal accessibility from all directions, perfect knowledge on the part of the retailer and no legal or social constraints, Firey[32] suggests that a systematic retail pattern is determined by the maximum rent that retailers are able and to pay. Garner[33] incorporates the concept that total sales volume decreases with distance from the peak intersection into his spatial model of business centre structure. He equates high threshold functions with high rent paying ability and concludes that these will be found on high value land at the centre of retail nucleations. Thus demonstrating a clear distinction between regional, neighbourhood and community business types. Garner also recognized the over simplification of his model and pointed out that establishments of a given type are by no means always associated with discrete economic distances from the peak land value intersection. Furthermore, he recognized that real world rent gradients are neither smooth nor symmetrical, but are characterized rather by subsidiary peaks alongside arterials and ring road intersections. Davies[34] extended Garner’s model, going beyond the consideration of accessibility and rent theory. He uses the varying accessibility requirement and rent-paying abilities of different business to link with the previous identification of three distinctive kinds of retail complexes (Centres, Ribbons and Specialized Areas). This overlaps with the hierarchical tenets of central place theory. Garner, Davies and other land value modellers have been strongly criticized over the model’s assumptions regarding accessibility, segregation of land use, a free market in property and again like central place theory, the existence of the economist’s “optimizing man”. The model ignores Curry’s[21] “summation man” and believes individuals to be fully informed utility maximizes who are not influenced by non-economic forces, including whim, tradition, aesthetics, prestige and sheer ignorance. The model ignores imperfections that occur in the property market as pointed out by Brown[8]: The developers of planned shopping centres ensure that the tenant mix and rentals paid are carefully controlled, with the highest order anchor stores often paying the lowest rentals per square foot. He concludes a free market in property does not exist, therefore, nor are rent curves smooth. As with central place theory and spatial interaction theory discussed earlier, land value theory fails to take the temporal dimension into account. Land use activities occupy locations sequentially and once established they can prove difficult to move. In an urban area there will always be non-conforming or outmoded land uses “interfering” with the logic of bid rent theory. Modern cities such as London are plagued with pedestrianization, congestion and restrictions on vehicular access and parking and, in addition, the centre has lost much of the accessibility expressed in land value theory. This has led to the existence of positive and non-negative rent gradients, which do not always decline with distance. Fine tuning by land value modellers in recent years have made substantial attempts to overcome the criticisms discussed earlier. However, Brown[8] highlights that the attention has focused on the residential sector, and that studies of retailing and internal structure of business districts being conspicuous by their absence. The principle of minimum differentiation The principle of minimum differentiation originates from Harold Hotelling’s[3] classic paper “stability in competition”. The prin-ciple suggests, in a retailing context, that a given number of stores operating within the same market sector will achieve superior performance if they are clustered together. In his original model, Hotelling makes key assumptions concerning location, pricing, transport costs, consumer behaviour, conjectural variations, market shape, and number of competitors; which in reality are not always consistent[35]. Brown[6, 8] believes, despite the interesting empirical work that supports the clustering of compatible retail entities, the bulk of the studies support Eaton and Lipsey’s[35] conclusion that: The Hotelling model is not able to explain the local clustering of firms … Indeed, once the assumptions are relaxed very slightly in the direction of realism, Hotelling’s model predicts that no two firms should be clustered together. Although Hotelling’s work is strongly criticized, there has been a considerable amount of research effort since publication. In a retailing context a number of empirical studies support the principle of minimum differentiation’s hypotheses that sellers of the same or similar categories of merchandise tend to cluster closely together. These studies have been carried out in a number of different countries, incorporating a variety of statistical techniques while referring to a wide range of retailing trades. Brown explains that high order retail trades, like ladies outfitters or department stores, exhibit the most clustered distributions, whereas low order retail businesses such as convenience stores and personal services, are the least agglomerated of all. However, it fails to explain why out-of-town supermarkets often out-perform supermarkets in the centre of the business district in close proximity to their competitors. In recent years, formal attempts to relax the traditional assumption of Hotelling’s perfectly informed and, thus completely rational, retailers and consumers, have provided a means of rehabilitating the principle in a retailing context. Arguably, the introduction of uncertainty and risk-reducing behaviour into Hotelling’s model has improved the accuracy of the principle. Brown[6] suggests that the reduction of uncertainty has provided the mechanism for mending the principle of minimum differentiation and melding it with the best known and inductive insights into retail location at the micro scale Methodology In order to pursue the aims and objectives outlined in the introduction, a content analysis of information gained from a multimethod research process was conducted to establish the underlying trends in location procedures used by UK grocery retailers. The first stage involved an in-depth interview with an acknowledged industry expert in order to establish an understanding of the industry and its terminology. The second stage involved semi-structured in-depth interviews with two major grocery retailers based around secondary research and the interview with the industry expert. The third stage involved the administration of a questionnaire to 16 grocery multiples based around secondary research and the interviews in stage one. The questionnaire was designed to gather information on location procedures used by the retailers studied. The directors of supermarket operations at 16 of the major UK grocery retailers were targeted with the questionnaire. The directors where asked to indicate their location procedures, frequency of use, factors considered in assessing a store’s location, their knowledge of location theory and data sources used. Open-ended questions were asked concerning the levels of accuracy, anticipated changes in procedures used and market saturation. A 25 per cent response rate was achieved for the questionnaire. In addition, two grocery retailers sent information regarding their location procedures instead of completing the questionnaire. To summarize, five major UK retailers were studied, accounting for in excess of 50 per cent of UK grocery retailing turnover. Due to the requirement for confidentiality these will henceforth be described as companies A to E. As grocery retailing in the UK approaches what is often called “saturation”, the detailed operationalization of location models forms part of a retailer’s competitive advantage. Respondents, while co-operative, where obviously reticent to fully elaborate on the way in which their in-house models were used in practice and the specific forms of input data that drive such models. This inevitably tends to constrain the level of insight that can be elaborated from their results. Location assessment procedures used in UK grocery multiples The research identified that five different location assessment procedures were being used by the sample retailers. These were: Checklist analysis. The checklist consists of a simple list of relevant factors regarding population, accessibility to the proposed store, competition and cost. Checklist analysis is often informal and represents a picture in the mind of the researcher. A typical checklist can be found in McGoldrick[36]. Analogue method. The analogue method attempts to predict turnover of a proposed site by assessing it against existing stores′ performance after adjusting for differences between the proposed site and existing stores. Such methods are not new and can be credited to the work of Applebaum[37] as far back as 1968. In a grocery retailing context, the main areas of examination are customer surveys, competitive analysis and the collection of demographic and socio-economic information. More recently, Geographic Information Systems (GIS) and loyalty card data have been incorporated into this method. Financial analysis. This simply studies the financial aspects of the development and operation of a store, comparing the development costs in terms of site acquisition, building and operational costs against estimated turnover. This approach does not take into account the competitive environment or consumer behaviour patterns as it is intended to serve as a complementary procedure rather than an assessment procedure in its own right. Regression modelling. In a grocery retailing context, multiple regression models have been developed around a number of determinants, i.e. competition (C), trading area composition and characteristics (T), the site accessibility (S), store physical attributes (A), and catchment area demographics (D); to estimate potential turnover (T/O) of a store. In algebraic terms: T/O = f[C, T, S, A, D]. The regression coefficients indicate the effects of each determinant on turnover, and the corresponding beta weights show the relative importance of each determinant. Regression models used by the sample retailers were SITEX (a store location model developed for a major retailer in the 1980s), SLAM, and a model developed in-house. Gravity modelling. The gravity model used by the retailers in the sample stems from the deductively derived spatial interaction theory, being a modified version of Reilly’s[4] Law of Retail Gravitation. From the location assessment procedures used by the sample retailers, only gravity modelling stems from a deductively derived (or derivable) theories of retail location, that is spatial interaction theory. Checklist analysis, the analogue method and financial analysis, can be best classified as techniques and regression modelling as a mechanism rather than deductively derived (or derivable) theories of retail location. There are, however, slight similarities between the analogue method and central place theory, in that central place theory states that the nearest store is patronized and the analogue method’s use of time bands with the majority of customers coming from the nearest time band. The way financial analysis assesses the viability of a site is to some extent anchored in the theory of land value. However, while financial analysis and the analogue method have similarities with deductively derived theories of retail location, they are not part of them. Of the five procedures identified in the research by the sample retailers, all five (A to E) used the checklist analysis, analogue approach and financial analysis, in one form or another. Three retailers (B, D and E) from the sample used regression modelling, while gravity modelling was only used by only two (A & B). This is shown in Table I below. The research indicated that the different location assessment procedures were complementary to each other, being used in sequence to maximize their overall effectiveness. This sequence is shown diagrammatically in Figure 1. The sequence of procedures starts initially with checklist analysis consisting of map work involving a detailed study of the proposed site and its catchment area; looking at the road system, urban development, the location of other supermarkets and urban distribution. This preliminary analysis enables the retailer to screen a large amount of potential sites (100+) with only the more suitable ones being analysed further, thus helping restrict the cost of location assessment. Checklist analysis has limitations in its inability to predict turnover, but the way in which it is used as a screening tool presents a cost-beneficial assessment method to the grocery retailer. After the initial checklist procedure, the retailers studied then applied the analogue approach. First, the retailers undertake an in-store intercept interview of customers at their existing stores. This normally entails 1,000 such interviews, which is a continuous process with each existing store’s customers being surveyed every two years. The results of the surveys provide the retailer with information about the origins of the store’s customers, their spending characteristics, the demographic composition, shopping behaviour and media usage habits. Generally the survey includes questions on the following topics: customer address; customer socio-economic characteristics: age, income, occupation, race, etc; customers’ patronage of the competition: identification of the major competitors; shopping behaviour: frequency, amount spent etc; media habits: newspaper readership, advertising awareness and recall. Second, the retailer identifies current and future stores of their competitors, which are then visited to develop a quantitative and qualitative database of information on competitors’ stores. Quantitatively, their distances in drive-time from the proposed site are calculated and their selling square footage estimated. When future competitors’ stores are assessed, the retailers studied used general press information and building contract leads from organizations such as ABI. Qualitatively, competitors are evaluated in terms of store appearance, merchandise presentation and quality, location and service levels. Third, demographic and socio-economic information about a proposed store’s catchment area and its component parts are collected by the retailer. The retailers in the sample all receive regular updates of UK geo-demographic data on computer disk or CD-ROM, mainly classified on a residential neighbourhood basis together with a clustering of environmental, personal and household variables (ACORN), or alternatively by types of neighbourhood plus lifestyle groupings (MOSAIC), or other computerized bibliographic search services (e.g. ABI/INFORM). The geo-demographic data is compared with the results of the in-store customer survey in order to identify certain trends. The comparisons will identify the average spending patterns, socio-economic group, car and house ownership. This in turn will enable the retailer to estimate the potential market share within the store’s catchment area and potential returns. Recent trends have seen three major grocery retailers introduce store loyalty cards while a further major retailer is assessing their viability. The information gained from these loyalty cards will inevitably be incorporated into location assessment procedures in that much of the customer data stored electronically is fundamentally similar to the data suggested earlier. It can be said that the analogue sales forecasting technique is only as strong as: the quality of the data collection effort; the experience of the analyst; and the analyst’s ability to demonstrate commonsense and good judgement in forecasting sales. However, Drummey[40] believes that this does not mean that it is not effective since the sensitivity of judgement can also be a major asset. The authors’ research agrees with Drummey. It shows that retailer C’s store location assessment procedures are based around this approach, using financial and checklist analysis to assist it. They reported a significantly high level of accuracy from the analogue approach and intend to continue with it. Retailer C found it particularly useful in locating sites for their new discount store concept where the use of gravity and regression modelling is not possible because of the low number of analogue stores[40, 41]. After the analogue approach the sample retailers location procedures varied. Retailer A then used gravity modelling and financial analysis; retailer B used gravity modelling, regression modelling and financial analysis, and was the only retailer in the sample to use all five procedures; retailer C only used financial analysis in addition to the checklist and analogue analysis; retailers D and E both used gravity modelling and financial analysis after checklist and analogue analysis. The research on the whole agreed with the previously stated advantages and disadvantages of sales forecasting models, including regression modelling and gravity modelling that Rogers[41] has identified. However, there are some contradictions. Regression modelling as expected, requires a database of at least 30 stores per model and is therefore irrelevant to smaller retailers. Nevertheless, the research showed a regression model successfully developed for grocery retailer E operating only 20 stores (at the date of the research). Here, 19 stores had built up the database of information to predict the “control store”. This was repeated, using each store as the control. Additionally, the level of “abuse” and “misuse” that Rogers believes occurs during the initial development has been overcome by retailer E, who employed a regression modelling expert who had experience in developing over 20 such models. Thus showing the importance of the learning curve when developing regression models. The volume of detailed fieldwork needed for gravity modelling is classed as a major disadvantage of this location assessment procedure[41]. However, in a grocery retailing context, the majority of the fieldwork research needed for gravity modelling has already been undertaken for the analogue analysis. The research shows that the procedures used by major grocery retailers operating within the UK, do not rely on one approach, but a combination of approaches. This combination of approaches reduces the risk involved in store location assessment by comparing their predicted turnovers. The initial use of checklist analysis reduces the cost and time required to assess a large number of stores before using the analogue approach, regression or gravity modelling. These, in comparison, have a greater degree of accuracy but require more time and money. These procedures provide the retailers in the sample with a high level of accuracy for predicting a store’s potential turnover. They are comprehensive and relatively easy to understand. The information required to use these procedures is readily available to the retailers. There is no one “best” method of assessing retail location. The research also looked at other models that have been developed to assess a store’s location. First, the Automatic Interaction Detector (AID) initially developed by Sonquist et al.[42]. Heard[43] suggested that a combination of the AID and multiple regression techniques could be used to provide criteria for judging outlets and assessing the potential of new sites. The main feature of this approach is the measurement of approximately 50 factors which may influence turnover and the inclusion of attitudinal data, derived from a sample survey of shoppers and quantifying factors such as the appearance and image of a store. This approach helps to understand the relationship between measures of performance and the predictor variables[37]. It provides a clear way of searching for structure among the variables. However, at least 1,000 (analogue) stores are required for the reliable use of this technique which is currently in excess of the maximum number of stores operated by any of the major UK grocery retailers. Second, the MCI (Multiplicative Competitive Interaction Model), is an extension to the basic form of spatial interaction models discussed earlier. This was developed by Nakanishi and Copper[44], building on Huff’s model to include more explicitly the specific competitive situation. Nakanishi and Copper demonstrated that the parameters of the model could be effectively estimated using the least squares approach, as in multiple regression analysis. However, the research undertaken by the authors of this paper showed that, unlike the gravity model, the majority of grocery retailers are unaware of the MCI model and/or unwilling to try new ideas which have had limited empirical testing in this context. Nakanishi and Copper did not relate the MCI model specifically to retail patronage forecasting. Although used by US firms in a retailing context[45], the research showed that grocery retailers operating within the UK believed that the consumer spatial behaviour in cities and the spatial structure of shopping opportunities differs to that found in the US. One retailer believed models developed for the US market cannot be easily adapted to the UK market, this view was also expressed by the industry expert. Third, the multiple store location (MULTILOC) model, developed by Achabal et al.[45] extends the MCI model discussed above to the multistore location problem utilizing a random search procedure combined with an interchange heuristic to identify optimal or near-optimal sets of locations. Although the MULTILOC model is used by retailers in the US, the authors’ research showed that none of the sample retailers operating in the UK actually use this approach. In fact, research showed that just like the MCI model, and unlike the gravity models, the majority of grocery retailers are unaware of this model or unwilling to adopt it. Conclusion To some extent the research only tells us “what is obvious” in that retailers use a series of models and often use them in combination and in a clearly defined sequence. However, deductively derived theories give a useful background to the understanding of location research. However, with the exception of spatial interaction theory gravity modelling, the theories discussed earlier are not used by the sample retailers. Instead they used a combination of checklist analysis, analogue analysis, financial analysis, gravity modelling and regression modelling. The grocery retailers believed their current location assessment procedures to be sufficiently accurate, generally predicting turnover within ±10 per cent. Retailer A stated that: No changes are anticipated to the procedures employed within this department (store location department). All tools/procedures are well tried and tested to cope with any subtle changes in market trends over the coming years. Following on from this, retailer C believes that: Store location assessment cannot be 100 per cent accurate and expects location assessment procedures to move away from being an exact science over the coming years and be based more around managerial judgement rather than mathematical modelling. The sample retailers are not developing new procedures, instead they are modifying their current approach to location assessment by the incorporation of geographical information systems (GIS) into their store location assessment procedures. This trend is expected to accelerate in the future in both the grocery and non-grocery retail sectors mainly because new procedures take time to develop and implement, require relatively large amounts of finance and often have little empirical testing. This is particularly apparent in a grocery retailing context. However, academics will continue to make modifications, improvements and provide alternatives to the theories reviewed in this research. These will inevitably suffer from a lack of empirical testing in a retailing context within western economies as companies are becoming less willing to “risk” developing new location procedures because of the time and cost constraints. Further to this, there is a noticeable slowdown in grocery retailers store expansion programmes as the UK market nears saturation level. Although grocery retailers are combating this by developing new concept stores, this causes problems in location assessment as the use of gravity and regression modelling is not possible (due to the lack of a databank of analogue stores) and the use of checklists, financial analysis and analogues have to be used. This arguably reduces the need for research into location theories and procedures within the UK grocery retail market. The future of retail location theory As the UK grocery market becomes increasingly saturated, the development of new stores on new sites would diminish in importance. The need for more sophisticated location assessment procedures would then become significantly less important to the retailers in their pursuit of growth strategies. Broadly, two strategic options are open for growth within their existing product formats in this emerging climate. First, retailers would embark on revamping or even re-building existing stores on their existing sites. The concept of the store re-vamp consisting of redecoration, new fixturization and re-merchandising has been around for many years. The concept of re-building on the existing site - “build and smash” - is newer and involves building what is essentially a new store on the existing store site, and on completion, demolishing the old store. This does not involve a location decision as we have known it, but more of an evaluation of the future potential of the existing site as a result of a capital injection. Thus, location assessment procedures will inevitably be modified to meet the assessment requirements of this phenomenon. The second strategic option is the expansion into non-domestic markets. The move by UK-domiciled retailers overseas has been examined by numerous authors and is comprehensively reviewed by Akehurst and Alexander[46]. From the perspective of location theory, those countries into which UK food retailers move can be classified into: Countries which are rich in location data from existing stores. Analogue data would, however, not be readily available to any new entrant unless the mode of market entry was by acquisition or joint venture with an indigenous partner. Other forms of location data, typically of the geo-demographic type, could be acquired from research organizations to help with the location decision. Countries with rich geo- demographic data would include the nations of northern Europe and north America. This would imply that location models used by retailers in the UK could be adapted to the new market environment. Countries which lack sophisticated geo- demographic data and where the analogue data of partners may be of doubtful quality and quantity, such as the emerging nations of eastern and central Europe. The issue then arises as to what is the future for location theory in these emergent states where westernstyle retailing will inevitably develop over time. Retailers expanding into those countries with less available data will presumably revert back to using location theory in conjunction with checklist analysis along with a less dataintensive analogue approach provided that the method of entry involves local partners and those partners have suitable historical data. To attempt some prediction as to the type of location theories that might have credence in the emergent nations is difficult. Clearly the inherent simplicity, limited data requirements and to some extent the subjectivity of the checklist, makes it a favourite as a potential method. The efficacy in the use of the analogue method is dependent on base data from existing retail operations. Direct entry onto “green field” sites in central and eastern Europe would effectively prevent the use of this method until such time as data is built up from stores in that country or countries of similar economic and social development. However, if entry is effected by joint venture or acquisitions, then, provided that the indigenous retailer has the necessary base data, the analogue method becomes a practical possibility in the short term. A similar set of criteria would apply to financial analysis, but this method may be more capable of being implemented in the shorter term on the basis of a more limited number of comparative stores. However, unlike the UK, where it is essentially used as a complementary measure to other forms of assessment, financial analysis may in the short term have to be used as a primary store assessment method. Using regression modelling, and in particular its in-house variants, would seem at first observation to be problematic in the emergent countries. However, the collection of vast quantities of economic data was a feature of the former command economies and the question to be posed is whether or not this data is capable of being utilized in a modern competitive environment. Basic catchment area data would have existed, site accessibility is calculable, and store physical attributes are to a large extent self-determined. Thus, the practicality of the use of regression modelling may lie more in the manipulation of the data and in the weighting of the various attributes in a new context rather that the existence of the raw data itself. There is little doubt that, over time, some of the basic tenets of location theory will come into use in some form or other in the new Europe. Indeed, some preliminary research into, for example, the Czech Republic, has found some interesting evidence of central place type relationships between overall levels of retail activity and the existence of commercial and cultural infrastructure[47]. Clearly the notion of central place and spatial interaction will have some degree of applicability in the virgin retailing landscapes of eastern and central Europe, especially when coupled with the relatively low per capita incomes and low levels of car ownership and subsequent population immobility. Indeed, the sheer vastness of the former Soviet Union would suggest an almost classical case of Christaller’s[5] “unbounded and featureless plains”. What is clear, however, is that we know so little about retail location outside of the developed nations, and this must therefore be an area in which the retailing academic and practitioner community will need to study as we reach the end of the millennium. This may act as a catalyst for re-visiting the research into the theories of retail location and perhaps this may indeed aid our understanding of retailing at a global level. Table ILocation procedures used by the sample retailers Figure 1Grocery location assessment process References Haig, R.M. (1926), "Towards an understanding of the metropolis: I. Some speculations regarding the economic basis of urban concentration", Quarterly Journal of Economics, Vol. 40. [Manual request] [Infotrieve] Haig, R.M (1926), "Towards an understanding of the metropolis: II. The assignment of activities to areas in urban regions", Quarterly Journal of Economics, Vol. 40 pp.402-34. [Manual request] [Infotrieve] Hotelling, H. (1929), "Stability in competition", The Economic Journal, Vol. 39 No.3, pp.41-57. [Manual request] [Infotrieve] Reilly,W. J. (1931), The Law of Retail Gravitation, Knickerbocker Press, New York, NY, . [Manual request] [Infotrieve] Christaller, W. Central Places in Southern Germany, . [Manual request] [Infotrieve] Brown, S. (1989), "Harold Hotelling and the principle of minimum differentiation", Progress in Human Geography, Vol. 13 No.4, pp.471-93. [Manual request] [Infotrieve] ”Prospect” (1991), Irish Marketing Review, Vol. 5 No.2, pp.52-60. [Manual request] [Infotrieve] Brown, S. "Retail location theory: evolution and evaluation", The International Review of Retail Distribution and Consumer Research, Vol. 3. [Manual request] [Infotrieve] Simkin, L.P. (1), "SLAM: store location assessment Model - theory and practice", Omega, International Journal of Management Science, Vol. 17. [Manual request] [Infotrieve] Simkin, L.P., Doyle, P., Sanubders, J. (2), "UK retail store location assessment", Journal of the Market Research Society, Vol. 27. [Manual request] [Infotrieve] Clarke, I., Bennison, D., Pal, J. (1-2), "Towards a contemporary perspective of retail location", Centro di Studi sul Commercio (CESCOM) 8th International Conference, Bocconi University, Milan, paper presented at, . [Manual request] [Infotrieve] Losch, A. The Economics of Location, . [Manual request] [Infotrieve] Craig, C.S., Ghosh A., McLafferty, S. (1984), "Models of the retail location process: a review", Journal of Marketing, Vol. 60 No.1, pp.5-36. [Manual request] [Infotrieve] Stevens, B.H. (1985), "Location of economic activities: the JRS contribution to the research literature", Journal of Regional Science, Vol. 25 No.4, pp.663-85. [Manual request] [Infotrieve] Marshall, J.N. (1978), "On the structure of the Loschian landscape", Journal of Regional Science, Vol. 18 No.1, pp.121-5. [Manual request] [Infotrieve] Berry, B.J.L., Garrison, W.L. (1958), "A note on central place theory and the range of a good", Economic Geography, Vol. 34 pp.304-11. [Manual request] [Infotrieve] Berry, B.J.L. (1967), Geography of Market Centres and Retail Distribution, PrenticeHall, Englewood Cliffs, NJ, . [Manual request] [Infotrieve] Carter, H. (1972), The Study of Urban Geography, Arnold, London, . [Manual request] [Infotrieve] Kivell, P.T., Shaw, G. (1980), "The study of retail location", in Dawson, J.A. (Eds),Retail Geography, Halstead Press, . [Manual request] [Infotrieve] Golledge, R.G., Rushton, G., Clarke, W.A.V. (1966), "Some spatial characteristics of Iowa’s dispersed farm population and their implications for the grouping of central place functions", Economic Geography, Vol. 42 pp.261-72. [Manual request] [Infotrieve] Curry, L. (1967), "Central places in the random spatial economy", Journal of Regional Science, Vol. 7 No.2, pp.131-47. [Manual request] [Infotrieve] Huff , D.L. (1963), "A probabilistic analysis of shopping centre trade areas", Land Economics, Vol. 39 pp.81-90. [Manual request] [Infotrieve] Thompson, R. (1969), "Intra-urban retail structure", Journal of Retailing, Vol. 45 No.3, pp.68-80. [Manual request] [Infotrieve] Warnes, A.M.,, Daniels, P.W. "Intra-urbanshopping travel: a review of theory and evidence from British towns", Transactions of the, Institute of British Geographers, . [Manual request] [Infotrieve] Converse, P.D. (1949), "New laws of retail gravitation", Journal of Marketing, Vol. 14 pp.379-84. [Manual request] [Infotrieve] Huff , D.L. (1962), "A note on the limitations of interurban gravity models", Land Economics, Vol. 38 pp.64-6. [Manual request] [Infotrieve] Lakshmanan, T.R., Hansen, W.G. (1965), "A retail potential model", Journal of the American Institute of Planners, Vol. 31 pp.134-43. [Manual request] [Infotrieve] Openshaw, S. (1973), "Insoluble problems in shopping model calibration when the trip pattern is not known", Regional Studies, Vol. 7 No.4, pp.367-71. [Manual request] [Infotrieve] Parr-Lewis, J.,, Bridges, M. (1974), "The two stage shopping model used in the Cambridge and sub-region study", Regional Studies, Vol. 8 pp.287-97. [Manual request] [Infotrieve] Jensen-Butler, C. (1972), "Gravity models as planning tools", Geografiska Annaler, Vol 54B, pp.68-78. [Manual request] [Infotrieve] Alonso, W. (1964), Location and Land Use: Toward a General Theory of Land Rent, Harvard University Press, Boston, MA, . [Manual request] [Infotrieve] Firey, W. (1947), Land Use in Central Boston, Greenwood Press, New York, NY, . [Manual request] [Infotrieve] Garner, B.J. The Internal Structure of Retail Nucleations, Northwestern University Studies in Geography, No. 12, Department of Geography, . [Manual request] [Infotrieve] Davies, R.L. (1976), Marketing Geography, Retail and Planning Associates, Corbridge, . [Manual request] [Infotrieve] Eaton, B.C., Lipsey, R.G. (1979), "Comparison shopping and the clustering of homogeneous firms", Journal of Regional Science, Vol. 19 No.4, pp.421-35. [Manual request] [Infotrieve] McGoldrick, P.J. (1990), Retail Marketing, McGraw-Hill, New York, NY, . [Manual request] [Infotrieve] Applebaum, W. (1968), Store Location Strategy Cases, Addison-Wesley, Reading, MA, . [Manual request] [Infotrieve] Zipf, G.K. (1949), Human Behavior and the Principle of Least Effort, Harvard University Press, Cambridge, MA, . [Manual request] [Infotrieve] Proundfoot, M.J. (1937), "City retail structure", Economic Geography, Vol. 14 pp.425-8. [Manual request] [Infotrieve] Drummey, G.L. (1984), "Traditional methods of sales forecasting", in Davis, R.L., Rogers, D.S. (Eds),Store Location and Store Assessment Research, John Wiley & Sons, New York, NY, . [Manual request] [Infotrieve] Rogers, D. (1992), "A review of sales forecasting models most commonly applied in retail site evaluation", International Journal of Retail & Distribution Management, Vol. 20 No.4, pp.3-11. [Manual request] [Infotrieve] Sonquist, J.A., Baker, E.L., Morgan J.N. (1971), Searching for Structure: Alias AIDIII, Institute for Social Research, University of Michigan, Ann Arbor, . [Manual request] [Infotrieve] Heard, G.I (1972), "The application of the automatic interaction detector (AID) programme and multiple regression techniques to the assessment of store performance and site selection", Operational Research Quarterly, Vol. 23 No.4, pp.445-57. [Manual request] [Infotrieve] Nakanishi, M., Copper, L.G. (1974), "Parameter estimation for a multiplicative interaction model - least squares approach", Journal of Marketing Research, Vol. 11 No.3, pp.303-11. [Manual request] [Infotrieve] Achabal, D. D. (1982), "MULTILOC: a multiple store location decision model", Journal of Retailing, Vol. 58 No.2, pp.4-25. [Manual request] [Infotrieve] Akehurst, G., Alexander, N. (1995), "The internationalisation process in retailing", The Service Industries Journal, Vol. 15 No.4, pp.1-15. [Manual request] [Infotrieve] Robinson, T.M., Simova, J., Clarke-Hill, C.M. "Clothing retailing in the Czech Republic", University of Bradford, July 1995., work in progress paper presented at the Marketing Education Group Conference, . [Manual request] [Infotrieve] Other refer http://www.jstor.org/stable/621854?seq=11 other refer: http://books.google.co.uk/books?hl=en&lr=&id=xbYOAAAAQAAJ&oi=fnd&pg=P A106&dq=tesco+store+location+policy+&ots=FXlB12BVFN&sig=w4gkYDnyNlGK mnW6tU7PpJCCtEs#v=onepage&q=&f=false