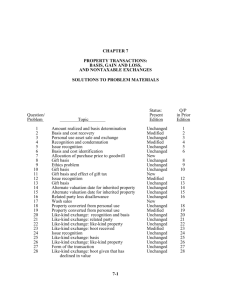

IRC Section 1033(e) Raised Cows

advertisement

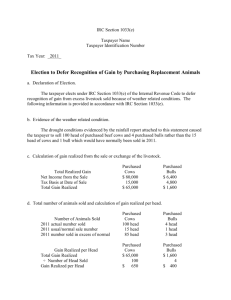

IRC Section 1033(e) Taxpayer Name Taxpayer Identification Number Tax Year: _2011_ Election to Defer Recognition of Gain by Purchasing Replacement Animals a. Declaration of Election. The taxpayer elects under IRC Section 1033(e) of the Internal Revenue Code to defer recognition of gain from excess livestock sold because of weather related conditions. The following information is provided in accordance with IRC Section 1033(e). b. Evidence of the weather related condition. The drought conditions evidenced by the rainfall report attached to this statement caused the taxpayer to sell 100 head of raised beef cows and 4 purchased bulls rather than the 15 head of cows and 1 bull which would have normally been sold in 2011. c. Calculation of gain realized from the sale or exchange of the livestock. Total Realized Gain Net Income from the Sale Tax Basis at Date of Sale Total Gain Realized Raised Cows $ 80,000 0 $ 80,000 Purchased Bulls $ 6,400 4,800 $ 1,600 d. Total number of animals sold and calculation of gain realized per head. Number of Animals Sold 2011 actual number sold 2011 usual/normal sale number 2011 number sold in excess of normal Raised Cows 100 head 15 head 85 head Purchased Bulls 4 head 1 head 3 head Gain Realized per Head Total Gain Realized ÷ Number of Head Sold Gain Realized per Head Raised Cows $ 80,000 100 $ 800 Purchased Bulls $ 1,600 4 $ 400 e. Amount of gain to be deferred until the cows and bulls are replaced according to IRC Section 1033(e). Amount of Gain Deferred Gain Realized per Head x Number of Head Sold in Excess of Normal Total Gain Deferred Raised Cows $ 800 85 $ 68,000 Purchased Bulls $ 400 3 $ 1,200