Income Tax

advertisement

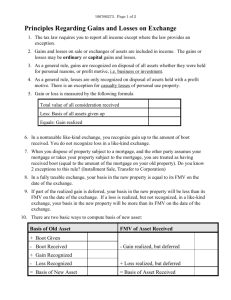

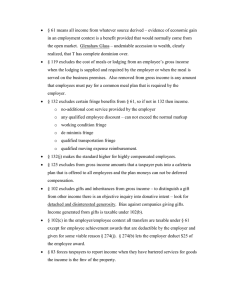

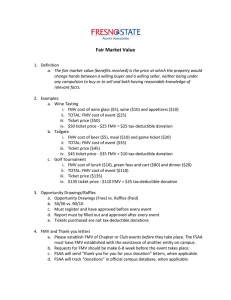

Income Tax Chapter 14 (Determination of Gain or Loss and Basis Consideration) I) Considerations upon sale or disposal of property A) Is there a realized gain or loss? B) If yes, is the gain or loss recognized? C) If yes, what is the nature of the gain or loss? D) If replacement property is acquired what is it's basis? II) Determination of realized gains and losses A) Basic formula: Amount realized - Adjusted basis (recovery of capital doctrine) = Realized gain or loss 1. Amount realized is sum of cash plus FMV of other property received less selling expense a. Also includes any liability assumed by buyer 2. Adjusted basis: Original basis plus capital additions minus capital recoveries a. Original basis depends upon manner of acquisition i. If purchased basis equal cost(cash plus FMV of other property given plus liabilities assumed) a) Lump sum purchases of assets - allocate cost b) Identical properties purchased at different times and amounts ii. If received as gift -- basis depends upon whether disposition will result in a gain or loss. a) Basis for gain -- substituted basis (donor's basis) b) Basis for loss -- lesser of: Donor's basis or, FMV at time of gift c) Adjustment for gift tax paid 1) Gifts before 1977 add 100% of gift tax paid (cannot exceed FMV of gifted property) 2) Gifts after 1976 add portion of gift tax which relates to appreciation. Formula for determination: Appreciation --------------------------FMV X Gift tax paid d) Holding period 1) If substituted basis then substituted holding period 2) If loss basis applies then hold period starts on date of gift iii Inherited property a) Basis generally is FMV on date of death 1) Alternate valuation date b) Sale always results in long-term gain or <loss> b. Capital Additions -- Capital improvements c. Capital recoveries -- depreciation, insurance proceeds, casualty/threft loss deductions. d. Other basis considerations i. Disallowed losses under Section 267 ii. Conversion of property to business use from personal use iii. Wash sale rules iv. Allocation of stock basis upon receipt of nontaxable stock dividends or nontaxable stock rights v. Amortization of discounts and premiums. vi. Special rules for tax straddles -- Section 1092 III) Will gain or loss be recognized? A) General rule -- All realized gains and losses will be recognized B) Many exceptions!!! 1. Losses on personal assets never recognized! 2. Certain nontaxable exchanges 3. Involuntary conversion gains 4. Certain other property transactions 5. Note -- many of the exceptions are elective