Syllabi FIN4214 Financial Statement Analysis

advertisement

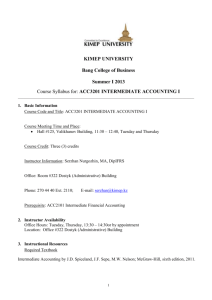

KIMEP University Bang College of Business (BCB) Fall Semester 2013 Course Syllabus for: FIN4214/ACC4208 INTRODUCTION TO FINANCIAL STATEMENT ANALYSIS ____________________________________________________________ 1. Basic Information Course Code and Title: FIN4214/ACC4208 INTRODUCTION TO FINANCIAL STATEMENT ANALYSIS Course Meeting Time and Place: Group 1: #117 (New Academic Building), 14:30 –15:45, Monday, Wednesday Group 2: #118 (New Academic Building), 17:30 –18:45, Tuesday, Thursday Course Credit: Three (3) credits Instructor Information: Akhliddin Ismailov, MBA Office: Room #318 Dostyk (Administrative) Building Phone: 270 44 40 Ext. 2140 E-mail: ismailov@kimep.kz Prerequisite: FIN3121 Principles of Finance FIN3101 Financial Institutions and Markets 2. Instructor Availability Office Hours: Monday – Thursday 16:00 – 17: 00 Location: Room #318 Dostyk (Administrative) Building Teaching Assistant Information: Danara Utemis E-mail: danara.utemis@kimep.kz Phone: 270 44 40 Ext. 2140 3. Instructional Resources Required Textbook Financial Statement Analysis and Security Valuation, Stephen H. Penman, Mc Graw Hill 4th ed. Optional text Please consult your KIMEP library for additional text available for this course. On-line sources: You will also be encouraged to access course information on KIMEP Network disk L:\ Akhliddin Ismailov Cases and Additional Readings: Listed in Course Schedule below, available on L-Drive, etc. 4. Course Description/Overview The course will examine the fundamental techniques of financial statement analysis. Building upon a review of accounting and investment concepts, the course will cover the analysis and interpretation of financial accounting information including the balance sheet, income statement and statement of cash flows. The course will also examine the use of accounting information in investment and credit decisions, including valuation and debt ratings 1 5. Learning objectives At the end of the course, students should be able to do the following: KNOWLEDGE: Integrate financial statement analysis with corporate finance Exploit accounting as a system for measuring value added Compare different technologies on a cost/benefit criterion Build from first principles SKILLS: Students will learnt to How intrinsic values are calculated How to pull apart the financial statements to get at the relevant information How growth is analyzed and valued How businesses are analyzed to assess the value they create How to do business forecasting APPLICATION ABILITIES: Students will be able to Assess the quality of the accounting Evaluate risk and return Calculate the P/E ratio that should be Pull apart the financial statements to get at the relevant information VALUES AND ATTITUDES: Students practice KIMEP Core Values Academic honesty Respect for peers and instructors 6. Teaching Methodology The format of the course is basically lectures but also includes the following: Tutorials, problem solving Case studies and discussions Group projects 7. Assessment Scheme Continuous Assessment Short exams (4*12%) Project (1*12%) Final Assessment Examination 60% 48% 12% 40% 40% TOTAL 100% ASSESSMENT IN DETAIL Organizational Note: For the group project, you should form groups of four (4) students. (60%) Continuous Assessment This part of assessment will include both group and individual components, as follows: 2 (48%) Four short exams, 12% each, throughout the course, which will include problem solving and quizzes (multiple-choice questions). The exact date of each will be agreed with the students in the class (12%) one project performed by a group of students (40%) Final Examination The final examination will be close-book and of two or three hour duration. 8. Grading Scale Letter grades for the course will follow the same standards as specified in the Catalog. See the following table for grading scale: Letter grade A+ A AB+ B BC+ C CD+ D DF Numerical scale or percentile 90-100 85-89 80-84 77-79 73-76 70-72 67-69 63-66 60-62 57-59 53-56 50-52 Below 50 9. Course Policies and Instructor’s expectations of students Students must attend 80% of the classes and those who are more than five minutes late will be marked absent. Academic honesty: We have a zero tolerance policy for academic dishonesty. Check the catalog for details. Cell phones: should be turned off at the beginning of the class, or put it on vibrate or silent mode (in case of emergency). Information dissemination: Information regarding this course and assignments will be given by the instructor during the class or can be found on the L-drive. No checking E-mails or surfing the Internet during the class. Students are also expected to check their Umails. Enrollment in the course constitutes an agreement with the terms and requirements in this syllabus. 10. Period-by-period Schedule (Tentative) Week 1 2 3 Chapter Chap 1 Chap 2 Chap 3 Topics, Readings & Activity Introduction to Investing and Valuation Introduction to the Financial Statements How Financial Statements Are Used in Valuation Short Exam#1 Chapter 1, 2, 3 3 4 Chap 4 Cash Accounting, Accrual Accounting, and Discounted Cash Flow Valuation 5 6 Chap 5 Chap 6 Accrual Accounting and Valuation: Pricing Book Values 7 Chap 8 The Analysis of the Statement of Shareholders` Equity Accrual Accounting and Valuation: Pricing Earnings Short Exam#2 Chapter 4, 5, 6 8 MID-TERM BREAK The Analysis of the Statement of Shareholders` Equity 9 Group project#1 The Analysis of the Statement of Shareholders` Equity 10 Chap 9 11 Chap 10 Short Exam#3 Chapter 8, 9, 10 12 13 14 15 16 The Analysis of the Cash Flow Statement Chap 11 Chap 12 Review The Analysis of Profitability The Analysis of Growth and Sustainable Earnings Short Exam#4 Chapter 11, 12 Preparation to final exam Course objectives and their assessment COURSE OBJECTIVES AND THEIR ASSESSMENT Learning Outcomes How they taught Understand the reformulation of the statement and its importance. How management can create value (and losses) for shareholders with share transactions. Chapter on the analysis of the Statement of the Shareholders Equity Short exam, project Understand what a valuation technology looks like. How a valuation model provides the architecture for fundamental analysis. Chapters on the valuation of the financial statements Short exam, project Understand how the dividend discount model works (or does not work). Why free cash flow may not measure value added In operations. Chapters on Cash Accounting, Accrual Accounting, and Discounted Cash Flow Short exam. What balance sheet and income statement ratios reveal. Chapters on the analysis of financial statements Short exam, project 4 will be How to assess