File

advertisement

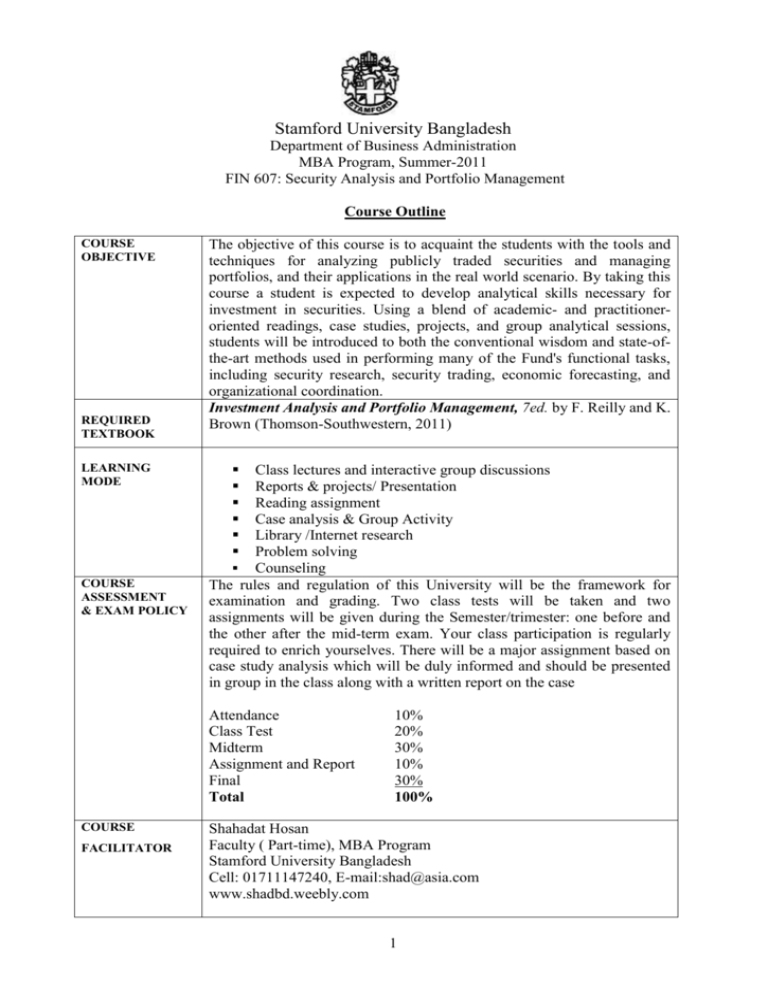

Stamford University Bangladesh Department of Business Administration MBA Program, Summer-2011 FIN 607: Security Analysis and Portfolio Management Course Outline COURSE OBJECTIVE REQUIRED TEXTBOOK LEARNING MODE COURSE ASSESSMENT & EXAM POLICY The objective of this course is to acquaint the students with the tools and techniques for analyzing publicly traded securities and managing portfolios, and their applications in the real world scenario. By taking this course a student is expected to develop analytical skills necessary for investment in securities. Using a blend of academic- and practitioneroriented readings, case studies, projects, and group analytical sessions, students will be introduced to both the conventional wisdom and state-ofthe-art methods used in performing many of the Fund's functional tasks, including security research, security trading, economic forecasting, and organizational coordination. Investment Analysis and Portfolio Management, 7ed. by F. Reilly and K. Brown (Thomson-Southwestern, 2011) Class lectures and interactive group discussions Reports & projects/ Presentation Reading assignment Case analysis & Group Activity Library /Internet research Problem solving Counseling The rules and regulation of this University will be the framework for examination and grading. Two class tests will be taken and two assignments will be given during the Semester/trimester: one before and the other after the mid-term exam. Your class participation is regularly required to enrich yourselves. There will be a major assignment based on case study analysis which will be duly informed and should be presented in group in the class along with a written report on the case Attendance Class Test Midterm Assignment and Report Final Total COURSE FACILITATOR 10% 20% 30% 10% 30% 100% Shahadat Hosan Faculty ( Part-time), MBA Program Stamford University Bangladesh Cell: 01711147240, E-mail:shad@asia.com www.shadbd.weebly.com 1 Course Contents S.l 1 2 3 4 5 6 7 Discussion Topics Investment and Portfolio Management, Objectives of Investment, Investment Constraints, Portfolio Management Process. Organization and Functioning of Securities Markets, Security Market Indicator Series, Efficient Capital Markets. Measures of Risk and Return, Determinant of Required Rate of Return, Relationship between Risk and return, Risk measures for portfolio, estimation issues, and efficient frontier. Capital market theory: CAPM, Empirical Tests, Relationship between Systematic Risk and Return. Multifactor Models of Risk and Return: APT, Multifactor Models and Risk Premium. Analysis of Financial Statement: Major Financial Statements, Analysis of Financial Ratios, Comparative Analysis of Financial Ratios. Introduction to Security Valuation: Three Step Valuation Process; Theory of Valuation; Valuation of Alternative Investments; Relative valuation Techniques, Estimating the Inputs. Relevant Chapters Reilly & Brown- Chap 1, 2 Reilly & Brown- Chap 4, 5, and 6 Reilly & Brown- Chap1, 7 Reilly & Brown- Chap 8 Reilly & Brown- Chap 9 Reilly & Brown- Chap 10 Reilly & Brown- Chap 11 8 Macroeconomic and Market analysis: Economic Activity Reilly & Brown- Chap 12 and Security Markets, Cyclical Indicator Approach to Forecasting the Economy; monetary variables, the Economy and Stock Prices. 9 Stock Market Analysis: Applying the DDM model, Reilly & Brown- Chap 13 valuation using relative valuation Approach, Estimating Expected ESP, Estimating Earning-Multiplier, calculating Expected Rate of Return. 10 Industry Analysis: Business Cycle and Industry Sectors, Reilly & Brown- Chap 14 Structural Economic Changes, evaluating Industry Life cycle, estimating Industry rate of Return, Industry Analysis using Relative Valuation Approach. Company Analysis and stock Valuation: Company Reilly & Brown- Chap 15 Analysis versus Valuation of Stock; Economic, Industry and Structural Links to Company Analysis; Company Analysis, Estimating Intrinsic value, Company Earning Multipliers, Additional Measures of Relative Value, Analysis of growth Companies, Measures of Values Added. 11 12 Derivative Securities: Call Option and put Option, Reilly & Brown- Chap 21 Forward and Future Contracts. & 22 -The End- 2