Corporate Finance Case Studies - Shanghai University Syllabus

advertisement

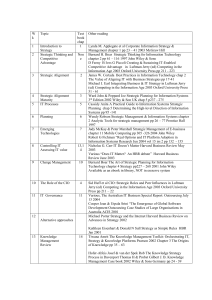

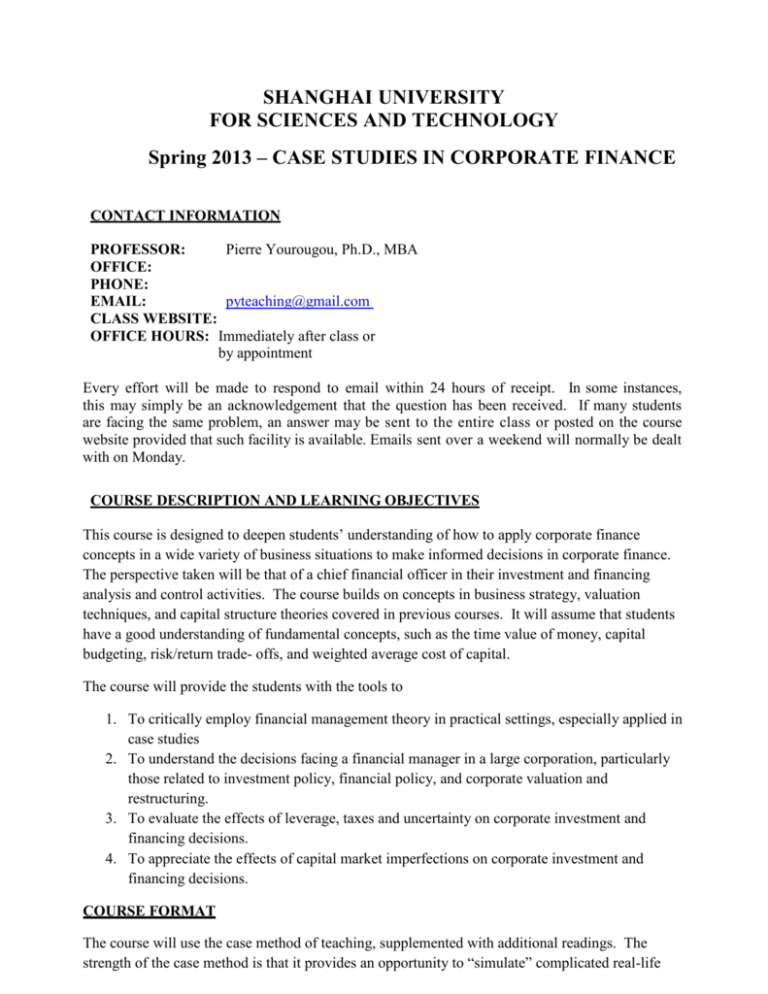

SHANGHAI UNIVERSITY FOR SCIENCES AND TECHNOLOGY Spring 2013 – CASE STUDIES IN CORPORATE FINANCE CONTACT INFORMATION PROFESSOR: Pierre Yourougou, Ph.D., MBA OFFICE: PHONE: EMAIL: pyteaching@gmail.com CLASS WEBSITE: OFFICE HOURS: Immediately after class or by appointment Every effort will be made to respond to email within 24 hours of receipt. In some instances, this may simply be an acknowledgement that the question has been received. If many students are facing the same problem, an answer may be sent to the entire class or posted on the course website provided that such facility is available. Emails sent over a weekend will normally be dealt with on Monday. COURSE DESCRIPTION AND LEARNING OBJECTIVES This course is designed to deepen students’ understanding of how to apply corporate finance concepts in a wide variety of business situations to make informed decisions in corporate finance. The perspective taken will be that of a chief financial officer in their investment and financing analysis and control activities. The course builds on concepts in business strategy, valuation techniques, and capital structure theories covered in previous courses. It will assume that students have a good understanding of fundamental concepts, such as the time value of money, capital budgeting, risk/return trade- offs, and weighted average cost of capital. The course will provide the students with the tools to 1. To critically employ financial management theory in practical settings, especially applied in case studies 2. To understand the decisions facing a financial manager in a large corporation, particularly those related to investment policy, financial policy, and corporate valuation and restructuring. 3. To evaluate the effects of leverage, taxes and uncertainty on corporate investment and financing decisions. 4. To appreciate the effects of capital market imperfections on corporate investment and financing decisions. COURSE FORMAT The course will use the case method of teaching, supplemented with additional readings. The strength of the case method is that it provides an opportunity to “simulate” complicated real-life situations without having the luxury of years of professional experience. By using complex realworld problems as a focus, cases are designed to challenge students to develop and practice skills that will be appropriate to practical problems that will be faced in their careers. As in real-life situations, it is unlikely that any two people would assemble the data or make inferences identically. Rather, case studies require independent thinking and grappling with the multidimensional nature of the decision-making process. Like any manager in a business, cases will be approached under time pressure, with decisions based on limited knowledge, and facing many unknowns. Therefore, all students are urged to actively participate in solving, writing up and presenting the cases. Students should have a good understanding of basic finance concepts, as well as some mathematical skills in algebra. COURSE MATERIALS TEXTBOOK: There is no required textbook for this course. Recommended textbook: Eugene F. Brigham, and Phillip R. Daves (BD), Intermediate Financial Management, 11th edition, South-Western Cengage Learning, 2012. Please note that any previous version or international version will be fine. The recommended textbook is used for background knowledge for those who need it. LECTURE NOTES: Lecture notes will be handed out in class or made available through the course reader. The lecture notes are designed to summarize the background theoretical concepts covered in the case studies, but they are not sufficient in and of themselves to substitute for a student’s own note- taking and reading of the recommended textbook. ARTICLES: Students are strongly encouraged to follow the financial news media for themselves. Recommended newspapers include The Wall Street Journal and Financial Times; recommended magazines include The Economist, CFO Asia EXCEL: A good knowledge of Excel is advantageous. A financial calculator will also be needed for the course, and should be brought to each class for use in solving problems and exercises. GRADING There will be a mid-term and a final exam. The exams will be based on the concepts, principles, and computations covered in class and in the assigned readings and problems. Determination of course grade will be based upon point accumulation from the following sources: Case Reports 40 points possible Case Presentations 20 points Written exam 30 points Class Participation 10 points Total 100 points possible Your course average is computed by dividing your total points earned (from homework and exams) by the total points available. Your letter grade is determined based on the course average score. The intended grade distribution is that about 35% of the students will receive an A or A-, about 45% a B+, B or B-, and about 20% a C+ or less. Students close to a cutoff point may receive subjective consideration based on their class participation. Please participate actively, and ask questions whenever something is not clear. APPROACH TO THE CASE STUDIES Four cases are assigned and will be discussed in class. The cases describe real world situations and provide the students with an opportunity to appreciate the extent to which the “theory” and “practice” interact in reality. In general, students like the case studies but find the process of case analysis quite frustrating but educating. The cases are not exercises. Frequently, there is no unique correct answer. What is important is how one defines and addresses the problem. It is therefore essential that, as a student, you develop your own thought in studying the cases and generate your own solution before meeting with the group. You will gain more out the case studies by confronting your views with those of your team members during the case preparations and by actively participating in the class discussions. Your contributions in the class discussions are valuable and will immensely enrich your own learning experience and that of the entire class. Always come in class prepared to participate actively in the discussions. You may be randomly called upon to share your view. The write-ups should be concise, and clearly and accurately communicate your solution to the issues raised in the case. The cases will be graded based not only on the soundness of your arguments but also on the clarity of your presentation. The body of write-ups must not exceed three (3) typed pages (based on 12point font, double-spaced, 1-inch margins all around) plus a cover page. You may attach annexes of tables, computations, graphs or spreadsheets to support the main text. The case studies are team projects and must be prepared in teams of at least three students but no more than five students. Students must form their own teams. Members of the same group must submit only one hard copy of their case write-ups with their names written on the cover page. You must keep a duplicate copy of your write-up for your group. The write-ups must be turned in at the beginning of the class on the due day. If none of your group member is unable to come to class to hand in your case write-up for whatever reason, then please hand it in early to the instructor before the due date and time. In addition to submitting a write-up, each team will be asked to make one case presentation and be discussant on another case. The presentations should take approximately 15 minutes, and every team member is expected to contribute. During the case presentations, my role will be to facilitate discussion of cases and related material. I will offer my views and may present a sample solution but I will not hand out my solution for the cases. As I said earlier there is no unique solution and I don’t want to give the impression of undermining the analysis carried out by you. All the students will be required to submit at the end of the semester a peer evaluation of his or her team members , each member assessing his or her own contribution as well as the contributions of the other team member on a scale from 1 to 5, with 5 being the highest. Based on the team member evaluations, the team work portions of a student’s grade will be adjusted accordingly. ATTENDANCE POLICY It is imperative that you attend every class. Missing classes will certainly have a negative impact on your final grade. If you miss a class, it is your responsibility to keep up with materials that were covered during your absence. You may be tested on ANY material covered in class and are responsible for knowing that material regardless of whether you were in attendance. You will lose 5 points for each absence. Please prepare a name card and put it up in front of you during every class. Tentative Course Calendar Case Studies in Corporate Finance TENTATIVE CLASS SCHEDULE Spring 2013 Week # Week Starting Monday 1 4-Mar-13 Topics Part 1: Risk and Return Course Introduction :Overview of Corporate Finance Chap. 1 Risk and Return Chap. 2 and 3 Bond and Stock Valuation Chap. 4 and 5 Cost of Capital Chap. 10 Case 1: Cost of Capital at Ameritrade Harvard Business School Case #9-201-046, Harvard College, Revised 04/26/2001, 24 Pages by Mark Mitchell and Erik Stafford, Harvard Business 2 11-Mar-13 Readings (BD) Part 2: Corporate Investment Decision Corporate Valuation: Valuation Model, Value-Based Management Chap. 11 Project Valuation: Cash Flow estimation, Capital Budgeting Chap. 13 Capital Structure Decisions I: Business and Financial Risks, Effects of Leverage on Firm Value, M&M Theory, Miller Models, Hamada's Equation Chap. 15 Case 2: American Chemical Corporation by William E. Fruhan and John P. Goldsberry 3 18-Mar-13 Part 3: Corporation Financial Policy Capital Structure Decisions II: Limit to the Use of Debt, Financial Distress, Agency Cost, Asymmetric Information Chap. 16 Payout Policy: Dividends and Share Repurchases Chap. 17 Case 3: Dividend Policy at Linear Technology Harvard Business School Case #9-204-066, Harvard College, Revised 02/11/2004,18 Pages. by Malcolm P. Baker and Alison Berkley Wagonfeld 4 25-Mar-13 Harvard Business School Case #9-280-102, Harvard College, Revised 12/01/1995, 11 Pages Part 4: Mergers and Acquisitions Leveraged Buyouts, Merger Analysis (Cash Flow Valuation, Taxes, Chap. 26 Captal Structure) Case 4: Seagate Technology Buyout by Gregor Andrade, Todd Pulvino and Stuart C. Gilson FINAL EXAM Harvard Business School Case #9-201-063, Harvard College, Revised 03/12/2002, 19 Pages