IN THE HIGH COURT OF DELHI AT NEW DELHI. (ORIGINAL

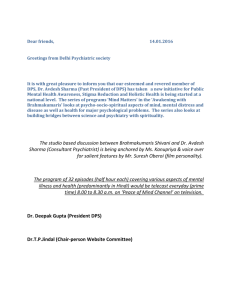

advertisement