table 1 here

advertisement

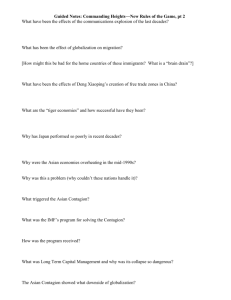

Gianni Vaggi ECONOMIC AND FINANCIAL INSTABILITY: LESSONS FORM THE ASIAN CRISIS in “International Financial Systems and Stocks Volatility: Issues and Remedies”, Edited by Nidal R. Sabri, The International Review of Comparative Public Policy, Vol. 13, Elsevier Science Ltd. 2002. Faculty of Economics, University of Pavia Via S. Felice 5, 27100 PAVIA, Italy gvaggi@eco.unipv.it Abstract The paper examines the major macroeconomic features of the 1997 financial and currency crisis of some South-east Asian countries. Within a few weeks the Thai baht, the Philippine peso, the Malaysian ringgit and the Indonesian rupiah lost 20-30% of their value against the dollar. The role of the so called ‘fundamentals’ and in particular of the current account balance is examined also with respect to the previous Mexican crisis of 1944-95. The financial and monetary crisis of 1997-98 brings to light the differences more than the analogies between the Asian economies, despite the common collapse of their currencies and stockmarkets. There was a major contagion ‘effect’, but the actual development of the crisis highlights the peculiarity of each country case as well as the role played by the International Financial Institutions. Important indications could be drawn in order to try to reduce financial and macroeconomic instability even though not all the lessons learned form that major crisis are yet being put in practice. JEL Classification numbers: F31, F41, G15, O53 Keywods: Asian crisis, currency crisis, fundamentals, instability, development. 1. The history of an economic success In June 1997 some South-east Asian countries were hit by the “Tequila syndrome”, a affliction which had struck the Mexican peso just two and a half years earlier, and which forced them to devalue their currencies. Within a few weeks the Thai baht, the Philippine peso, the Malaysian ringgit and the Indonesian rupiah lost 20-30% of their value against the dollar. Had the Asian road to prosperity and capitalism come to a dead end? Important differences and not only analogies exist between Mexico and the first four countries struck by the crisis: Indonesia, Malaysia, the Philippines and Thailand1. Moreover, there are differences between these Asian economies and those which had industrialised earlier, the first four “tigers”: Singapore, Hong Kong, Taiwan and South Korea, without mentioning China. The financial and monetary crisis of 1997-98 brings to light the differences more than the analogies between the Asian economies, despite the common collapse of their currencies and stockmarkets. There was certainly a contagion effect”, but to understand the possible future evolution of the crisis, it becomes important to single out the differences between these economies and the political conditions they operate under, which have for twenty years attracted the admiration and studies of economists. The fact remains that the once booming East Asian economy and not only troubled Latin America is doing through a grave crisis. Yet, what exactly is the East Asian model of growth and industrialisation? Between 1965 and 1996 East Asia had an average rate of per capita product growth near to 6%, in comparison with 2% for developed countries and South Asia, 1% for Latin America and negative rates for the Middle East and Africa. The average annual GDP growth rates were 7.2% from 1965 to 1980, 7.6% in the 1980s and 10.3% from 1990 to 1995 (World Bank 1989, p. 167 and 1997, p. 235; World Bank 1994, p. 7). This impressive growth led some countries, like South Korea, to increase their per capita product ten fold between 1965 and 1995, and to double it over the last ten years. As the Vice-President of the World Bank, Joseph Stiglitz, recognised, it was the success of the East Asian economies which led his organisation to reconsider some of its prescriptions and advice on political economy often indicated with the expression, Washington Consensus (Stiglitz 1998, pp. 2-3, 34). Give room to the market, liberalisation, no subsidies to companies and industrial sectors and so on. In an effort to understand the reasons for the high rates of Asian growth, the World Bank published a book in 1993 with an important sounding title: The East Asian Miracle. The World Bank emphasised how the main economic policies applied by the countries in the region were always ‘market friendly’ (World Bank 1993, Chap. 1) and hence saw no contradiction with the liberalising policies it and the International Monetary Fund advocated. However, the World Bank’s explanation for the success of the Asian model is not very convincing. Excepting the motivation of the famous “Asian values”, economic and industrial policies in these countries have been very different. Of the four Newly Industrialising Economies, or NIEs, only Hong Kong had really followed liberalising policies (Akyüz 1998 p. 1). In fact, the economic and industrial structure of the other three evolved differently and saw more or less heavy intervention by governments, reaching a high point with the South Korean five year plans. The country which most caught the imagination of economists was South Korea, which ten years ago was being touted as the next economic giant in the region, to paraphrase the title of Amsden’s book. This author argued that the role of the state and in particular the formation of human capital linked to the workplace as the key to the Korean success story (Amsden 1989, Chap. 5, par. 5.5). Robert Wade also believed that the success of South Korea and Taiwan was linked to the active role played by the state in the economy. In particular, regarding South Korea he emphasises the role of industrial and commercial policies (Wade 1990, Chap. 4, par. 3), which led in 1964 to the establishment by the government of the Korean association for the promotion of trade, or KOTRA. In practice, the state, while not opposing the market2, played and important part in orienting credit, in favouring investment, especially in manufacturing, and in incentivating and supporting exports(Chang1993). According to a study by UNCTAD, the economic growth in Asia can be interpreted by the paradigm of the “flying geese” which fly in an inverted V formation (UNCTAD 1996, pp. 75, 102-103). According to this argument, in industrial development there is a ‘product cycle’ which allots work intensive sectors to poorer countries while wealthier ones specialise in new products. However, there are countries with different levels of industrialisation and development which grow together because from time to time, they specialise in products with different degrees of technological content. Hence, there is a leading goose that leads all the rest, which in this case is, of course, Japan3. The ‘product cycle’ is associated with the growth cycles of the countries in the region. Japan is the guide supplying the technologically most advanced products, following which there are the NIEs which were the “first tigers” producing traditional manufactured goods, then following we find the ASEAN countries and China producing goods which are the most work intensive and have the lowest technological content. The model of Asian economic integration assigns a fundamental role to Foreign Direct Investment, or FDI. South East Asia is the region which has received by far the most foreign investment. (World Bank 1996, p. 95) And a substantial amount of this investment has come from within the region, as can be seen in Table 1. TABLE 1 HERE It must be remembered that these investment flows are concentrated in a few countries and even the investing countries are not very differentiated. From 1986 to 1992, over 80% of FDI in China came from only five Asian countries: Japan, Singapore, Hong Kong, South Korea and Taiwan. In Thailand, the percentage of FDI from NIEs is greater than 70%. Of the other South East Asian countries, only in the Philippines is the quota of United States investment significant. Regarding investments towards other emerging Asian countries (the so-called second tier NIEs: Indonesia, Thailand, Philippines and China), UNCTAD emphasises how the NIEs play a very similar role to that played by Japan towards them in the past (UNCTAD1996, pp. 81-85). In practice, Japan during the 1960s and 70s invested heavily in the four NIEs enhancing their growth. In the second half of the 80s, the NIEs together with Japan, invested in other Asian countries. If direct investments have surely played a vitally important role in South East Asian economic growth, regional trade has also steadily increased over the decades. From 1980 to 1994 exports from developing East Asian countries towards other countries in the same area increased nine fold, against five fold in their total exports towards the world as a whole. Direct investments and growth in trade have occurred hand in hand. Exports play a fundamental role in the scheme of Asian regional. On the one hand, from 1980 to 1994, all the economies in the area saw their exports grow towards the rest of the world, but exports within the different regional areas increased even more. The explanation provided by the “flying geese” model for the success of East Asia has the advantage of accounting for the role played by trade and investment policies which were a fundamental aspect of economic growth in the area. 2. Asian ‘flue’ and the “contagion” Some of the most interesting short term characteristics of the East Asian economic crisis are the modalities and the timing of the development of the currency crisis for the countries involved. If we go over the events taking place in the last year, we discover that the differences in the modalities and timing of the crisis between the countries involved are more interesting then the analogies. Figure 1 describes the changes in the exchanges rates and equity prices in 1996 and during the months of the crisis. FIGURE 1 HERE The currency crisis began in the second half of June 1997 with strong speculative attacks by international investment funds4(the so called hedge funds) on the baht which in the course of these two weeks lost 15% of its value with respect to the dollar (IMF 1998a, pp. 56). From July 2 there was controlled fluctuation, but towards the end of the month the loss in value was already 30%. This was not an complete surprise. For some months the Thai economy had shown strong similarities with the situation in Mexico in 1994, when the peso was heavily devalued against the dollar. In the case of Thailand there were three factors which can be considered indicators of the possibility of a financial crisis. First, a current account deficit of about 8% of the GDP, similar to Mexico’s two and a half years earlier. Second, an exchange rate substantially pegged to the dollar which had brought about an increase of the real exchange rate (which takes into account relative inflation) by 17% between 1995 and June 1997, with the resulting loss of competitivity and the risk of worsening the current account deficit (World Bank 1997b). Third, a high foreign debt and especially an extremely high ratio between short term debt and currency reserves. Between 1990 and 1996, 46% of private flows of capital were short term loans (ibid). There were thus many reasons for anticipating a crisis, which it was believed would be less extensive than the Mexican one. The rescue package needed for Thailand was originally calculated to be about 17 billion dollars, less than half the Mexican one, and in any case the devaluation of the baht was expected to be much less than the peso. In addition, between mid June and the end of August, the baht had stabilised at the rate of about 32 per dollar. It looked like a crisis which could be contained, even though the “contagion” effect towards other currencies had already begun. The “contagion” describes the situation where a country undergoes an economic shock such as a devaluation and a stock exchange crash, following a similar crisis in another country. The theories which explain the transmission mechanisms of this “virus” can be placed into two different categories. According to the first, the contagion occurs simply because economic operators, above all financial market investors, perceive significant similarities between the two economies, in particular similar pathologies, such as elevated current account deficits. Following the 1994 Mexican crisis, conventional wisdom was that deficits above 3% were difficult to sustain (Wolrd Bank 1995). In this regard there are similarities between Thailand in 1997 and Mexico in 1994. In the case of the 1994 Mexican crisis, international investors quickly abandoned Mexican government debt bonds, the Tesobonos, bringing about the devaluation of the peso. The crisis appeared to have been triggered by the excessive current account deficit, which in 1994 exceeded 8% of GDP. International investors considered this level of deficit to be inconsistent with an exchange rate of little more than 3 pesos per dollar, causing a confidence crisis. The peso was devalued by about 100% within a few months, and short term interest rates almost touched 80%. At that time, the term “Tequila effect” was coined, to express the likelihood that the Mexican crisis would involve other countries which had followed similar policies in stabilising money supply and exchange rates, principally Argentina. This country saw an increase in the differential of the interest rates of its Brady Bonds by 150 base points, with a resulting significant increase in the cost of servicing its foreign debt5. Following the December 1994 Mexican crisis, a number of factors were singled out for the construction of an index describing crises due to macroeconomic imbalances. Some argue that these three factors indicate the likelihood a currency crisis will take place: an increase in the exchange rate, a rapid expansion of credit and a low ratio between currency reserves and money supply (for some authors the current account deficit and capital flows play a secondary role) (Sachs, Tornell and Velasco 1996)6. The second mechanism of transmission concerns trade. According to this theory, an economy is “infected” because an important trading partner undergoes a currency crisis and enters into a recession. In the case of industrialised countries for the period 1959-1993, it has been emphasised that a currency crisis in a country increases the likelihood that it will also take place in other countries (Eichengreen, Rose and Wyplosz 1996). However, the prevalent mechanism of transmission appears to be linked to the existence of significant trade between countries rather than similarities in macroeconomic conditions7. In the case of the Asian currency crisis, infection was quite rapid, but not as virulent, in three other currencies: the Malaysian ringgit, the Philippine peso and the Indonesian rupiah. In was at this point that the four ASEAN countries, or the “second generation tigers”, encountered their currency crisis. Towards the end of July the peso was devalued by 15%, while the rupiah and ringgit held on for one week more and then went down, but not suddenly. Up to this stage, the crisis was worrying but not excessively, nor were its effects on the Philippines, Malaysia and Indonesia all that unexpected. In reality, the Philippines had a current account deficit which was lower than 4% of GDP, and the same could be said for Malaysia8. In 1997 Malaysia was improving its balance of payments, which in 1995 was still 10% of GDP, hence higher than Mexico’s fateful 8% in 1994 (IMF 1998a, p. 57). It should be noted that despite the high current account deficit and the very recent Mexican crisis, no currency crisis hit the ringgit in 1995 nor significantly in 1996, when information regarding the worsening Malaysian balance of payments between 1994 and 1995 became already available. This fact rebuts the hypothesis of “contagion” due to analogies in macroeconomic imbalances. In Malaysia’s case, an important compensating factor was considered to be its strong economic growth, which was over 9% in 1995 and had settled down to 8% in 1996. In effect, Malaysia had not been influenced by the “Tequila effect”, despite incorporating many of its preconditions. Instead, the crisis broke a year later in Thailand. The case of Malaysia in 1995 and 1996 indicates a phenomenon which has not been adequately highlighted and which may indicate how international investors and the great financial centres considered East Asia a promising area thanks to high levels of GDP growth and perhaps also to the duration of the same growth. It was believed that crises of the type that struck Latin America at fairly regular intervals could not occur in East Asia. The mechanism or the miracle of Asian economic growth appeared to have immunised these economies despite very marked macroeconomic imbalances. In the summer of 1997, the crisis appeared to be confined to the four ASEAN countries and of smaller dimensions than the Mexican one. The press over this period contained numerous comments about how the economies of Singapore, Hong Kong, Taiwan, South Korea and China were successfully holding out. Although their currencies had been devalued, this had been limited and especially, had not collapsed ruinously. 3. The ‘second contagion’ and the breaking of the “dams” In the Autumn of 1997, three events showed how much the crisis had changed in dimension and nature, highlighting to the world the economic, political and institutional differences existing between East Asian countries. Not only did the crisis persist and the contagion continue to spread, but the “pathology” also changed character, affecting the nature of the problems that these economies had to face. To begin with, a first ‘dam’ broke. The exchange rate stabilisation effected in August failed, and the currencies of the four ASEAN countries continued to fall suddenly, devaluing for four months. By the end of January 1998, the baht had lost more than 50% of its value against the dollar, and the ringgit and peso about 45%. Successively there was a rally, with devaluation settling on between 30% to 40% for the three currencies (see Figure 1). However, during the Spring of 1998 both the stockmarkets and the currencies of these countries continued to oscillate greatly, generally downwards. The impact was felt prevalently in Thailand, whose economy appeared weaker than Malaysia and the Philippines’ making it difficult to define credible thresholds for the exchange rate and stockmarket values. The second event was the total economic collapse of Indonesia, followed in the Spring by an increasingly acute political crisis which led to the resignation of Suharto in May. The rupiah collapsed, devaluing by 85% against the dollar at the end of January, and rising only marginally to 72% in April. Of the four ASEAN countries affected by the crisis, Indonesia was the one posing the greatest problems and presenting the most fragile political and economic situation. Like Latin American countries, Indonesia had been burdened for decades with a high foreign debt, which had already amounted to 100 billion dollars before the 1997 crisis. Then there were internal ethnic tensions, especially hostility towards the dynamic Chinese community, enormous regional differences, and to cap it all off an authoritarian political system. The over thirty year rule by Suharto had been accompanied by economic growth, but of the second tier NIEs Indonesia was the country that had developed last. As late as in the mid 1980s Indonesia’s had a per capita income which was only slightly higher than India and China’s (World Bank 1989, p. 164). It had been classified as a poor, middle income country as recently as 1994. In 1995 Indonesia’s per capita income reached 980 dollars, while the Philippines’ was just over 1,000, Thailand’s 2,740 and Malaysia’s almost 3,900 (World Bank 1997c, pp. 214 –215). The third event which highlighted the seriousness of the crisis, and motivated massive intervention by the IMF, was the economic crisis in South Korea. This event is of capital importance because at this point the crisis had broken through the second ‘dam’ to become more than just a regional concern, but one which was beginning to create serious problems for financial markets and the world monetary system. In the last months of 1997, the Korean won devalued by 50% compared to the dollar, picking up a little only in Spring 1998. But the devaluation was still between 40% and 50% compared to 1996. The South Korean situation shed light on an aspect of the crisis which had hitherto remained in the dark, except for some signs in Thailand: the crisis was no longer monetary, but had become financial and had affected the banking system9. Banking crises are denoted by the insolvency of the big national and international banks due to the high proportion of irrecoverable credit, to the point of causing their collapse. In the case of South East Asian banks, the percentage of bad loans was between 10 to 20%, against 1% for United States’ banks. While it is true that in Thailand 58 financial companies had to be suspended from the very beginning of the crisis, the South Korean case was different in character and dimensions. The South Korean economic system is the closest to Japan’s in its strong links between banks, companies and the government, meaning that banking crises endanger the fundamental framework of the economy. In 1995, South Korea was classified as a high income country by the World Bank with a per capita income of 9,700 dollars (World Bank 1997c, p. 63 and World Bank 1997a, p. 215). It is the most important of the first generation NIEs, and with a GDP of 430 million dollars holds eleventh place among the economically most advanced nations, after Spain, Canada, Brazil and China, but before Australia and India. The sheer size of the initial rescue package organised by the IMF, with the help of the World Bank and the wealthier countries was astonishing: over 58 billion dollars, significantly more than Mexico’s in 1994 and that given to both Thailand and Indonesia put together. In addition, of the over 20 billion dollars directly committed by the IMF from April 10, 1998, 15 had already been granted; a clear sign of the liquidity crisis in which South Korea had already been embroiled (see Tabl2 2). The size of the bail-out and the fact that it had been added to already large loans given to Thailand and Indonesia give the Asian financial and monetary crisis such dimensions as to beg the question of the adequacy of the IMF’s resources and more generally, those of its member states, in facing crises of such magnitude. Also in South Korea’s case there had been warning signals. If we look at Figure1 we can see that in Thailand the stockmarket crisis had begun before its currency collapsed. Already in 1996 and particularly in the early months of 1997 there was a continuous deterioration in equity prices leading to a nearly 50% drop in the Bangkok stock exchange index between the Spring of 1996 and 1997. Over the same period, the Seoul stock exchange index lost about 40% of its value and was the only Asian stock exchange, aside from Bangkok’s to experience this rapid fall in its index. The currency crisis appeared to be more a product of the fall in equity prices than its cause. South Korea found itself in the midst of a liquidity crisis with a drop in reserves and the risk of a collapse in its banking system. For the first time in over twenty years it had to renegotiate with foreign creditors for its debt repayments. South Korea was already an indebted economy at the beginning of the 1980s, but until 1998 it never had to ask for a modification of its terms of payment for its foreign debt and interest rates. Indeed it was the only remaining country which had always honoured its debts. South Korea had hitherto been able to avoid debt rescheduling, a typical feature of Latin American and some Asian economies, which for fifteen years had been one of the main instruments used to face debt crises. (Vaggi 1993, pp. 97 and ff). The legend of the model debtor, which service its foreign debt thanks to a strongly growing economy had been decisively shattered. This growth in foreign debt stock is the other face of the current account deficit in the balance of payments. South Korea had experienced these from the 1960s onwards, reaching in some years 8-10% of GNP, excepting a period of surpluses in the mid 1980s. Following the Mexican crisis in 1994, it has been emphasised by economists that to judge the solidity of an economic system the reasons behind a current account deficit also had to be fathomed and not just simply note taken of its dimensions. In particular, comparisons were made between Mexico and South Korea. In Mexico the deficit was caused by an excess in imports of consumer goods and weak exports, while South Korea imported investment goods and was a strong exporter. The South Korean deficit appeared to be justified by the need for accumulation and not consumption, and yet this did not prevent the crisis from emerging in all its virulence. 4. Intervention by the IMF From August 1998, the IMF intervened with loan packages (see Table 2), including reform programs, with the aim of getting these economies back on their feet. From the start, the declared objective of the IMF was maintaining active financial channels between the economies in crisis and international markets, guaranteeing the former access to the latter. In practice, the IMF tried to prevent any block to loans10. TABLE 2 HERE The restructuring policies dictated by the IMF were not very different to traditional ones, being similar to the structural adjustment programs of the 1980s. In the event, the following main recommendations were formulated (IMF 1998b. pp. 1-2): a) Financial companies on the verge of collapse had to be closed, while those that could survive had to be kept under close surveillance. b) Fiscal tightness was recommended, in particular cuts to current spending, to cover costs due to the restructuring of the financial and credit sectors, even though some lip service was paid to the need to maintain present levels of social security outlays. Indonesia was asked to reduce or eliminate subsidies on some goods, particularly on fuel products such as petrol and kerosene, even though policy makers were well aware of the impact this would have on the population’s living standards(IMF 1998c). c) Monetary policy had to be restrictive temporarily, with increases in interest rates, to contain inflation and lessen pressure on the balance of payments. d) Exchange rates had to be flexible. e) Although not always stated explicitly, greater flexibility in the labour market was advocated, making retrenchments and hiring easier so as to rapidly reallocate manpower from crisis sectors. f) In this context, the request to liberalise access to foreign capital becomes extremely important, especially in the financial and credit sectors, so as to guarantee entry of new capital to the economy during a liquidity crisis, and to increase the participation of foreign capital in local concerns, especially in the financial sector. In South Korea’s case, the IMF insisted particularly on the removal of procedures and regulations which hindered trade liberalisation and access to foreign capital, to the point of setting the deadline of the 31 December 1997 for this to happen (IMF 1998a, box 4). Indonesia represented a special case, with an explicit connection between the concession of loans and the dismissal of Suharto. The IMF was criticised for having used the same instruments to face this crisis as it had for previous ones, underestimating the deflationary impact of the combined measures of fiscal and credit tightness. These measures would not only have a heavy impact on society, but could even bring more financial institutions and banks to the point of bankruptcy, particularly after increases in interest rates and the drop in equity and bond prices. This criticism is well founded. However, it should be noted that the Asian crisis eventually led to changes in the IMF’s approach. On the one hand, these changes were positive: the IMF rapidly changed its recommendations with regard to fiscal tightness and in particular its request for an budget surplus. The adjustment program for Thailand in August 1997 was modified for the first time at the beginning of November and then at the end of February 1998. From the initial request for a budget surplus equal to 1% of GDP, the IMF finally ended up accepting a 2% deficit (IMF 1998b, box 2). For Indonesia, the request to reach a surplus 1% of GDP in November, became a 1% deficit in the following January, given the reduction in the growth of the economy. The IMF even accepted the continuation of a budget deficit for South Korea (Ibid, box 4). In addition, the IMF insisted on measures to lessen the impact of these measures, such as the social safety nets, in favour of those sectors of the population struck hardest by the crisis. On the other hand, these continuous changes and repeated reviews of forecasts also indicate the difficulties which the IMF had in following the development of the crisis. Even the predictions regarding the effects of the crisis, especially its impact on growth rates were continually being revised downwards. During Autumn 1997 and Winter 1998, it became increasingly clear that the world was facing a different and much more serious crisis than Mexico’s in 199411. 5. The Real and financial effects of the crisis The most important effect of the crisis is on the real economy, that is, on the potential reduction in GDP, primarily due to the collapse of many companies, financial institutions and banks. In dollar terms, the figures are staggering: on the basis of the exchange rate with the dollar, the GDP of the South Korean and Thai economies was halved compared to 1996; Malaysia and the Philippines lost respectively 12% and 20%, and Indonesia’s GDP dropped from 226 to 51 billion dollars. In terms of Purchasing Power Parities which take into consideration the incidence of internal prices on the cost of living, the drop is not so catastrophic12. In any case, these figures give a measure of the loss of purchasing power of these economies on international markets and thus explain the collapse of their imports, which was by about 30% in the first quarter of 1998. Over the same period, Indonesia’s GDP, diminished by 8.5%, Malaysia’s by 1.8% and even Hong Kong saw its decrease by about 2%. It was almost as if these countries had gone backwards five or ten years. Of course, this collapse in imports led to a rapid improvement in the balance of payments and in the current account deficit, so that already in 1998, the four ASEAN countries and South Korea had a surplus in their trade balance, which progressed from a deficit of about 50 billion dollars in 1996 to a surplus of similar value in 1998 (IMF 1998a. p. 64). This striking improvement by 100 billion dollars in one year, was obtained however, mainly by a drastic contraction in imports due to the drop in domestic demand and only later by an increase in exports benefiting from the devaluation in the exchange rate. In the beginning, it was thought that the Asian crisis could be overcome fairly rapidly after Mexico’s example. There, the GDP had dropped by nearly 6% in 1995, but by 1996 it had already reached 4%. The crisis had been violent but brief, even though salaries had not yet reached 1994 levels. In Mexico’s case, international intervention, amounting to 50 billion dollars, had been sufficient to plug the holes and convince markets that the international community, particularly the United States, would aid this economy in crisis. Moreover, NAFTA ensured that the impact of the devaluation of the peso on foreign accounts would be rapid and positive. In effect, the Mexican case brought out some favourable circumstances, principally the “big brother” to the north, which guaranteed the country from a financial point of view and provided an important market for exports, also thanks to the expansion of the United States economy over the same period. However much it may be criticised, the financial, economic and political commitment by the United States in favour of Mexico played a fundamental role in stopping the crisis. In Asia, there were a number of circumstances which could have been favourable if the crisis had been limited to only a few countries, but which became boomerangs when it spread. At the very beginning many countries came to Thailand’s aid: these were Japan and Australia, but also South Korea, Malaysia, Hong Kong, Singapore and Indonesia itself (IMF 1997a and IMF 1997b). There was a sharing of the risks by the main trading partners and by others in which Thailand had made direct or financial investments. The “flying geese” model based on regional trade and direct foreign investment could have been a factor supporting the recovery of the Thai economy. But the spread of the crisis changed this advantage to a weakness when demand in neighbouring countries which supported the Thai economy fell. Indeed, the same recession could then spread to countries whose financial institutions were grounded on more solid foundations13. Regional integration could be a protective shield in the case of isolated crises, but it became a negative factor in widespread ones. To this should be added Japan’s economic stagnation beginning in 1990 , and worsening in 1992. In fact, Japan had offered to prepare a 100 billion dollar fund to rescue the East Asian economies, but this was met with the refusal by the United States and the IMF, which imposed the latter’s traditional procedures, restrictions and programs. Japan had reserves of 220 billion dollars, a trade surplus of 23% in terms of its GDP, and over 800 billion dollars worth of credit invested abroad (Bank of Italy 1998a, Appendix, p. 52). Japanese intervention was therefore credible in size, but would have probably led to disinvestment from other activities, including American bonds, with possible repercussions on the financial system of the United States and its interest rates. In any case, the Japanese proposal for a regional solution to the crisis was not adopted. Outside the region the countries hit the hardest were those trading extensively with this region. Excluding Japan, the European countries and the United States export towards Asia about 2% of their GDP. However, this figure in New Zealand and Australia reached 7-8% and these two countries suffered the most from the collapse in demand in this region. Moreover, the impact of the heavy devaluations and hence the greater competitivity of exports from the same economies caused a worsening of the trade surplus enjoyed in 1997 by the main European countries with regard to the region. The United States saw their already enormous trade deficit to increase even more. The immediate effects of the Asian crisis on the most developed economies will also be a ‘flight to quality’ of capital leaving these areas for economies with stronger currencies, like the dollar but also the Euro group, in the search for safer investments. Another aspect of the Asian financial crisis are the spreads, or the differences between interest rates on bonds issued on international markets by some developing countries, especially in Asia and Latin America, and interest on American treasury bonds. This difference is an index of “country risk” and expresses the extra cost that some countries have to pay to place their bonds. These spreads, which had gone down to about 3% in the Summer of 1997, went up to nearly 7% during the Autumn, fell again to 4.5% in Spring 1998, and rose once more in August because of the Russian crisis and That of Brazil in winter 1998-99. 6. Excesses of investment and of short-term financial inflows How could a crisis of this size occur in countries with so many positive economic indicators such as: strong and prolonged growth, high savings, very small budget deficits, controlled inflation, export diversification based principally on manufactured products and not raw materials unlike Africa and Latin America? With rates of saving and investment above 30% of GDP and the government budget under control, the NIEs did not appear to be susceptible to foreign limitations or dearth of internal savings. The 1990s carried some novelties with them, which turned out to be among the fundamental causes of the crisis. If we examine average rates of investment and savings as a percentage of GDP in the four ASEAN countries and South Korea between 1989 and 1993 we can see that the former are about 32.2% and the latter 28.9%. Even with such high rates of saving there is an excess of investment by over 3% of GDP (World Bank 1996, p. 22}. The difference between internal savings and investment must be financed by money from abroad and this shows in the current account deficit. It must be noted that an excess of investments over savings is quite a normal feature in some East Asian countries, particularly the Philippines, Thailand and South Korea (World Bank 1996, pp. 58-59)14. A study by the IMF highlighted this excess of private investment by comparing it with what had happened in the 1970s in some Latin American countries. For South Korea and Malaysia, starting in 1970, when savings exceeded investment, there was a current account surplus and vice –versa (Milesi-Ferretti and Razin 1996, pp. 24c and 24d). In contrast to Latin America in the 1980s, balance of payment deficits in Asia in the 1990s were caused by an excess of private investment. By themselves these are not considered a risk factor, because they are held to be intrinsically more efficient than public investment in that they involve a direct risk for the investor and hence a more careful evaluation of the efficiency of the enterprise is assumed (Eatwell 1997, pp. 9-11)15. Already during the 70s and 80s, the Asian economies had large current account deficits, which could be eliminated thanks to diversification of the productive base and the export boom. In addition, Asian foreign debt consisted not only of bank loans but also portfolio investments and especially direct investment, which are the direct foreign capital flows considered to be the most stable and least liable to fluctuate. This too appeared to be an element making the Asian situation much more stable than Latin America’s in the 80s16. The high rates of investment led to a significant process of accumulation even in those sectors which in the 90s had already shown excess productive capacity, like the automobile industry. But the “new tigers” insisted on wanting to repeat Japan and South Korea’s experience, to gain prominence in world automobile markets. Thus Malaysia got its national car, made in Proton City by a joint venture with Mitsubishi. But in August 1997, car sales collapsed by two thirds and the Proton went the way of the rest of the sector, having to postpone a planned increase in the production capacity of the plant. Other sector in East Asia where heavy investments were made, was new technology, especially production of semi-conductors and hardware structures. For both these products world demand did not seem to be able to keep up with potential supply. Semi-conductor prices decreased significantly which further reduced the value of exports. For many important sectors of production, one can talk about overproduction consequent to the fact that in the last twenty years a new region had entered the world market: Asia, with its old and new “tigers”. Thence derives the difficulty in making investments profitable, which was instead ensured mainly by continued export growth. Another two factors created difficulties for exports from the East Asian countries: the devaluation of China’s currency by 35% against the dollar at the beginning of 1994 and Chinese government financial support for exports. This lead to a drop in China’s export prices by about a quarter between 1994 and 1997. In addition, the increase in the value of the dollar against the yen created further difficulties for those countries in the area whose currencies were pegged to the dollar. This link had favoured exports when the yen was increased against the dollar; but then it became a problem. The result was an increase in the real exchange rate from1995 onwards and a loss in competitivity. Economic policy mistakes were also made in the 90s and particularly from 1994 onwards. In the first place, the danger of a fixed exchange rate with the dollar had been underestimated, despite clear signals after the Mexican crisis. What would have been necessary was a gradual movement away from a fixed exchange rate or at least a more flexible exchange based on a range of fluctuation as in Chile or Brazil. Another option would have been to fix the exchange with reference to a basket of currencies, including those of the major trading partners, and not just the dollar17. In the second place, governments thought they could absorb any external or internal shocks by relying on high growth rates, so that they continued to look upon only the “good side” of investment and accumulation. In addition, the countries in the region had gone through a number of speculative bubbles both in the stockmarkets and real estate. The capital that was entering these countries was not all being invested in factories and productive capacity, but also being fed into the stockmarket and real estate markets. Thus, the increasing value of shares and real estate masked the problems many financial and industrial companies had in balancing their books, making microeconomic sustainability indicators appear positive, including risk indexes for new international loans. Thanks to the continuous flow of capital, and especially short term portfolio investments, very high values were reached which in turn justified further capital flows from abroad. Paul Krugman emphasised the nature of the crisis of the financial system and argued that the exchange rate crisis was an effect rather than a cause (Krugman 1998a, pp. 5-6). The collapse of the stock exchange and the real estate market reduced the value of the assets held by listed companies and financial brokers. In turn these, when in difficulty, either sold their equity leading to further drops in share prices or bankrupted outright. A similar mechanism can be imputed to loans guaranteed by real estate. In both cases the amount of bad loans would increase, leading to further reductions in share values and triggering a confidence crisis among investors, both foreign and domestic. In these circumstances, there would be a flight from the local financial system and the beginnings of the currency crisis. The financial crisis was also due to the fact that both domestic and international operators were taken in by the so-called ‘moral hazard’, a belief that their investments were safe or that the problems financial companies and/or private banks had in balancing their accounts would be solved by government intervention or by an external investor (such as Japan) saving them from bankruptcy. International money markets are very susceptible to alternating waves of optimism and pessimism which can either lead to speculative bubbles or excessive downturns, with strong destabilising effects. Such behaviour is called ‘herding’; investors rush to invest or to sell by following leading financial operators or junk fund operators like a herd. In either of these cases, we have a self fulfilling prophesy, with overshooting, or excessive bear or bull reactions in prices. During 1998 currencies and Asian equity prices appeared to be undervalued, provoking acquisitions of businesses and companies, particularly South Korean ones, at bargain basement prices by investors and companies from OECD countries or the United States. These preoccupations were also voiced by the Malaysian Prime Minister Mahatir Mohamad as well as by Krugman (Krugman 1998b, p. 2). 7. International finance in the 90s Errors of judgement committed by Asian governments in managing the economy reflect their difficulties in interpreting the changes taking place in the international financial system in the 90s. Capital flows, particularly short term capital and currency exchanges, reached levels unheard of only ten years earlier. In 1973, currency markets exchanged from 10 to 20 billion dollars per day, in 1980 the figure was 80. But in 1992 currency transactions reached 880 billion dollars per day, becoming 1,260 billion in 1995. This was 50 times more than the entire value of world trade and 70 times more than the value of all gold and currency reserves, and these figures refer to days in which trading was average (ul Haq, Kual and Grunberg 1996, Statistical Appendix). Moreover, most of these currency transactions were extremely short lived; more than 80% last less than a week (Eatwell 1997, p. 4). This market, which lies at the centre of the international financial system, is the largest, the most liquid, the most innovative and only world market open 24 hours a day. Daily exchanges are concentrated in only a handful of international banks18 . Although this does not justify errors of judgement by governments and East Asian operators, it still explains their difficulties in facing the impact of this new situation. Hence, these economies continued to fall into debt, and increasingly over the last three before the crisis years, with short term capital. Between 1994 and 1996 net private flows more than doubled with a particularly high increase in short term credits by commercial bank and non bank creditors(IIF 1998, p. 2). Thus in the five Asian countries capital flows exploded, leading to a foreign debt structure excessively skewed towards the short term and hence susceptible to liquidity crises. A measure of the fragility of the structure of foreign debt is given by summing the current account deficit and short term debt in relation to reserves, indicating the capacity of the economy to face rapid flights of capital. Table 3 shows the three year trend for this relationship for some East Asian economies and compares it with four Latin American countries. TABLE 3 HERE South Korea’s particular situation emerges clearly from these figures: in two years it fell into incredible levels of debt, almost as if the economy had lost control of its credit and financial instruments. It did this by betting implicitly on the capacity of its economy to exploit this mass of dollars in the very short term and with high returns, thus placing thirty years of growth at risk. With the increase of short term foreign capital private institutions and the government did not move to cover this capital with financial and insurance measures in case of flight by the same capital or a collapse in the exchange rate. In the language of international finance these short term debts were ‘unhedged’. In 1996 the 30 most important chaebols showed a debt to total share value ratio of approximately 400%, bringing eight of them to bankruptcy (IIF 1998, p. 12a). Instead China, Malaysia and Chile navigated in much calmer waters, in line with economic indicators in other developing countries. The financial and credit system of many of these countries turned out to be insufficiently transparent and without rules to guarantee the stability of those institutions operating in it. There was thus a lack of intervention by the government and monetary authorities leading to the growth of unreliable financial companies which could continue to operate only thanks to the constant influx of foreign capital together with the stockmarket and real estate boom. The reasons behind the short term capital flows towards East Asia was slowing growth and especially falling interest rates in the more industrialised countries. Many institutional investors, pension and health insurance funds, invested in emerging market equity particularly in East Asia. At the same time, the spread between equity from these emerging countries and developed countries was becoming smaller, making it less expensive for local companies to secure loans on international markets (ibid., p. 11a). In contrast, the increase in spread during the crisis made it much more costly to service foreign debt. The spread on South Korean bonds compared to European bonds was nearly zero until 1997, but it increased to nearly 700 base points at the end of the same year, then coming down to 50019. Portfolio investments, especially those in bonds, were in practice part of the ‘hot money’ typically financial investments seeking high returns over the short term) that caused strong flows of capital from Mexico after December 1994. The issue of bonds by emerging markets went from 40 billion dollars in 1995 to 108 in 1997, with a peak of nearly 40 billion in the third quarter of that year (IIF 1998, pp. 5-6). Indonesia and South Korea continued to issue bonds, and so found acquirers for their bonds until Autumn 1997, which underscores once again the difficulty even institutional investors have in forecasting crises. The East Asian crisis cannot be explained only by the imposing amount of short-term capital that moves daily in the international market. But the sheer size of this phenomenon is a new factor that will pose new problems during the adjustment phase of these crisis. The liberalisation of the capital market remains an important objective, especially because it can guarantee finance for developing countries. However, in the light of the Asian crisis of 1997-98, some cautionary measures appear to be necessary. Following the Mexican crisis of 1994, the IMF recommended that those countries that had made little progress in strengthening their internal financial markets should be cautious about removing barriers to foreign capital flows, particularly short term ones (IMF 1998d). Many voices have been heard in support of a tax on short term capital flows (Eatwell 1997; ul Haq, Kaul and Grunberg 1996). Even within the IMF, studies exist which indicate that capital flows can have destabilising effects. The examples given here of countries with effective control of speculative movements of capital are Chile and Colombia, but also South Korea and Thailand in the 80s (Lee 1997, p. 3). In the presence of large movements of capital in currency markets, it becomes difficult to choose the best exchange policies and the management of the exchange rate may pose problems (Caramazza and Aziz 1998). The IMF emphasises the need to liberalise capital flows, but also indicates what conditions should be met before continuing on this track. In particular, an already solid domestic financial sector should already be in place, carefully controlled and transparent. In addition, controls over capital movements should be removed only gradually (Fischer 1997, pp. 5-6). 8. Asian countries and the Latin American syndrome? Does the crisis of 1997 mark the end of the East Asian miracle? Would the area become a second Latin America with continuous currency and financial problems(see also Palma 1998)? Some considerations can be attempted. Certainly a high growth economic phase closed with 1997, these countries will have fluctuations in GDP and the exchange rates and equity prices, together with growing unemployment. This latter problem is particularly grave because we are dealing with countries which had been used to long periods of high economic growth, nearly negligible unemployment and which have no social welfare buffers capable of lightening the impact of unemployment on the living conditions of the population. Some analogies with the 1980s debt crisis in Latin America exist: the Asian economies now have in common with their Latin American counterparts a huge amount of foreign debt. The existence of a very large stock of foreign debt manifests itself in the so called debt overhang. This consists in a vicious circle in which the existence of foreign debt and the costs of servicing it discourages foreign investment. Indeed, there a real risk exists for new loans, given that the resources of the country are already being used to pay arrears on already existing debt; any profits from local activities could be taxed to pay for previous debts. Moreover this crisis is more widespread and involves more than one country in the same area. Unlike the Mexican crisis, the Asian crisis is a regional one. Unlike Latin America, the Asian countries, however, have a solid industrial base and their exports are not concentrated on a limited number of primary goods, but are strongly diversified. The quality of the workforce together with the high levels of primary and secondary education ensure a high quality of human capital which will be of certain usefulness in overcoming the crisis. Their infrastructures need to be improved, but they exist, and have already made an important contribution to the fight against poverty. After the collapse of the weaker financial institutions the remaining institutions and structures will continue to allow these countries to intervene in international financial and credit markets. It must be noticed that already in 1998 some of the affected countries were able to repay part of the money received from the IMF. As soon as 1998 the Asian countries had strong trade and current account surpluses, a clear indication of the ability of the economic structure to face the crisis and to repay the loans. Inflation has increased but has also been kept largely under control. After the initial large depreciation of 1997 the exchange rates have partly recovered. At mid 2001 the percentage depreciation of the exchange rate with respect to June 1997 was: 16% for South Korea, 19% for Malaysia, 20% for Thailand, 32% for the Philippines and 43% for Indonesia. The latter country is a much more serious case; this country is still affected by political uncertainty and major economic problems. Another element which indicates the renewed strength of many economies in the region is the high level of foreign reserves which have been built there since the crisis. The four Asean countries, Malaysia, Thailand, the Philippines and Indonesia, have combined reserves of almost 100 billion dollars(excluding gold). The average amount for each country does not shield her from the risk of a possible run on the currency. But the story is different for the rest of Asia: South Korea has almost 100 billion dollars by herself. Coming to the Asian countries which have not been deeply affected by the 1997 crisis we have: Taiwan with more than 110 billion and Singapore with almost 80 billion. Therefore the economies of South East Asia plus Korea have almost 400 billion dollars of foreign reserves. This is almost the size of the United States trade deficit for 2001, but to this already impressive sum we may add the nearly 300 billion dollars of China and Hong Kong. The highest share of world currency reserves is in developing Asia and by large. In the region there is only one currency on a fixed exchange rate and hence more prone to an attack; the Hong Kong dollar has a fixed exchange rate with the dollar at 7. 8 regulated by a currency board introduced far back in 1983. Under this system, the Hong Kong Monetary Authority only issues money, the actual printing of which is delegated to three commercial banks, after having deposited the exact equivalent in US dollars in its own reserves20. Speculation already attacked the Hong Kong dollar in the first half of June 1998 but failed to achieve a devaluation and the joint reserves of Hong Kong and China seems to be a sufficient deterrent. Despite the financial crisis of 1997 the East Asian countries will continue to represent an pole of growth for trade and the world economy, not to mention a pole of attraction for direct and portfolio investments. East Asia will continue to be an important competitor on international markets for the most industrialised countries. However the whole of East Asia may now face another problem, which is not limited to the countries involved in the 1996 crisis. The slowdown of the American economy in 2001, the persistent recession in Japan and the signs of an over-capacity in the sectors linked to the new and information technology may lead to a reduction of demand on these markets, which are of great importance for the Asian economies. Both the growth rate of the GDP and of exports of east Asia could suffer. The continuing long stagnation of the Japanese economy seems to have set in a type of sclerosis, reminiscent of the “liquidity trap” described by Keynes, when businesses refuse to invest even at minimal interest rates. One cannot exclude the risk of widespread deflation, especially if Europe and Japan continue with policies which do not encourage growth in demand(Akyüz 1998, pp. 8 and ff.). The Asian crisis of 1997 is different to previous currency crises of the 90s 21 and teaches us that no economy is immune from financial crises. But perhaps this will be a continuing characteristic denoting economic fluctuations that we will just have to get used to. References Akamatsu, K. 1962. “A Historical Pattern of Economic Growth in Developing Countries” The Developing Economies vol. 1 n. 1 March-August. Akyuz, Y. 1998. The East Asain Financial Crisi: Back to the Future? UNCTAD mimeo Geneva. Amsden, A. 1989. Asia’s Next Giant. On South Korea and Late Industrialization Oxford University Press Oxford. Bank of Italy 1998a. Relazione Generale Rome May. ---------------- 1998b. Economic Bullettin n. 30 Rome February. Caramazza F. e Aziz J. 1998. “Fixed or Flexible? - Getting the Exchange Rate Right in the 1990s” IMF Economic Issues n. 13 Washington. Chang H.J. 1993. “The Political Economy of Industrial Policy in Korea” Cambridge Journal of Economics vol. 17. Eatwell J. 1997. “International Financial Liberalization: The Impact on World Development” UNDP Discussion Papers n. 12 New York. Eichengreen B. Rose A. e Wiplosz C. 1996. “Contagious Currency Crises” NBER Working Paper n. 5681 July. Fischer S. 1997. Capital Account Liberalization and the Role of IMF, IMF, Washington, September. Grilli E. 1994. Interdipendenze macroeconomiche Nord-Sud il Mulino Bologna. Heidensohn K. 1995. Europe and World Trade, Pinter, London. Krugman P. 1998a. What Happened to Asia, mimeo, January. Krugman 1998b. Fire-Sale FDI, mimeo, Maggio. IIF 1998. Institute of International Finance Capital Flows to Emerging Market Economies January. IMF, International Monetary Fund 1998a. World Economic Outlook, May, Washington. ---------------------------------------- 1998b. The IMF’s Response to the Asian Crisis, April, Washington. ---------------------------------------- 1998c. IMF Survey May11 Washington. ---------------------------------------- 1998d. IMF Survey April 6 Washington. ---------------------------------------- 1997a. IMF Survey August 18 Washington. ---------------------------------------- 1997b. IMF Survey September 17 Washington. Lee Jang-Yung 1997. “Sterilizing Capital Inflows” IMF Economic Issues n. 7 Washington. Lopez J. G. 1997. “Mexico’s Crisis. Financial Modernization and Financial Fragility” Banca Nazionale del Lavoro Quarterly Review vol. L n. 201 June. Milesi-Ferretti G.M. e Razin A. 1996. “Current Account Sustainability: Selected Asian and Latin American Experiences” IMF Working Paper n.110 Washington. Palma G. 1998. “Three and a half cycles of ‘mania’, panic and [asymmetric] crash’: east Asia and Latin America compared” Cambridge Journal of Economics vol. 22 n. 6 November Sachs J. Tornell A. e Velasco A. 1996. “Financial Crises in Emerging Markets: the Lessons from 1995” NBER Working Paper n. 5576 May. Stiglitz J. E. 1998. More Instruments and Broader Goals: Moving toward the PostWashington Consensus, WIDER Annual Lectures 2, Helsinki. Taylor L. 1991. Income Distribution, Inflation and Growth-Lectures on Structuralist Macro-economic Theory, MIT Press Cambridge, Massachusetts. ul Haq M., Kaul I. e Grunberg I. 1996. The Tobin Tax: Coping with Financial Volatility, Oxford University Press Oxford. UNCTAD 1997. Trade and Development Report, 1997, United Nations Publications, New York and Geneva. ------------ 1996. Trade and Development Report 1996 United Nations Publications New York and Geneva. Vaggi G. 1993. “A brief debt story” in G. Vaggi (editor) From the Debt Crisis to Sustainable Development - Changing Perspectives on North-South Relationships Macmillan London. Wade R. 1990. Governing the Market Princeton University Press Princeton. World Bank 1997a. The state in a changing world - World Development Report Oxford University Press, New York. -------------- 1997b. World Bank News October 23. -------------- 1997c. Global Development Finance Washington. -------------- 1996. Managing Capital Flows in East Asia The World Bank Washington. -------------- 1995. Latin America after Mexico: Quickening the Pace World Bank Report in World Bank News 15.6.1995. -------------- 1994. Global Economic Prospects and the Developing Countries Washington. -------------- 1993. The East Asian Miracle: Economic Growth and Public Policy Washington. --------------- 1989. World Development Report 1989 Oxford University Press. TABLES AND FIGURE Table 1. Direct Foreign Investment in East Asia according to origin and destination (1986-92). Economy Receiving Economy (or region) (percentage of FDI from the economy of origin) Of origin China Indonesia Malaysia Philippines Thailand Hong Kong 62.8 7.6 3.1 10.4 17.1 South Korea 0.4 5.7 5.5 3.3 0.6 Singapore 1.3 3.8 6.8 1.5 9.5 Taiwan 6.4 8.0 22.3 2.7 8.2 Total NIEs 70.9 25.1 37.7 17.9 35.4 Japan 10.2 17.6 22.2 26.4 35.6 NIESs + Japan 73 59.9 44.3 71 42.7 Source: Figures based on World Bank data, 1996b, p. 29. Table 2. Commitments by the International Community and Loans by the International Monetary Fund in Response to the Asian Crisis (billions of US dollars) Commitments Loans by IMF Country IMF1 Multilateral2 Bilateral3 Total to 10 April 1998 Indonesia 9.9 8.0 18.7 36.6 3.0 S. Korea 20.9 14.0 23.3 58.2 15.1 Thailand 3.9 2.7 10.5 17.1 2.7 Total 34.7 24.7 52.5 111.9 20.8 1 IMF loans amount to 36 billion dollars if we include those given in 1997 to the Philippines. 2 World Bank e Asian Development Bank.3 Directly by governments. Source: IMF 1998b, Box 1. Table 3. Short Term Debt plus Current Account deficit (% of reserves) 1994 1995 1996 China 42 40 35 Indonesia 139 169 138 South Korea 125 164 251 Malaysia 46 60 55 Thailand 127 152 153 Philippines 212 203 149 Argentina 151 118 110 Brazil 101 124 121 Mexico 900b 267 241 Chile 43 37 31 a . International Reserves excluding gold at the end of the period; at the end of February 1997 for Indonesia and Malaysia. b. Estimate of reserves at mid December, just before the crisis. Source: UNCTAD 1997, pp. 32-33. Figure 1. Some Asian Economies: Bilateral Exchange Rates with the Dollar Equity Prices. (In dollars per currency unit, logarithmic scale, January 5: 1996=100) Source: IMF 1998b. 1.Pegged to the US dollar. 2. Indonesia’s currency reached the low exchange rate of 14.750 rupees per dollar (corresponding to a value of 15.5 in the index used here) during the week ending January 23 1998 and recovered to 8.150 (28.1 in terms of the index) in the week ending April 10 1998. ENDNOTES 1 ASEAN gathers together more countries than these, but unless otherwise indicated, with ASEAN we shall refer to these four countries only. 2 On the type of intervention by the state which has always given room to private enterprise see also: Chang 1993. 3 See Unctad 1966 pp. 75 and ff., Akamatsu’s model has been available in English since the Sixties see Akamatsu 1962. 4 It appears that these speculative funds, the hedge funds, in the Asian currency crisis played an important role only for the baht (see IMF 1998a, pp. 5-6). 5 The Argentinian bonds had been guaranteed by United States Treasury Bonds, on the basis of the scheme laid down by the Brady Plan for indebted countries. 6 According to these authors the current account deficit and capital flows play a secondary role. 7 In the case of industrialised countries for the period 1959-1993, it has been emphasised that a currency crisis in a country increases the likelihood that it will also take place in other countries (Eichengreen, Rose and Wyplosz 1996). However, the prevalent mechanism of transmission appears to be linked to the existence of significant trade between countries rather than similarities in macroeconomic conditions. 8 The short term debt of Malaysia and the Philippines was also very limited, with only Indonesia having worrying levels of foreign debt. 9 World Bank 1998a, pp. 112 and ff., 133. For a classification of the various types of crises see: IMF 1998a, pp. 112-ss e 133. 10 Japan system of credit is one of the largest creditors of the East Asian crisis economies. Less well known is the fact that Europe has a total amount of credit to Asian banks, including China and Taiwan’s, which is greater than Japan’s. According to figures held by the Bank of International Regulations in Basel, out of a total of 357 billion dollars in foreign bank debt to the end of June 1997, Europe held over 39%, with Germany in the lead, with Japan holding over 33%, while the United States held only 8%. Thus, European bank exposition was about 140 billion dollars, a huge figure. 11 In November 1997, the IMF predicted for Indonesia a GDP growth rate drop from 8% in 1996-7, to 5% in 1997-8, and to 3% in 1998-99. Hence, one which was still positive (IMF Survey 17 November 1997). In the course of 1998, however, it recognised that GDP growth would be negative. 12 It should be noted that the negative impact on growth was limited by the fact that the currencies of China, Hong Kong, Taiwan and Singapore had not been subjected to heavy devaluations, so that the negative impact of these changes mainly involved the ASEAN countries and South Korea. 13 We have already seen that for some authors the contagion is transmitted by trade (see Eichengreen, Rose e Wyplosz 1996). 14 In economic development literature the phenomena associated with such constraints have been termed foreign exchange constraints or saving constraints, respectively (Taylor 1991, pp. 160 and ff.; Grilli 1994, pp. 151-152). Economic systems labouring under these two deficits will certainly have difficulty in launching development sustainable over the middle to long term, especially from the macroeconomic point of view. 15 For some authors it was a typical crisis due to an excess of private foreign debt, in which even capital flows which do not create debt, like the acquisition of shares and real estate by foreigners, contributed to the speculative bubble over the two markets (Akyüz 1998, p. 4). 16 The excess of private investment over private savings had already been pointed out in Mexico in 1994 where the public sector had a surplus, while between 1987 and 1994 the rate of private savings had decreased steeply (Lopez 1997, pp. 168-170). 17 It must be said, however, that exchange fluctuations are very difficult to predict: the exchange rate between the yen and the dollar went from 260 yen per dollar in 1985 to 80 in 1995, only to return to nearly 150 in June 1998, when an agreement between Hashimoto and Clinton appeared to give the Federal Reserve’s support to the yen which then rose to above 140 per dollar. These variations can be only with difficulty explained by reference to the socalled economic fundamentals. 18 IMF Survey 23 September 1996, also ul Haq, Kaul e Grunberg 1996. It is worthwhile remembering that in September 1992 both the Bank of England and the Bank of Italy were ‘taken by surprise’ by the size and weight of the so-called speculation in the world. Both these prestigious institutions sought to defend the exchange rate of their national currencies for one day and little more, consuming very significant amounts of their reserves. The crisis of the European Monetary System in 1992 was perhaps the first signal denoting this new context which had been created in the currency markets in the 90s. 19 Between 1994 and 1996, in the five economies hit hardest by the crisis, short term bank loan flows doubled and most of the new bank loans were concentrated in South Korea and Thailand. 20 The most well known example of currency board is in Argentina where a convertibility plan was devised by Domingo Cavallo which laid down the fixed exchange rate of one dollar for one peso. This measure probably helped to tame the hyper-inflation of the eighties, but certainly has created problems in the trade balance and has not shielded Argentina from the risk of a currency crisis. 21 In the case of the British pound and the Italian lira in 1992 as well as for Mexico’s peso, the decisive event was rapid devaluation, but these currency crisis were briefer.