An Improved Conceptual Framework for Financial Reporting

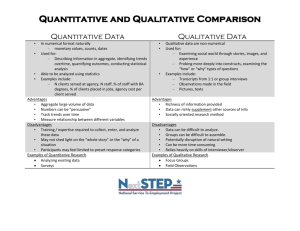

advertisement

Response to IASB/FASB Exposure Draft: An Improved Conceptual Framework for Financial Reporting: Chapter 1: The Objectives of Financial Reporting and Chapter 2: Qualitative Characteristics and Constraints of Decision-useful Financial Reporting Information By Michael Page Professor of Accounting University of Portsmouth Get a grip guys, the financial system is falling about our ears, the myth of the mighty market has been exploded and you are trying to carry on business as usual. The current version of a conceptual framework may try to be elegant but it does not address the problems of the real world. In order to create the standards needed for a stable, growing economy the Boards need to abandon some of the unfounded assumptions that they cling to and undertake a radical rethinking of how they accomplish their mission. The core assumptions that should be abandoned include: There exists a single objective for financial reporting. Financial reporting is a practical activity that serves multiple objectives: it can usefully help a number of economic and social processes but trade offs need to be made to optimise its usefulness. Market prices are the best kind of information. The credit crunch illustrates in a very vivid way the shortcomings of markets. In many situations financial reporting should enable users to calculate alternatives to market prices so that they can make informed decisions about what kind of relationship to enter into with the entity, what to buy and sell (including both securities and goods) and what to invest in (including both financial and real investment). Financial reporting should be neutral. Financial reporting exists to remedy information asymmetries and in so doing it prevents (or at least should attempt to mitigate) dishonesty, greed and idleness by the informed at the expense of the uninformed. That is to say, if it is to be effective financial reporting needs to constrain certain kinds of behaviour. Financial measurements should be statistically unbiased and statistical reliability is not important. On the contrary, biased reliable estimates are frequently more useful than unbiased unreliable ones. Where errors in one direction are more costly than errors in the other, bias may actually be a good thing. There is a sound mathematical and statistical logic underlying prudence in financial measurement. (Christoffersen and Diebold, 1997) Use of financial reporting information by financial markets is the most important kind of use. The accountability function of financial reporting may be less glamorous but it is more important for the functioning of the economy than the buying and selling of securities in secondary markets. Applying this thinking to the current draft of chapters 1 and 2 of the conceptual framework gives two grave causes for concern. Despite the overwhelming body of response to preliminary views paper, the Boards have still not provided a separate stewardship objective. Stewardship is not just about providing information for owners to take decisions, it is essentially about preventing dishonesty and lack of diligence by agents (people entrusted with other people’s resources). It does this by providing an assurance that if they are less than honest or diligent, they will be found out. That is the fundamental nature of accountability and it changes the behaviour of agents. The ED conspicuously fails to recognise this aspect of accountability. While it makes some mention of stewardship as a kind of minor byproduct of financial reporting, at no point does it recognise that financial reporting is about constraining the behaviour of agents who have the potential to act in opportunistic, greedy and self-interested ways. The substitution of ‘faithful representation’ for ‘reliability’ is confused, and if interpreted as preferring unbiased estimates, however unreliable, to reliable biased estimates would lead to very poor choices of measurement methods. A feature of the current economic crisis is that it illustrates that market values, or market informed estimates of value, are often very unreliable and that they can lead to dysfunctional behaviour by market participants and consequent instability in the financial system. We should consider whether it is the function of financial measurement not to mimic market prices, but to provide useful alternative measurements that provide a basis of comparison and a reality check. The Boards’ Questions The boards decided that an entity’s financial reporting should be prepared from the perspective of the entity (entity perspective) rather than the perspective of its owners or a particular class of owners (proprietary perspective). (See paragraphs OB5–OB8 and paragraphs BC1.11–BC1.171.) Do you agree with the boards’ conclusion and the basis for it? If not, why? I’m not sure that the answer matters much. There are some advantages to the proprietary perspective and the interests of residual claimants are different in kind to the interests of holders of fixed claims – although financial instruments can mix these up. The entity perspective would provide some difficulties since, logically, it would be necessary to calculate the cost of equity finance at some point if equity is to be treated on an equal footing with debt. The answer would become more evident if the Conceptual Framework specified the purposes of financial reporting before setting out objectives. Financial reporting does many things: it encourages management to act in the interests of stakeholders; it contributes to the smooth running of financial markets (except when it doesn’t); it forms a basis for a wide range of possible economic relationships that could not otherwise exist, it assists competition to work in factor markets; it is a source of 1 Sic – it should be BC1.16 information useful for regulation of entities and control of the economy; it may help direct funds to economically productive uses. The boards decided to identify present and potential capital providers as the primary user group for general purpose financial reporting. (See paragraphs OB5–OB8 and paragraphs BC1.18–BC1.24.) Do you agree with the boards’ conclusion and the basis for it? If not, why? In making this selection the boards appear to have elevated the status of capital providers at the expense of the notion of general purpose of financial statements. It would be better if capital providers were the exemplar of users rather than the primary users. That said, the notion of capital providers as users is a considerable improvement on the preliminary views paper. The boards decided that the objective should be broad enough to encompass all the decisions that equity investors, lenders and other creditors make in their capacity as capital providers, including resource allocation decisions as well as decisions made to protect and enhance their investments. (See paragraphs OB9–OB12 and paragraphs BC1.24–BC1.30.) Do you agree with that objective and the boards’ basis for it? If not, why? Please provide any alternative objective that you think the boards should consider. As discussed above, the nature and focus of the stewardship objective is different from information use in decisions about capital provision. A separate objective of equal prominence to the decision-usefulness objective is needed for stewardship. It is not clear that ‘capacity as owners’ is included within the category of ‘capacity as capital providers’ – clarification is needed. It could also be added that the holding of shares is a long way short of ownership of the enterprise (Kay and Silberston, 1997). One of the points about legal personality of corporate entities is to circumscribe shareholders rights and duties to be short of ownership. Chapter 2 describes the qualitative characteristics that make financial information useful. The qualitative characteristics are complementary concepts but can be distinguished as fundamental and enhancing based on how they affect the usefulness of information. Providing financial reporting information is also subject to two pervasive constraints – materiality and cost. Are the distinctions – fundamental and enhancing qualitative characteristics and pervasive constraints of financial reporting – helpful in understanding how the qualitative characteristics interact and how they are applied in obtaining useful financial reporting information? If not, why? The current kind of discussion of qualitative characteristics serves only to obscure the disjunction between objectives and recognition and measurement. Furthermore the poor quality of the reasoning relating to the different characteristics gives the chapter an air of tendentiousness. The distinction between fundamental, enhancing and pervasive serves no useful purpose. An entirely different chapter coming to different conclusions is needed. It would be much better to concentrate on measurement before looking at the qualitative characteristics that useful measurements entail. 1 Do you agree that: (a) relevance and faithful representation are fundamental qualitative characteristics? (See paragraphs QC2–QC15 and BC2.3–BC2.24.) If not, why? It would be hard to be in favour of irrelevance. But what counts as relevance? Users have different decision-models. Should financial reports attempt to provide the information they desire, or the information standard setters think they need. In practice a compromise needs to be reached. Faithful representation, as described, is a muddled concept dressed up with a valueladen name. It is muddled because of reliance on some confused notion of attempting to measure an underlying reality. For example: does ‘profit’ exist independently of a series of rules for calculating it? Arguably, no well defined notion of profit can be constructed in a world of uncertain futures and discussions of the ontology of various phenomena are probably outside the scope of the conceptual framework. The same can even be said of market prices. If an asset has not been sold, the question of what it could have been sold for at a particular time is mere conjecture, not an economic phenomenon that exists objectively. Reliability is a much more useful notion than faithful representation. In particular users need measurements that reliably return values close to the value of what they purport to represent so that users can confidently use the information in their decisionmodels. Information theory tells us that a biased reliable measure will often be better than an unbiased unreliable one, and if measurement errors in one direction are more costly than measurement errors in the other, then a biased measure may be useful than an unbiased one. The reasoning of QC9 is circular. All summarised information, such as financial reporting, is to a certain extent, incomplete in that it seeks to focus on the important characteristics of interest and to leave out the less important. In practice decisions like appropriate level of aggregation need to be taken that result in incompleteness. Of course, everything needs to be included in appropriate categories so in that respect information needs to be complete – in which case it would better just to say that nothing material should be omitted from summarisation of data. Given relevance and completeness, materiality is redundant – relevance entails including only important information and completeness means including all of it. As stated above, financial reporting should seek to constrain some behaviours (dishonesty) and encourage others (diligence) so that it cannot be behaviourally neutral. A better word than neutrality would be something like ‘independent’ or ‘impartial’. It would be good to get away from ‘neutrality’ because the ED confuses itself into thinking that neutrality implies freedom from statistical bias, which, as explained above, it shouldn’t. The paper needs to be clearer about what measurement error is and to recognise that it is a continuous variable – not a dichotomy between material and non-material amounts. (b) comparability, verifiability, timeliness and understandability are enhancing qualitative characteristics? (See paragraphs QC17–QC35 and BC2.25–BC2.35.) If not, why? Comparability of information saves users costs and legitimates the activities of standard setters. It deserves more prominence. ‘Objectivity’ would be a better word for what is called ‘verifiability’. It would be even better to replace the notion with one of ‘based on adequate evidential support’. (c) materiality and cost are pervasive constraints? (See QC29–QC32 and BC2.60–2.66.) If not, why? Is the importance of the pervasive constraints relative to the qualitative characteristics appropriately represented in Chapter 2? See previous comments. 2 The boards have identified two fundamental qualitative characteristics – relevance and faithful representation: (a) Financial reporting information that has predictive value or confirmatory value is relevant. But other information may also be relevant – some kinds of stewardship information, for example. (b) Financial reporting information that is complete, free from material error and neutral is said to be a faithful representation of an economic phenomenon. The condition is neither necessary nor sufficient. (i) Are the fundamental qualitative characteristics appropriately identified and sufficiently defined for them to be consistently understood? If not, why? See previous comments. (ii) Are the components of the fundamental qualitative characteristics appropriately identified and sufficiently defined for them to be consistently understood? If not, why? See previous comments. 3 Are the enhancing qualitative characteristics (comparability, verifiability, timeliness and understandability) appropriately identified and sufficiently defined for them to be consistently understood and useful? If not, why? See previous comments. 4 Are the pervasive constraints (materiality and cost) appropriately identified and sufficiently defined for them to be consistently understood and useful? If not, why? See previous comments. References Christoffersen, P. F., & Diebold, F. X. (1997). Optimal prediction under asymmetric loss. Econometric Theory, 13(6), 808-817. Kay, J. A., & Silberston, A. (1997). Corporate Governance. In F. M. Patfield (Ed.), Perspectives on Company Law (Vol. 2). London: Kluwer International.