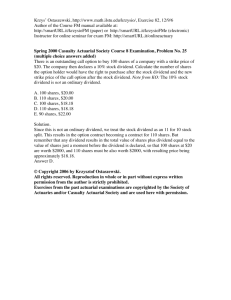

Corporate Taxation Outline

advertisement