solutions

advertisement

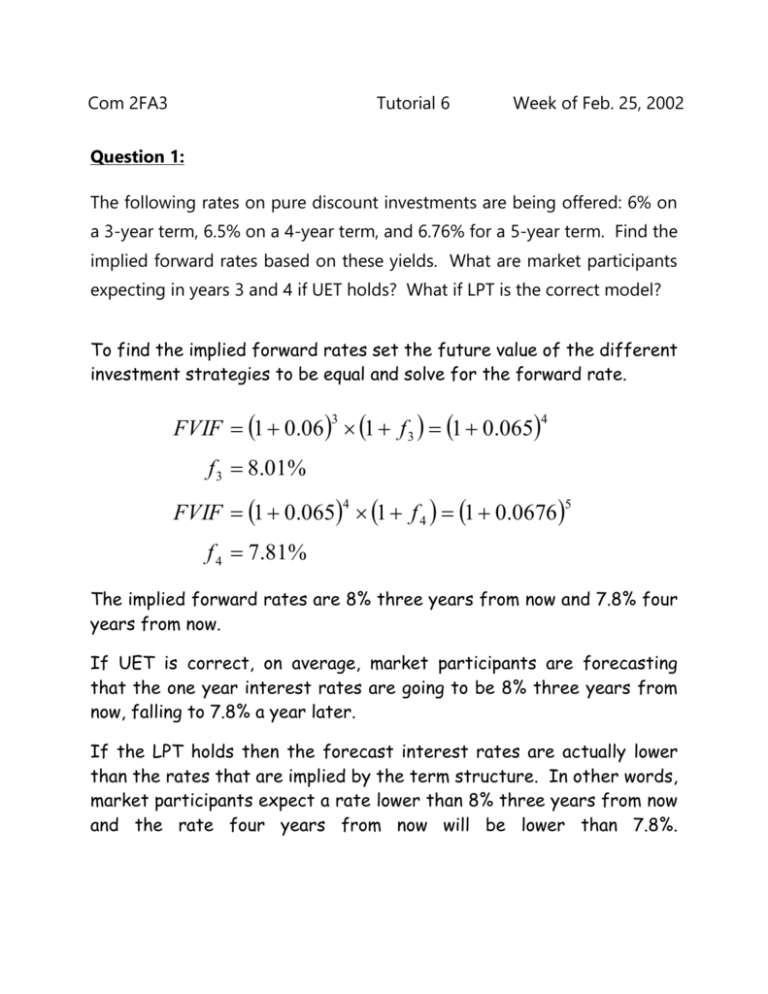

Com 2FA3 Tutorial 6 Week of Feb. 25, 2002 Question 1: The following rates on pure discount investments are being offered: 6% on a 3-year term, 6.5% on a 4-year term, and 6.76% for a 5-year term. Find the implied forward rates based on these yields. What are market participants expecting in years 3 and 4 if UET holds? What if LPT is the correct model? To find the implied forward rates set the future value of the different investment strategies to be equal and solve for the forward rate. FVIF 1 0.06 1 f 3 1 0.065 3 4 f 3 8.01% FVIF 1 0.065 1 f 4 1 0.0676 4 5 f 4 7.81% The implied forward rates are 8% three years from now and 7.8% four years from now. If UET is correct, on average, market participants are forecasting that the one year interest rates are going to be 8% three years from now, falling to 7.8% a year later. If the LPT holds then the forecast interest rates are actually lower than the rates that are implied by the term structure. In other words, market participants expect a rate lower than 8% three years from now and the rate four years from now will be lower than 7.8%. Com 2FA3 Tutorial 6 Week of Feb. 25, 2002 Question 2: You have been considering purchasing shares in PDG Inc. The company's dividends have been growing at a rate of 4.5% annually for the last 15 years and you expect this growth rate to continue indefinitely. If your require a 9.5% rate of return on this sort of investment, and you are willing to pay $40 for shares of PDG, what dividend are you expecting PDG to pay in one year? The assumptions in this question make the Gordon Growth Model the appropriate valuation model. In this case, you have P0, g, and r, you are missing the value for D1. P0 D1 rg D1 P0 r g $40 9.5% 4.5% $2 With the given values, the expected dividend is $2.00. If you had been asked the most recent dividend, that would have been D0, which is D1 present valued at the growth rate. Com 2FA3 Tutorial 6 Week of Feb. 25, 2002 Question 3: DFP has been very successful recently. Their dividends have been increasing at 25% per year. You expect this growth rate to continue for four years after which time you expect a stable growth rate of 2.5% indefinitely. How much are DFP shares worth if the most recent dividend was $4 and your required rate of return is 12% on this investment? This is a supernormal growth model problem. The initial growth rate is 25% for 4 years falling to 2.5% indefinitely. t t D0 1 g H 1 g H D0 1 g H 1 g P0 1 r gH r g 1 r t 1 r 4 $4 1.25 1.25 $4 1.254 1.025 1 0.12 0.25 1.12 0.12 0.025 1.12 4 $21.21 66.96 $88.17 It is also possible to find the present value of each of the 4 early dividends and add the PV of the price in 4 years. P4 is forecast as $115.13 based on the expected dividend in 5 years, the required rate of return and the indefinite growth rate. Com 2FA3 Tutorial 6 Week of Feb. 25, 2002 Question 4: Way2Go shares are currently trading at $57 per share. The latest reported earnings per share was $3. What percentage of the price of Way2Go shares is due to the growth potential of the company if the required rate of return is 12.5%? The P/E ratio for Way2Go is simply 57/3 = 19. There are two components of the P/E ratio, the inverse of the required rate of return and the portion that is based on growth. If Way2Go had no growth potential, the P/E ratio would be 1/r or 1/0.125 = 8. The price of Way2Go shares would be 8 x 3 = $24 if there was no potential for growth. The part of the P/E ratio that is due to the growth potential of the company is 19 - 8 = 11. The fraction of the price of Way2Go that is related to the growth potential is 11/19 = 58%.