Krzys’ Ostaszewski, http://www.math.ilstu.edu/krzysio/, Exercise 82, 12/9/6

Author of the Course FM manual available at:

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

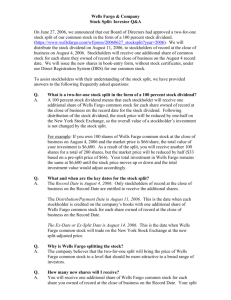

Spring 2000 Casualty Actuarial Society Course 8 Examination, Problem No. 25

(multiple choice answers added)

There is an outstanding call option to buy 100 shares of a company with a strike price of

$20. The company then declares a 10% stock dividend. Calculate the number of shares

the option holder would have the right to purchase after the stock dividend and the new

strike price of the call option after the stock dividend. Note from KO: The 10% stock

dividend is not an ordinary dividend.

A. 100 shares, $20.00

B. 110 shares, $20.00

C. 100 shares, $18.18

D. 110 shares, $18.18

E. 90 shares, $22.00

Solution.

Since this is not an ordinary dividend, we treat the stock dividend as an 11 for 10 stock

split. This results in the option contract becoming a contract for 110 shares. But

remember that any dividend results in the total value of shares plus dividend equal to the

value of shares just a moment before the dividend is declared, so that 100 shares at $20

are worth $2000, and 110 shares must be also worth $2000, with resulting price being

approximately $18.18.

Answer D.

© Copyright 2006 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited.

Exercises from the past actuarial examinations are copyrighted by the Society of

Actuaries and/or Casualty Actuarial Society and are used here with permission.