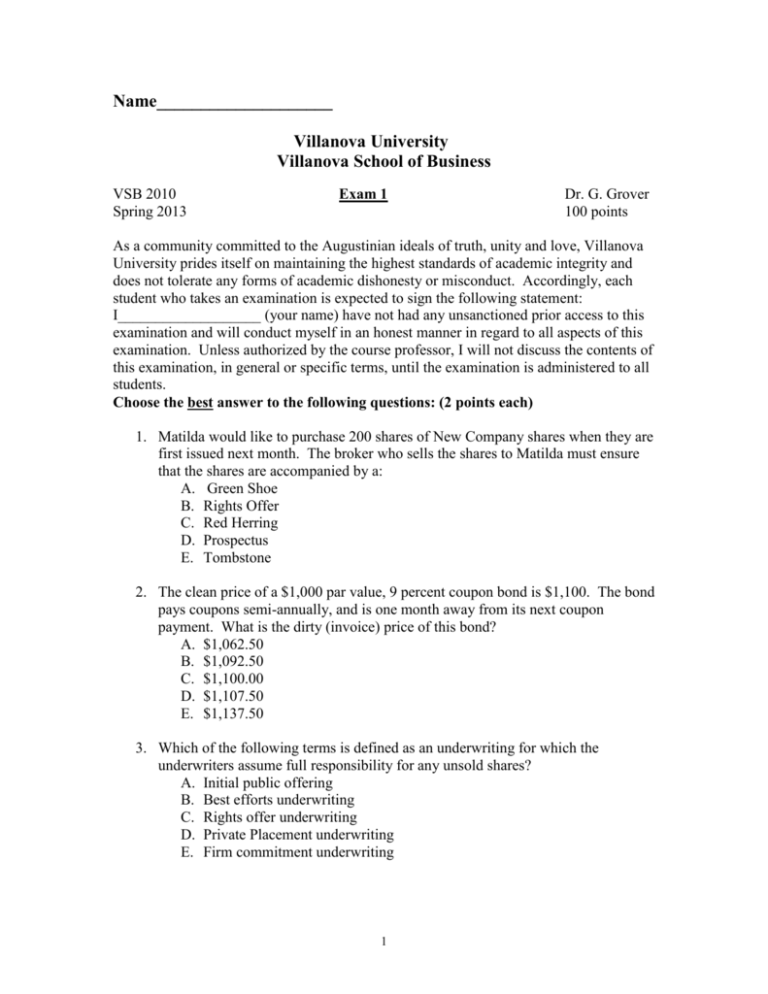

Exam 1

advertisement

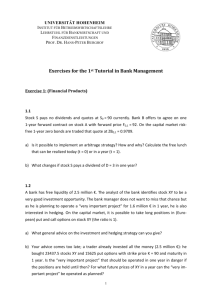

Name____________________ Villanova University Villanova School of Business VSB 2010 Spring 2013 Exam 1 Dr. G. Grover 100 points As a community committed to the Augustinian ideals of truth, unity and love, Villanova University prides itself on maintaining the highest standards of academic integrity and does not tolerate any forms of academic dishonesty or misconduct. Accordingly, each student who takes an examination is expected to sign the following statement: I___________________ (your name) have not had any unsanctioned prior access to this examination and will conduct myself in an honest manner in regard to all aspects of this examination. Unless authorized by the course professor, I will not discuss the contents of this examination, in general or specific terms, until the examination is administered to all students. Choose the best answer to the following questions: (2 points each) 1. Matilda would like to purchase 200 shares of New Company shares when they are first issued next month. The broker who sells the shares to Matilda must ensure that the shares are accompanied by a: A. Green Shoe B. Rights Offer C. Red Herring D. Prospectus E. Tombstone 2. The clean price of a $1,000 par value, 9 percent coupon bond is $1,100. The bond pays coupons semi-annually, and is one month away from its next coupon payment. What is the dirty (invoice) price of this bond? A. $1,062.50 B. $1,092.50 C. $1,100.00 D. $1,107.50 E. $1,137.50 3. Which of the following terms is defined as an underwriting for which the underwriters assume full responsibility for any unsold shares? A. Initial public offering B. Best efforts underwriting C. Rights offer underwriting D. Private Placement underwriting E. Firm commitment underwriting 1 4. If a bond’s current yield exceeds its coupon rate, the bond is selling at: A. A discount B. Par (or face) value C. A premium D. Either discount or premium, but not at par E. Not enough information available to answer the question 5. The price at which you would sell a Treasury bond would be its: A. Bid price B. Asked price C. Call price D. Put price E. Bid-Asked price 6. Which of the following bonds is likely to have the least volatility in price? A. Zero percent coupon; 5 years to maturity B. Zero percent coupon; 10 years to maturity C. 5 percent coupon; 10 years to maturity D. 8 percent coupon; 5 years to maturity E. 8 percent coupon; 10 years to maturity 7. The price of a $1,000 par value Treasury bond quoted at 95:04 is: A. $95.04 B. $950.04 C. $950.40 D. $951.25 E. $954.00 8. Which one of the following best matches the primary goal of financial management? A. Increasing the firm’s market share B. Minimizing the firm’s total expenses C. Maximizing the firm’s earnings per share D. Maximizing the market value of existing stock E. Minimizing the taxes paid by the firm 9. Leslie bought 5 Treasury bonds just auctioned off by the U.S. Treasury. She plans to sell them in about 6 months. This transaction took place in the: A. Primary, debt and capital markets B. Primary, equity and money markets C. Primary, debt and money markets D. Secondary, debt and money markets E. Secondary, debt and capital markets 2 10. A sole proprietorship: A. Provides limited liability for its owner B. Involves significant legal costs during the formation process C. Has an unlimited life D. Its income is subject to double taxation E. Is not likely to be concerned with agency problems 11. The capital structure of a firm refers to the firm’s: A. Buildings and equipment B. Combination of assets C. Combination of long-term debt and equity D. Availability of cash E. Current assets and liabilities 12. The written agreement between a corporation and its lenders that spells out the terms of the bond issue is called the: A. Debenture B. Indenture C. Registration Statement D. Trustee Agreement E. Private Placement Agreement Answers to multiple choice questions: 1.________ 2.________ 3.________ 4. _________ 5._________ 6.________ 7.________ 8. ________ 9.________ 10.________ 11. ________ 12._______ Show all your work (clearly) for full or partial credit. No credit will be given unless work is shown. When using your financial calculator, show the inputs you are entering into your calculator. Please circle your final answer. 1. Al and Hal each borrow $20,000 from their parents (remember this is a loan, not a gift), and promise to repay the amount at an interest rate of 0.50 percent per month, by making equal monthly payments to their parents. How long will it take each of them to pay back the loan if Al pays $250 each month and Hal pays $80 each month? (6 points) Al: Hal: 3 2. You plan to deposit $2,000 each quarter, starting three months from today, into a “Home Down Payment Account”. Your financial planner assures you that you will have the required $70,000 you need, 7 years from today for the purchase of your home. What APR are you being promised? (6 points) What is the EAR of the above investment? 3. Daisy Flowers has just retired with $650,000 in her retirement account. She would like $5,000 each month to pay her bills (and have some fun). She expects to receive a $1,500 check each month from Social Security, and will obtain the rest from her retirement account, which should earn an interest of 6 percent, compounded monthly. If she ends up living for 30 years in retirement, would she leave an inheritance for her children or will she be in debt at the time of her death? What will her kids be left with – inheritance or debt, and what is the amount? (6 points) 4. The Winter Comfort Company wants to raise $6 million for a construction project, by issuing zero-coupon bonds, with 25 years to maturity and a yield to maturity of 3.8 percent. How many bonds would they need to issue to raise the required amount? Use semi-annual compounding. (5 points) 4 5. Your lovely great-aunt Irma has left you a nice inheritance - $20,000 a year forever. Given an interest rate of 5 percent, how much is the inheritance worth today if: (8 points) You receive the first payment today You receive the first payment a year from now You receive the first payment 6 years from now, when you have achieved a sufficient level of maturity 6. Moe Blacko has been offered a new contract by his employer which will give him the following amounts on an after-tax basis: A sign-on bonus of $30,000 today $60,000 one year from now $70,000 two years from now and $90,000 three years from now Given an interest rate of 7 percent, what is this contract worth today? (8 points) Moe, who is independently wealthy, doesn’t plan to spend any of this money but deposit each amount as soon as he receives it, into an account earning an interest of 7 percent a year. What will the balance in the account be in February 2028? 5 7. You have decided to buy your dream car for a price of $75,000. Not being independently wealthy like Moe Blacko, you do not have the cash to pay for it. However, there is a bank willing to lend you money to buy the car, at an interest rate of 6 percent if you promise to make a 20 percent down payment and will repay the loan in equal monthly installments over the next 5 years. (10 points) What is the amount of your monthly installments? What is the total amount of interest you will be paying over the duration of the loan? You receive a big bonus one year after you have taken the loan, and would like to pay off the loan at this point. What amount must be paid off, assuming you made your scheduled payments for the first year? 8. Jack Blue plans to borrow $40,000 at an interest rate of 6 percent for a 3-year period. Calculate Jack’s payments and total interest that will be paid for each of the following types of loans: (11 points) Pure Discount Loan Interest-Only Loan Amortized Loan Year 1 _______________ _______________ ______________ Year 2 _______________ _______________ ______________ Year 3 _______________ _______________ ______________ Total Payments_______________ _______________ ______________ Total Interest _______________ _______________ ______________ Which of these loans is the best? Explain. 6 9. Mrs. Fields is planning to invest in some bonds. Her choices are: A municipal bond paying 4 percent interest A corporate bond paying a 6 percent interest If Mrs. Fields’s tax rate is 35 percent, and the above two bonds are equally risky, which of the two bonds should she invest in? Please show your work. (3 points) 10. The following bond quotation for Pepsico Inc. was obtained from Yahoo.com. Use the information to answer the questions below: (11 points) Coupon Maturity Price Fitch Rating 4.500 15-Feb-2020 116.78 AA Assume the bond pays semi-annual coupons and has a par value of $1,000. a. Calculate the current yield of the bond. b. Calculate the bond’s yield to maturity. c. You bought the above bond at the quoted price today, and sold it 4 years later for $1080. What is your holding period yield (HPY) over this time period? 11. You earned a return of 5.2 percent on your bond portfolio over the last 2 years. If the average inflation over this time period was 2.8 percent, what was your real rate of return? (2 points) 7