Paper - Faculty of Economics

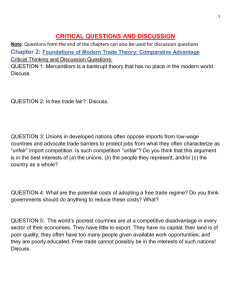

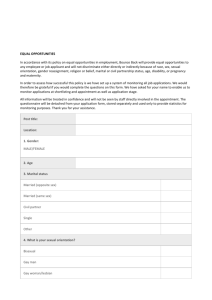

advertisement