Green Gadget business plan sample

advertisement

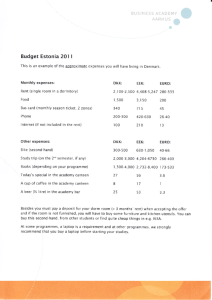

GREEN GADGETS A/S Business Plan 42435 Knowledge based Entrepreneurship E10 10-12-2010 Group 24 Delivered by s062001 Pia Michelsen s061969 Lars Rask s062347 Hildur Arna Magnúsdóttir s061974 Line K. Svenstrup s052619 Agnes Ástvaldsdóttir Executive summary Environmental thinking and sustainability has become the centre of attention within almost all aspects of product development during the last years. The focus will only increase in the future and this calls for increased awareness and thinking green. This is also the case when looking at festivals around Europe. Having a green image is becoming more and more important, and therefore festivals are putting more effort, time and financial resources into developing and using green solutions. Nevertheless, festivals generate huge amounts of waste and experience problems when they need to collect and dispose of it. Handling the waste represents a high financial cost for the festivals. At the Danish festival, Roskilde Festival, this alone presents a two-digit million expense. A big part of the waste is made up by left-behind pavilions that are used as gathering points in the camps at the festivals’ camping sites, and that are discarded after only a limited period of use. At Roskilde Festival, 8.000 pavilions are left behind and account for 50 tons equalling 5 % of the total waste. Green Gadgets A/S has designed an environmentally friendly pavilion, the Green Pavilion, made from recycled plastics, that reduces the festivals’ costs on handling the pavilions as waste and at the same time a pavilion that boosts the festivals’ green image. The music festival market is a rather homogeneous market with the same problems and needs. It is not a competitive market, which should ease the expansion of the Green Pavilion. In Europe alone, there are over 85 festivals with a total of 4.239.000 visitors every year. This means that there is a potential of 452.000 pavilions sold each year. The most vital criteria for success is to get sales agreements with the festivals around Europe as fast as possible to make sure, that the Green Pavilion will be able to penetrate the market. The overall costs call for a total of DKK 3.500.000 in capital. Green Gadgets A/S seeks an investor with the capital required for project support and production setup. After a period of six years, the investor, as well as the founders, will have an exit opportunity with a return on investment exceeding a factor 10. All five of the founders of Green Gadgets A/S are master students at DTU, studying Design and Innovation/Management, and are B.Sc. from Design and Innovation/Industrial Engineering. The education has provided the team with knowledge and experience from innovation processes and product development. Green Gadgets A/S is constructed as an “Aktieselskab”, initially holding a share capital of DKK 500.000. Green Gadgets A/S is initially owned by 5 holding companies. Each of these holding companies is owned by a founder. By providing enough capital to establish an A/S, the founding team aims to show their willingness and firm belief in the business and its prospects. [The detailed figures can be seen in appendix II - Budget model assumptions and III - Budget model]. Page 2 of 18 The Background Company profile Green Gadgets A/S has emerged from the environmental focus and the idea of thinking green. Green Gadgets A/S focuses on a major problem that most of European festivals struggle with; the thousands of pavilions that are left at the festivals each year, and that constitute a huge amount of waste that cannot be optimally disposed of. In collaboration with Green Gadgets A/S’ first customer, “Roskilde Festival”, the problem has been explored, and the problem is very obvious! Each year, 8.000 pavilions are brought to Roskilde Festival and left after ten days of music, partying and camping. These pavilions are fabricated in China and made from metal and polyethylene plastics. The quality of the product is so low, that the tendency is that festival visitors use it as a single-use product and leave it behind when they go home after the festival. When the festival ends, the 8.000 pavilions (equalling 50 tons of waste) are a part of a huge amount of waste of left behind chairs, tents, sleeping bags and other camping equipment spread all-over the festival area. The pavilions constitute a huge problem during the gathering of the waste because they cannot be properly handled by the machines cleaning the camping site. They also create a serious problem during the incineration because of the mix of metal and plastic, which cannot be optimally processed. This huge amount of waste represents a heavy, two-digit million DKK financial cost. The problem is well-known, not only at festivals in Denmark, but also at festivals around the world, who are struggling with the enormous implications of the cheap pavilions. Green Gadgets A/S produces the “Green Pavilion”, a new environmental friendly pavilion made from more sustainable materials with the possibility of reuse; recycled plastics and wood are manufactured into a pavilion consisting of a skeleton and a cloth. By establishing a re-use-system surrounding the pavilions at the festivals, the Green Pavilion helps solving the waste issues that festivals around the world deal with when handling pavilions after use. The Business Idea The pavilion is one of the most visible artefacts on the festival. It rises above the tents and creates a gathering point for the campsite visitors. This makes the pavilion an obvious target for emphasizing an environmental friendly image for the festivals. To ensure the penetration of the Green Pavilion at the festival sites, a ban against the old pavilions is preferred. Introducing the Green Pavilion will ease the waste handling for the festivals and through that foster economic gain. These facts should encourage the festivals to ban the existing pavilions. However a ban is not a specific requirement for Green Gadgets A/S. The Green Pavilion can compete with the existing discount-pavilions on properties like its durability and environmental advantages along with its many design opportunities. It is therefore attractive for Green Gadgets A/S to make sales agreements with festivals, even if a ban cannot be executed. Because of the current focus on having a green profile, many of the festivals have chosen to ban the use of pavilions, because they cause a huge financial expense. These festivals have expressed a wish to withdraw the ban of pavilions, if they are able of offering an alternative pavilion to their camping guests. Page 3 of 18 The pictures illustrate how the pavilions constitute both a negative and positive element at festivals. The Green Pavilion is made from two major components: Poles and a cloth. To support the green image of the pavilion, both components are made from recycled plastics and the poles can be reused. To strengthen the free nature of the festivals, the idea is to provide them with a pavilion that is flexible when it comes to size. The Green Pavilion comes in two different basic sizes, a small version and a big version. The small pavilion is a set of two half pavilions which can also be used as an extension on the big pavilion. The pavilion is a modular system where the users decide the final construction and size. The figure shows how the Green Pavilion is module based. The Green Pavilion will be sold to the festival visitors waiting in queue at the entry areas before entering the festival. During a festival, Green Gadgets A/S will be present on the festival site to sell additional pavilions and spare parts. After the festival, trucks will drive around the camping area to pick up used pavilions, creating an easy delivery system for the festival visitors to use. The trucks will play music and pass a positive vibe around while handling the pavilions. The system will make it easier for Green Gadgets A/S to handle the gathering Page 4 of 18 of pavilions scattered around the large festival area and enables an on-site quality check of parts, and thereby preparing the next festival already when collecting the pavilions. By handing in the used pavilions, visitors will receive a reward. The nature of this reward will be decided by each festival, since they finance the rewards with a part of the many millions they save on waste handling. When the pavilions have been gathered from the camping site, the functioning poles and joints are divided into large containers and driven to a storage facility. The broken poles and joints not suitable for reuse as well as the cloths will be transported to an incineration facility by Green Gadgets A/S. The cloth is not suitable for reuse since it tends to get very damaged and filthy. Since not all poles can be reused from year to year and new cloths also have to be fabricated, more raw material/plastic is required. This material partly comes from other products used and disposed at the festivals. The figure shows the system surrounding the Green Pavilion. The technology and the product The Green Pavilion is produced by using an already existing technology, which enables recycling of plastics. The quality of those plastics can vary greatly (in coherence with the price). The aim is that the quality of the pavilion will be robust and strong enough for festival use and reuse the following years. Recent technological development has allowed the use of wood in recycled plastics (WPC, Wood Polymer Composite), which will be used for producing the poles and joints. By using wood in the composite, less plastics are needed. As a side-effect, this combination of materials provides a natural look, which goes well with emphasizing a green image for the festival. Green Gadgets A/S has already started collaboration with the Danish company Aage Vestergaard Larsen ApS that produces this material. The cloth, which needs to be more flexible, is made from recycled plastics alone. A temporary agreement has been made with the Danish company DKI Plast A/S to produce the poles of the pavilion. They specialize in making plastic components by extrusion and injection moulding. Page 5 of 18 Market analysis Market segmentation The primary customers for the Green Pavilion are the organisers of music festivals with camping facilities. They plan the festivals and are responsible for all the practical arrangements before, during and after the festival, as well as the financial aspect. The festivals will gain an economical advantage in terms of less waste handling, they will promote their green profile and be able to offer their customers a new and better product. The end users of the Green Pavilion are the visitors of the festivals who stay at the camping facilities. These visitors are customers of the festivals. The visitors use the pavilion as a gathering point for the individual camps on the camping site, and the Green Pavilion fulfils this purpose better than the existing pavilion. Market size The market for music festivals is global. In Europe alone, there are over 85 festivals with a total of 4.239.000 visitors every year. This means that there is a potential of 452.000 pavilions sold each year. 1 The figure shows the North European market potential. Green Gadgets A/S intends to start up on the Danish market with Roskilde Festival as a pioneer. With a success at Roskilde Festival, the plan is to quickly expand to the European music festival market and maybe even further to other continents in the long-range future. 1 This number is calculated based on Roskilde Festival where it is known that there are 8.000 pavilions per 75.000 visitors. The potential number is found by dividing the number of visitors in Europe (4.239.000) by number of visitors per pavilion (9,375). Page 6 of 18 Market trends Awareness of environmental friendly products is global and the music festival industry is no exception. Festivals in Europe have a central focus on environmental issues, and therefore launch many different green initiatives. The European Festival Association nominates festivals with a green profile every year and chooses the winner of the “Green´n´Clean”-award. In England, a festival is chosen as the year’s “Greener Festival”. Competitors On the global market, there seems to be no solution focusing on an environmental friendly profile. The most widespread pavilions at festivals are pavilions fabricated in China made from metal and plastic. This model consists of steel poles as well as joints and cloths made from polyethylene plastics. The construction of the pavilion is very fragile, which means that the users at the festivals secure the joints by using tape to prevent the pavilion from falling apart, as well as repairing cuts in the cloth. The strength and green profile of the Green Pavilion will therefore make up two important parameters when competing with other pavilions. Intellectual Property Rights Due to the fact that many pavilion solutions exist on the market, seeking a patent is not the solution for Green Gadgets A/S. However, to secure the market penetration of the Green Pavilion, it is Green Gadgets A/S’ goal to apply a first-mover strategy. Green Gadgets A/S seeks to protect the Green Pavilion through design protection. Registering the design provides the exclusive right to the design in the territory in which it is registered. Design protection can be applied for all the countries that are members of the European Union, including Denmark, and lasts for 25 years. Generally, an application will take about three months to take effect. A design protection means that it will be prohibited to directly copy the design of the Green Pavilion. The design protection will ensure that competitors must spend time on developing their own design before launching a competing product. This will provide time for Green Gadgets A/S to enter the market and gain a relative market share. Strategic Market Entry Market entry execution In order to obtain a fast time to market, it is vital to make arrangements with other festivals around Europe as soon as possible. By this, the company creates an advantage regarding its strategic position as the initial occupant on the market, as well as gaining access to resources and capabilities that a follower cannot match [see Appendix I on Porter’s Five Forces]. Sales agreements with other festivals outside Denmark will be initiated after the pavilions have been tested at Roskilde Festival or even before. The test year at Roskilde Festival provides an opportunity to invite other festival organisers to observe the Green Pavilion in use – thereby convincing them to implement the concept of the Green Pavilion at their own festival and cooperate with Green Gadgets A/S. The music festival market is a rather homogeneous market with the same problems and needs. It is not a competitive market, which should ease the expansion of the Green Pavilion. European festivals work together and many are connected through the European Festival Association. They share their knowledge and have a lot of common initiatives. Page 7 of 18 Green Gadget A/S’ intention is to reach break-even in cooperation with Danish music festivals, before entering the European music festival market. That way the company will have gained financial advantages as well as experiences with the product, the market and the customers. 2011: Prototypes at Roskilde Festival 2012: Sales at Roskilde Festival 2013: Sales now include other Danish festivals 2014: Expanding to the English market 2015: Sales now include more festivals in England 2016: Sales now include even more festivals in England 2017: Expanding to Germany. Starting development of new products The figure shows the market entry execution from Roskilde Festival to Europe. Prospects In order to make sales agreements with music festival organisers abroad, the company will appoint a marketing manager that will be responsible for meeting the organisers and making the necessary arrangements, e.g. gathering statistics on the number of pavilions expected to be sold and making sure that the festival has the right facilities for selling the Green Pavilion at the camping site. This will help to secure a fast time to the European market. Marketing Strategy Green Gadgets A/S’ marketing strategy relies on close cooperation with the festivals. Festivals aim to promote themselves with green profile initiatives, and it is Green Gadgets A/S’ objective to make the Green Pavilion an initiative they will choose. By gathering the pavilions after use, the festivals cut down on their waste handling expenses. The festivals can use the initiative to raise the visitors’ awareness of the amount of waste being left at the festival and the environmental consequences that arise. The visitors are primarily young people who seek information online. Green Gadgets A/S will have its own webpage where visitors can get information on the company profile, the products and get in contact with the company. The sales agreements offer the advantage of using the festivals’ own websites as additional sales channels. This will make it possible to sell the pavilions before the festivals actually begin and thereby both make it possible to estimate the amount of pavilions needed as well as reduce the sales pressure at the festival. Having the pavilion available at the campsite during the festival provides an opportunity to attract more customers who want to buy a pavilion or extra modules. It also offers an opportunity for Green Gadgets A/S to promote the company. Page 8 of 18 Pricing The most widespread existing pavilion used at festivals sets the pricing standard on the market. This pavilion is considered the main competitor and can be found to a selling price of DKK 100. The selling price for the Green Pavilion is set to DKK 300 for the big pavilion, DKK 200 for the small one and DKK 100 for an extension module (half a small pavilion). The customers get a better product which justifies the increased price. It is also common that festival visitors share expenses when buying a pavilion for a camp, which makes the product less price-sensitive. Risks and barriers The largest risk lies within conquering the European market by making sales agreements. The strategy will be to seek out the largest and most dominating music festivals first to set the standard and thereby making other festivals follow. To have Roskilde Festival as an alliance already provides Green Gadgets A/S with a solid starting position. Roskilde Festival is a known music festival around the world and with a success many others are interested in following. Even if Green Gadgets A/S does not manage to conquer the entire European market, the business is still sustainable. Break-even is located during the second year where the business has expanded from Roskilde Festival to also include other Danish festivals. Another risk factor lies within testing the first prototypes. It is important that they meet the users’ expectations and are capable of being reused. It is important to establish a trustworthy relationship with the festivals and the users in form of a reliable product and a system that works. This is important for a successful startup. The Green Pavilion sales are seasonal, and Green Gadgets A/S is very dependent on the production facilities. If a production fails, it can have fatal consequences for the business. Not being able to deliver to a festival at time (or deliver at all) will decrease the revenue and the long time between potential sales makes this a very sensitive area. The test year at Roskilde Festival will, however, give the production facility in Denmark an opportunity to gain experience in producing the pavilions. In case of a production failure or delay, Green Gadgets A/S holds the production facility responsible. This is a part of the terms and conditions stated in the contracts with the production facilities. The production facility will in this case pay a financial compensation that will minimize Green Gadgets A/S’ losses. The risk of not being able to conquer the European market, having success in testing prototypes and secure the production is hard to fully hedge against. But to make sure that running into one of these barriers will not bring down the business and at the same time be able to pay unforeseen costs, the cash-in-hand is set to a minimum of DKK 800.000, and this margin is maintained throughout the budget model. Operational Plan Company outline Green Gadgets A/S is constructed as an “Aktieselskab”, initially holding a share capital of DKK 500.000. Green Gadgets A/S is initially owned by 5 holding companies. Each of these holding companies is owned by a founder. By providing enough capital to establish an A/S, the founding team aims to show their willingness and firm belief in the business and its prospects. The choice of a holding company is a way of protecting the founding team from claims against Green Gadgets A/S, along as making it more easy to sell the company and use the capital for new business, in case of a wish to leave the business. Page 9 of 18 The required capital and the shares will be equally distributed between the founding members. However, there is need for more capital from investors, in order to launch the company and make it safe through the first three years. Three capital injections from investors are needed, in order to maintain a reasonable buffer of capital. They are described below. Funding Initially there is a need for DKK 2.000.000 in order to launch, because of the initial investments outlined later in this document. We are looking for one investor to provide this capital, who will thereby get ownership as stated in the table below. Investment goal: Kilo DKK 2.500 Share Price: DKK 1,00 per share class A DKK 10,00 per share class B (Kilo DKK) Shares Contribution Ownership Ratio Founding Team, cash 500.000 500 Investor A 200.000 2.000 Total 700.000 2.500 Total cash contribution at kick-off: 71,43% Class A 28,57% Class B 100,00% 2.500 Funding round 1 During 2013, three production facilities are initiated, and capital of DKK 1.000.000 is needed to invest in production tools and initiation of the new production facilities. The ownership and share distribution is stated below. Valuation pre-money: Kilo DKK 8.000 Investment goal: Kilo DKK 1.000 Share Price: (Kilo DKK) DKK 11,43 per share Shares ante OR ante Value ante Contribution New shares Value post Shares post OR Post Founding Team 500.000 71,43% 5.714 0 0 5.714 500.000 63,49% Investor A 200.000 28,57% 2.286 1.000 87.500 3.286 287.500 36,51% 8.000 1.000 87.500 9.000 787.500 100,00% Total 700.000 100,00% Capital expansion from DKK 700.000 - to - DKK 787.500 Funding round 2 In the second quarter of 2014, just before a major launch in England, an extra investment of DKK 500.000 is needed. The budget on cash-flow states that there is room for handling if something should go wrong, but entering such a big marked with three new production facilities involves a certain amount of risk, which there is made extra room for. Investor A is again asked for capital, and the share distribution and ownership is outlined below. After this point the founding team holds ownership majority of 60 %. Valuation pre-money Kilo DKK 10.000 Funding goal: Kilo DKK 500 Share Price: DKK 12,70 per share (Kilo DKK) Shares ante OR ante Value ante Contribution New shares Value post Shares post OR Post Founding Team 500.000 63,49% 6.349 0 0 6.349 500.000 60,47% Investor A 287.500 36,51% 3.651 500 39.375 4.151 326.875 39,53% Total 787.500 100,00% 10.000 Capital expansion from DKK 787.500 - to - DKK 826.875 500 39.375 10.500 826.875 100,00% Page 10 of 18 After the third and final injection, the investor has ownership of 40 %, while the founding team maintains the share majority. Business Management Because of the choice of an A/S, a board is needed. The board will consist of the five founders, and the investor will be offered two seats on the board. The roles of the founding team are shown below. BOARD 7 seats CEO Will be appointed Key Account Manager Hildur Magnúsdóttir Marketing Project Manager Agnes Ástvaldsdóttir Line K. Svenstrup Financing and Administration Lars Rask R&D Pia Michelsen The figure shows Green Gadgets A/S’ management, board and the roles of the founding team. The founding team The qualifications of the founding team are an important resource for the company. All five of the founders are master students at DTU, studying Design and Innovation/Management, and are B.Sc. from Design and Innovation/Industrial Engineering. The education has provided the team with knowledge and experience from innovation processes and product development. The founding team will work in the following fields: Agnes Ástvaldsdóttir: Will take part in R&D work, but will mainly focus on presenting the product on site as well as sales and marketing, because of her wide experience in sales. Hildur Arna Magnúsdóttir: She will be in charge of optimizing and customizing the production process. She will also be the company’s face towards the festivals and handle their demands. Pia Michelsen: Founder of the design team and original inventor of the Green Pavilion. She will be in charge of the process of R&D, because of her experience in product development and executing projects. Line Kagenow Svenstrup: Founder of the design team and the original inventor of the Green Pavilion. She will be the project manager and thereby responsible for the quality of the product development. Lars Christian Rask: Lars’ background in accounting and annual reporting makes him responsible for the financial management and administration. One of the most important phases of establishing Green Gadgets A/S is the initial phase of product development. The founding team considers itself to be well qualified to take on the challenges that the team will encounter in the process of creating the first prototypes and testing them at Roskilde Festival 2011. With the launch and further expansion, Green Gadgets A/S will assess the upcoming tasks and hire employees or external consultants with relevant qualifications in sales and management when needed. The figure below describes the founding team’s competencies in seven dimensions. The needed employees or external consultants will provide Green Gadgets A/S with a more complete company profile which is needed as the business grows. Page 11 of 18 The figure shows the qualifications of the founding team as well as the future complete company profile. Finances Financial considerations As mentioned previously, the most vital criteria for success is to get the sales agreements with the festivals around Europe as fast as possible to make sure, that the Green Pavilion will be able to penetrate the market. Because of this, many of Green Gadgets A/S’ expenses will be within this area. Especially in the beginning but also in the long run, money will be needed to expand the business. When sales agreements with festivals outside Denmark have to be made, financial room for travel, prototypes, sales personnel and a legal adviser will be needed. Also when sales agreements have been established, the relationship with the festival must be nursed to secure future sales agreements. The key account manager will control this activity. In order to make sure that the sales proceed as planned, it will be necessary to hire more salesmen when the portfolio of festivals increases. The volunteers at each festival site will be used as cheap workforce when selling the pavilions, since a large number of pavilions must be sold over a short period of time. To get the business up and running, an office is required. The office will be located close to Roskilde given that a lot of close collaboration with Roskilde Festival will take place. Also, investments in a car will be made in order to make visits at festivals more accessible amongst other things. This car will be an electrical car, to boost Green Gadgets A/S’ green profile. [The detailed figures can be seen in appendix II: Budget model assumptions, and III: Budget model]. Page 12 of 18 KILO DKK INITIAL INVESTMENTS 600 Tools 500 Travel Internet 400 Materials 300 Electric car 200 Lawyer and auditor fees Software 100 Computers 0 Costs Assets Production tools Furniture Deposit The graph shows the distribution of the initial investments in costs, assets and production tools (also assets) respectively. Green Gadgets A/S does not produce the Green Pavilion itself. Instead, external production facilities are used. In order to initiate a production unit, there will be one-time expenses for the tools (extrusion and injection molding) that the production facility needs to start a production of pavilions. Due to the current hard financial period, Green Gadgets A/S does not expect that the production facility will be willing to finance the start-up. Setting up a production will cost DKK 540.000. First, a production facility will be set up in Denmark. Later, three local production facilities will be established in England and two in Germany. Since the technology is mastered by many potential production sites and is not advanced, sites will be easy to find. Having local production facilities will make logistics cheaper, create savings on the environment and minimize risk regarding transportation. As mentioned above, Green Gadgets A/S will finance the startup costs in relation to the production of the pavilions. With regards to the payment of the pavilions, Green Gadgets A/S will make credit agreements with the production facilities, so that the payment of tools will be up-front, but payment of the products themselves will be due in the third quarter of each year where Green Gadgets A/S sells the pavilions. Page 13 of 18 COSTS 2012-2017 Percentage of overall costs 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2012 2013 2014 2015 2016 2017 Production 1.082 2.221 6.535 11.632 15.971 21.701 Salaries 1.000 1.100 1.560 2.720 3.220 4.280 Rent 120 120 120 240 240 300 Storage 132 264 796 1.412 1.320 2.480 Transportation 90 180 540 960 1.320 1.800 Travels 50 40 40 40 40 66 Depreciations 198 522 522 522 594 594 The graph shows how the costs during year 2012 to 2017 are distributed and how much they each account for in the percentage of overall costs. Financial outline The costs mentioned above calls for a total of DKK 3.500.000 in investments. The business case has a potential of repaying the investor by 14 times in six years. The financial strategy is elaborated below, focusing on the main considerations regarding the first six years of Green Gadgets A/S. Year 0 (2011) The final considerations regarding product development are made. Prototypes are manufactured and presented at Roskilde Festival to include the end-users in the final design. The financial costs in relation with finishing the prototypes are sponsored by Roskilde Festival and outlined below. Development of prototypes Final dimension and optimization of construction, 1 prototype: Optimization on the basis of user feedback, 30 full-scale prototypes: In all DKK 50.000 DKK 150.000 DKK 200.000 Roskilde Festival has an interest in getting the Green Pavilion ready for production and testing. Because of this, they are willing to make a contribution of DKK 200.000 without wanting any long-term part in the company. Green Gadgets A/S searches for an investor with emphasis on the positive results of the prototyping experience at Roskilde Festival. Capital is found to invest in manufacturing equipment and other initial costs. Year 1 (2012) Pavilions are produced, stocked and sold at Roskilde Festival. The production and storage takes place a few months before the festival, since it takes time to produce the needed 8.000 pavilions. When the festival is Page 14 of 18 over, 70% of the pavilions are stocked for reuse along with plastics gathered at the festival, providing material for next year’s additional production. To cover initial costs and get the production running, an investment of DKK 2.000.000 is needed. Year 2 (2013) Three additional Danish festivals are now included in the client portfolio, which again calls for production and storage of pavilions. Every time a new festival is included as a client, more production materials are needed for the production of the first year’s pavilions. The next year, collected plastics are put into production of the missing 30% of the needed pavilions. The turnover from last year is used to produce and stock new pavilions. Since year 1 has resulted in a loss and further production units are needed to expand into the English market, an investment of DKK 1.000.000 is needed. Break-even occurs during year 2. Year 3-5 (2014-2016) Three of England’s more than 20 festivals are included in the client portfolio in the year 2014. During 20152016 more English festivals are included in the client portfolio. Local production and storage is found. To secure setting up the production facilities in England a small cash injection of DKK 500.000 is needed in the second quarter of year 3. Year 6 (2017) Two of Germany’s largest festivals are included in the client portfolio and local production and storage is found. Product development of new products is initiated. Sales scenario The total sales figures can be seen on the graph below. The figures are divided in countries and show, how the different markets are penetrated. CASH IN (from sales) 60000 KILO DKK 50000 40000 30000 20000 10000 0 2012 2013 2014 2015 2016 2017 Denmark 2400 4900 5600 6300 6300 6300 England 0 0 8940 19680 29500 36600 Germany 0 0 0 0 0 5600 The graph shows how the cash in from sales increases as the market expands from Denmark to England and Germany throughout the years. Page 15 of 18 Profit-loss The net profit-loss of the business case is shown below. Since all the festivals are taking place within a short period of time each year, and the sales therefore are very much based on season-sales, it would not make sense to look at a break-even based on quarterly figures. Instead, we focus on the annual figures and have located break-even below. NET PROFIT-LOSS 14.000 12.000 10.000 KILO DKK 8.000 6.000 4.000 Break Even 2.000 0 -2.000 NET PROFIT-LOSS 2012 2013 2014 2015 2016 2017 -552 398 3.174 5.989 8.869 12.287 The graph shows how the net profit-loss plays out and where break-even is located. Equity capital The progress of the equity capital is shown below. Green Gadgets A/S’ activities are very much based on season sales, which is reflected in the graph. EQUITY CAPITAL 45000,0 40000,0 Kilo DKK 35000,0 30000,0 25000,0 20000,0 15000,0 10000,0 5000,0 ,0 2012 2013 2014 2015 2016 2017 Year 2012 + The graph shows how the equity capital evolves during the first six years of the business. Page 16 of 18 Exit Strategy At the end of the presented period of six years, Green Gadgets A/S will have equity of approximately DKK 34.000.000. Additionally, Green Gadgets A/S has a potential to further expand and gain market shares in more European countries. During 2017, new product development is initiated and again provides Green Gadgets A/S with an opportunity to expand the business. Green Gadgets A/S seeks to establish a company that in the long run can function and perform on its own without dependency of the founding team – which, in case of selling the business, makes it easier to sell the company at a high price. After a period of six years, the investor as well as the founders will have an exit opportunity with a return on investment exceeding a factor 10. Exit Opportunity Price/Earnings ratio (P/E) at exit: 5 Share value Company value 2012 n/a n/a 2013 4.599 6.254 2014 24.354 30.205 2015 44.198 56.560 2016 64.561 85.306 2017 88.297 121.923 2012 n/a 2013 2.502 2014 12.082 2015 22.624 2016 34.122 2017 48.769 n/a 1 3 6 10 14 Investors Return On Investment (ROI) With OR = 40% Yield ROI Obvious buyers of Green Gadgets A/S could be the production company DKI Plast A/S which is the production facility used for production to the Danish market. Another obvious buyer could be an environmental foundation which could have great interest in the branding value that the pavilions can offer throughout Europe. The Moment of Truth In today’s society, people are becoming more and more aware of the environmental impact from consumer products. The tendency is green and the focus is on more sustainable products that political rules and regulations tend to support. The Green Pavilion is a product that meets the growing demand for environmental friendly solutions. The festival market potential is large and ready to embrace this kind of product, which does not already exist on the market. Green Gadgets A/S is aware of the attractiveness of the market. Therefore, it can be expected that many competitors would find it desirable to enter the market once the idea has been intercepted. Hence, it is important to establish a reliable collaboration with the festivals as well as the production facilities in a rapid pace. Furthermore, the image of the company is a part of maintaining this relationship and attracting new portfolio clients. Even though our research shows that there are the same tendencies abroad, there is always a risk in expanding to other countries. The cost, culture and the way of doing business might differ from the underlying assumptions in the business plan. However, there are expansion opportunities within the Danish market. The usage situations can be expanded to flea markets, parties and big events like weddings and confirmations etc. There also exists an opportunity of expanding the product portfolio with chairs, tents, cutlery etc. made from the same material as the Green Pavilion. Page 17 of 18 Furthermore, the pavilions stand out on the campsite as they rise above the tents and would make an evident advertising opportunity. This opens the possibility for additional cooperation with some of the festivals’ sponsors or other interested parties. Sponsor deals covering advertisement on the large surfaces (which are visible to millions of people) can provide a supplementary income to Green Gadgets A/S. The Green Pavilion is a desirable product. The festivals save money on waste collection and treatment, such as incineration costs and at the same time promote their green image. The end-users get a more robust and appealing pavilion that fits their needs. It provides a good venture case with economic prospects for the founders as well as the investors. Page 18 of 18 Appendix I - Porter‘s Five Forces Porter’s five forces give a framework for industry analysis and business strategy development, by Michael E. Porter, Harvard Business School in 1979. It uses concept developing, industrial organisation economics, to derivate five forces that determine the competitive intensity and the attractiveness of a market. The tool is a simple way to understand where power lies in a business situation, which is useful for understanding the strength of current competitive position and the strengths needed for a business who wishes to enter the given market. Threat of substitute products Bargaining power of Customers Competitive Rivalry within an industry Threat of New Entrants Bargaining Power of Suppliers The figure shows Porters five Forces. Competitive Rivalry The existing pavilion used at Roskilde Festival In Denmark it´s mainly bought in Harald Nyborg and Jysk Other products that provide ‘shelter’ for rain and a get-together place: Bamboo solutions Sunshades Wooden solutions Threat of new entrants Other green solutions (especially if they include cheaper material and production solutions) Large start-up cost for the production Finding investors The threat of substitute products There are no identified substitute products which offer a better solution for the problems that the existing pavilion creates at festival sites. The pavilion creates a common ground for the festival customers and this need cannot be fulfilled by products that do not offer shelter and the possibility of having a gathering point, as a pavilion does. The bargaining power of customers If given a better product the festival customers are willing to pay more for a pavilion than the 100 DKK the existing cheap discount solution costs. Roskilde Festival is willing to contribute money in order to get the business started since the Green Pavilion will be able to help them with their waste problems. The bargaining power of the Green Pavilion is higher than for the existing discount pavilion since it offers a better product for the users in regards to durability, reuse and environmental considerations. The bargaining power of the Green Pavilion is also higher because it offers a better solution to a need that the festival customers are not willing to compromise on. The bargaining power of suppliers Suppliers do not necessarily depend on upon producing the Green Pavilions which gives Green Gadgets A/S low bargaining power. In regard to the material use, Green Gadgets A/S has higher bargaining power since the producers of recycled plastics are looking to find a ways to use/sell the material. It will be necessary to produce new production equipment since the design of the Green Pavilion is unique. Marketing and Distribution The target market is festivals that have a camping site. It is therefore crucial to enter into sales agreements with the festivals. Marketing Strategy Collaboration with other business’ that sell equipment to festival customers. Collaboration with other Festivals Setting a price range that suits the market and the customers. The Green Pavilions are going to be distributed by truck throughout Denmark. When entering the European market local production facilities will be established in order to be able to use trucks in the given countries and thereby diminish distribution distances. 2 Appendix II – Budget Model Assumptions Budget Model This appendix contains the financial considerations that form the basis for the budget model for The Green Pavilion. Initial Costs Office facilities: In Roskilde, expenses: 10.000 DKK/month – office hotel with mutual facilities as well as private office space. Deposit: 2x rent = 20.000 DKK http://www.lokalebasen.dk/kontorlokaler/leje/4000-roskilde/hersegade/emne-1381 Furniture: 15.000 DKK (desk + chairs for 5 persons) Computers: 5x 5000 DKK = 25.000 DKK Software: 50.000 DKK (Cad-Cam + CS4) Company car: Better Place: 205.000 DKK Renault Fluence ZE + battery subscription (works likes tanking fuel) http://danmark.betterplace.com/danmark-faq-pris Lawyer fees: Making contracts between shareholders (shareholder agreements) and sales agreements with festivals. Expenses: 2000-2500 DKK per hour. 7 days of work: 100.000 DKK Money for prototyping: We need 5 units so that we have one each, within the team. 20.000 DKK http://www.davinci.dk/rapid-prototyping-rpt/hvad-koster-prototyper-hos-davinci.html Website: We need one which offers different languages. 50.000 DKK Important features: To send the right message, represent the company in the right way Who are our customers and collaborators Promote our sponsors Up-to-date Digital procurement system for online purchases Available in several language (Danish, English, German) The site should associate to music festivals The website should have links to collaborating music festivals and vice versa. Travel expenses: Travels to UK and Germany. http://www.easyjet.com UK, London; 300-400 DKK each way. Hotel, London (Radisson Hotel); 90 £ per night. Car rent: per day 300 DDK (excl. fuel). Travel expenses for the 3 largest festivals in England: 10 trips, to and from London (7000 DKK) + Hotel for 15 nights (13.500 DKK) + Car 15 days (7000 DKK (2500 DKK for fuel))) = 27.500 DKK A trip for two representatives from the three largest festivals in England to Roskilde Festival in Denmark to observe the pavilions. Expenses: 4200 DKK for flight + 6 persons for 1 night in double rooms 3000 DKK =7200 DKK In all costs of 34.700 DKK to which is added an extra accommodation cost of 15.300 DKK for food, client nursing (dinners ect.) and so on. Germany, Berlin 150-200 DKK each way: Hotel Berlin: 450 DKK per night. Car rent: 1000 DKK per day (excl. fuel). 6 trips, to and from Berlin (2400 DKK) + Hotel for 7 nights (3150 DKK) + Car 7 days (7000 DKK) = 12.550 DKK Salary Key Account Manager: Two persons from 2015 (When the market is expanded) The tasks for the Key Accountant are Customer (festival organisers) responsibility Nurture the collaboration with the customers Have the market under control Make budget, and responsible for financial tasks etc. Sales clerks: Their role is to control the sales sites on the festivals and makes sure that everything functions as planned. The sales clerks are not accounted as employees in the rent Engineering: Employed in 2017 to develop the new product line Production: The production is outsourced and the team has the relevant production knowledge for the design process. Therefore, there is no need for extra employment. The Key Accountant can be responsible for the inspection of the production facilities. Volunteers: year 1: 20 persons, year 2: 40 persons, year 3: 120 persons, year 4: 220 persons, year 5: 320 persons, year 6: 430 persons (estimated from the needed number of volunteers at Roskilde Festival). A volunteer earns ca. 2000 DKK, which corresponds to the price of a Roskilde Festival ticket. The volunteers are not accounted as employees in the rent Administration: With the expansion of the company there is a need to attract to employees with core competences. Hence, the salaries should increase accordingly. Rent: 15.000 DKK per Qt. (Sales clerks and volunteers are not included in this number, since they do not need the accommodation). Production material The company does not possess any production facilities and the production is outsourced. However, there are initial production start-up expenses for extrusion and injection molding tools. Today, it is custom that these expenses are paid by Green Gadget ApS, as their customer. Engineering expenses due to design of extrusion and injection molding tools: The team possess the relevant competences (it is therefore part of the salary). Installing and calibration are included in the production tool expenses. (Total price is expected from the collaborating production company). 340.000 DKK for starting up the production (same cost in all three countries: Denmark, UK and Germany) One extrusion tool costs: 10.000 DKK (informed by DKI). Four pieces needed. One injection molding tool costs: 250.000 DKK (informed by DKI). Two pieces needed. Three local production facilities in England. Two local production facilities in Germany. Local production facilities have to be identified. This should not be difficult, thus the production method is common. Local production should be situated close to the festivals. This will minimize the logistic costs. Unit costs The Green Pavilion is available in two sizes: small and large. We do not differ between the numbers of pavilions sold in the unit price, since the market demand only calls for deliverables of a certain size. It is possible to buy an extension to the large pavilion, which is half of the small one. (Extensions are included in the sales of the small pavilions). Packaging and transportation of the cloths from China to Denmark is included in the unit price of the products. Market entry scenario Payments are conducted in the same quarter as the pavilions are sold, hence all sales are cash sales. Time and money is invested in the production start-up (production tools). However, agreements with the collaborating production companies are made, where the payment of the production is conducted in the same quarter as the sales. The payment agreement is particularly important in start-up phase. However, when the business is running they are not as important since the company possesses the necessary cash in hand. Cash flow Transportation cost in Denmark, England and Germany. The amount transported to the festivals is divided on trucks and then multiplied by two because we have to transport both to the festivals and afterwards to the storage facility. The price per truck is 3000 DKK (local transport in Denmark and abroad). 1st year: 15 trucks, 90.000 DKK. 2nd year: 30 trucks, 180.000 DKK. 3rd year: 90 trucks, 540.000 DKK. 4th year: 160 trucks, 960.000 DKK. 5th year: 220 trucks, 1.320.000 DKK. 6th year: 300 trucks, 1.800.000 DKK. Travel: The Key Accountant manager has regularly travel expenses to maintain a good collaboration with existing customers as well as establishing new ones. The expenses are set to 20.000 DKK in both 3rd and 4th quarter from 2013. Storage: 100 square metre: 6.800 DKK per month. In order to store 8.500 pavilions two rooms are needed. Per quarter equaling: 40.800 DKK minus WAT (20%) = 33.000 DKK for 2012. For the years 2013-2017 the total production of pavilions each year is divided by 4250 pavilions/room and multiplied by 16.500 DKK per room. To make sure that running into a barrier will not bring down the business and at the same time to be able to pay unforeseen expenses the cash-in-hand is set to a minimum of 800.000 DKK and this margin is maintained throughout the budget plan. Loan It is not reasonable to take bank loans since the company does not intend to start up own production, and therefore does not possess any valuables. Therefore, it is not considered realistic to take loans in the first couple of years. Appendix III – Budget Model Profit and Loss Profit and Loss kilo DKK REVENUE Rev./employee, 1000*unit/yr 2012 2.400 1,2 2013 4.900 2,5 2014 14.540 7,3 2015 25.980 6,5 2016 35.800 9,0 2017 48.500 9,7 COSTS 2.754 3.980 9.669 17.140 22.888 30.841 EBITDA -354 920 4.871 8.840 12.912 17.659 0 198 0 198 0 522 0 522 0 522 0 522 0 522 0 522 0 594 0 594 0 594 0 594 -552 398 4.349 8.318 12.318 17.065 Cummulated earnings -552 -153 TAX 0 0 28% Annual taxpayment on Earnings Before Tax (EBT) 4.196 1.175 12.514 2.329 24.832 3.449 41.898 4.778 NET PROFIT-LOSS FINANCIAL ENTRIES Interest Depreciations Amortisation FINANCIAL ENTRIES Earnings Before Tax (EBT) -552 398 3.174 5.989 8.869 12.287 CASH-IN-HAND end yr 1.356 1.656 5.852 12.362 20.745 33.626 Accum investments 2.000 3.000 3.500 3.500 3.500 3.500 n/a n/a 5 4.599 6.254 24.354 30.205 44.198 56.560 64.561 85.306 88.297 121.923 EXIT OPPORTUNITY Price/Earnings ratio (P/E) at exit: Share value Company value INVESTORS RETURN ON INVESTMENT (ROI) with OR = Yield n/a 2.502 12.082 ROI n/a 1 3 Venture Case? n/a No No Budget 10-12-2010 40% : 22.624 6 No (OR = Ownership Ratio) 34.122 10 No 48.769 14 Yes Green Gadgets A/S Assets Liabilities Budget on Assets & Liabilities / Aktiver & Passiver Budget kilo DKK ASSETS IPR Production tools Other initial investments Debtors Cash Other ASSETS 2012 0 405 188 0 1.356 0 1.948 2013 0 1.566 125 0 1.656 0 3.347 2014 0 1.107 63 0 5.852 0 7.021 2015 0 648 0 0 12.362 0 13.010 2016 0 1.134 0 0 20.745 0 21.879 2017 0 540 0 0 33.626 0 34.166 LIABILITIES Loan Creditors Other Equity LIABILITIES 2012 0 0 0 1.948 1.948 2013 0 0 0 3.347 3.347 2014 0 0 0 7.021 7.021 2015 0 0 0 13.010 13.010 2016 0 0 0 21.879 21.879 2017 0 0 0 34.166 34.166 10-12-2010 Green Gadgets A/S Assets and Liabilities, quarterly Assets and Liabilities, quarterly kilo DKK Opening ASSETS IPR Production tools Other initial investments Debtors Cash Other ASSETS Total LIABILITIES Loan Creditors Other Equity LIABILITIES Total 2012 1. Qt 2. Qt 3. Qt 2013 1. Qt 4. Qt 2. Qt 3. Qt 4. Qt 2014 1. Qt 2. Qt 3. Qt 2015 1. Qt 4. Qt 2. Qt 3. Qt 4. Qt 2016 1. Qt 2. Qt 3. Qt 4. Qt 2017 1. Qt 2. Qt 3. Qt 4. Qt 500 0 101 47 0 1.650 0 1.798 0 101 47 0 800 0 948 0 101 47 0 1.671 0 1.819 0 101 47 0 1.356 0 1.504 0 392 31 0 1.008 0 1.431 0 392 31 0 1.660 0 2.083 0 392 31 0 2.834 0 3.256 0 392 31 0 1.656 0 2.078 0 277 16 0 1.175 0 1.467 0 277 16 0 1.194 0 1.486 0 277 16 0 7.590 0 7.883 0 277 16 0 5.852 0 6.144 0 162 0 0 4.935 0 5.097 0 162 0 0 4.018 0 4.180 0 162 0 0 15.628 0 15.790 0 162 0 0 12.362 0 12.524 0 284 0 0 11.314 0 11.598 0 284 0 0 10.266 0 10.550 0 284 0 0 25.865 0 26.149 0 284 0 0 20.745 0 21.029 0 135 0 0 19.389 0 19.524 0 135 0 0 18.032 0 18.167 0 135 0 0 39.794 0 39.929 0 135 0 0 33.626 0 33.761 500 500 0 0 0 1.798 1.798 0 0 0 948 948 0 0 0 1.819 1.819 0 0 0 1.504 1.504 0 0 0 1.431 1.431 0 0 0 2.083 2.083 0 0 0 3.256 3.256 0 0 0 2.078 2.078 0 0 0 1.467 1.467 0 0 0 1.486 1.486 0 0 0 7.883 7.883 0 0 0 6.144 6.144 0 0 0 5.097 5.097 0 0 0 4.180 4.180 0 0 0 15.790 15.790 0 0 0 12.524 12.524 0 0 0 11.598 11.598 0 0 0 10.550 10.550 0 0 0 26.149 26.149 0 0 0 21.029 21.029 0 0 0 19.524 19.524 0 0 0 18.167 18.167 0 0 0 39.929 39.929 0 0 0 33.761 33.761 500 Equity capital 45.000 40.000 35.000 Kilo DKK 30.000 25.000 20.000 15.000 10.000 5.000 0 2012 2013 2014 2015 2016 2017 Year 2012 + Budget 10-12-2010 Green Gadgets A/S Profit and Loss quarterly Cash flow quarterly Budget on Profit and Loss, quarterly kilo DKK 2012 1. Qt TURN OVER Sales TURN OVER COSTS Production Salaries Rent Storage Transportation Initial investments (costs) Miscellaneous Travels 2012 2. Qt 3. Qt 2013 1. Qt 4. Qt 2013 2. Qt 3. Qt 2014 1. Qt 4. Qt 2014 2. Qt 3. Qt 2015 1. Qt 4. Qt 2015 2. Qt 3. Qt 2016 1. Qt 4. Qt 2016 2. Qt 3. Qt 2017 1. Qt 4. Qt 2017 2. Qt 3. Qt 4. Qt 0 0 0 0 2.400 2.400 0 0 2.400 2.400 0 0 0 0 4.900 4.900 0 0 4.900 4.900 0 0 0 0 14.540 14.540 0 0 14.540 14.540 0 0 0 0 25.980 25.980 0 0 25.980 25.980 0 0 0 0 35.800 35.800 0 0 35.800 35.800 0 0 0 0 48.500 48.500 0 0 48.500 48.500 0 240 30 33 0 240 30 33 1.082 280 30 33 90 0 240 30 33 0 240 30 66 0 240 30 66 2.221 380 30 66 180 0 240 30 66 0 240 30 199 6.535 780 30 199 540 0 300 30 199 0 480 60 353 11.632 1.280 60 353 960 0 480 60 353 0 480 60 484 15.971 1.720 60 484 1.320 0 540 60 484 0 630 75 620 21.701 2.390 75 620 1.800 0 630 75 620 19 20 12 20 12 0 12 0 39 20 15 20 24 0 24 0 64 20 24 20 24 0 24 0 86 20 27 20 15.971 3.220 240 1.936 1.320 0 161 40 0 630 75 620 12 0 11.632 2.720 240 1.412 960 0 136 40 0 480 60 484 12 0 6.535 1.560 120 796 540 0 78 40 0 480 60 353 12 0 2.221 1.100 120 264 180 0 55 40 0 240 30 199 14 0 1.082 1.000 120 132 90 280 50 0 32 0 32 0 120 33 32 33 21.701 4.280 300 2.480 1.800 0 214 66 140 140 12 12 (In initial investm.) COSTS 455 455 1.529 315 2.754 348 348 2.916 368 3.980 481 481 8.143 564 9.669 917 917 14.369 937 17.140 1.048 1.048 19.661 1.131 22.888 1.357 1.357 26.738 1.390 30.841 EBITDA -455 -455 871 -315 -354 -348 -348 1.984 -368 920 -481 -481 6.397 -564 4.871 -917 -917 11.611 -937 8.840 -1.048 -1.048 16.139 -1.131 12.912 -1.357 -1.357 21.762 -1.390 17.659 PROFIT MARGIN n/a n/a Depreciations EARNINGS BEFORE TAX 36% n/a -15% n/a n/a 40% n/a 19% n/a n/a 44% n/a 33% n/a n/a 45% n/a 34% n/a n/a 45% n/a 36% n/a n/a 45% n/a 36% 49 49 49 49 198 130 130 130 130 522 130 130 130 130 522 130 130 130 130 522 149 149 149 149 594 149 149 149 149 594 -504 -504 821 -364 -552 -478 -478 1.853 -498 398 -611 -611 6.266 -694 4.349 -1.047 -1.047 11.480 -1.067 8.318 -1.197 -1.197 15.991 -1.280 12.318 -1.505 -1.505 21.613 -1.538 17.065 Cash flow kilo DKK 2012 1. Qt Opening 2012 2. Qt 3. Qt 2013 2. Qt 3. Qt 2014 1. Qt 4. Qt 2014 2. Qt 3. Qt 2015 1. Qt 4. Qt 2015 2. Qt 3. Qt 2016 1. Qt 4. Qt 2016 2. Qt 3. Qt 2017 1. Qt 4. Qt 2017 2. Qt 3. Qt 4. Qt 0 0 2.400 0 2.400 0 0 4.900 0 4.900 0 0 14.540 0 14.540 0 0 25.980 0 25.980 0 0 35.800 0 35.800 0 0 48.500 0 48.500 CASH OUT From costs (above) 455 455 1.529 315 2.754 348 348 2.916 368 3.980 481 481 8.143 564 9.669 917 917 14.369 937 17.140 1.048 1.048 19.661 1.131 22.888 1.357 1.357 26.738 1.390 30.841 270 125 270 125 810 810 1.620 0 0 540 540 1.080 0 0 0 0 0 0 1.175 1.175 2.329 2.329 3.449 3.449 4.778 4.778 850 850 1.529 315 3.544 348 348 3.726 1.178 5.600 481 481 8.143 1.739 10.844 917 917 14.369 3.266 19.469 1.048 1.048 20.201 5.120 27.417 1.357 1.357 26.738 6.168 35.619 -850 -850 871 -315 -1.144 -348 -348 1.174 -1.178 -700 -481 -481 6.397 -1.739 3.696 -917 -917 11.611 -3.266 6.511 -1.048 -1.048 15.599 -5.120 8.383 -1.357 -1.357 21.762 -6.168 12.881 From investment in assets Production tools (assets) Initial investments (assets) IPR (R&D, patents) 540 250 0 Tax CASH OUT TOTAL NET CASH FLOW before investors From investor A Budget 2013 1. Qt 4. Qt CASH IN From sales (above) 2.000 0 0 0 1.000 0 0 0 0 0 0 500 CASH IN 500 2.000 0 0 0 0 0 1.000 0 0 0 0 500 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Cash in Hand, end qrt 500 1.650 800 1.671 1.356 1.356 1.008 1.660 2.834 1.656 1.656 1.175 1.194 7.590 5.852 5.852 4.935 4.018 15.628 12.362 12.362 11.314 10.266 25.865 20.745 20.745 19.389 18.032 39.794 33.626 33.626 10-12-2010 Green Gadgets A/S Product unit costs Product unit costs kilo DKK Large pavillon Item Pieces 1. Arch small 0 2. Arch medium 24 3. Arch large 8 4. Cross joint 17 5. Base joint 4 6. Cloth small 0 7. Cloth large 1 8. Packaging 1 Product unit price Price per vehicle (Bill of Materials = BOM) Unit price 0,0016 0,0021 0,0026 0,0021 0,0032 0,0037 0,0084 0,0021 Small pavillon Item Pieces Unit price 1. Arch small 24 0,0016 2. Arch medium 8 0,0021 3. Arch large 0 0,0026 0,0021 4. Cross joint 17 5. Base joint 4 0,0032 6. Cloth small 2 0,0037 7. Cloth large 0 0,0084 8. Packaging 1 0,0021 (Covers costs of big boxes distributed to all the units in the box) Product unit price Product unit price 0,000 0,051 0,021 0,036 0,013 0,000 0,008 0,002 0,131 (kilo DKK) 130,51 DKK Product unit price 0,038 0,017 0,000 0,036 0,013 0,007 0,000 0,002 0,000 0,113 (kilo DKK) 112,62 DKK There is no distinction based on production quantity, because we always need a large number of products produced. Budget 10-12-2010 Green Gadgets A/S Initial investments Initial investments / Etableringsinvesteringer Production tools / Produktionsmateriel kilo DKK kilo DKK Location Deposits Remodelling Other Total Costs Assets 20 0 0 20 Production tools 0 Production Tools 0 Item no. 1. 2. 3. 4. 5. 6. Description Extrusion tool Extrusion tool Extrusion tool Extrusion tool Casting mould Casting mould Engineering Procurement Installing 0 10 0 10 0 10 0 10 0 250 0 250 0 0 0 0 0 0 0 0 540 Total Total 0 Business equipment Furniture Computers Software Lawyer and auditor fees Electric car Total 0 540 0 540 Total production tools 540 This value is used as the default initial investment on a production unit 15 25 50 100 140 200 250 0 Marketing Bureau Materials Internet Travel Total 0 20 50 50 120 0 0 Other categories 0 0 0 250 540 TOTAL INITIAL INVESTMENT 280 (Costs) (Assets) The total initial investments are distributed in the Budget on Profit and Los / Cashflow as shown below Initial Initial Production Investments Investments Tools (Costs) (Assets) (Assets) 2012 1. Qt. 140 125 2012 2. Qt. 140 125 Budget Running in 0 0 0 0 0 0 270 270 10-12-2010 Green Gadgets A/S Market Entry Scenario Salesbudget Market entry scenario / Salgsbudget 2012 1. Qt Unit sale Large pavillon Roskilde festival Denmark England Germany Total 2. Qt 3. Qt 2013 1. Qt 4. Qt 2. Qt 3. Qt 7.000 0 Small pavillon Roskilde festival Denmark England Germany Total 0 Cash out, production 0 0 3. Qt 7.000 0 0 0 0 14.000 0 0 0 43.000 0 0 0 78.000 0 0 109.000 0 0 0 0 8.200 0 0 0 12.900 0 0 0 15.500 0 0 2.000 2.500 15.000 4.000 0 23.500 6.535 0 0 0 2.000 2.500 8.400 0 4. Qt 7.000 11.000 112.000 16.000 0 146.000 2.000 2.500 11.000 0 11.632 0 0 0 15.971 0 0 0 21.701 2.400 0 0 0 4.900 0 0 0 14.540 0 0 0 25.980 0 0 0 35.800 0 0 0 48.500 0 0 0 0 4.900 0 0 0 14.540 0 0 0 25.980 0 0 0 35.800 0 0 0 48.500 0 0 0 0 3. Qt 2.400 100% Creditors paied due 0 2. Qt 7.000 11.000 91.000 0 0 2.221 0 2017 1. Qt 4. Qt 0 0 0 0 3. Qt 0 0 0 0 2. Qt 7.000 11.000 60.000 2.000 2.000 4.200 3.500 2016 1. Qt 4. Qt 0 Ingoing cash, sales 0 0 3. Qt Cash in, sales Deptors, paying 1 qt. late 1.082 0 2. Qt 7.000 9.000 27.000 2.000 1.500 1.500 2015 1. Qt 4. Qt Registered sales 100% Paid due time (all sales are cash sales, no period deferment) 0 2. Qt 7.000 7.000 1.500 0 2014 1. Qt 4. Qt 2.400 0 0 0 4.900 0 0 0 14.540 0 0 0 25.980 0 0 0 35.800 0 0 0 48.500 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2.400 0 0 0 4.900 0 0 0 14.540 0 0 0 25.980 0 0 0 35.800 0 0 0 48.500 0 0 21.701 0 1.082 0 0 0 2.221 0 0 0 6.535 0 0 0 11.632 0 0 0 15.971 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Outgoing cash, production 0 0 1.082 0 0 0 2.221 0 0 0 6.535 0 0 0 11.632 0 0 0 15.971 0 0 0 21.701 0 Net cash flow from sales & production 0 0 1.318 0 0 0 2.679 0 0 0 8.005 0 0 0 14.348 0 0 0 19.829 0 0 0 26.799 0 Creditors(late payment to subcontr.) End year: 2012 2013 2014 2015 2016 2017 Deptors 0 0 0 0 0 0 Creditors 0 0 0 0 0 0 Net outstanding 0 0 0 0 0 0 Since all sales are cash sales, there is never made sales on credit, and there are no outstanding Net cash flow from sales & production Sales in numbers sold per quarter 30.000 160.000 140.000 25.000 Kilo DKK Kilo DKK 120.000 100.000 80.000 60.000 20.000 15.000 10.000 40.000 5.000 20.000 0 0 2012 2013 2014 2015 2016 2017 2012 2013 2014 Year Large pavillon 2015 2016 2017 Year Small pavillon Contribution margin Budget Large pavillon Sales price Unit costs Contribution margin Contribution ratio kilo DKK 0,30 300,00 DKK 0,13 130,51 DKK 0,17 169,49 DKK 56% Small pavillon Sales price Unit costs Contribution margin Contribution ratio 0,20 200,00 DKK 0,11 112,62 DKK 0,09 87,38 DKK 44% 10-12-2010 Green Gadgets A/S Organisation Salaries Organisation / Lønninger kilo DKK Head count, Head Quarter Key account manager Engineering Administration Total 2012 1. Qt 2. Qt 3. Qt 2013 1. Qt 4. Qt 2. Qt 3. Qt 2014 1. Qt 4. Qt 2. Qt 3. Qt 2015 1. Qt 4. Qt 2. Qt 3. Qt 2016 1. Qt 4. Qt 2. Qt 3. Qt 2017 1. Qt 4. Qt 2. Qt 3. Qt 4. Qt 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 1 0 1 2 2 0 2 4 2 0 2 4 2 0 2 4 2 0 2 4 2 0 2 4 2 0 2 4 2 0 2 4 2 0 2 4 2 1 2 5 2 1 2 5 2 1 2 5 2 1 2 5 1 0 1 1 0 1 1 20 21 1 0 1 1 0 1 1 0 1 2 40 42 1 0 1 1 0 1 1 0 1 6 120 126 2 0 2 2 0 2 2 0 2 8 220 228 2 0 2 2 0 2 2 0 2 12 320 332 3 0 3 3 0 3 3 0 3 18 430 448 3 0 3 240 240 280 240 240 240 380 240 240 240 780 300 480 480 1.280 480 480 480 1.720 540 630 630 2.390 630 Rent 30 30 30 30 30 30 30 30 30 30 30 30 60 60 60 60 75 Rent per employee per qt. 15 kilo DKK Head count, volunteers and sales Sales department/sales clerks Volunteers Total CASH BURN on HEADS Salaries Per employee, incl. social expenditures Key account manager Sales dept. Engineering Volunteers Administration Budget 60 60 60 60 75 75 75 Per qt. Per month 90,0 30,0 kilo DKK 60,0 20,0 kilo DKK 90,0 30,0 kilo DKK 2,0 0,7 kilo DKK 90,0 30,0 kilo DKK 10-12-2010 Green Gadgets A/S Depreciations Depreciations / Afskrivninger / Anlægskartotek kilo DKK 2012 Production tools Value Depreciation Depreciated value 2013 Production tools Value Depreciation Depreciated value 2014 Production tools Value Depreciation Depreciated value 2015 Production tools Value Depreciation Depreciated value 2016 Production tools Value Depreciation Depreciated value 2017 Production tools Value Depreciation Depreciated value 25% 2012 2013 2014 2015 2016 2017 540 135 405 405 135 270 270 135 135 135 135 0 0 0 0 0 0 0 2012 2013 2014 2015 2016 2017 1.620 324 1.296 1.296 324 972 972 324 648 648 324 324 324 324 0 2013 2014 2015 2016 2017 0 0 0 0 0 0 0 0 0 0 0 0 2014 2015 2016 2017 0 0 0 0 0 0 0 0 0 2015 2016 2017 1.080 270 810 810 270 540 2016 2017 20% 2012 25% 2012 2013 25% 2012 2013 2014 25% 2012 2013 2014 2015 0 0 0 25% Production tools, summary 2012 135 405 2013 459 1.566 2014 459 1.107 2015 459 648 2016 594 1.134 2017 594 540 25% 250 63 188 188 63 125 125 63 63 63 63 0 0 0 0 0 0 0 25% 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2012 198 593 2013 522 1.691 2014 522 1.170 2015 522 648 2016 594 1.134 2017 594 540 Depreciation Total depreciated value Initial investments Value end year Depreciation Depr. Value IPR Value end year Depreciation Depr. Value DEPRECIATIONS SUMMARY Depreciation Depreciated value Budget 10-12-2010 Green Gadgets A/S