chap-1 -Final accounts with adjustment

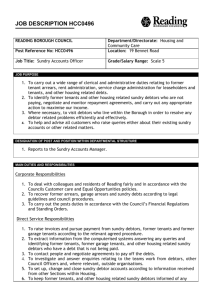

advertisement