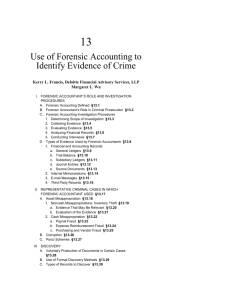

Forensic Accounting Slides - Arkansas State University

advertisement

FORENSIC ACCOUNTING THE HOTTEST JOBS For College Grads FORENSIC ACCOUNTANT Combines accounting, auditing and investigative skills: $30,000-$150,000 LOGISTICS MANAGER Plan, implement and control flow of goods or services: $35,000-$118,000 CORPORATE LIBRARIAN More companies need specialists to manage information: $37,000-$93,000 EMERGING MEDIA SPECIALIST Managers in Web content and online marketing need communication skills and tech savvy: $26,500-$100,000 PHYSICAL THERAPIST Aging baby boomers will drive the increasing need: $34,600-$74,000 INFORMATION SECURITY Workers plan, implement and support network security: $47,000-$122,000 FORENSIC ACCOUNTING FORENSIC: Refers to items used in debate or argument. In commerce or business, things forensic are generally those things that relate to a legal forum or court. ACCOUNTING: “The language of business”. Quantifying data for financial purposes; accounting refers to many activities that relate to financial accounts. WHAT IS FORENSIC ACCOUNTING? Forensic accounting refers to: The use of accounting for legal purposes. The use of intelligence-gathering techniques and accounting to develop information and opinion for use by attorneys involved in civil litigation and give trial testimony if called upon. Identifying, recording, settling, extracting, sorting, reporting, and verifying past financial data or other accounting activities for settling prospective legal disputes or using such past financial data for projecting future financial data to settle legal disputes. FORENSIC AUDIT V. FINANCIAL AUDIT Financial audit is generally a sampling activity that does not look at every transaction. A financial audit relies heavily on a company’s internal control system. An auditor expresses an opinion as to whether or not the financial statements are presented in conformity with GAAP. Forensic audit looks at the detail of a specific aspect of the records. Forensic accountant usually brought in when fraud is suspected. BACKGROUND Before financial statements were audited by an independent auditor, the courts were often the only place where challenges were made and accounting experts were brought in to give testimony on the disputes in question. In North America, forensic accounting can be traced back as far as 1817 to Meyer v. Sefton, a Canadian case, that allowed an ‘expert witness’ to testify in court. FAMOUS FORENSIC CASE or HOW AN ACCOUNTANT NABBED AL CAPONE Al Capone, bootlegger and gangster, seemed to be impossible to arrest and convict on any crime. Although he made millions from his illegal activities, he had never filed a tax return. The IRS ushered forensic accounting into the modern age in the US when they went after Al Capone. An IRS agent from the Special Intelligence Unit found enough evidence to convict Capone of income tax evasion. Capone received an 11 year sentence. FORENSIC ACCOUNTING COMES OF AGE In the 40s and 50s, Forensic accountant becomes an investigative accountant, not just an expert witness. During WWII, FBI employed 500 agents who were accountants. In the 60s, J. Edgar Hoover emphasized fraud detection. Today, there are more than 600 FBI agents with accounting backgrounds. The Financial Crimes Section investigates money laundering, internet crimes, financial institution fraud and other economic crimes. WHAT DO FORENSIC ACCOUNTANTS DO?? Investigate occupational fraud and abuse. Investigate fraudulent financial reporting. Serve as a litigation services specialist and expert witness. Trace assets in bankruptcy or divorce cases. Consulting. Work for government agencies such as IRS, FBI, SEC, law enforcement agencies, corporate security specialists. Occupational Fraud and Abuse Losses from occupational fraud and abuse has been estimated to run in the billions. Many cases are never reported. Actual cost unknown. Difficult to discover because it’s an inside job. When fraud is suspected, the forensic accountant may be called in to investigate. Fraudulent Financial Reporting In the 80s, Crazy Eddie’s. In 2001 and 2002, several major financial statement frauds resulting in billions of dollars of loss. Adelphia: Rigas family defrauded the company out of 3.1 billion. Enron: more than $1 billion. Merck: $12.4 billion Bristol-Myers Squibb: $1.5 billion. WorldCom: $3.8 billion. Prison time for many of the perpetrators. Typical White-Collar Criminal Likely to be married Member of a church Educated beyond high school No arrest record Age range from teens to older than 60 Socially conforming Employment tenure from 1 to 20 years Acts alone 70% of the time Bottom Line: Given the right pressures, opportunities and rationalizations, many people are capable of committing crime. GOVERNMENTAL FORENSIC ACCOUNTANTS Most common: IRS agents. Look for unreported income or disallowable expenses. Techniques include income reconstruction and “follow the money trail”. DEA, FBI, CIA and other governmental agencies use forensics accountants also. Treasury department agents work hand-in-hand with the DEA. They carry a badge and pack iron. Who better to “follow the money” than an accountant? COMPUTER FORENSICS Analysis of electronic data and residual data for the purposes of discovery, legal preservation, authentication, reconstruction, and presentation to solve or aid in solving technology-based crimes. Most financial fraud involves a computer. Forensic accountant needs to be technologically savvy! May employ services of a tech person to assist in investigation. CYBERCRIMES Fraudulent spam Financial frauds Unauthorized access Industrial espionage Illegal use of encryption Cyberstalking Denial of service Damaging networks or computers Illegal use of resources obtained from hacking activities. CYBERCRIME STATUTES International law: No international laws per se, each country responsible for its own legislation. Many countries have no such laws on the books. US Federal Legislation See: http://www.usdoj.gov/criminal/cybercrime/cclaws.html. These laws: outlaw “counterfeit” access devices that are used for fraudulent purposes; deal with fraud in connection with computers, communication lines, interception of electronic communications, etc. USA Patriot Act, passed in 2001, strengthened US cyber laws and expanded cybercrime definitions. Under the Patriot Act, an activity covered by the law is considered a crime if it causes a loss exceeding $5000, impairment of medical records, harm to a person or a threat to public safety. STATE LEGISLATION Unique to each state. Arkansas Code Sections 5-41-203 and 5-41-206 cover computer related crimes. KSAs FOR FIGHTING CIBERCRIME KSAs: knowledge, skills and abilities. Ability to build an internet audit trail. Skills needed to collect “usable” courtroom electronic evidence. Basic understanding of the information that can be collected from various computer logs. Ability to place a valuation on incurred losses. Technical familiarity with the internet, web servers, firewalls, attack methodologies, security procedures, and penetration testing. Understanding of legal protocols to prevent employee rights violations. ROLL OF FORENSIC ACCOUNTANT When fraud is suspected, may be called in to investigate. Gathers evidence. May interview witnesses. Determines suspects. Estimates losses. Serves as expert witness. CANNOT AND DOES NOT HAVE AUTHORITY TO ACT AS LAW ENFORCEMENT OFFICER UNLESS HE/SHE IS A LAW ENFORCEMENT OFFICER. KNOWLEDGE BASE Obviously, need strong background in accounting. Investigative auditing. Law, legal system, courts and courtroom procedures. Criminology, criminal law and criminal procedure. Computer skills, including computer auditing. Oral and written communication skills. SUGGESTED COURSES Major accounting courses. Financial statement analysis course. Taxation and business law. Technical writing. Criminology. Computer forensics. Psychology Business ethics. Business valuation.