job & batch costing - Meadowgate Training

advertisement

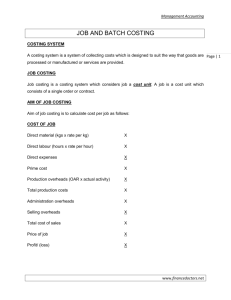

JOB & BATCH COSTING Encyclopaedia of Accounting JOB AND BATCH COSTING Job Costing Job costing is the calculation of the actual cost of production of a product, where work is undertaken to specific customer requirements and each order is of comparatively short duration. A Job is a cost unit which consists of a single order or contract. The administration of an order in a job costing environment typically follows this sequence: 1. 2. 3. 4. 5. 6. 7. 8. Estimate requested by customer Total cost calculated using a Job Cost Sheet Profit is added to total cost Customer accepts the estimate Actual costs are recorded on a job sheet The job is completed & despatched to customer Any variance between estimate & actual cost is analysed Action is taken to overcome variances The total cost includes: Direct Material Cost Direct Labour Cost Direct Expenses Production Overheads Administration, selling & distribution overheads In calculating the total actual cost, production overheads are: Actual labour hours x Overhead absorption rate (actual or predetermined) © Copyright 2012 Meadowgate Training Ltd Example Shopfronts Ltd prepare signage for retail outlets. Job No. 123, is based on the following cost estimates The backing board will cost £82 Standard lettering will cost £55 Templates will cost £25 Direct labour will be 5 hours printing at £12/hour and 2 hours finishing at £9/hour Overheads at charged at £20 per labour hour The business requires a profit of 40% of cost price The Job Cost Sheet will appear as follows: Job No. 123 £ Direct Materials Backing board Standard lettering Templates 82.00 55.00 25.00 Direct Labour Printing: 5 hrs @ £12/hr Finishing: 2 hrs @ £9/hr 60.00 18.00 Overheads 7 hrs @ £20/hr 140.00 Total Cost 380.00 Profit (40% of cost price) 152.00 Selling Price 532.00 © Copyright 2012 Meadowgate Training Ltd Batch Costing Batch costing is very similar to job costing. A batch is a group of similar articles which is treated as a single job during production. The cost per unit then calculated as the total batch cost divided by the number of units in the batch Service Industries Similar approaches to job and batch costing are used in service industries. They are sometimes known as service costing techniques. Services differ from goods in being: Intangible Simultaneously produced and consumed (eg. a concert) Perishable Heterogeneous (each customer is different) A challenge in service costing is often to establish a suitable cost unit. For example, bus companies calculate a cost per passenger kilometre; colleges calculate a cost per full-time student. © Copyright 2012 Meadowgate Training Ltd