1 SULEMAN DAWOOD SCHOOL OF BUSINESS MBA

advertisement

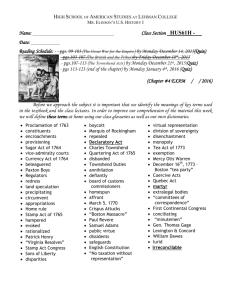

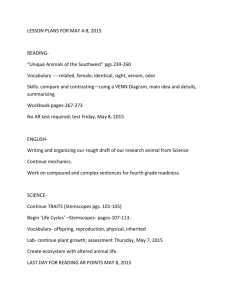

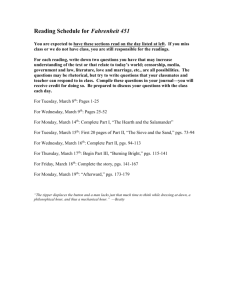

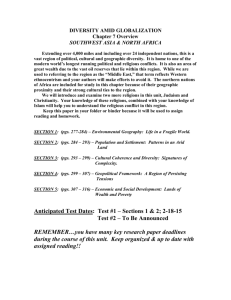

SULEMAN DAWOOD SCHOOL OF BUSINESS MBA PROGRAMME CLASS OF 2016 AUDITORIUM A-203 SEMESTER IV 2015-16 (SIVA) Assignments for the week of February 15 to February 19, 2016 *************************************************************************** MONDAY, FEBRUARY 15 0830 - 1000 ENTREPRENEURIAL FINANCE SALMAN KHAN Topic: Venture Analytics Learning Objectives: To become familiar with the term sheets commonly used in venture capital deals. Read: SpiffyTerm, Inc.: January 2000 (Pgs. 12) 1000 - 1030 Tea break 1030 - 1200 HUMAN RESOURCE MANAGEMENT ABDUR RAHMAN MALIK Topic: 360 Feedback Process Learning Objectives: Understand various types of appraisal systems and associated pros and cons Case: The Firmwide 360° Performance Evaluation Process at Morgan Stanley (Pgs.16) Read: 1. 2. Getting 360-Degree Feedback Right (Pgs. 7) Chapter 9: Performance Management and Appraisal (Pgs. 38) 1200 - 1230 Break 1230 - 1400 INTEGRATED MARKETING COMMUNICATIONS KHAWAJA ZAIN UL ABDIN Topic: Effectively Managing Advertising 1 Learning Objectives: Campaign Evaluation Case: Charles Schwab & Co., Inc.: The “Talk to Chuck” Advertising Campaign (Pgs. 18) Read: 1. 2. Linking Advertising and Brand Value (Pgs. 8) Campaign Tracking and Evaluation (Pgs. 24) 1400 - 1500 Lunch break 1500 - 1630 CORPORATE FINANCE BUSHRA NAQVI Topic: Introduction to Mergers and Acquisitions (M & A) Learning Objectives: Develop abilities and skills in evaluating potential merger and divestiture candidates using standard valuation techniques Case: Radio One Inc. (Pgs. 15) Assignment: 1. What price should Radio One offer based on a discounted Cash Flow Analysis? Discuss the assumptions you used to find out the price and their reasonableness? 2. What price should Radio One offer based on a trading multiple approach? Discuss the assumptions you used to find out the price and their reasonableness? Read: Valuing a Business Acquisition Opportunity (Pgs. 8) 1630 - 1830 Break 1830 - Onwards SESSION WITH THE MBA PLACEMENT OFFICE Campus Drive Venue: Auditorium B-3 (SDSB Basement) TUESDAY, FEBRUARY 16 0830 - 1000 BRAND MANAGEMENT ROHAIL ASHRAF Topic: Line Extensions (Vertical – Downward) 2 Learning Objective: Analyse situations where line extensions help protect revenue streams Case: Altius Golf and the Fighter Brand (Pgs. 9) Read: Should you Launch a Fighter Brand (Pgs. 11) 1000 - 1030 Tea break 1030 - 1200 BUSINESS LAW WALID IQBAL Topic: The Law of Contract (Indemnity and Guarantee) Learning Objective: Understanding a contract of guarantee and the difference between a guarantee and an indemnity. Case: Onion Bank Limited (Pgs. 4) Assignment: Be prepared for a class discussion. Read: 1. 2. Sections 124 to 147 of the Contract Act, 1872. Avtar Singh, Chapters 11 and 12 Note: Please bring Contract Act, 1872 (Bare Act) to class. 1200 - 1230 Break 1230 - 1400 AGRICULTURE VALUE CHAINS IN DEVELOPING ECONOMIES SYED ZAHOOR HASSAN Topic: Role of Seed and Proper Cultivation Practices in Agriculture Value Chains Assignment: 1. Be prepared to discuss the reading and the significance of seed and proper cultivation practices. 2. We will have three panelist for this session: Mr Shariq Bukhari (LUMS MBA) from Monsanto, Muhammad Farooq from FritoLay -Pepsico Pakistan and Mr Shakeel Rizvi (a seed farmer, IT entrepreneur and LUMS MS in CS). 3 3. Review the McDonald’s India case and other material related to Potato cultivation and value chain to be prepared to ask relevant questions. Read: The Inspection Dutch Seed Potatoes (Pgs. 38) 1400 - 1500 Lunch break 1500 - 1630 PROJECT MANAGEMENT ARIF I RANA Learning Objective: To introduce the concepts of timelines, schedules and the scheduling process; to introduce the MS Project Software Read: Scheduling of Work: Put the Horse before the Cart (Pgs. 15) 1630 - 1830 Break 1830 - Onwards SESSION WITH THE MBA PLACEMENT OFFICE Campus Drive Venue: Auditorium B-3 (SDSB Basement) WEDNESDAY, FEBRUARY 17 0830 - 1000 ENTREPRENEURIAL FINANCE` SALMAN KHAN Topic: Investment Strategy Learning Objectives: Investment strategy and deal structuring will be discussed Read: Car Wash Partners Inc. (Pgs. 26) 1000 - 1030 Tea break 1030 - 1200 HUMAN RESOURCE MANAGEMENT ABDUR RAHMAN MALIK Topic: Training Employees Learning Objectives: Understand the importance of Training & Development system Design the basics of a T&D system 4 Case: SUPERVALU Inc. Professional Development (Pgs. 21) Read: Chapter 8: Training & Development Employees (Pgs. 36) 1200 - 1230 Break 1230 - 1400 INTEGRATED MARKETING COMMUNICATIONS KHAWAJA ZAIN UL ABDIN Topic: Promotions and Stakeholder Relationships Learning Objectives: Sales Promotions Case: JWT CHINA: Advertising For the New Chinese Consumer (Pgs. 26) Read: Chapter 16 (Pg1-34) 1400 - 1500 Lunch break 1500 - 1630 CORPORATE FINANCE BUSHRA NAQVI Topic: Hostile Takeover and Defensive Tactics Learning Objectives: Analyse business strategy with respect to the pros and cons of merging the two companies with different cultures, the value of companies, and the tactics of a hostile tender offer Case: Roche's Acquisition of Genentech (Pgs. 32) Assignment: In preparing the case, you can assume that Genentech has 1,052 million shares outstanding: 1. As of June 2008, what is the value of the synergies Roche anticipates from a merger with Genentech? Assess the value of synergies per share of Genentech. Use 9% WACC in your analysis. 2. Based on DCF valuation techniques, what range of values is reasonable for Genentech as a stand-alone company in June 2008? Please exclude synergies from your valuation and use a 9% WACC. You can assume that as of the end of June 2008, Genentech held approximately $7 billion in cash, which included investment and securities that were not needed in its daily operations. (Exhibit 10 is a good starting point for this analysis) 5 3. What does the analysis of comparable companies (Exhibits 12, 13 and 14) indicate about Genentech’s value within the range established in question 4? 4. What should Franz Humer do? Specifically, should he launch a tender offer for Genentech’s shares? What are the risks of the move? What price should he offer? Should he be prepared to go higher? How much new financing will Roche need to complete the tender offer? THURSDAY, FEBRUARY 18 0830 - 1000 BRAND MANAGEMENT ROHAIL ASHRAF Topic: Line Extensions (Vertical – Upward) Learning Objectives: Analyse situations where line extensions help improve brand image and abilities to tap into high margin segments Case: Diesel for Successful Living (Pgs. 23) Read: The Brand Relationship Spectrum (Pgs. 17) 1000 - 1030 Tea break 1030 - 1200 BUSINESS LAW WALID IQBAL Topic: The Law of Contract (Bailment and Pledge) Learning Objective: Understanding bailment of goods and the concept of pledge, which is the bailment of goods as security for the repayment of debt or the performance of a contract Case: Onion Bank Limited (Pgs. 4) Assignment: Be prepared for a class discussion. Read: 1. 2. Sections 148 to 172 of the Contract Act, 1872. Avtar Singh, Chapters 13 and 14. Note: Please bring Contract Act, 1872 (Bare Act) to class. 1200 - 1230 Break 6 1230 - 1400 PROJECT MANAGEMENT ARIF I RANA Guest Speaker Session 1400 - 1500 Lunch break 1500 - 1630 AGRICULTURE VALUE CHAINS IN DEVELOPING ECONOMIES SYED ZAHOOR HASSAN Topic: Role of Financial Services Case: Faysal Bank Limited – Agriculture Finance Strategy (To be distributed later) Assignment: 1. Be ready to discuss the conclusions and recommendations given about changing the role of Arthi in the report. 2. What services does the Arthi provide? What are the sources of finance and risks in his business model? 3. What challenges do you foresee in implementation of the various recommendations given in the Arthi report? How would the business model of the Arthi need to change? 4. What can a bank learn from the Arthi's business model? 5. What entrepreneurial opportunities can you identify based on what you have learnt from the readings? 6. Discuss the main characteristics of the approach followed by Faysal Bank Limited (FBL) for their agricultural financing. What are the main features of their agri financing strategy? 7. What would you suggest to Ali Raza regarding the challenges and opportunities that agriculture finance division at FBL faces in early 2015? 8. What lessons can we draw regarding upgrading of agriculture value chains from this case? 7 9. What is value chain finance and how does it impact value creation and value capture for various stakeholders in the agricultural value chains? What ideas discussed in the reading “Understanding agricultural value chain finance” can be applied to develop the agricultural value chains in Pakistan? 10. How do the ideas presented in the readings compare with the approach followed by FBL agriculture finance division? Read: 1. 2. 3. Understanding Agricultural Value Chain Finance (Pgs. 21) Agriculture value Chain Finance and Strategy and Design (please also read the Annex 1, 2 and 3) (Pgs. 50) Who is the Arthi? (Pgs. 50) 1630 - 1645 Break 1645 - 1715 SESSION WITH THE ASSOCIATE DEAN AND PROGRAMME DIRECTOR KAMRAN ALI CHATHA / AHSAN SHAMIM CH Venue: Auditorium 203 FRIDAY, FEBRUARY 19 0830 - 1000 AGRICULTURE VALUE CHAINS IN DEVELOPING ECONOMIES SYED ZAHOOR HASSAN Case: Kevlaar – From Retail to Contract Farming and Beyond (To be distributed later) Assignment: To be distributed later. Read: Review the relevant readings from previous sessions 1000 - 1030 Break 1030 - 1645 MBA PROJECT HASSAN RAUF Work on MBA Project 8

![Introduction [max 1 pg]](http://s3.studylib.net/store/data/007168054_1-d63441680c3a2b0b41ae7f89ed2aefb8-300x300.png)