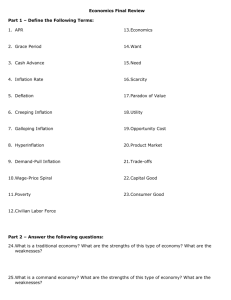

12 Thinking at the margin is whether to decide to use one more

advertisement

Economics Essential knowledge The following are the essential knowledge they you must retain for your economics class: 1 2 Capital: is resources that are made by humans and used to create other goods and services shortage: is when a good/service is unavailable or when demand is higher than supply a. occurs when market prices is below equilibrium 3 factors of production: are resources used to make the goods and services (land, labor, & capital) 4 efficient economy: is one that uses its resources to make the most goods and services 5 law of increasing cost: when the production of one item goes up the production cost goes up 6 production possibility graph: is used to examine opportunity cost 7 production possibility frontier: the line on the P.P. graph a. they curve because increasing cost results in less output b. Move to the right if increase of land, labor etc.; move left if you lose L., L., etc. 8 scarce: hard to come by; all resources are scarce 9 opportunity cost: the high value given up when making a choice 10 Human capital: the abilities and skills of any individual, especially those acquired through investment in education and training, that enhance potential income earning 11 Physical capital: Tangible asset that that is created by humans and somehow used in production 12 Thinking at the margin is whether to decide to use one more additional unit (resource) 13 14 15 16 17 18 Scarcity: limited number of resources (all are scarce) in which you cannot meet unlimited wants. If a company is producing fewer goods/service than it could be it Underutilizing its resources Production possibility curve moves down and left: Centrally planned economy: is when the gov’t owns the means to production Mixed economy is have a combination of free market with gov’t control The most important advantage of a free market economy is that it encourages growth 19 Profits: are what manufactures, etc. make on a good/service after they pay expenses; it motivates them to sell a product. 20 Competition: the process of trying to win or do better than others; motivating force in the free market economy 21 Function of an economic system is to produce and distribute goods/services 22 Safety net: is a gov’t program that protects people which are experiencing unfavorable economic conditions. Unemployment, social security, etc. 23 Product market: is where purchase and supply of goods/services takes place Be able to draw and understand free market diagram 24 Economic equity: society decides the best way to divide up the economic pie; ex: Lawyers make more than nurses; some countries teacher make more money than others; 25 Socialism: social/political philosophy based on the belief that democratic principles should be used to distribute wealth 26 Communism: political system characterized by a centrally planned economy with all economic/political power resting with the gov’t. 27 Capitalist: An investor of capital in business, especially one having a major financial interest 28 Authoritarian: type of gov’t that requires strict obedience. 29 Interest groups is a private organization that attempts to influence public officials 30 Positive externality: is an economic side effect that generates on expected benefits 31 Business cycle: is a period of macroeconomic expansion followed by a period of decline 32 33 34 35 36 37 38 39 Public good is when the total benefits to society are greater than the total cost Gross domestic product is the total value of all goods and services produced in a particular economy A free rider: is a person who consumes a good/services but does not pay for it Externality can be positive/negative; it is a side effect of a good/service that generates a benefit or cost to someone other than the person making the decision of what produce or consume Policy makers try to achieve 3 main outcomes when it comes to stabilizing the economy: high employment, stead growth, & stable prices Patent/copyrights: a set of rules that protect an inventors rights; these promote innovation which in turn will help economy Social security is money that is deducted from your paycheck; it is given to people when they retire and the disabled Supply/demand determines the price and quantity produced of most goods a. Demand: how much of a good/service a person is willing to buy at a price i. Curve shift means a change in demand at every price; b. Supply: how much of a good/service a producer is will to produce at a certain price c. Curve shift means a change in supply at every price If price rises demand will drop d. F.I.C.A. is the tax taken from your check to fund Social security/Medicare 40 Elasticity a. Determines how a change in price will affect total revenue b. Has an effect on demand; price goes up won’t buy or look for substitute c. If elasticity for a good/services is less than one, that good/services elastic 41 Inelastic means a price increase has very little effect on demand a. When a good/service is inelastic, if a new tax is added the consumer will pay it 42 Time has the greatest influence on elasticity and inelasticity of supply 43 Be able to determine if a good/service is elastic or inelastic a. Supply example would be oranges 44 Unitary elastic demand is that the percentage change in quantity demanded is exactly equal to percentage change in price. 45 Ceteris paribus means all other things are held constant which causes movement up and down the curve (not a shift) 46 A market demand schedule shows the quantities of products demanded at each price by all consumers in a market 47 Total revenue is the amount of money a company receives for selling its goods/services 48 Prices have a direct impact on income; if it goes up income buys less 49 Inferior good: a good that people demand less of when income increases (Ramon noodles) 50 A natural monopoly market is one large firm supplying all the output; it runs most efficiently 51 Monopolistic competition is where many companies are selling similar but not identical products 52 Non-price competition (do not want to get into price war): is a marketing strategy "in which one firm tries to distinguish its product or service from competing products on the basis of attributes like design and workmanship; examples: brand, advertising 53 Monopoly: a market dominated by a single seller 54 Perfect competition: market in which a large number of firms all produce the same product a. Conditions are many buyer/sellers, buyer/sellers are well informed about products, sellers are able to enter/exit market freely 55 Commodity: product that is the same no matter who produces it; (milk, notebook paper) 56 Oligopoly is 2 to 4 firms producing 70/80 percent of the output. 57 Technology has a big effect on the economy by reducing start-up cost and making business more efficient. 58 Price discrimination: division of customers into groups based on how much they will pay for a good/service 59 Economies of scale: factors that cause a producer’s average cost per unit to fall as output rises. 60 Taxes: purpose is so gov’t can pay its bills a. Major sources is property tax which is a tax assessed to property; major funding for schools b. Income tax: tax placed on wages c. Proportional tax: tax for which the percentage of income paid in taxes remains the same for all income levels d. Progressive tax: tax for which the percentage of income paid in taxes increases as income increases e. Regressive tax: tax for which the percentage of income paid in taxes decreases as income increases f. Excise tax: (also called sin tax) put on a product; alcohol. g. Constitution allows taxes on things except exports h. Tax deductions 61 Operating budget: is for day to day expenses 62 Capital budget: is for investment spending 63 Entitlement is a social welfare program providing benefits to people who meet certain eligibility requirements 64 Discretionary spending: gov’t planners can make choices on what to spend (education, defense) 65 Mandatory spending: required by law to spend on certain programs ( Medicare, social security) 66 Fixed cost does not change; example would be car payment 67 Variable cost changes; for example heating cost; 68 Market price is where the buy & seller agree 69 At the most profitable level, marginal cost is always equaled to market price 70 Subsidies: is assistance paid to a business or economic sector. Most subsidies are made by the government to producers to influence supply. 71 Equilibrium is where buyers will purchase exactly as much as sellers are willing to sell 72 Excess in demand: when quantity demanded exceeds quantity supplied 73 Excess in supply: when quantity supplied exceeds quantity demanded 74 Price floor: minimum price for a good/service 75 Price ceiling: government puts a cap on good/services that are essential but too expensive; example rent control 76 Minimum wage: lowest legal wage that can be paid to a worker 77 You must be able to read a graph and be able to plot on a graph 78 Frictional unemployment occurs when people take time to find a job 79 Seasonal unemployment pertains to mostly agricultural/tourist industries; they slow down or shut down for a season 80 Structural unemployment are when a person’s skill doesn’t match the jobs that are available 81 Cyclical unemployment happens during economic downturns (recession) and falls when the economy improves (Full employment) 82 Unemployment rate is a percentage of a country’s workforce that is unemployed 83 Underemployment is when one is working in a job in which they are overqualified for or working parttime when they want full-time work 84 inflation is a general increase in prices; an increase in the supply of currency or credit relative to the availability of goods and services, resulting in higher prices and a decrease in the purchasing power of money; hyperinflation is inflation that is out of control 85 inflation rate is the percentage rate of change over time (you will need to know how to calculate) 86 core inflation rate is the rate of inflation excluding the effects of food and energy prices 87 Price index is a measurement that shows how the average price of a standard group of goods change over time 88 CPI (consumer price index) is a price index determined by measuring the price of a standard group of goods meant to represent the “market basket” of a typical urban consumer 89 Market basket is a representative collection of goods and services 90 Causes of inflation: a. Quantity theory: too much money in economy causes inflation b. Demand-pull theory: inflation occurs when demand for goods/services exceed existing supplies c. Cost-push theory: inflation occurs when producers raise prices in order to meet increased costs. 91 Deflation is a sustained drop in price level 92 Fixed income is income that does not increase even when prices go up (ex: social security) 93 Poverty threshold is the income level which income is insufficient to support a family/house hold 94 Poverty rate is the percentage of people who live in households with income below the official poverty line 95 Income distribution is how the nation’s total income is distributed among its population 96 Lorenz curve is the curve that shows income distribution when plotted on a graph