Economics Final Review

advertisement

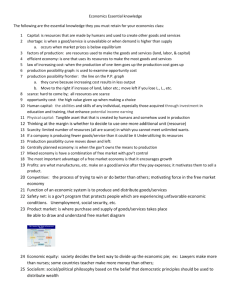

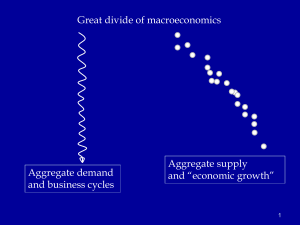

Economics Final Review Part 1 – Define the Following Terms: 1. APR 13.Economics 2. Grace Period 14.Want 3. Cash Advance 15.Need 4. Inflation Rate 16.Scarcity 5. Deflation 17.Paradox of Value 6. Creeping Inflation 18.Utility 7. Galloping Inflation 19.Opportunity Cost 8. Hyperinflation 20.Product Market 9. Demand-Pull Inflation 21.Trade-offs 10.Wage-Price Spiral 22.Capital Good 11.Poverty 23.Consumer Good 12.Civilian Labor Force Part 2 – Answer the following questions: 24.What is a traditional economy? What are the strengths of this type of economy? What are the weaknesses? 25.What is a command economy? What are the strengths of this type of economy? What are the weaknesses? 26.What is a market economy? What are the strengths of this type of economy? What are the weaknesses? 27.What is a mixed economy? What are the strengths of this type of economy? What are the weaknesses? 28.What is capitalism? What are the advantages and disadvantages of capitalism? 29.What is socialism? What are the advantages and disadvantages of socialism? 30.What is communism? What are the advantages and disadvantages of communism? 31.Why is it important for a supplier to pay attention to the equilibrium point? 32.If the demand for an item increases, which direction does the demand curve shift? 33.If the supply of an item increases, which directions does the supply curve shift? 34.How do complements and substitutes impact a demand curve? 35.What are other factors which may impact the demand curve? 36.What are the factors that would impact the supply curve? 37.What is the disadvantage of supplying a shortage? 38.What is the disadvantage of supplying a surplus? 39.What is a price floor? 40.What is a price ceiling? 41.What relationship exists between price and quantity on a demand curve? 42.What relationship exists between price and quantity on a supply curve? 43.Explain three, real-world influences that might cause a change in the equilibrium point. Be specific with your three examples and explain what effect they will have on a supply and/or demand curve. 44.What are the advantages of prices? 45.How are prices determined? 46.What is the disadvantage of rationing? 47.What is unlimited liability? 48.What document specifies the roles within a limited partnership? 49.What is a silent partner? 50.Explain the Pros and Cons of the following: A. Sole proprietorships B. Partnerships C. Corporations 51.What document must be purchase for a group to become a corporation? 52.What is product differentiation? 53.Provide a true-to-life example of the following product differentiation tactics: A. Narrow price change B. Advertising campaign C. Giveaway promotion/game D. Change of packaging E. Creation of an “imaged” difference in the product F. Introduction of a new type, flavor, color etc. 54.Why do competitors prefer to compete without price changes? 55.What are the five conditions required for perfect competition? 56.Why does perfect competition never really exist? 57.What can oligopolies legally do to steal sales from a competitor? 58.What is the goal of a price war? 59. Describe the following acts of collusion and explain why they are illegal. A. Price-fixing B. Undercutting C. Division of market for guaranteed sales 60.Briefly describe the 4 types of monopolies. 61.What condition(s) of perfect competition is absent in monopolistic competition? 62.What condition(s) of perfect competition is absent in an oligopoly? 63.What condition(s) of perfect competition is absent in a monopoly? 64.What is the difference between a limited partnership and a general partnership? 65.Which of the business organizations is most common? Most uncommon? Why? 66.Describe the responsibilities of the following government agencies A. FDA F. NLRB B. FCC G. FAA C. FTC H. EEOC D. SEC I. OSHA E. EPA J. CPSC 67.When looking at unemployment statistics, who is officially count as “unemployed”? 68.How do you calculate the inflation rate? 69.How do you calculate the unemployment rate? 70.List and explain the five types of unemployment. 71.Explain the concept of full employment. 72.Any unemployment that occurs during a period of full employment is because of _____. 73.What happens to the value of the dollar when the US government decides to print more money? 74.What are three causes of income inequality? 75.Describe four consequences of inflation. 76.How might inflation affect: A. A person who has just withdrawn a considerable amount from a savings account? B. A retired autoworker on a fixed pension? C. A borrower about to repay a loan? 77.The Fed uses an “Easy Money” policy to fight what? 78.The Fed uses a “Tight Money” policy to fight what? 79.What is the most common tool the fed uses to affect money supply? 80.Be able to define: reserve requirement, open market operations, discount rate 81.What is GDP? 82.What is counted in GDP? 83.What is not counted in GDP? 84.How do you calculate GDP? 85.Who is responsible for implementing fiscal policy? 86.What are the two tools of discretionary fiscal policy? 87.Expansionary fiscal policy is used to fight what? 88.Contractionary fiscal policy is used to fight what? 89.Who is responsible for implementing monetary policy? 90.Describe the 4 categories of labor. 91.Describe three ways in which credit card companies take advantage of credit card users. 92.Explain three common problems people run into when using credit cards. 93.Explain three characteristics you should look for when selecting your first credit card. 94.Explain three ways in which you can be a responsible credit card user. 95.What are some of the consequences of having bad credit? Good credit? 96.Why are cash advances bad? 97.Why are payday loans bad 98. What are some characteristics of developing nations? *** Be able to draw and interpret changes in a supply and demand graph *** Be able to identify an equilibrium point and interpret its significance ***Understand how the Circular Flow Diagram works ***Understand the Production Possibilities Curve